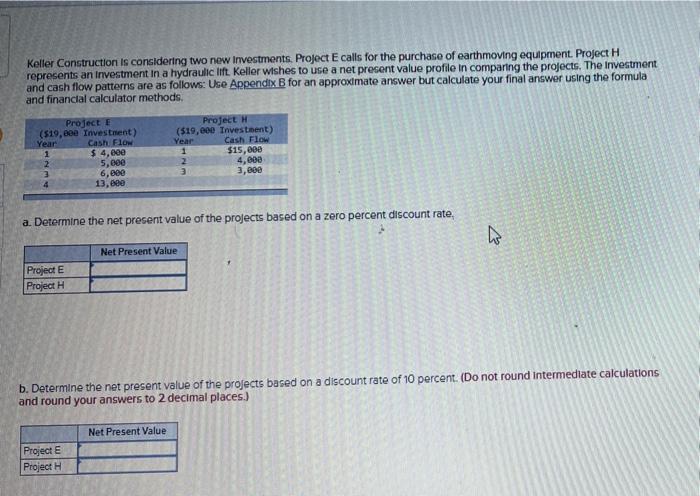

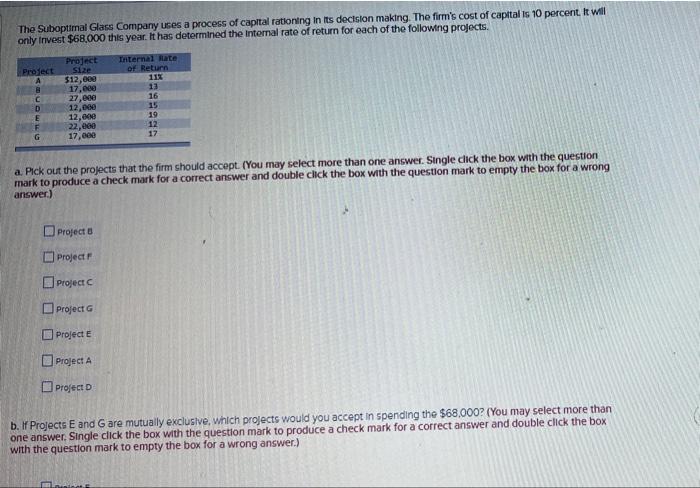

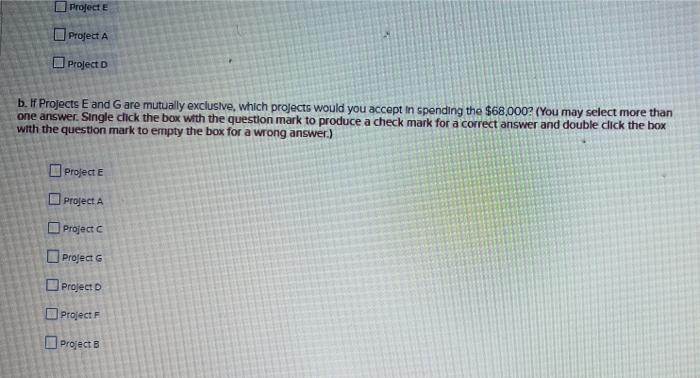

Keller Construction is considering two new Investments Project E calls for the purchase of earthmoving equipment Project H represents an investment in a hydraulic lift. Keller Wishes to use a net present value profile in comparing the projects. The investment and cash flow patterns are as follows: Use Appendix B for an approximate answer but calculate your final answer using the formula and financial calculator methods. Project E ($19, Bee Investment) Year Cash Flow 1 $ 4,000 2 5.cee 3 6,000 4 13. Bee Project (519,000 Investment) Year Cash Flow 1 $15,000 2 4,000 3 3,000 a. Determine the net present value of the projects based on a zero percent discount rate, N Net Present Value Project E Project H b. Determine the net present value of the projects based on a discount rate of 10 percent. (Do not round Intermediate calculations and round your answers to 2 decimal places.) Net Present Value Projecte Project H The Suboptimal Glass Company uses a process of capital rationing in its decision making. The firm's cost of capital is 10 percent. It will only Invest $68.000 this year. It has determined the Internal rate of return for each of the following projects. Project A C D E F G Project Size $12,600 17.080 27,000 12,080 12,69 22.000 17,000 Internal rate of Return 11% 13 16 15 19 12 17 a. Pick out the projects that the firm should accept. (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer) - Projecte Project Project Project Projecte Project A Project b. Projects E and Gare mutually exclusive, which projects would you accept in spending the $68,000? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) Projecte Project A Project D b. Projects E and G are mutually exclusive, which projects would you accept in spending the $68,000? (You may select more than one answer. Single click the box with the question mark to produce a check mark for a correct answer and double click the box with the question mark to empty the box for a wrong answer.) Projecte Project Project Project Project D Project Projects