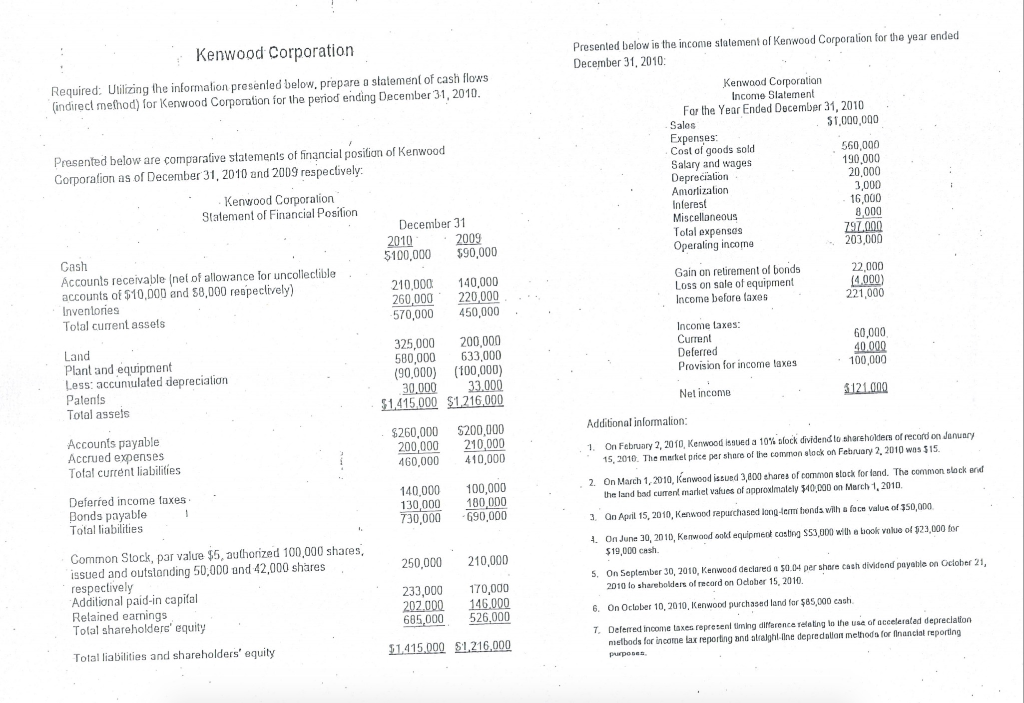

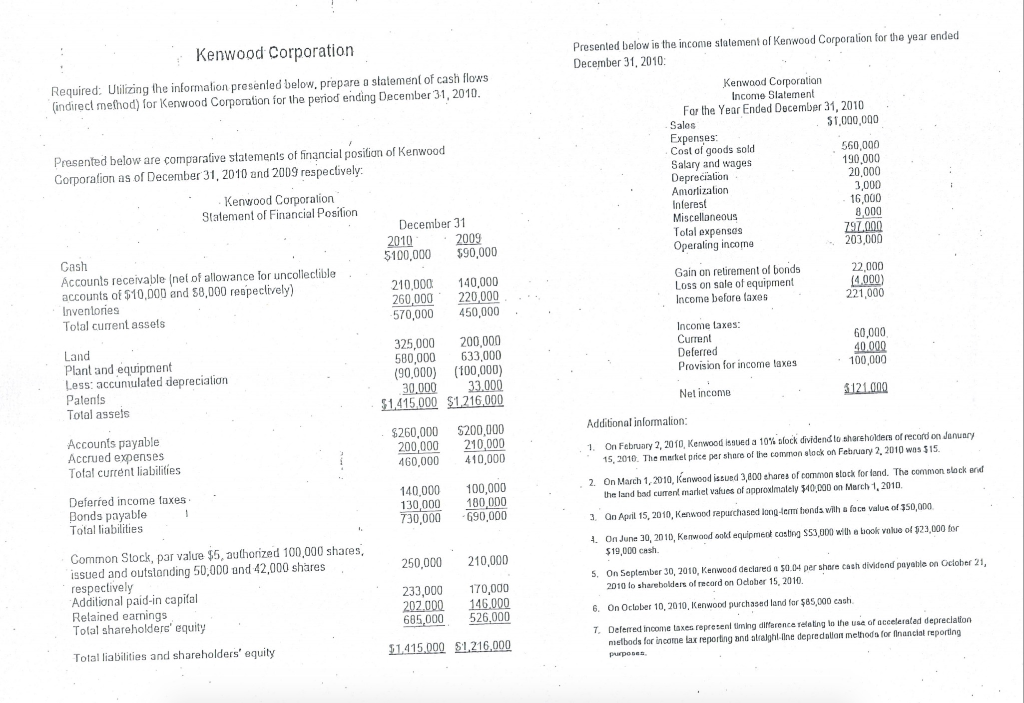

Kenwood Corporation Required: Utilizing the information presented below. prepare a statement of cash flows (indirect method) for Kenwood Corporation for the period ending December 31, 2010. Presented below is the income statement of Kenwood Corporation for the year ended December 31, 2010: Kenwood Corporation Income Statement For the Year Ended December 31, 2010 Sales $1,000,000 Expenses Cost of goods sold 560,000 Salary and wages 190.000 Depreciation 20,000 Amortization Interest 16,000 Miscellaneous 8,000 Total expenses 797.000 Operating income 203.000 Gain on retirement of bonds 22.000 Loss on sale of equipment 14.000) Income before taxes 221,000 Presented below are comparative statements of financial position of Kenwood Corporation as of December 31, 2010 and 2009 respectively: Kenwood Corporation Statement of Financial Position December 31 2010 2009 Cash $100,000 $90,000 Accounts receivable (net of allowance for uncollectible accounts of $10,000 and $8,000 respeclively) 210,000 140,000 Inventories 260,000 220,000 Total current assets -570,000 450,000 3,000 Income taxes: Current Deferred Provision for income taxes 60,000 40.000 100,000 Land Plant and equipment Less: accumulated depreciation Patents Total assets 325,000 200.000 580,000 633,000 (90,000) (100,000) 30.000 33.000 $1415,000 $1,216.000 Nel income 31121.000 Additional information: Accounts payable Accrued expenses Total current liabilities $260.000 $200,000 200,000 210,000 460,000 410,000 Deferred income taxes Bonds payable Total liabilities 140,000 130,000 730,000 100,000 180.000 -G90,000 1. On February 2, 2010, Kenwood issued a 10% alock dividend to shareholders of record on January 15, 2018. The market price per share of the common slock on February 2, 2010 was $15. 2. On March 1, 2010, Kenwood issued 3,000 shares of common stock for land. Tha common slacker the land bad current market values of approximately 340,000 on March 1, 2010, 3. On April 15, 2010, Kenwood repurchased long-term hands with a foce value o! $50,000 4. On June 30, 2010, Kenwood sold equipment casting S53,000 with a book value of $23,000 for $19,000 cash 250.000 210,000 5. On September 30, 2010, Kenwood declared a 50.04 per share cach dividend payable on October 21, 2010 lo sharebolders of record on dober 15, 2010 Common Stock, par value $5, authorized 100.000 shares issued and outstanding 50,000 and 42,000 shares respectively Additional paid-in capital Relained earnings Total shareholders' equity Total liabilities and shareholders' equity 233,000 202.000 685,000 170,000 146.000 526.000 6. On October 10, 2010, Kenwood purchased land for $85,000 cash 7. Delerred income taxes represent timing difference relating to the use of accelerated depreciation methods for income tax reporting and atalghline depredalon methods for