Question

Kastner and Associates, Inc. is a growing HR consulting firm that has been building its business for the last two years. With a strong client

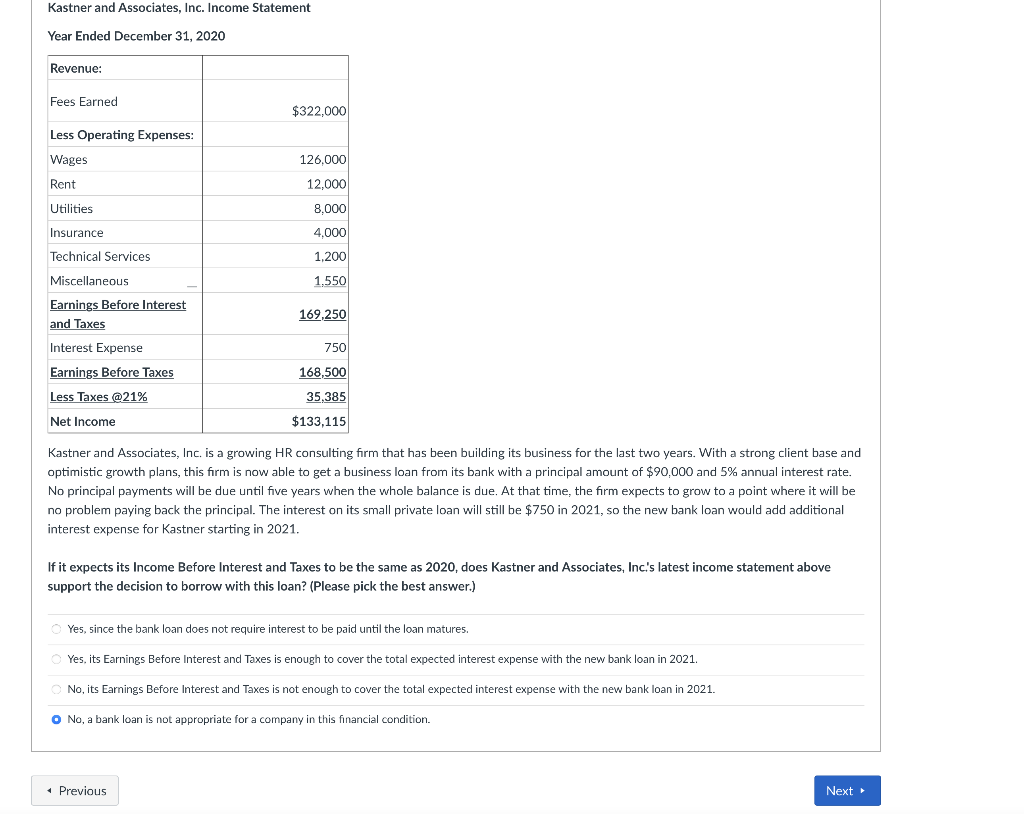

Kastner and Associates, Inc. is a growing HR consulting firm that has been building its business for the last two years. With a strong client base and optimistic growth plans, this firm is now able to get a business loan from its bank with a principal amount of $90,000 and 5% annual interest rate. No principal payments will be due until five years when the whole balance is due. At that time, the firm expects to grow to a point where it will be no problem paying back the principal. The interest on its small private loan will still be $750 in 2021, so the new bank loan would add additional interest expense for Kastner starting in 2021. If it expects its Income Before Interest and Taxes to be the same as 2020, does Kastner and Associates, Inc.'s latest income statement above support the decision to borrow with this loan?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started