Answered step by step

Verified Expert Solution

Question

1 Approved Answer

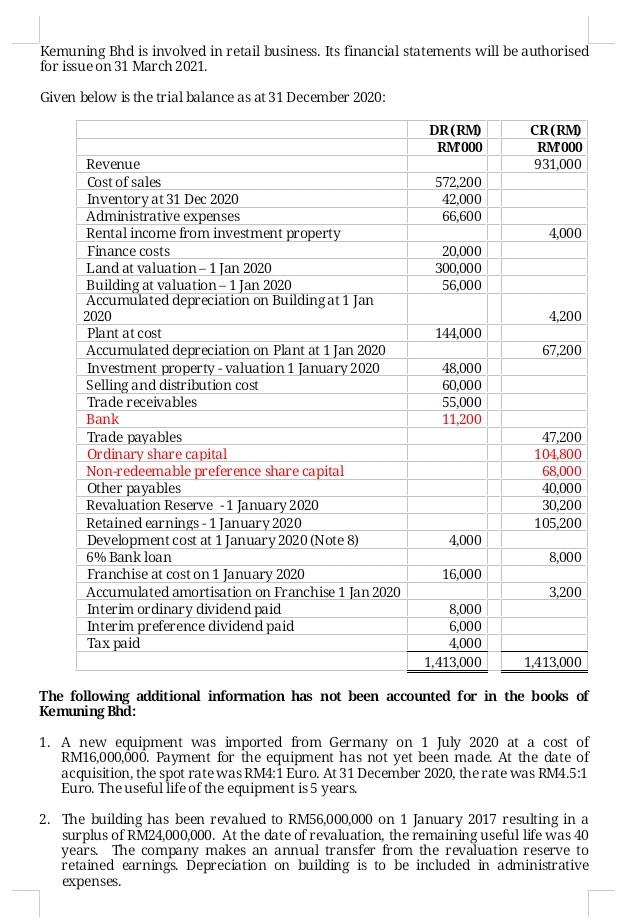

Kemuning Bhd is involved in retail business. Its financial statements will be authorised for issue on 31 March 2021. Given below is the trial balance

Kemuning Bhd is involved in retail business. Its financial statements will be authorised for issue on 31 March 2021. Given below is the trial balance as at 31 December 2020: DR(RM) RM000 CR(RM) RM 000 931,000 572,200 42,000 66,600 4,000 20,000 300,000 56,000 4,200 144,000 67,200 Revenue Cost of sales Inventory at 31 Dec 2020 Administrative expenses Rental income from investment property Finance costs Land at valuation-1 Jan 2020 Building at valuation - 1 Jan 2020 Accumulated depreciation on Building at 1 Jan 2020 Plant at cost Accumulated depreciation on Plant at 1 Jan 2020 Investment property - valuation 1 January 2020 Selling and distribution cost Trade receivables Bank Trade payables Ordinary share capital Non-redeemable preference share capital Other payables Revaluation Reserve - 1 January 2020 Retained earnings - 1 January 2020 Development cost at 1 January 2020 (Note 8) 6% Bank loan Franchise at cost on 1 January 2020 Accumulated amortisation on Franchise 1 Jan 2020 Interim ordinary dividend paid Interim preference dividend paid Tax paid 48,000 60,000 55,000 11,200 47,200 104,800 68,000 40,000 30,200 105,200 4,000 8,000 16,000 3,200 8,000 6,000 4,000 1,413,000 1,413,000 The following additional information has not been accounted for in the books of Kemuning Bhd: 1. A new equipment was imported from Germany on 1 July 2020 at a cost of RM16,000,000. Payment for the equipment has not yet been made. At the date of acquisition, the spot rate was RM4:1 Euro. At 31 December 2020, the rate was RM4.5:1 Euro. The useful life of the equipment is 5 years. 2. The building has been revalued to RM56,000,000 on 1 January 2017 resulting in a surplus of RM24,000,000. At the date of revaluation, the remaining useful life was 40 years. The company makes an annual transfer from the revaluation reserve to retained earnings. Depreciation on building is to be included in administrative expenses. A. The following requirements relates to the additional information above. Relate your answers to the relevant MFRSs. i Based on (1), prepare journal entries to account for the acquisition of equipment including the gain or loss on foreign exchange transaction. (2 marks) ii. Based on (2), prepare journal entries to account for the revaluation of the land and building for the year ended 31 December 2020 (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started