Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Karen Partridge was born on May 15, 1983. She is a single mother to Annie, who was born on June 4, 2014. Karen worked

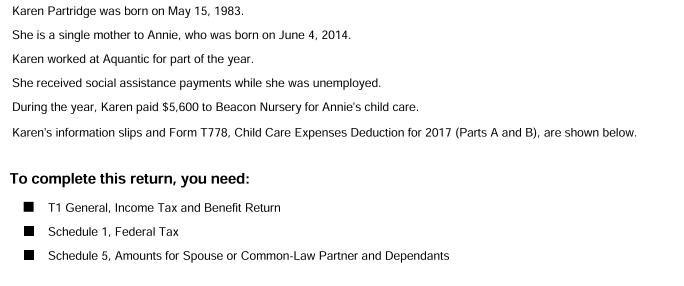

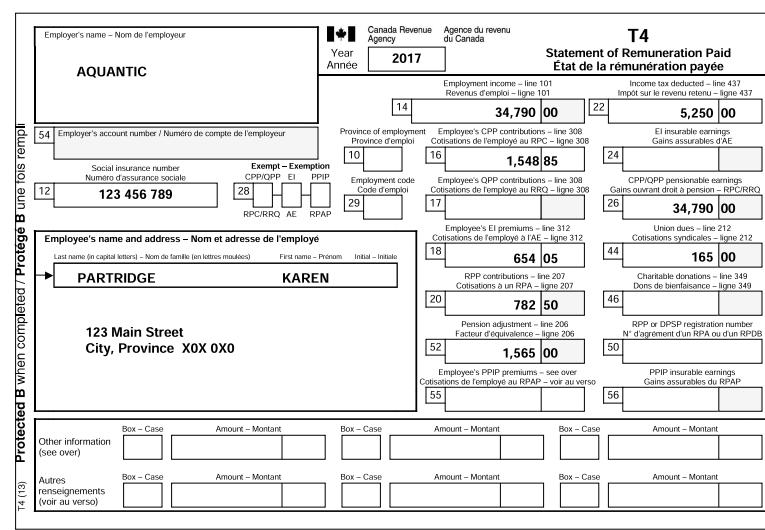

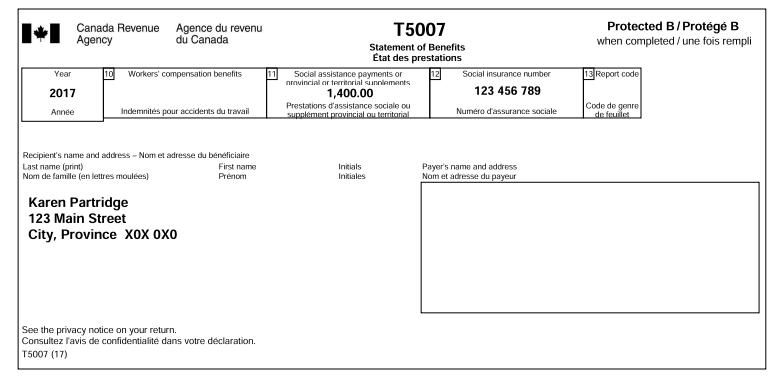

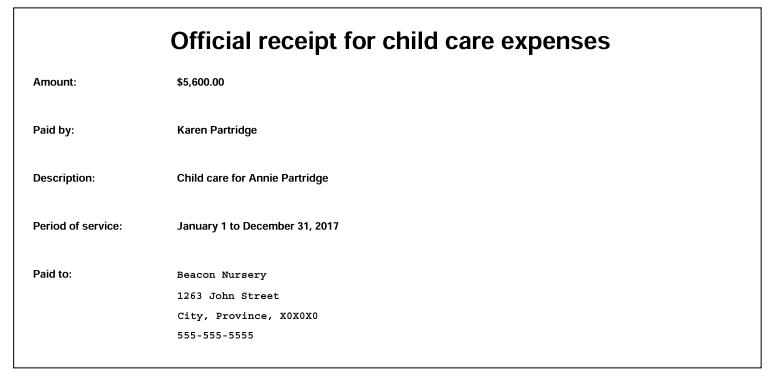

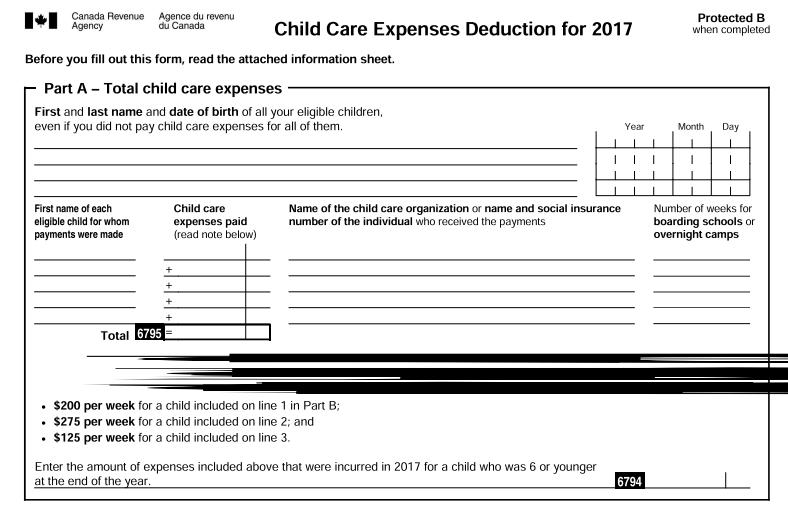

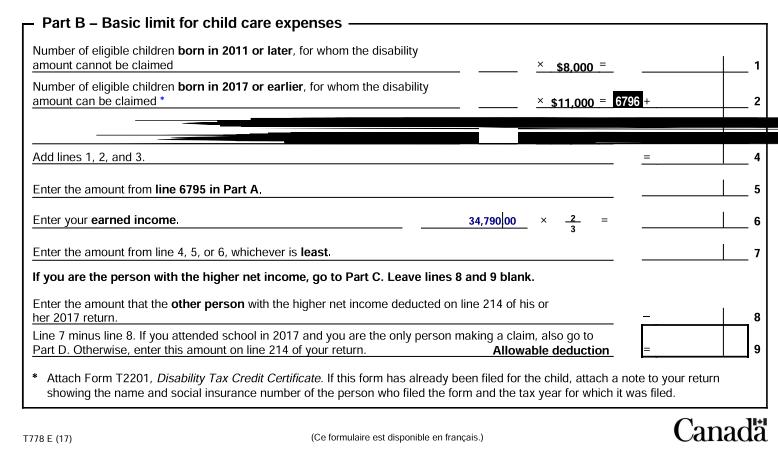

Karen Partridge was born on May 15, 1983. She is a single mother to Annie, who was born on June 4, 2014. Karen worked at Aquantic for part of the year. She received social assistance payments while she was unemployed. During the year, Karen paid $5,600 to Beacon Nursery for Annie's child care. Karen's information slips and Form T778, Child Care Expenses Deduction for 2017 (Parts A and B), are shown below. To complete this return, you need: T1 General, Income Tax and Benefit Return Schedule 1, Federal Tax Schedule 5, Amounts for Spouse or Common-Law Partner and Dependants Protected B when completed / Protg B une fois rempli T4 (13) Employer's name - Nom de l'employeur AQUANTIC 54 Employer's account number / Numro de compte de l'employeur 12 Social insurance number Numero d'assurance sociale 123 456 789 123 Main Street City, Province XOX OXO Other information (see over) Autres renseignements (voir au verso) Box - Case Employee's name and address - Nom et adresse de l'employe Last name (in capital letters) - Nom de famille (en lettres moules) First name-Prnom PARTRIDGE Box - Case Exempt - Exemption CPP/QPP EI PPIP 28 Year Anne RPC/RRQ AE RPAP Amount - Montant Amount-Montant KAREN Canada Revenue Agency 2017 Province of employment Province d'emploi 10 14 Employment code Code d'emploi 29 Initial-Initiale Box - Case Box - Case Agence du revenu du Canada 20 34,790 00 Employee's CPP contributions - line 308 Cotisations de l'employ au RPC - ligne 308 16 1,548 85 Employee's QPP contributions - line 308 Cotisations de temploye au RRO-ligne 308 17 52 Employment income-line 101 Revenus d'emploi-ligne 101 Employee's El premiums - line 312 Cotisations de l'employe l'AE-ligne 312 18 654 05 T4 