kelly and Chanelle chambers, not the rock band one

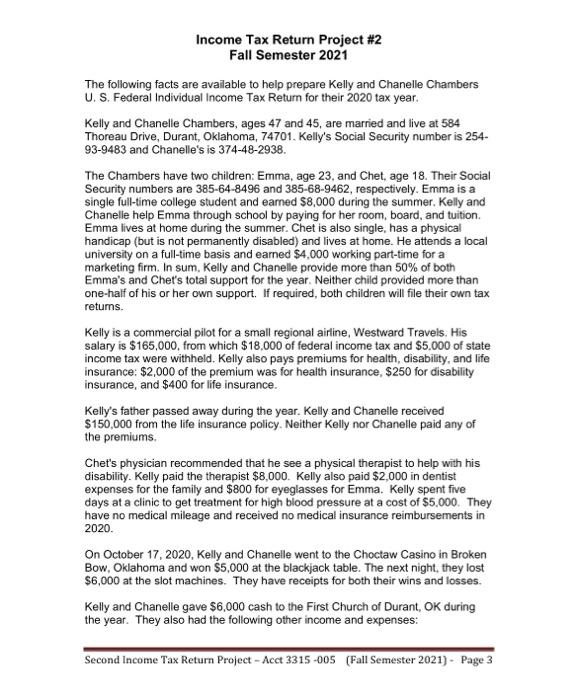

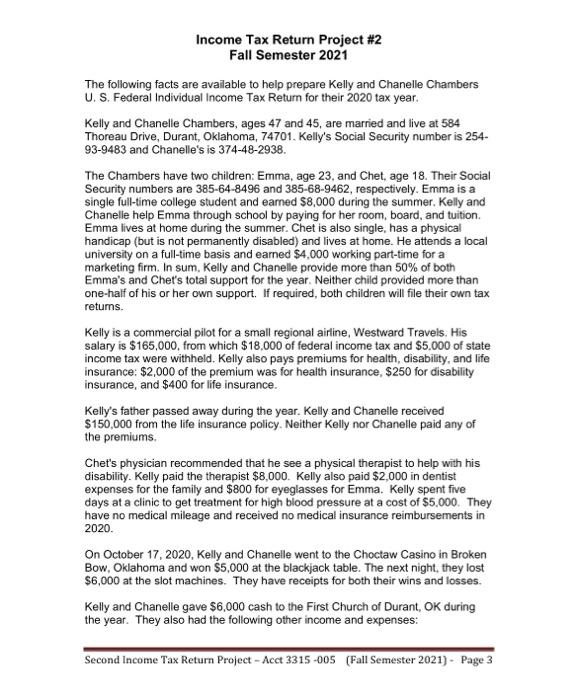

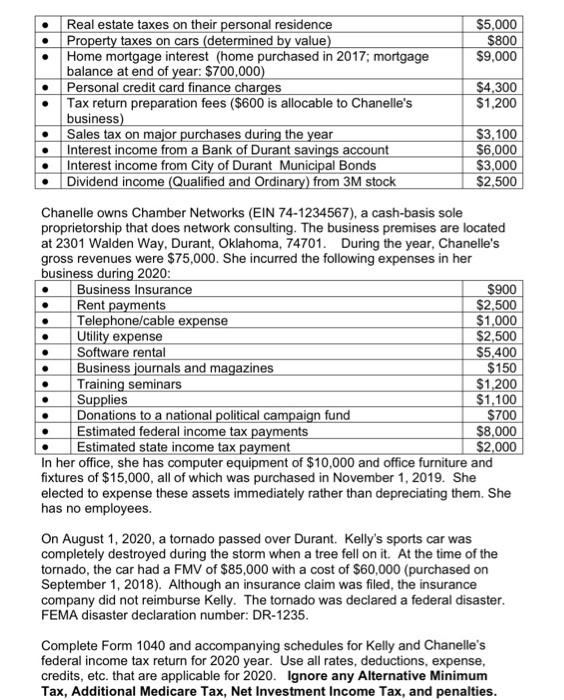

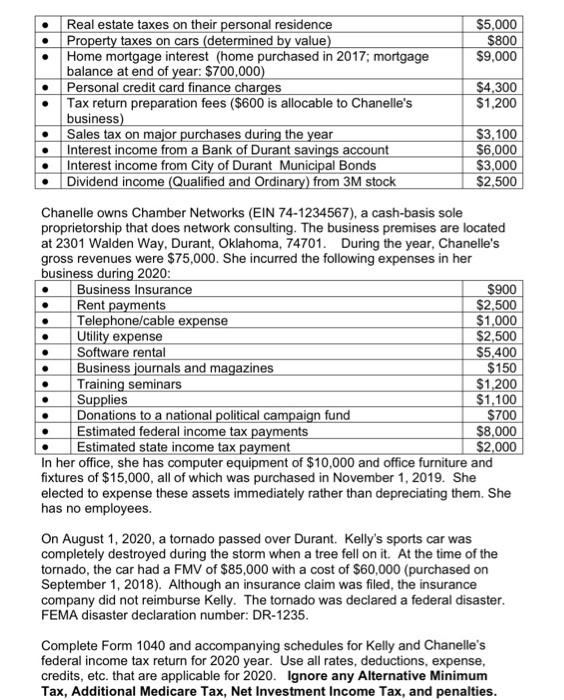

Income Tax Return Project #2 Fall Semester 2021 The following facts are available to help prepare Kelly and Chanelle Chambers U.S. Federal Individual Income Tax Return for their 2020 tax year. Kelly and Chanelle Chambers, ages 47 and 45, are married and live at 584 Thoreau Drive, Durant, Oklahoma, 74701, Kelly's Social Security number is 254- 93-9483 and Chanelle's is 374-48-2938. The Chambers have two children: Emma, age 23, and Chet, age 18. Their Social Security numbers are 385-64-8496 and 385-68-9462, respectively. Emma is a single full-time college student and eamed $8,000 during the summer. Kelly and Chanelle help Emma through school by paying for her room, board, and tuition Emma lives at home during the summer. Chet is also single, has a physical handicap (but is not permanently disabled) and lives at home. He attends a local university on a full-time basis and earned $4,000 working part-time for a marketing firm. In sum, Kelly and Chanelle provide more than 50% of both Emma's and Chet's total support for the year. Neither child provided more than one-half of his or her own support. If required, both children will file their own tax retums. Kelly is a commercial pilot for a small regional airline, Westward Travels. His salary is $165,000, from which $18.000 of federal income tax and $5.000 of state income tax were withheld. Kelly also pays premiums for health, disability, and life insurance: $2,000 of the premium was for health insurance, $250 for disability insurance, and $400 for life insurance. Kelly's father passed away during the year. Kelly and Chanelle received $150,000 from the life insurance policy. Neither Kelly nor Chanelle paid any of the premiums. Chet's physician recommended that he see a physical therapist to help with his disability. Kelly paid the therapist $8,000. Kelly also paid $2,000 in dentist expenses for the family and $800 for eyeglasses for Emma. Kelly spent five days at a clinic to get treatment for high blood pressure at a cost of $5,000. They have no medical mileage and received no medical insurance reimbursements in 2020. On October 17, 2020, Kelly and Chanelle went to the Choctaw Casino in Broken Bow, Oklahoma and won $5,000 at the blackjack table. The next night, they lost $6,000 at the slot machines. They have receipts for both their wins and losses. Kelly and Chanelle gave $6,000 cash to the First Church of Durant, OK during the year. They also had the following other income and expenses: Second Income Tax Return Project - Acct 3315-005 (Fall Semester 2021) - Page 3 C uc Real estate taxes on their personal residence $5,000 Property taxes on cars (determined by value) $800 Home mortgage interest (home purchased in 2017, mortgage $9,000 balance at end of year: $700,000) Personal credit card finance charges $4,300 Tax return preparation fees ($600 is allocable to Chanelle's $1,200 business) Sales tax on major purchases during the year $3,100 Interest income from a Bank of Durant savings account $6,000 Interest income