Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kellogg pays $2.28 in annual per-share dividends to its common stockholders, and its recent stock price was $62.50. Assume that Kellogg's cost of equity

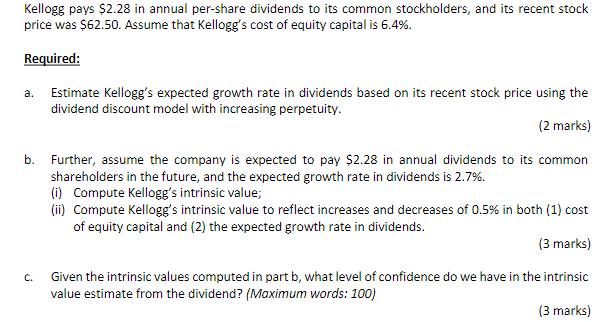

Kellogg pays $2.28 in annual per-share dividends to its common stockholders, and its recent stock price was $62.50. Assume that Kellogg's cost of equity capital is 6.4%. Required: a. Estimate Kellogg's expected growth rate in dividends based on its recent stock price using the dividend discount model with increasing perpetuity. (2 marks) b. Further, assume the company is expected to pay $2.28 in annual dividends to its common shareholders in the future, and the expected growth rate in dividends is 2.7%. (i) Compute Kellogg's intrinsic value; (ii) Compute Kellogg's intrinsic value to reflect increases and decreases of 0.5% in both (1) cost of equity capital and (2) the expected growth rate in dividends. (3 marks) C. Given the intrinsic values computed in part b, what level of confidence do we have in the intrinsic value estimate from the dividend? (Maximum words: 100) (3 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started