Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kaitlyn is 51 and requires $300,000 of life insurance to pay the capital gains tax at her death on her cottage and the income tax

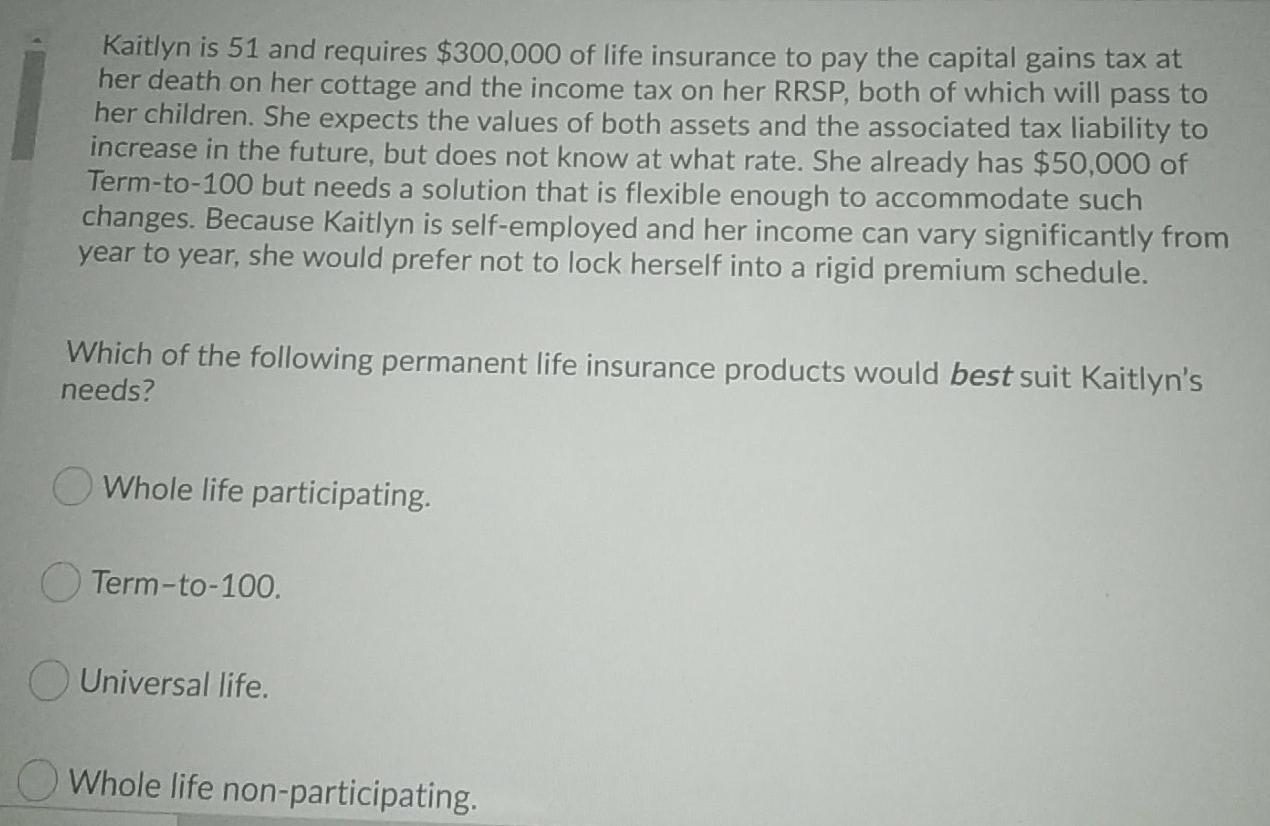

Kaitlyn is 51 and requires $300,000 of life insurance to pay the capital gains tax at her death on her cottage and the income tax on her RRSP, both of which will pass to her children. She expects the values of both assets and the associated tax liability to increase in the future, but does not know at what rate. She already has $50,000 of Term-to-100 but needs a solution that is flexible enough to accommodate such changes. Because Kaitlyn is self-employed and her income can vary significantly from year to year, she would prefer not to lock herself into a rigid premium schedule. Which of the following permanent life insurance products would best suit Kaitlyn's needs? Whole life participating. Term-to-100. Universal life. Whole life non-participating

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started