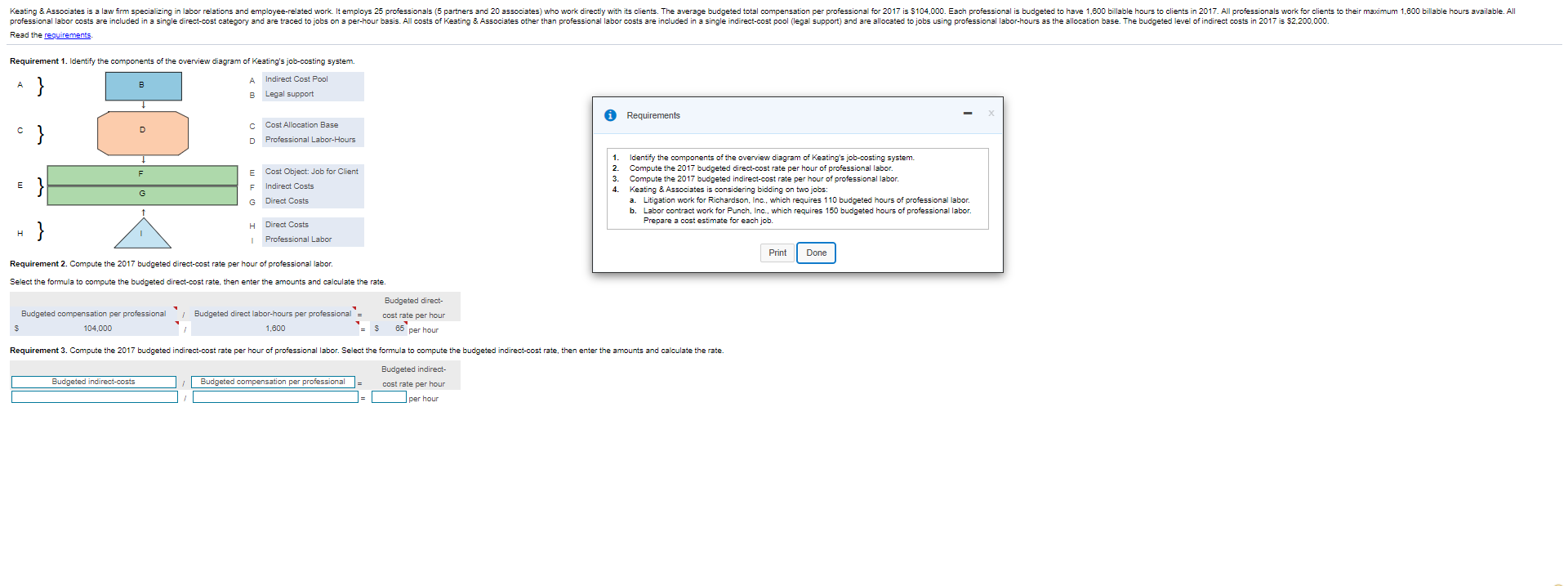

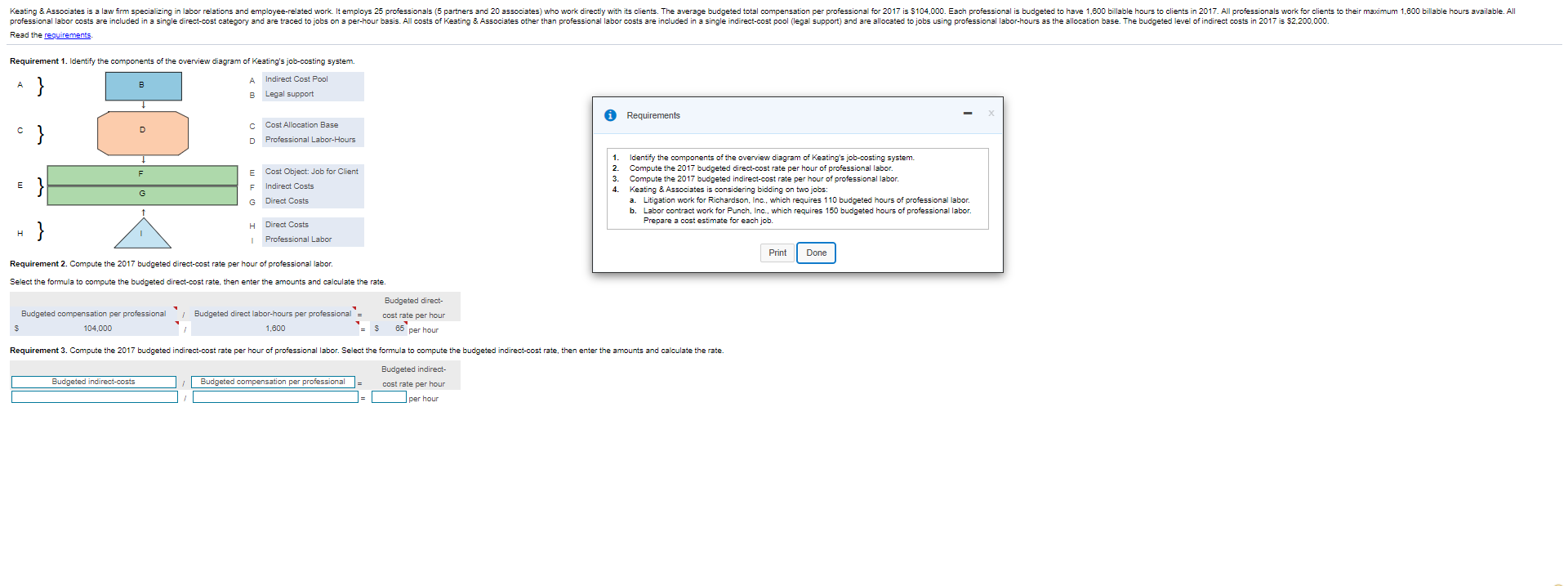

Keating & Associates is a law firm specializing in labor relations and employee-related work. It employs 25 professionals (5 partners and 20 associates) who work directly with its clients. The average budgeted total compensation per professional for 2017 is $104.000. Each professional is budgeted to have 1.600 billable hours to clients in 2017. All professionals work for clients to their maximum 1.600 billable hours available. All professional labor costs are included in a single direct-cost category and are traced to jobs on a per-hour basis. All costs of Keating & Associates other than professional labor costs are included in a single indirect-cost pool (legal support) and are allocated to jobs using professional labor-hours as the allocation base. The budgeted level of indirect costs in 2017 is $2,200.000. Read the requirements Requirement 1. Identify the components of the overview diagram of Keating's job-costing system. . B A Indirect Cost Pool B Legal support } i Requirements D } c Cost Allocation Base D Professional Labor-Hours F E Cost Object: Job for Client Indirect Costs | rnimit E } F 1 Identify the components of the overview diagram of Keating's job-costing system. 2. Compute the 2017 budgeted direct-cost rate per hour of professional labor. 3 Compute the 2017 budgeted indirect-cost rate per hour of professional labor. 4. Keating & Associates is considering bidding on two jobs: a. Litigation work for Richardson, Inc., which requires 110 budgeted hours of professional labor. b. Labor contract work for Punch, Inc., which requires 150 budgeted hours of professional labor. Prepare a cost estimate for each job. G G Direct Costs H } H Direct Costs | Professional Labor Print Done Requirement 2. Compute the 2017 budgeted direct-cost rate per hour of professional labor. Select the formula to compute the budgeted direct-cost rate, then enter the amounts and calculate the rate. Budgeted direct- Budgeted compensation per professional Budgeted direct labor-hours per professional = cost rate per hour $ 104,000 1,600 85 per hour Requirement 3. Compute the 2017 budgeted indirect-cost rate per hour of professional labor. Select the formula to compute the budgeted indirect-cost rate, then enter the amounts and calculate the rate. Budgeted indirect Budgeted indirect-costs Budgeted compensation per professional cost rate per hour 1 per hour