Question

Kedah, Malaysia. Among the property, plant and equipment (PPE) of the company is a vacant land in Sungai Petani. The land was acquired in year

Kedah, Malaysia. Among the property, plant and equipment (PPE) of the company is a vacant land in Sungai Petani. The land was acquired in year 2010 with a cost of RM400,000. Sungai Petani area is currently known for the booming of residential houses, and the location of the land is nearby the development area and suitable for residential property. Statement of Financial Position of the company as at 31 December 2020 shows the carrying value of the land of RM1 million. A recent sale of similar vacant land in the area was at RM1.8 million. It is estimated that the fair value of the residential property would be RM6 million with the cost to convert the land to residential property of RM3.5 million.

The SSB's Chief Executive Officer (CEO), Mr. Rahman, is planning to acquire Mesra Sdn Bhd (MSB), a potential cat food manufacturing firm located in Kuala Kedah. The current return to shareholders for a company in the same industry as MSB is 7% and it is expected that an additional risks premium of 2% will be applicable to MSB, being a smaller and unlisted company. The CEO estimates that the expected cash flows before tax for MSB for years 2021, 2022, 2023 and 2024 are RM1.5 million, RM2.0 million, RM2.5 million and RM3.0 million, respectively. MSB is expected to sustain its 2024 after tax cash flows in the future indefinitely. The growth rate of the estimated cash flow in year 2025 and beyond is at historical rate. The probability for the attainment of the estimated cash flow is expected to be 90% for the first two years and remain constant at 80% on year 3 and beyond. The corporate tax rate remains at 24% for all years.

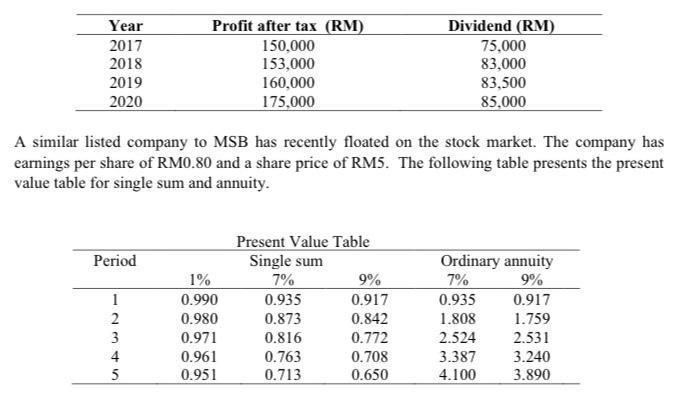

Checking on the previous performance of MSB shows the following amount of profit after tax and dividend payment for the last 4 years:

REQUIRED:

Calculate the fair value of MSB based on the following valuation models. Round up the

growth rate to two decimal points and fair value of the company to the nearest RM. Show all

the workings.

1. Dividend valuation model

2. P/E or earnings valuation

3. Discounted cash flow

Year 2017 2018 2019 2020 Period A similar listed company to MSB has recently floated on the stock market. The company has earnings per share of RM0.80 and a share price of RM5. The following table presents the present value table for single sum and annuity. 1 12345 2 Profit after tax (RM) 150,000 153,000 160,000 175,000 5 1% 0.990 0.980 0.971 0.961 0.951 Present Value Table Single sum 7% 0.935 0.873 0.816 0.763 0.713 Dividend (RM) 75,000 83,000 83,500 85,000 9% 0.917 0.842 0.772 0.708 0.650 Ordinary annuity 7% 9% 0.935 1.808 2.524 3.387 4.100 0.917 1.759 2.531 3.240 3.890

Step by Step Solution

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

1 Dividend Valuation model Do g The9 Do Past Dividend ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started