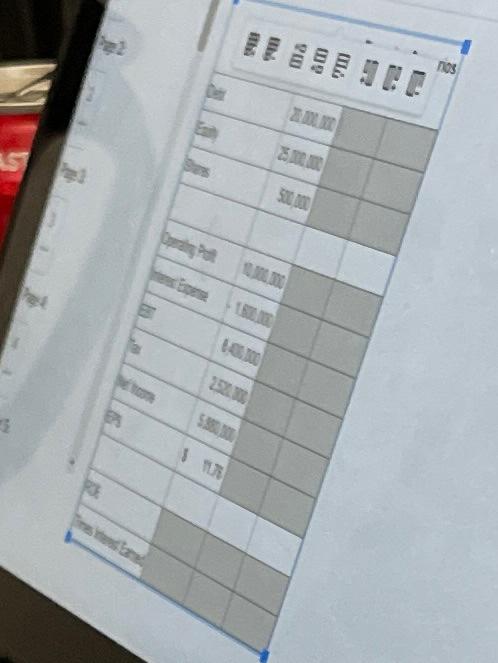

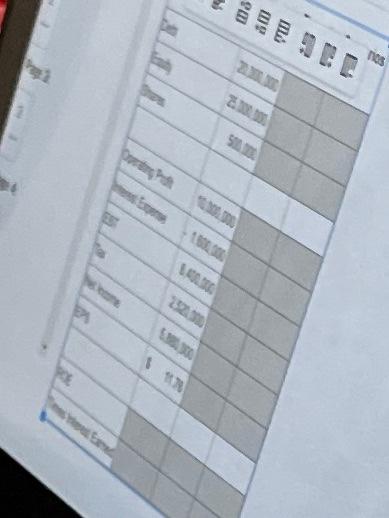

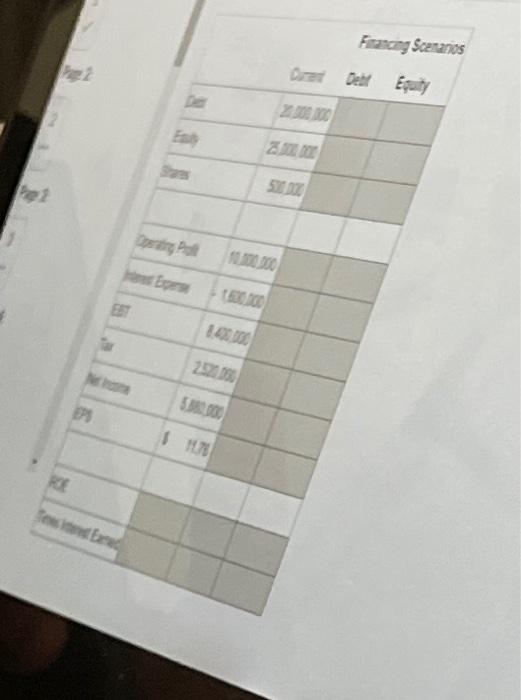

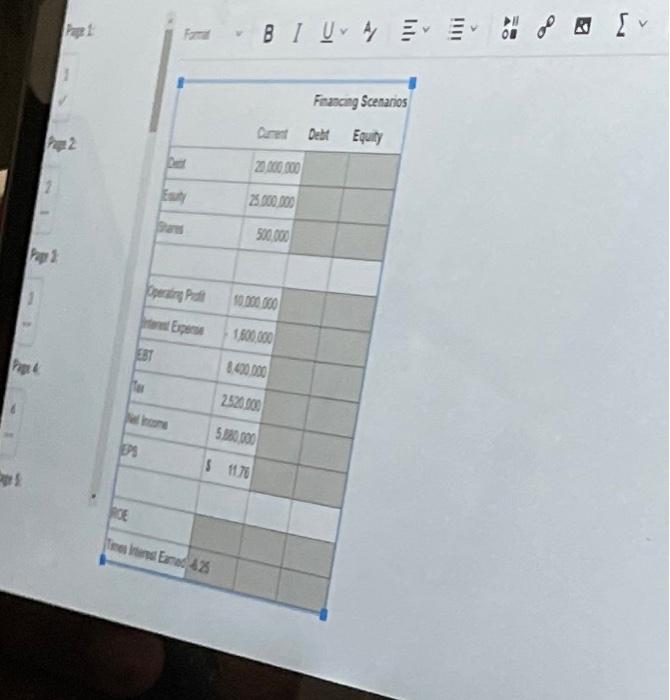

kDown Browser + Wa Levend 2 Company loc intends to raise $8 milion for plant expansion. The company has an option of financing by way of either an equity issue (new shares), by ing shares a $50 per share or through a bond issue debt financing) bearing an za test 12% The compansament capital structure consists of $20.000.000 in debt bearing 8% mes and $25.000.000 in equity New capital injection will increase company's Flauta taldeas in the table below. EPS/ROE/Times Interest Eamed can be mountains 2 decimes using the following formas EPAN Varing + SUS standing POEM neders equity Terezne Operating profit/interest expense 1892 10 28 *** 30 nos . S 3 50 30 100 2522 5. 23 33 Tos 2 Francing Scenas Esity 2009 Per 50Z 10.300 252.00 1978 RE Levered (2) Company Inc intends to raise $8 million for plant expansion. The company has an option of financing by way of either an equity issue (new shares), by seling shares at $50 per share or through a bond issue (debt financing) bearing an mal interest of 12% The company's current capital structure consists of $20,000,000 in debt bearing 8% interest and $25.000.000 in equity. New capital injection will increase company's operating profits by 10% Filost al shaded areas in the table below. EPS/ROE/Times Interest Earned can be rounded to 2 decimals using the following formulas: EPS-Net carmings/4 shares outstanding ROENet earnings/stockholders equity Times interest earned-Operating profit/Interest expense B 1 0 1 = = Financing Scenarios Curent Debt Equity 2 23 00 600 2.500.000 500.000 50.000.000 Expert 1.500.000 EBT 100 DOO 250.000 5120000 PS S 1170 Terinda kDown Browser + Wa Levend 2 Company loc intends to raise $8 milion for plant expansion. The company has an option of financing by way of either an equity issue (new shares), by ing shares a $50 per share or through a bond issue debt financing) bearing an za test 12% The compansament capital structure consists of $20.000.000 in debt bearing 8% mes and $25.000.000 in equity New capital injection will increase company's Flauta taldeas in the table below. EPS/ROE/Times Interest Eamed can be mountains 2 decimes using the following formas EPAN Varing + SUS standing POEM neders equity Terezne Operating profit/interest expense 1892 10 28 *** 30 nos . S 3 50 30 100 2522 5. 23 33 Tos 2 Francing Scenas Esity 2009 Per 50Z 10.300 252.00 1978 RE Levered (2) Company Inc intends to raise $8 million for plant expansion. The company has an option of financing by way of either an equity issue (new shares), by seling shares at $50 per share or through a bond issue (debt financing) bearing an mal interest of 12% The company's current capital structure consists of $20,000,000 in debt bearing 8% interest and $25.000.000 in equity. New capital injection will increase company's operating profits by 10% Filost al shaded areas in the table below. EPS/ROE/Times Interest Earned can be rounded to 2 decimals using the following formulas: EPS-Net carmings/4 shares outstanding ROENet earnings/stockholders equity Times interest earned-Operating profit/Interest expense B 1 0 1 = = Financing Scenarios Curent Debt Equity 2 23 00 600 2.500.000 500.000 50.000.000 Expert 1.500.000 EBT 100 DOO 250.000 5120000 PS S 1170 Terinda