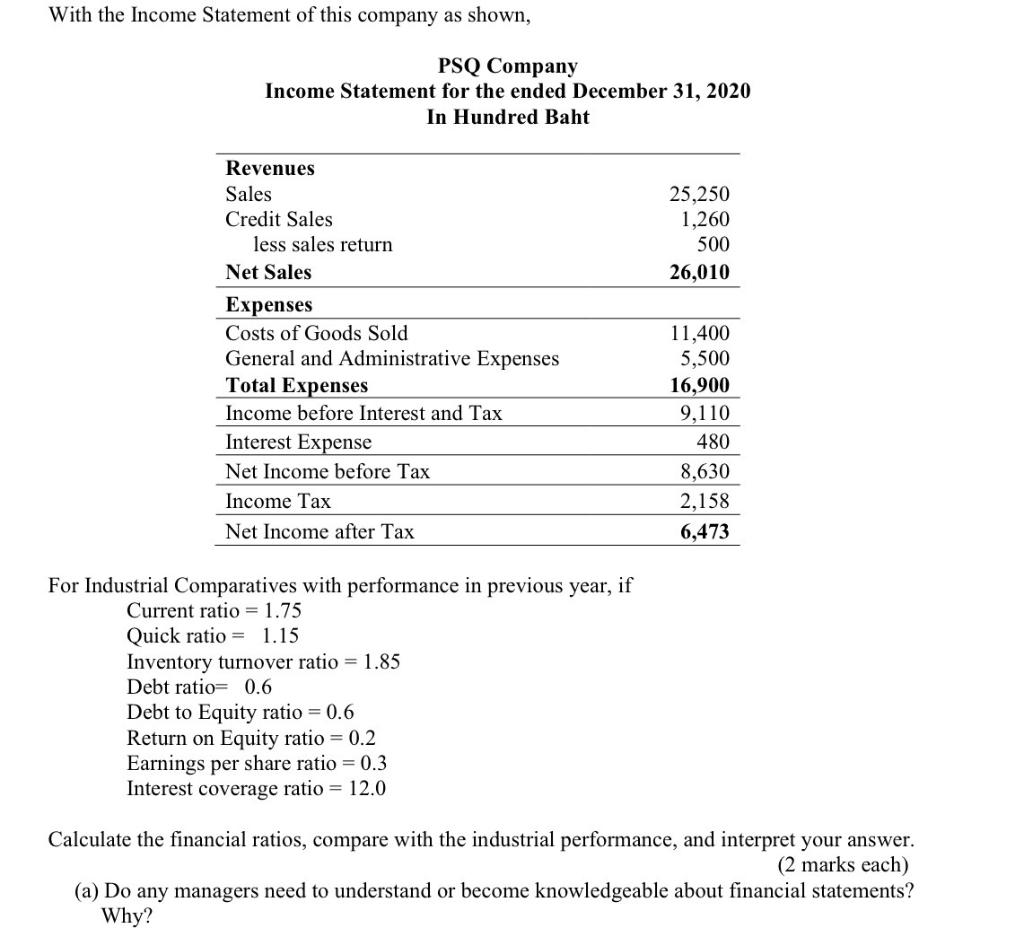

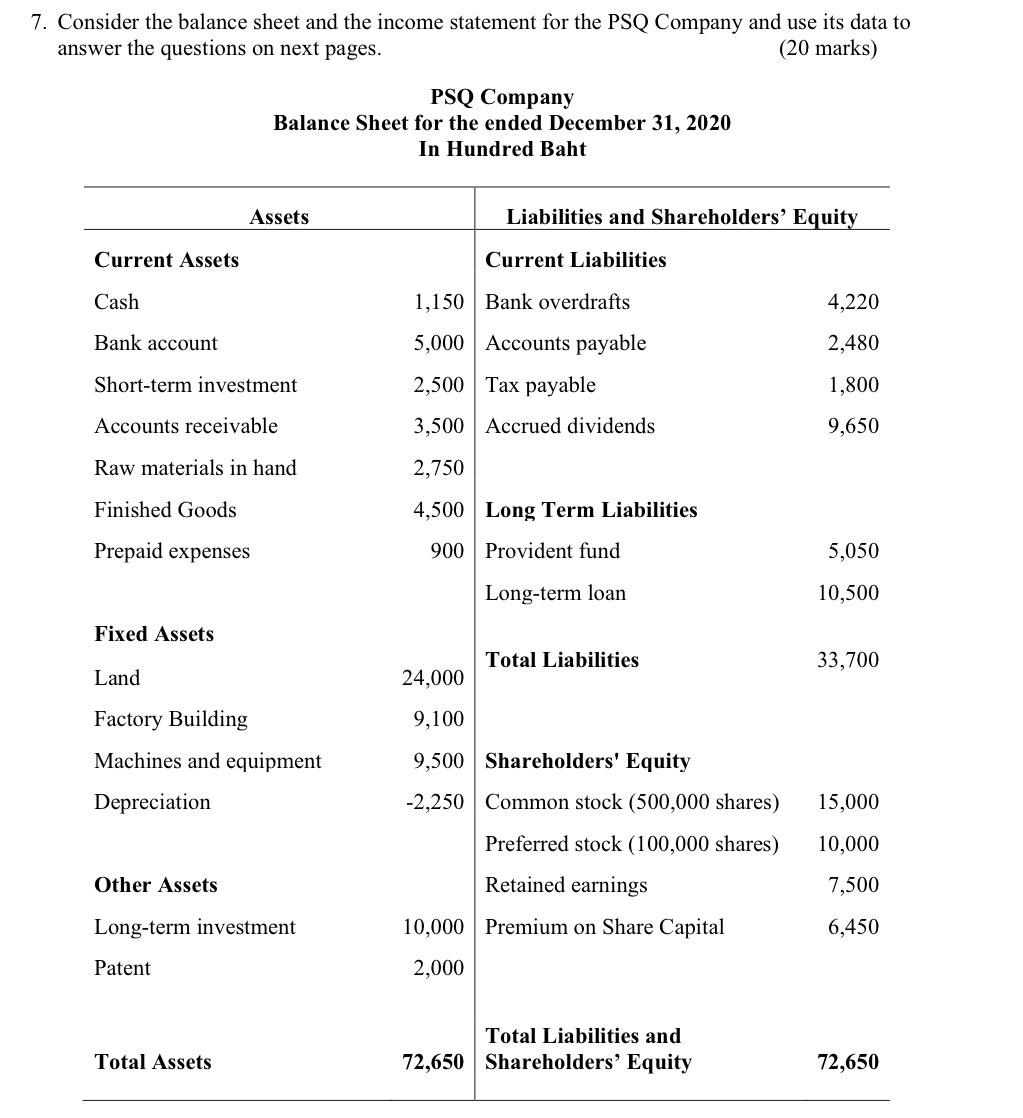

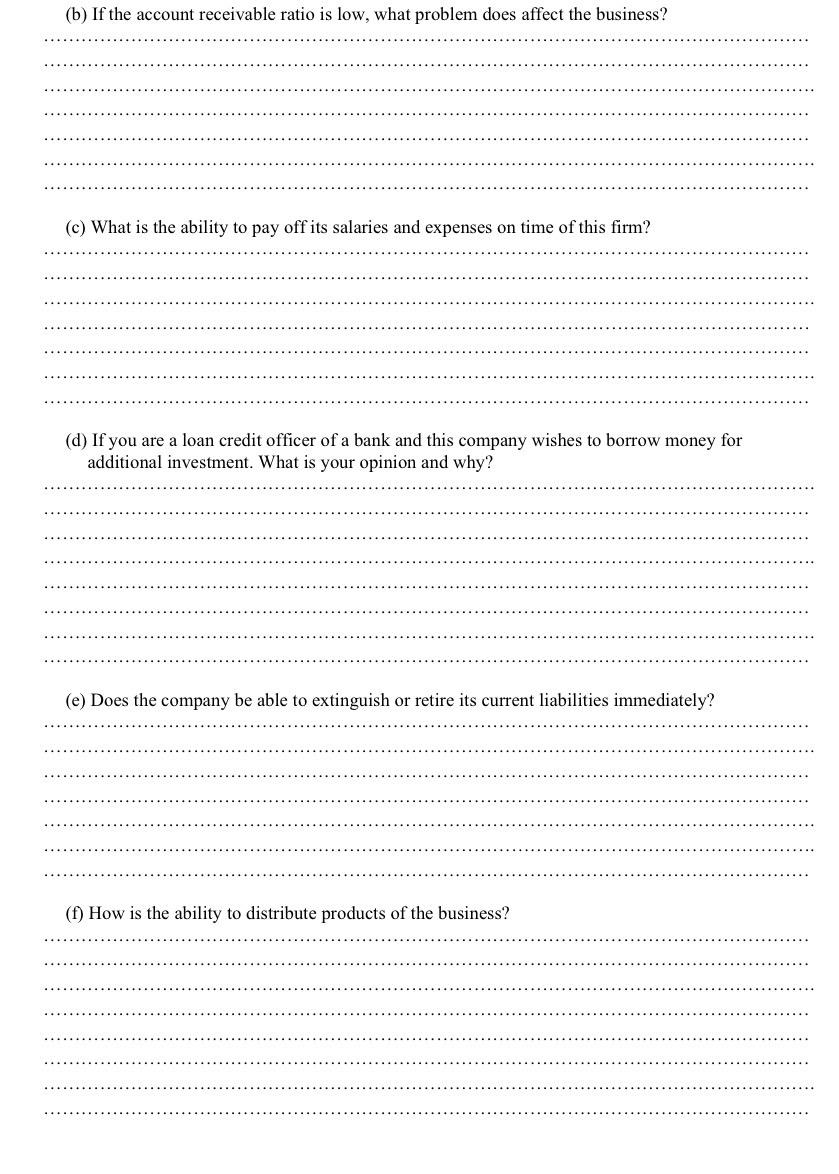

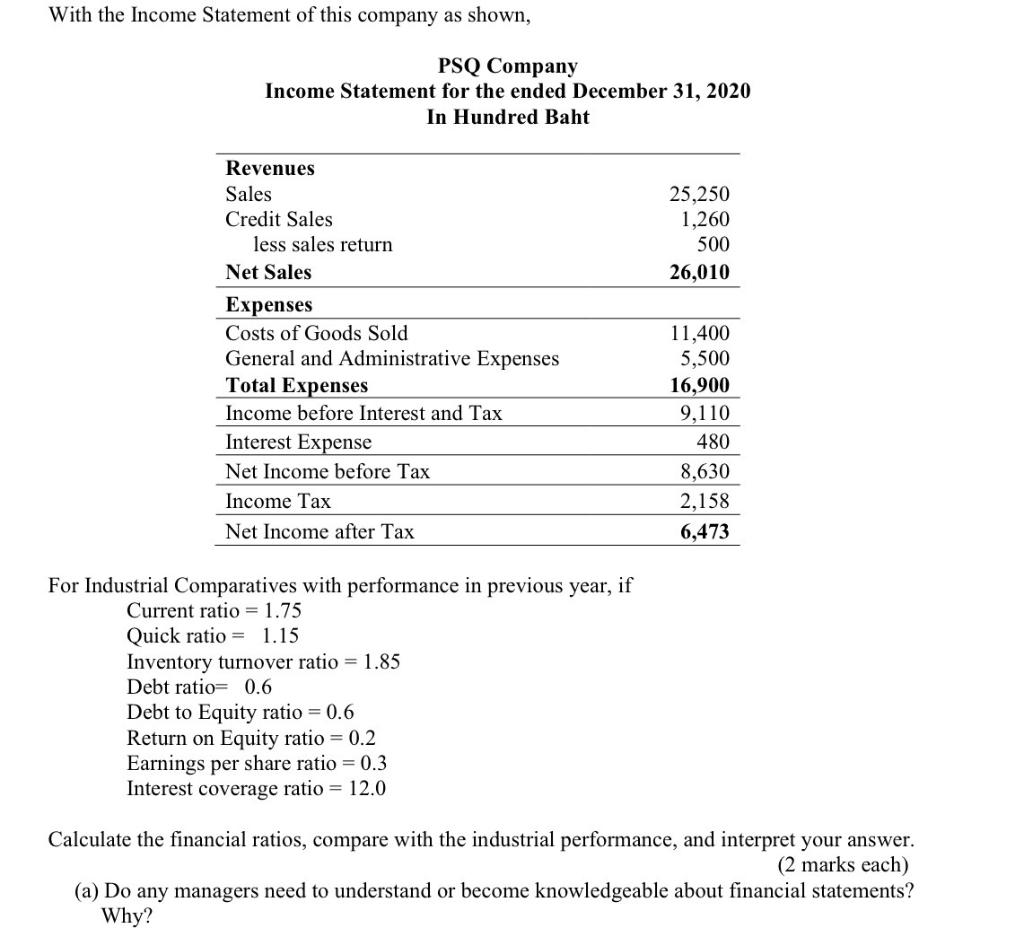

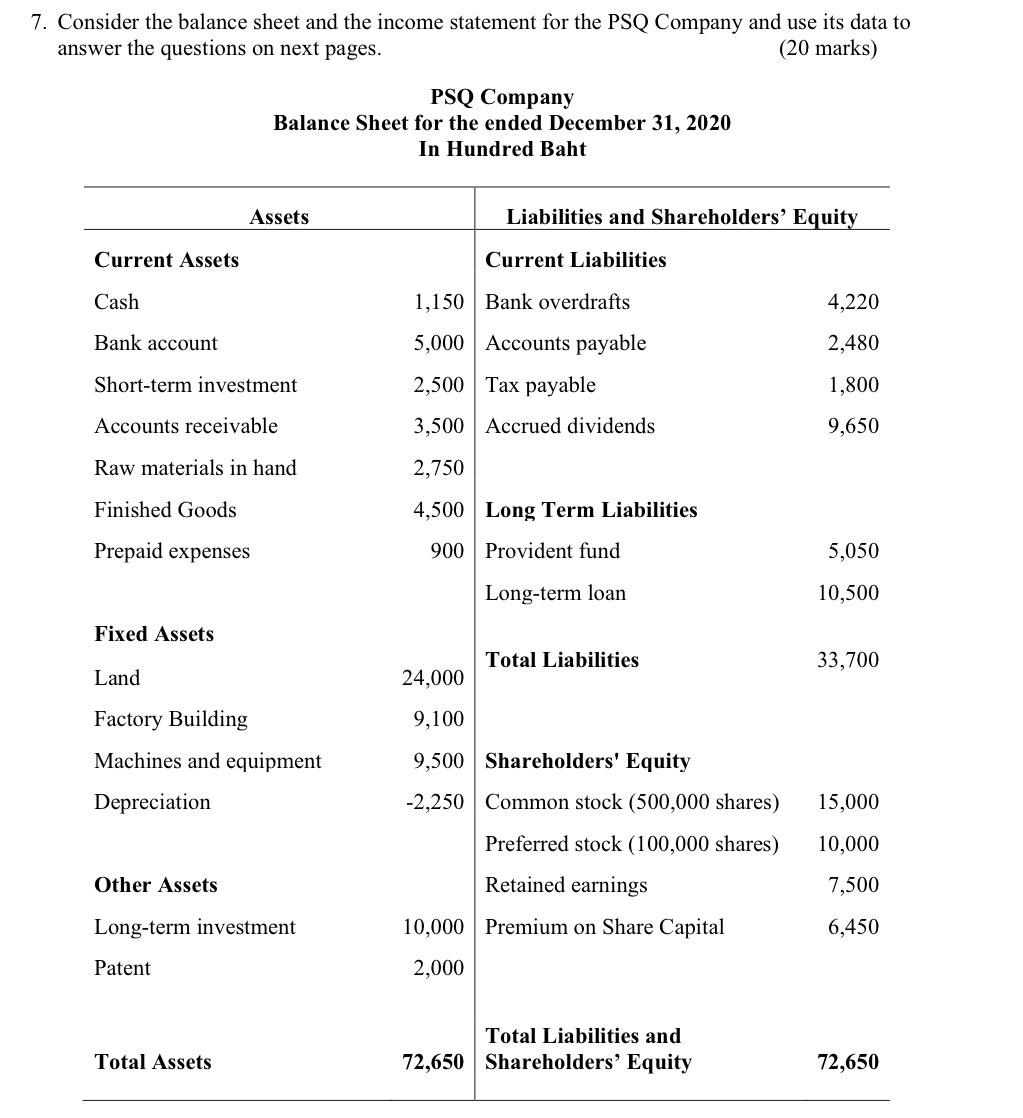

(k) If your cousin is an investor who is looking for an interesting business to invest. Will you recommend this business to hers? Why? (g) How effectively does the manager of this company utilize the company's assets? (h) How effective is the review and confirmation of the debt collection policy of this company? (i) Due to the epidemic situation in the past 1-2 years, the company gets troubles of lower profit. Therefore, the management