Answered step by step

Verified Expert Solution

Question

1 Approved Answer

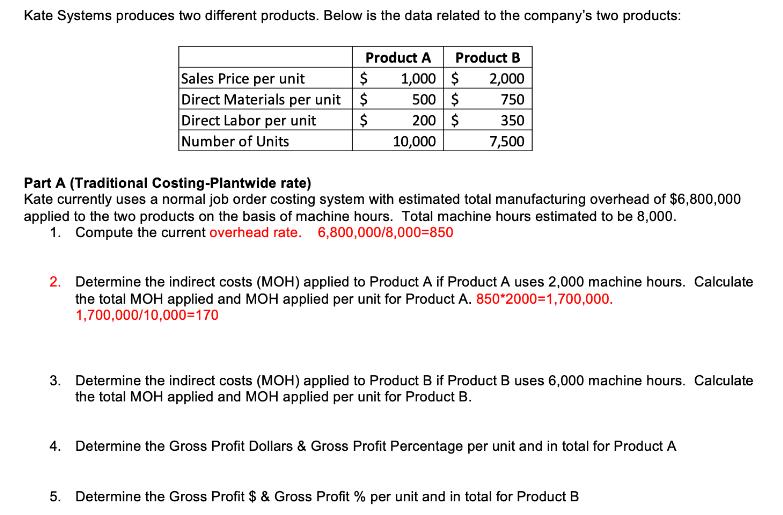

Kate Systems produces two different products. Below is the data related to the company's two products: Product A Product B 1,000 $ 500 $

Kate Systems produces two different products. Below is the data related to the company's two products: Product A Product B 1,000 $ 500 $ 200 $ Sales Price per unit $ Direct Materials per unit $ Direct Labor per unit Number of Units $ 10,000 2,000 750 350 7,500 Part A (Traditional Costing-Plantwide rate) Kate currently uses a normal job order costing system with estimated total manufacturing overhead of $6,800,000 applied to the two products on the basis of machine hours. Total machine hours estimated to be 8,000. 1. Compute the current overhead rate. 6,800,000/8,000-850 2. Determine the indirect costs (MOH) applied to Product A if Product A uses 2,000 machine hours. Calculate the total MOH applied and MOH applied per unit for Product A. 850*2000=1,700,000. 1,700,000/10,000=170 3. Determine the indirect costs (MOH) applied to Product B if Product B uses 6,000 machine hours. Calculate the total MOH applied and MOH applied per unit for Product B. 4. Determine the Gross Profit Dollars & Gross Profit Percentage per unit and in total for Product A 5. Determine the Gross Profit $ & Gross Profit % per unit and in total for Product B Kate is considering implementing an ABC system and determined the determined the following are the three primary activities: Design, which uses Engineering Hours as an activity driver; Machining, which uses machine hours as an activity driver; and Inspection, which uses number of batches as an activity driver. The cost of each activity and usage of the activity drivers are as follows: Cost $1,500,000 7. Design (Engineering Hours) Machining (Machine Hours) Required: 6. 8. Inspection (Batches) $5,000,000 $300,000 Calculate the activity rate for Design. Calculate the activity rate for Machining. Calculate the activity rate for Inspection. Usage by Product A Usage by Product B 400 600 2,000 90 6,000 30 11. 12. Determine the Gross Profit Dollars & Gross Profit Percentage per unit and in total for Product A Determine the Gross Profit Dollars & Gross Profit Percentage per unit and in total for Product B. 13. The President of Kate is skeptical about whether the benefits of ABC will be worth the cost. She notes that ABC is just a different way of "spreading the same total of cost around", so overall company profitability will remain the same under either method. Do you agree with this view? Why or why not?

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Part A 1 Compute the current overhead rate Current overhead rate Estimated total manufacturing overhead Estimated total machine hours Current overhead rate 6800000 8000 machine hours Current overhead ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started