Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kathrine estimated the stock beta for TASTA, a new EV company, using the past 60 months of data, (RitRf)=.5+(3.50)1.3(RmtRf)+eit(.33) The current risk-free interest rate is

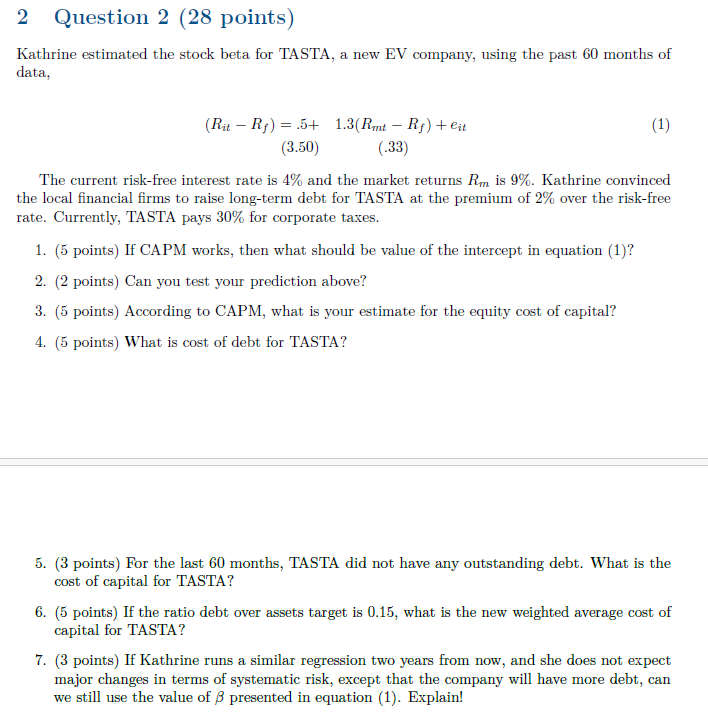

Kathrine estimated the stock beta for TASTA, a new EV company, using the past 60 months of data, (RitRf)=.5+(3.50)1.3(RmtRf)+eit(.33) The current risk-free interest rate is 4% and the market returns Rm is 9%. Kathrine convinced the local financial firms to raise long-term debt for TASTA at the premium of 2% over the risk-free rate. Currently, TASTA pays 30% for corporate taxes. 1. (5 points) If CAPM works, then what should be value of the intercept in equation (1)? 2. (2 points) Can you test your prediction above? 3. (5 points) According to CAPM, what is your estimate for the equity cost of capital? 4. (5 points) What is cost of debt for TASTA? 5. (3 points) For the last 60 months, TASTA did not have any outstanding debt. What is the cost of capital for TASTA? 6. (5 points) If the ratio debt over assets target is 0.15 , what is the new weighted average cost of capital for TASTA? 7. (3 points) If Kathrine runs a similar regression two years from now, and she does not expect major changes in terms of systematic risk, except that the company will have more debt, can we still use the value of presented in equation (1). Explain

Kathrine estimated the stock beta for TASTA, a new EV company, using the past 60 months of data, (RitRf)=.5+(3.50)1.3(RmtRf)+eit(.33) The current risk-free interest rate is 4% and the market returns Rm is 9%. Kathrine convinced the local financial firms to raise long-term debt for TASTA at the premium of 2% over the risk-free rate. Currently, TASTA pays 30% for corporate taxes. 1. (5 points) If CAPM works, then what should be value of the intercept in equation (1)? 2. (2 points) Can you test your prediction above? 3. (5 points) According to CAPM, what is your estimate for the equity cost of capital? 4. (5 points) What is cost of debt for TASTA? 5. (3 points) For the last 60 months, TASTA did not have any outstanding debt. What is the cost of capital for TASTA? 6. (5 points) If the ratio debt over assets target is 0.15 , what is the new weighted average cost of capital for TASTA? 7. (3 points) If Kathrine runs a similar regression two years from now, and she does not expect major changes in terms of systematic risk, except that the company will have more debt, can we still use the value of presented in equation (1). Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started