Answered step by step

Verified Expert Solution

Question

1 Approved Answer

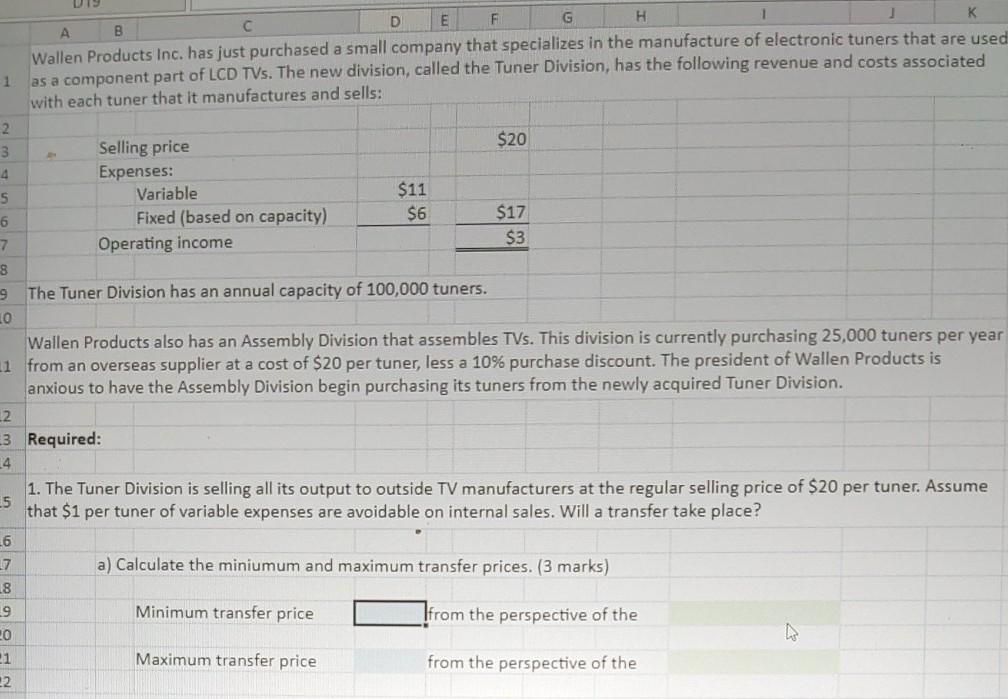

K D E B F G H Wallen Products Inc. has just purchased a small company that specializes in the manufacture of electronic tuners that

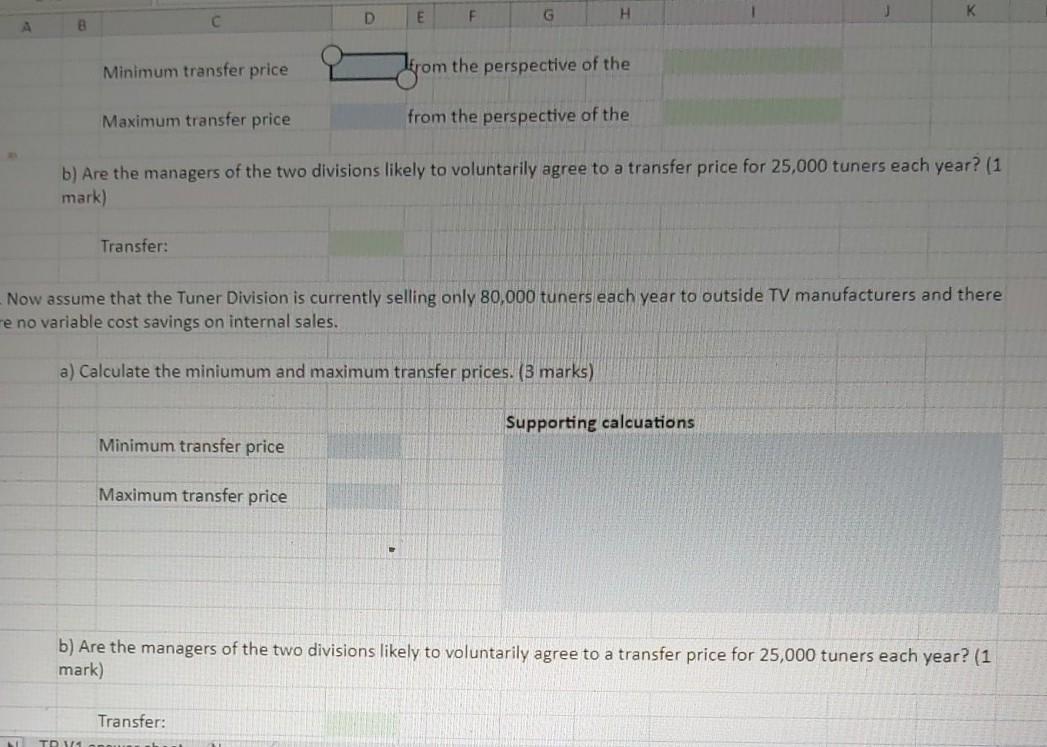

K D E B F G H Wallen Products Inc. has just purchased a small company that specializes in the manufacture of electronic tuners that are used as a component part of LCD TVs. The new division, called the Tuner Division, has the following revenue and costs associated with each tuner that it manufactures and sells: 2 3 Selling price $20 4 Expenses: 5 Variable $11 6 Fixed (based on capacity) $6 $17 7 Operating income $3 8 9 The Tuner Division has an annual capacity of 100,000 tuners. 10 Wallen Products also has an Assembly Division that assembles TVs. This division is currently purchasing 25,000 tuners per year 11 from an overseas supplier at a cost of $20 per tuner, less a 10% purchase discount. The president of Wallen Products is anxious to have the Assembly Division begin purchasing its tuners from the newly acquired Tuner Division. 2 3 Required: 14 5 1. The Tuner Division is selling all its output to outside TV manufacturers at the regular selling price of $20 per tuner. Assume that $1 per tuner of variable expenses are avoidable on internal sales. Will a transfer take place? a) Calculate the minimum and maximum transfer prices. (3 marks) 26 7 8 9 20 Minimum transfer price Ifrom the perspective of the Maximum transfer price 1 22 from the perspective of the D E F H G 8 Minimum transfer price Jyo from the perspective of the Maximum transfer price from the perspective of the b) Are the managers of the two divisions likely to voluntarily agree to a transfer price for 25,000 tuners each year? (1 mark) Transfer: Now assume that the Tuner Division is currently selling only 80,000 tuners each year to outside TV manufacturers and there me no variable cost savings on internal sales. a) Calculate the minimum and maximum transfer prices. (3 marks) Supporting calcuations Minimum transfer price Maximum transfer price b) Are the managers of the two divisions likely to voluntarily agree to a transfer price for 25,000 tuners each year? (1 mark) Transfer

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started