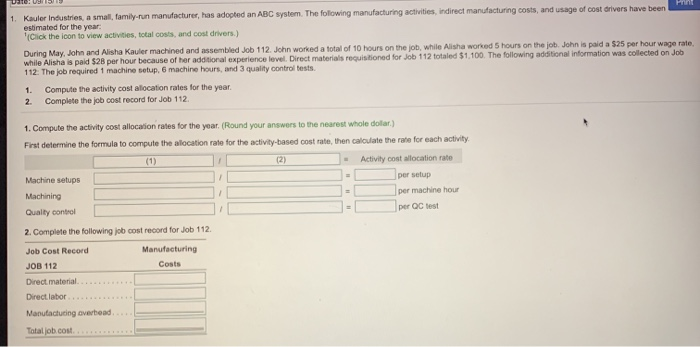

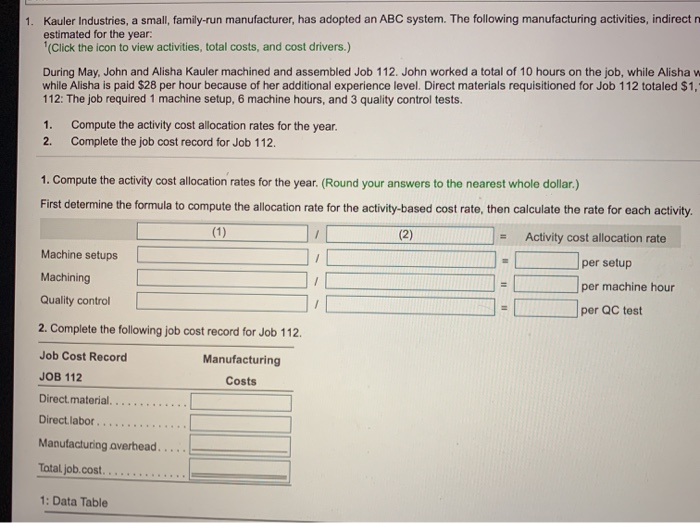

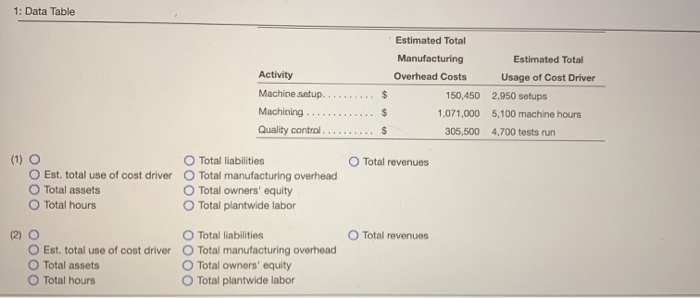

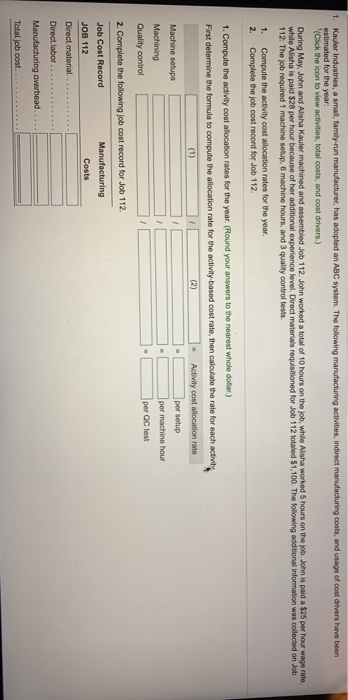

Kauler Industries, a small family-run manufacturer, has adopted an ABC system. The following manufacturing activities, indirect manufacturing costs, and usage of cost drivers have been estimated for the year Click the icon to view activities, total costs, and cost drivers.) During May, John and Alisha Kauler machined and assembled Job 112. John worked a total of 10 hours on the job, while Alisha worked 5 hours on the job. John is paid a $25 per hour wage rate while Alisha is paid $2B per hour because of her additional experience level Direct materials requisitioned for Job 112 totaled $1,100. The following additional information was collected on Job 112. The job required 1 machine setup. 6 machine hours and 3 quality control tests 1. 2. Compute the activity cost allocation rates for the year Complete the job cost record for Job 112 1. Compute the activity cost allocation rates for the year. (Round your answers to the nearest whole dolar) First determine the formula to compute the allocation rate for the activity-based cost rate, then calculate the rate for each activity Activity coat allocation rate Machine setups Machining Quality control per setup per machine hour per QC test 2. Complete the following job cost record for Job 112 Manufacturing Job Cost Record JOB 112 Costs Direct material.... Direct labor............. Manufacturing overbead Tattob cout 1. Kauler Industries, a small, family-run manufacturer, has adopted an ABC system. The following manufacturing activities, indirect estimated for the year: (Click the icon to view activities, total costs, and cost drivers.) During May, John and Alisha Kauler machined and assembled Job 112. John worked a total of 10 hours on the job, while Alishaw while Alisha is paid $28 per hour because of her additional experience level. Direct materials requisitioned for Job 112 totaled $1,- 112: The job required 1 machine setup, 6 machine hours, and 3 quality control tests. 1. 2. Compute the activity cost allocation rates for the year. Complete the job cost record for Job 112. 1. Compute the activity cost allocation rates for the year. (Round your answers to the nearest whole dollar.) First determine the formula to compute the allocation rate for the activity-based cost rate, then calculate the rate for each activity. = Machine setups Machining Activity cost allocation rate per setup per machine hour per QC test Quality control 2. Complete the following job cost record for Job 112. Manufacturing Costs Job Cost Record JOB 112 Direct material. ........... Direct labor............... Manufacturing averhead.... Totaljob.cost... 1: Data Table 1: Data Table Activity Estimated Total Manufacturing Overhead Costs 150,450 1,071,000 305,500 Machine setup...... Machining ......... Quality control.......... Estimated Total Usage of Cost Driver 2,950 setups 5,100 machine hours 4.700 tests run Total revenues (1) O O Est. total use of cost driver Total assets Total hours Total liabilities O Total manufacturing overhead Total owners' equity Total plantwide labor Total revenues (2) O O Est. total use of cost driver Total assets Total hours Total liabilities 0 Total manufacturing overhead Total owners' equity Total plantwide labor Kauler Industries, a smal, family-run manufacturer, has adopted an ABC system. The following manufacturing activities, indirect manufacturing costs, and usage of cost drivers have been estimated for the year: (Click the icon to view activities, total costs, and cost drivers.) During May, John and Alisha Kauler machined and assembled Job 112. John worked a total of 10 hours on the job, while Alisha worked 5 hours on the job. John is paid a $25 per hour wage rate, while Alisha is paid $20 per hour because of her additional experience level Direct materials requisitioned for Job 112 totaled $1,100. The following additional information was collected on Job 112: The job required 1 machine setup, 6 machine hours, and 3 quality control tests. 1. 2. Compute the activity cost allocation rates for the year. Complete the job cost record for Job 112. 1. Compute the activity cost allocation rates for the year. (Round your answers to the nearest whole dolar) First determine the formula to compute the allocation rate for the activity-based cost rate, then calculate the rate for each activity (2) Activity cost allocation rate per setup per machine hour per QC test Machine setups Machining Quality control 2. Complete the following job cost record for Job 112. Job Cost Record Manufacturing JOB 112 Costs Direct material.. Direct.labor. Manufacturing averhead.. Totaljob.cost