from City of Durant Municipal Bonds $3,000 Dividend income (Qualified and Ordinary) from 3M stock $2,500 Chanelle owns Chamber Networks (EIN 74-1234567), a cash-basis sole proprietorship that does network consulting. The business premises are located at 2301 Walden Way, Durant, Oklahoma, 74701. During the year, Chanelle's gross revenues were $75,000. She incurred the following expenses in her business during 2020: Business Insurance $900 Rent payments $2.500 Telephone/cable expense $1,000 Utility expense $2,500 Software rental $5,400 Business journals and magazines $150 Training seminars $1,200 Supplies $1,100 Donations to a national political campaign fund $700 Estimated federal income tax payments $8,000 Estimated state income tax payment $2.000 In her office, she has computer equipment of $10,000 and office furniture and fixtures of $15,000, all of which was purchased in November 1, 2019. She elected to expense these assets immediately rather than depreciating them. She has no employees. On August 1, 2020, a tornado passed over Durant. Kelly's sports car was completely destroyed during the storm when a tree fell on it. At the time of the tornado, the car had a FMV of $85,000 with a cost of $60,000 (purchased on September 1, 2018). Although an insurance claim was filed, the insurance company did not reimburse Kelly. The tornado was declared a federal disaster. FEMA disaster declaration number: DR-1235. Complete Form 1040 and accompanying schedules for Kelly and Chanelle's federal income tax return for 2020 year. Use all rates, deductions, expense, credits, etc. that are applicable for 2020. Ignore any Alternative Minimum Tax, Additional Medicare Tax, Net Investment Income Tax, and penalties. ... Income Tax Return Project #2 Fall Semester 2021 The following facts are available to help prepare Kelly and Chanelle Chambers U.S. Federal Individual Income Tax Return for their 2020 tax year. Kelly and Chanelle Chambers, ages 47 and 45, are married and live at 584 Thoreau Drive, Durant, Oklahoma, 74701, Kelly's Social Security number is 254- 93-9483 and Chanelle's is 374-48-2938. The Chambers have two children: Emma, age 23, and Chet, age 18. Their Social Security numbers are 385-64-8496 and 385-68-9462, respectively. Emma is a single full-time college student and eamed $8,000 during the summer. Kelly and Chanelle help Emma through school by paying for her room, board, and tuition Emma lives at home during the summer. Chet is also single, has a physical handicap (but is not permanently disabled) and lives at home. He attends a local university on a full-time basis and earned $4,000 working part-time for a marketing firm. In sum, Kelly and Chanelle provide more than 50% of both Emma's and Chet's total support for the year. Neither child provided more than one-half of his or her own support. If required, both children will file their own tax retums. Kelly is a commercial pilot for a small regional airline, Westward Travels. His salary is $165,000, from which $18.000 of federal income tax and $5.000 of state income tax were withheld. Kelly also pays premiums for health, disability, and life insurance: $2,000 of the premium was for health insurance, $250 for disability insurance, and $400 for life insurance. Kelly's father passed away during the year. Kelly and Chanelle received $150,000 from the life insurance policy. Neither Kelly nor Chanelle paid any of the premiums. Chet's physician recommended that he see a physical therapist to help with his disability. Kelly paid the therapist $8,000. Kelly also paid $2,000 in dentist expenses for the family and $800 for eyeglasses for Emma. Kelly spent five days at a clinic to get treatment for high blood pressure at a cost of $5,000. They have no medical mileage and received no medical insurance reimbursements in 2020. On October 17, 2020, Kelly and Chanelle went to the Choctaw Casino in Broken Bow, Oklahoma and won $5,000 at the blackjack table. The next night, they lost $6,000 at the slot machines. They have receipts for both their wins and losses. Kelly and Chanelle gave $6,000 cash to the First Church of Durant, OK during the year. They also had the following other income and expenses: Second Income Tax Return Project - Acct 3315-005 (Fall Semester 2021) - Page 3 C uc Real estate taxes on their personal residence $5,000 Property taxes on cars (determined by value) $800 Home mortgage interest (home purchased in 2017, mortgage $9,000 balance at end of year: $700,000) Personal credit card finance charges $4,300 Tax return preparation fees ($600 is allocable to Chanelle's $1,200 business) Sales tax on major purchases during the year $3,100 Interest income from a Bank of Durant savings account $6,000 Interest income from City of Durant Municipal Bonds $3,000 Dividend income (Qualified and Ordinary) from 3M stock $2,500 Chanelle owns Chamber Networks (EIN 74-1234567), a cash-basis sole proprietorship that does network consulting. The business premises are located at 2301 Walden Way, Durant, Oklahoma, 74701. During the year, Chanelle's gross revenues were $75,000. She incurred the following expenses in her business during 2020: Business Insurance $900 Rent payments $2.500 Telephone/cable expense $1,000 Utility expense $2,500 Software rental $5,400 Business journals and magazines $150 Training seminars $1,200 Supplies $1,100 Donations to a national political campaign fund $700 Estimated federal income tax payments $8,000 Estimated state income tax payment $2.000 In her office, she has computer equipment of $10,000 and office furniture and fixtures of $15,000, all of which was purchased in November 1, 2019. She elected to expense these assets immediately rather than depreciating them. She has no employees. On August 1, 2020, a tornado passed over Durant. Kelly's sports car was completely destroyed during the storm when a tree fell on it. At the time of the tornado, the car had a FMV of $85,000 with a cost of $60,000 (purchased on September 1, 2018). Although an insurance claim was filed, the insurance company did not reimburse Kelly. The tornado was declared a federal disaster. FEMA disaster declaration number: DR-1235. Complete Form 1040 and accompanying schedules for Kelly and Chanelle's federal income tax return for 2020 year. Use all rates, deductions, expense, credits, etc. that are applicable for 2020. Ignore any Alternative Minimum Tax, Additional Medicare Tax, Net Investment Income Tax, and penalties