team sets an investment plan to expand the business. If you are one of company's shareholders, how will you decide? () If you are a shareholder of this company, are you satisfied with its performance and why? (b) If the account receivable ratio is low, what problem does affect the business? (c) What is the ability to pay off its salaries and expenses on time of this firm? (d) If you are a loan credit officer of a bank and this company wishes to borrow money for additional investment. What is your opinion and why? (e) Does the company be able to extinguish or retire its current liabilities immediately? (1) How is the ability to distribute products of the business? With the Income Statement of this company as shown, PSQ Company Income Statement for the ended December 31, 2020 In Hundred Baht 25,250 1,260 500 26,010 Revenues Sales Credit Sales less sales return Net Sales Expenses Costs of Goods Sold General and Administrative Expenses Total Expenses Income before Interest and Tax Interest Expense Net Income before Tax Income Tax Net Income after Tax 11,400 5,500 16,900 9,110 480 8,630 2,158 6,473 For Industrial Comparatives with performance in previous year, if Current ratio = 1.75 Quick ratio = 1.15 Inventory turnover ratio = 1.85 Debt ratio= 0.6 Debt to Equity ratio = 0.6 Return on Equity ratio = 0.2 Earnings per share ratio = 0.3 Interest coverage ratio = 12.0 Calculate the financial ratios, compare with the industrial performance, and interpret your answer. (2 marks each) (a) Do any managers need to understand or become knowledgeable about financial statements? Why? 7. Consider the balance sheet and the income statement for the PSQ Company and use its data to answer the questions on next pages. (20 marks) PSQ Company Balance Sheet for the ended December 31, 2020 In Hundred Baht Assets Liabilities and Shareholders' Equity Current Assets Current Liabilities Cash 1,150 Bank overdrafts 4.220 Bank account 5,000 Accounts payable 2,480 Short-term investment 2,500 Tax payable 1,800 Accounts receivable 3,500 Accrued dividends 9,650 Raw materials in hand 2,750 Finished Goods 4,500 Long Term Liabilities Prepaid expenses 900 Provident fund 5,050 Long-term loan 10,500 Fixed Assets Total Liabilities 33,700 Land 24,000 Factory Building 9,100 Machines and equipment 9,500 Shareholders' Equity Depreciation -2,250 Common stock (500,000 shares) 15,000 10,000 Other Assets 7,500 Preferred stock (100,000 shares) Retained earnings 10,000 Premium on Share Capital 2,000 Long-term investment 6,450 Patent Total Liabilities and 72,650 Shareholders' Equity Total Assets 72,650