financial reporting 51.415,000 $1,216.000 Kenwood Corporation Required: Utilizing the information presented below. prepare a statement of cash flows (indirect method) for Kenwood Corporation for the period ending December 31, 2010. Presented below is the income statement of Kenwood Corporation for the year ended December 31, 2010: Kenwood Corporation Income Statement For the Year Ended December 31, 2010 Sales $1,000,000 Expenses Cost of goods sold 560,000 Salary and wages 190.000 Depreciation 20,000 Amortization Interest 16,000 Miscellaneous 8,000 Total expenses 797.000 Operating income 203.000 Gain on retirement of bonds 22.000 Loss on sale of equipment 14.000) Income before taxes 221,000 Presented below are comparative statements of financial position of Kenwood Corporation as of December 31, 2010 and 2009 respectively: Kenwood Corporation Statement of Financial Position December 31 2010 2009 Cash $100,000 $90,000 Accounts receivable (net of allowance for uncollectible accounts of $10,000 and $8,000 respeclively) 210,000 140,000 Inventories 260,000 220,000 Total current assets -570,000 450,000 3,000 Income taxes: Current Deferred Provision for income taxes 60,000 40.000 100,000 Land Plant and equipment Less: accumulated depreciation Patents Total assets 325,000 200.000 580,000 633,000 (90,000) (100,000) 30.000 33.000 $1415,000 $1,216.000 Nel income 31121.000 Additional information: Accounts payable Accrued expenses Total current liabilities $260.000 $200,000 200,000 210,000 460,000 410,000 Deferred income taxes Bonds payable Total liabilities 140,000 130,000 730,000 100,000 180.000 -G90,000 1. On February 2, 2010, Kenwood issued a 10% alock dividend to shareholders of record on January 15, 2018. The market price per share of the common slock on February 2, 2010 was $15. 2. On March 1, 2010, Kenwood issued 3,000 shares of common stock for land. Tha common slacker the land bad current market values of approximately 340,000 on March 1, 2010, 3. On April 15, 2010, Kenwood repurchased long-term hands with a foce value o! $50,000 4. On June 30, 2010, Kenwood sold equipment casting S53,000 with a book value of $23,000 for $19,000 cash 250.000 210,000 5. On September 30, 2010, Kenwood declared a 50.04 per share cach dividend payable on October 21, 2010 lo sharebolders of record on dober 15, 2010 Common Stock, par value $5, authorized 100.000 shares issued and outstanding 50,000 and 42,000 shares respectively Additional paid-in capital Relained earnings Total shareholders' equity Total liabilities and shareholders' equity 233,000 202.000 685,000 170,000 146.000 526.000 6. On October 10, 2010, Kenwood purchased land for $85,000 cash 7. Delerred income taxes represent timing difference relating to the use of accelerated depreciation methods for income tax reporting and atalghline depredalon methods for financial reporting 51.415,000 $1,216.000