Statement of Remuneration Paid tat de la rmunration paye RPP contributions - line 207 Cotisations un RPA-ligne 207 782 50 Pension adjustment-line 206 Facteur d'quivalence-ligne 206 1,565 00 Amount - Montant Employee's PPIP premiums - see over Cotisations de temploy au RPAP-voir au verso 55 Amount - Montant 22 Box-Case Box - Case Income tax deducted-line 437 Impt sur le revenu retenu - ligne 437 5,250 00 24 CPP/QPP pensionable earnings Gains ouvrant droit pension - RPC/RRO 26 34,790 00 Union dues-line 212 Cotisations syndicales-ligne 212 165 00 44 46 50 El insurable earnings Gains assurables d'E 56 Charitable donations - line 349 Dons de bienfaisance -ligne 349 RPP or DPSP registration number N d'agrment d'un RPA ou d'un RPDB PPIP insurable earnings Gains assurables du RPAP Amount-Montant Amount-Montant Year 2017 Anne Canada Revenue Agency Agence du revenu du Canada 10 Workers' compensation benefits Indemnits pour accidents du travail Recipient's name and address-Nom et adresse du bnficiaire Last name (print) Nom de famile (en lettres moules) Karen Partridge 123 Main Street City, Province XOX OXO First name Prnom See the privacy notice on your return. Consultez ravis de confidentialit dans votre dclaration. T5007 (17) T5007 Statement of Benefits tat des prestations Social assistance payments or nrovincial or territorial sunniements 1,400.00 Prestations d'assistance sociale ou supplement provincial ou territorial Initials Initiales Social insurance number 123 456 789 Numro d'assurance sociale Payer's name and address Nom et adresse du payeur Protected B/Protg B when completed / une fois rempli 13 Report code Code de genre de feuilles Amount: Paid by: Description: Period of service: Paid to: Official receipt for child care expenses $5,600.00 Karen Partridge Child care for Annie Partridge January 1 to December 31, 2017 Beacon Nursery 1263 John Street City, Province, XOXOXO 555-555-5555 Canada Revenue Agency First name of each eligible child for whom payments were made . Before you fill out this form, read the attached information sheet. Part A - Total child care expenses First and last name and