Question

Kardashian investment company is evaluating two different capital investments, project north and project south. Both projects would cost $210,000 and the kardashian investment company cannot

Kardashian investment company is evaluating two different capital investments, project north and project south. Both projects would cost $210,000 and the kardashian investment company cannot afford to do both. The kardashhian company expects that project north would provide net cash inflows of $62,000 per year for five years. For project south, the bet cash inflows are expected to be as follows.

YEAR 1 - $44,000

YEAR 2 - $48,000

YEAR 3 - $60,000

YEAR 4 - $76,000

YEAR 5 - $80,000

YEAR 6 - $308,000

Kardashian investment companys cost of capital is 12%.

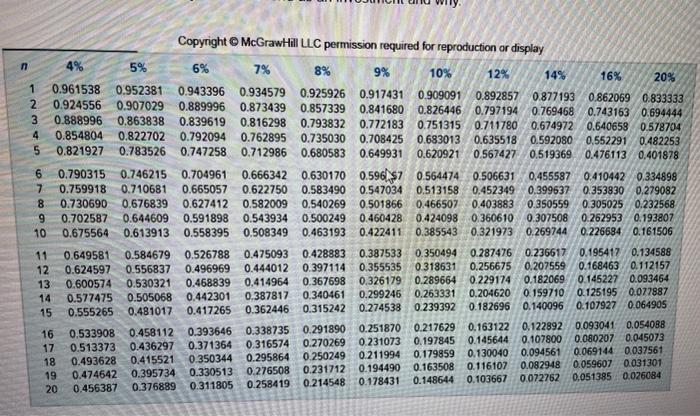

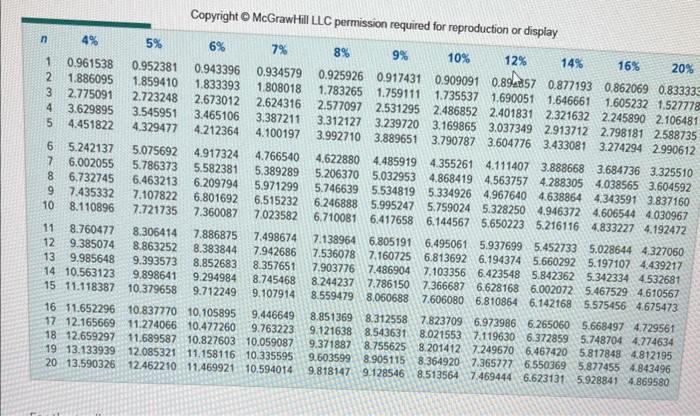

USE THE APPROPRIATE FACTORS FROM THE TABLE BELOW

- Calculate the net present value for project North and for Project South. Round net present to the nearest dollar.

- Discuss which project you recommend as an investment and why.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started