Answered step by step

Verified Expert Solution

Question

1 Approved Answer

keep 4 post decimal digits when entering your final answer and keep 4 post decimal digits in all intermediate steps. Jefferson's recently pasid an annual

keep 4 post decimal digits when entering your final answer and keep 4 post decimal digits in all intermediate steps.

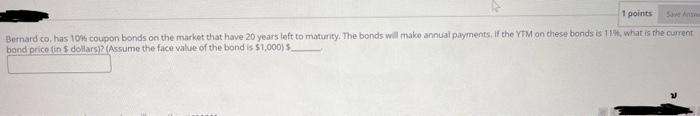

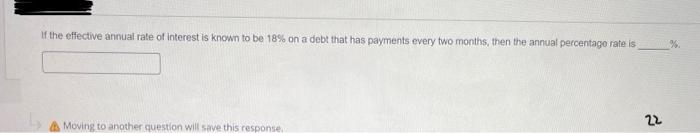

Jefferson's recently pasid an annual dividend of $8 per share. The dividend is expected to decrease by 19 each year. How much should you pay for this stock today if your cequend return is 14W tin s dollarsi? 5 Bernard co, has 10% coupon bonds on the market that have 20 years left to maturity. The bonds will make annual payments, if the YTM on these bonds is 114, whiat is the carrent bond price fin 5 dollars)? (Assume the face value of the bond is $1,000 ) $ If the effective annual rate of interest is known to be 18% on a debt that has payments every two months, then the annual percentage rate is Moving to another question will save this response. 22

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started