date of birth of all your eligible children, even if you did not pay child care expenses for all of them. . Agence du revenu du Canada Total 6795 Child Care Expenses Deduction for 2017 Child care expenses paid (read note below) Name of the child care organization or name and social insurance number of the individual who received the payments $200 per week for a child included on line 1 in Part B; $275 per week for a child included on line 2; and $125 per week for a child included on line 3. Enter the amount of expenses included above that were incurred in 2017 for a child who was 6 or younger at the end of the year. Year 6794 Protected B when completed Month Day Number of weeks for boarding schools or overnight camps Part B - Basic limit for child care expenses Number of eligible children born in 2011 or later, for whom the disability amount cannot be claimed Number of eligible children born in 2017 or earlier, for whom the disability amount can be claimed Add lines 1, 2, and 3. Enter the amount from line 6795 in Part A. Enter your earned income. 34,790 00 X Enter the amount from line 4, 5, or 6, whichever is least. If you are the person with the higher net income, go to Part C. Leave lines 8 and 9 blank. Enter the amount that the other person with the higher net income deducted on line 214 of his or her 2017 return. T778 E (17) X (Ce formulaire est disponible en franais.) $8.000 Line 7 minus line 8. If you attended school in 2017 and you are the only person making a claim, also go to Part D. Otherwise, enter this amount on line 214 of your return. Allowable deduction $11.000 6796 1 2 5 01 7 8 * Attach Form T2201, Disability Tax Credit Certificate. If this form has already been filed for the child, attach a note to your return showing the name and social insurance number of the person who filed the form and the tax year for which it was filed. Canada 9

Step by Step Solution

★★★★★

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Sure here is Karens child care expense deduction for 2017 Part A Total child care expenses First and ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started