Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Karen Kline purchased 200 shares of Mex Inc. common stock for $15 per share exactly two years ago, in December 2017. Today, December 15,

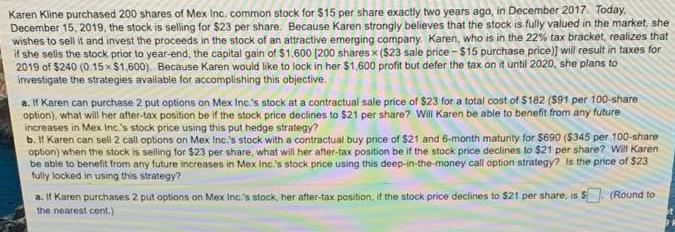

Karen Kline purchased 200 shares of Mex Inc. common stock for $15 per share exactly two years ago, in December 2017. Today, December 15, 2019, the stock is selling for $23 per share. Because Karen strongly believes that the stock is fully valued in the market, she wishes to sell it and invest the proceeds in the stock of an attractive emerging company. Karen, who is in the 22% tax bracket, realizes that if she selis the stock prior to year-end, the capital gain of $1,600 (200 shares x ($23 sale price - $15 purchase price)) will result in taxes for 2019 of $240 (0.15 x$1,600). Because Karen would like to lock in her $1,600 profit but defer the tax on it until 2020, she plans to investigate the strategies available for accomplishing this objective. a. If Karen can purchase 2 put options on Mex Inc.'s stock at a contractual sale price of $23 for a total cost of $182 (S91 per 100-share option), what will her after-tax position be if the stock price declines to $21 per share? Will Karen be able to benefit from any future increases in Mex Inc's stock price using this put hedge strategy? b. If Karen can sel 2 call options on Mex Inc.'s stock with a contractual buy price of $21 and 6-month maturity for $690 ($345 per 100-share option) when the stock is selling for $23 per share, what will her after-tax position be if the stock price declines to $21 per share? Will Karen be able to benefit from any future increases in Mex Inc.'s stock price using this deep-in-the-money call option strategy? is the price of $23 fully locked in using this strategy? a. If Karen purchases 2 put options on Mex Inc's stock, her after-tax position, if the stock price declines to $21 per share, is S (Round to the nearest.cent.)

Step by Step Solution

★★★★★

3.42 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 a AFTERTAX POSITION IF STOCK DECLINES TO 20 PER SHARE NET PROFIT2420 200 232 568 LESS TAX 1...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started