Question

Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106. November and December. Job 105 was completed on December 10; the other

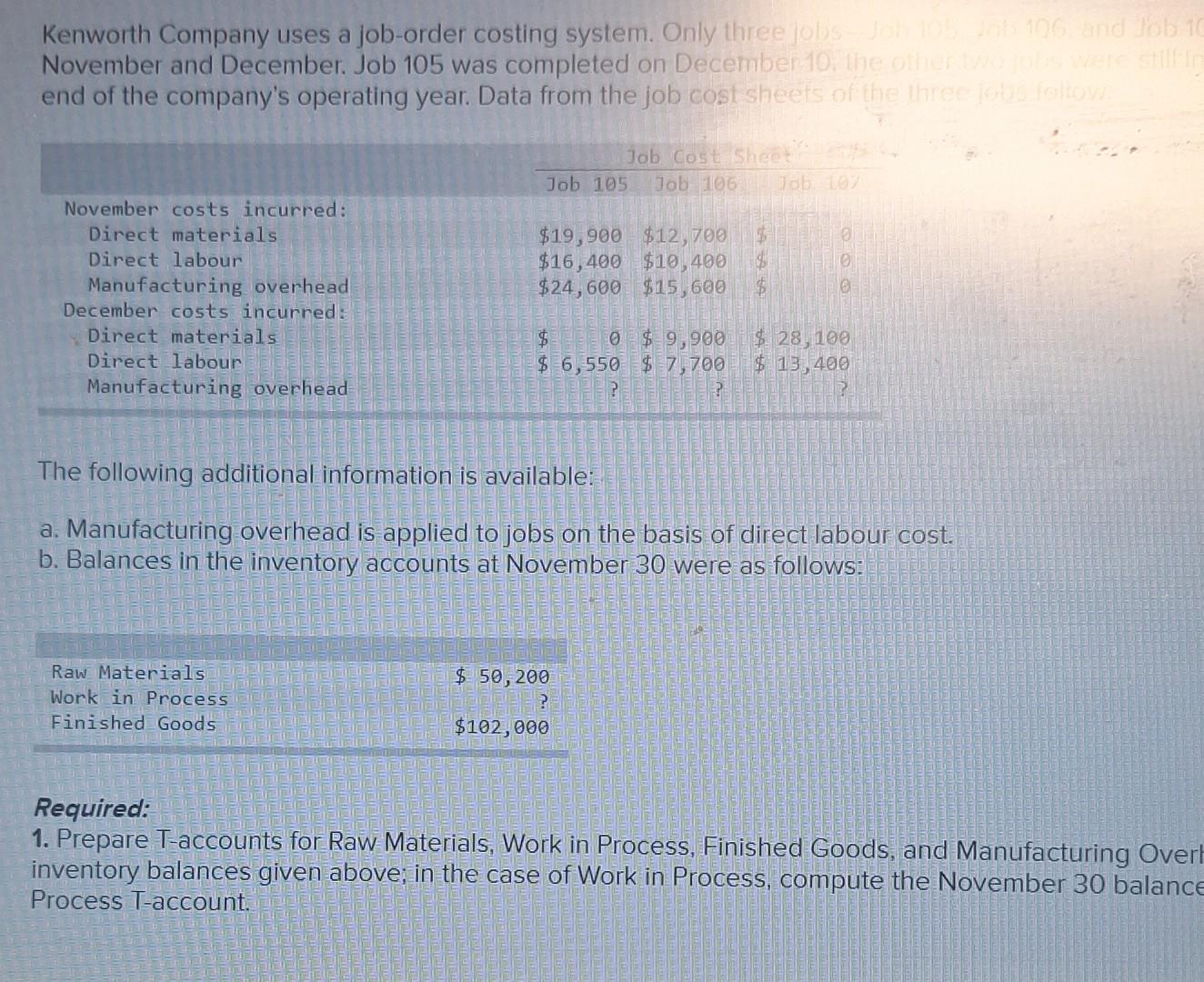

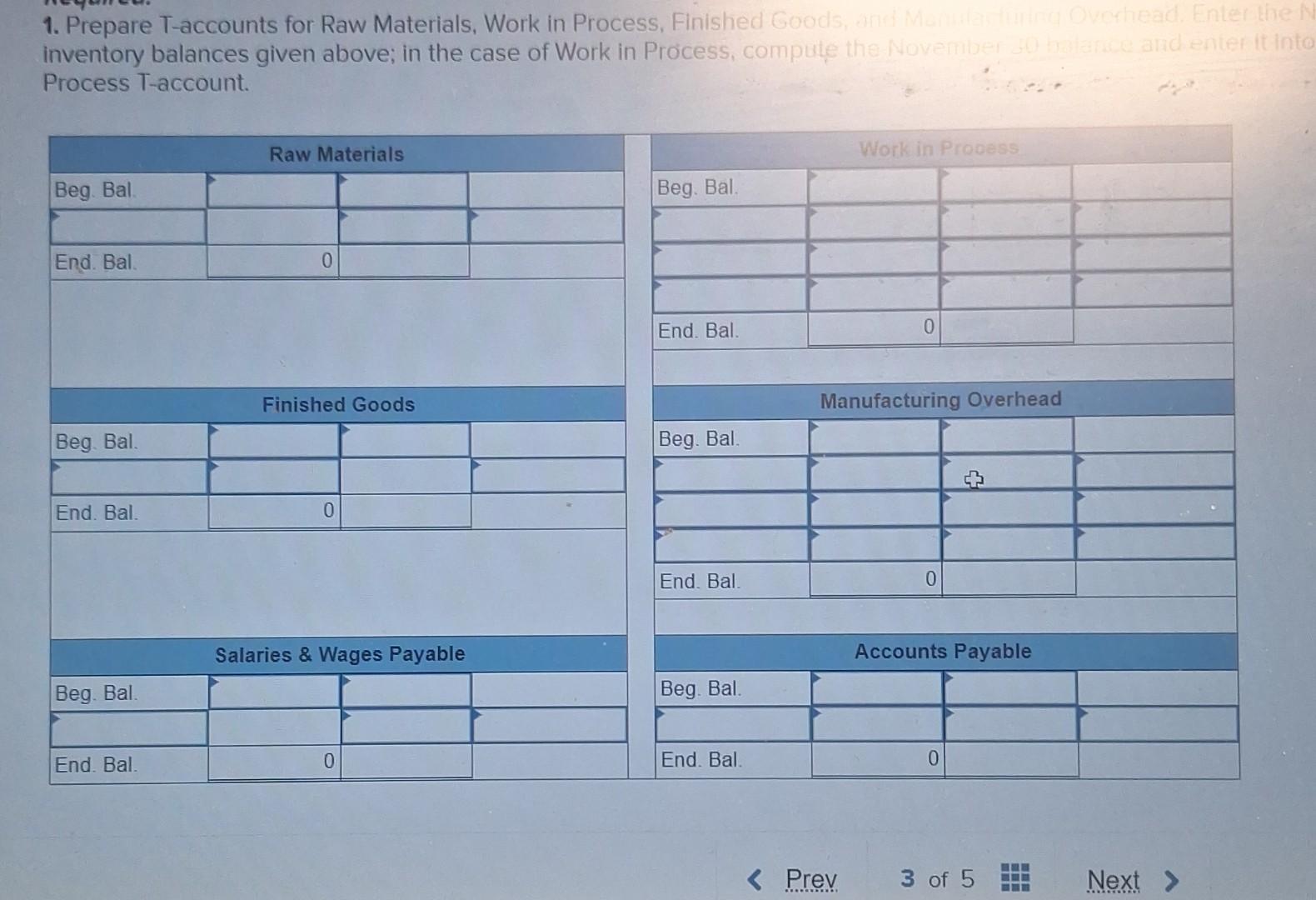

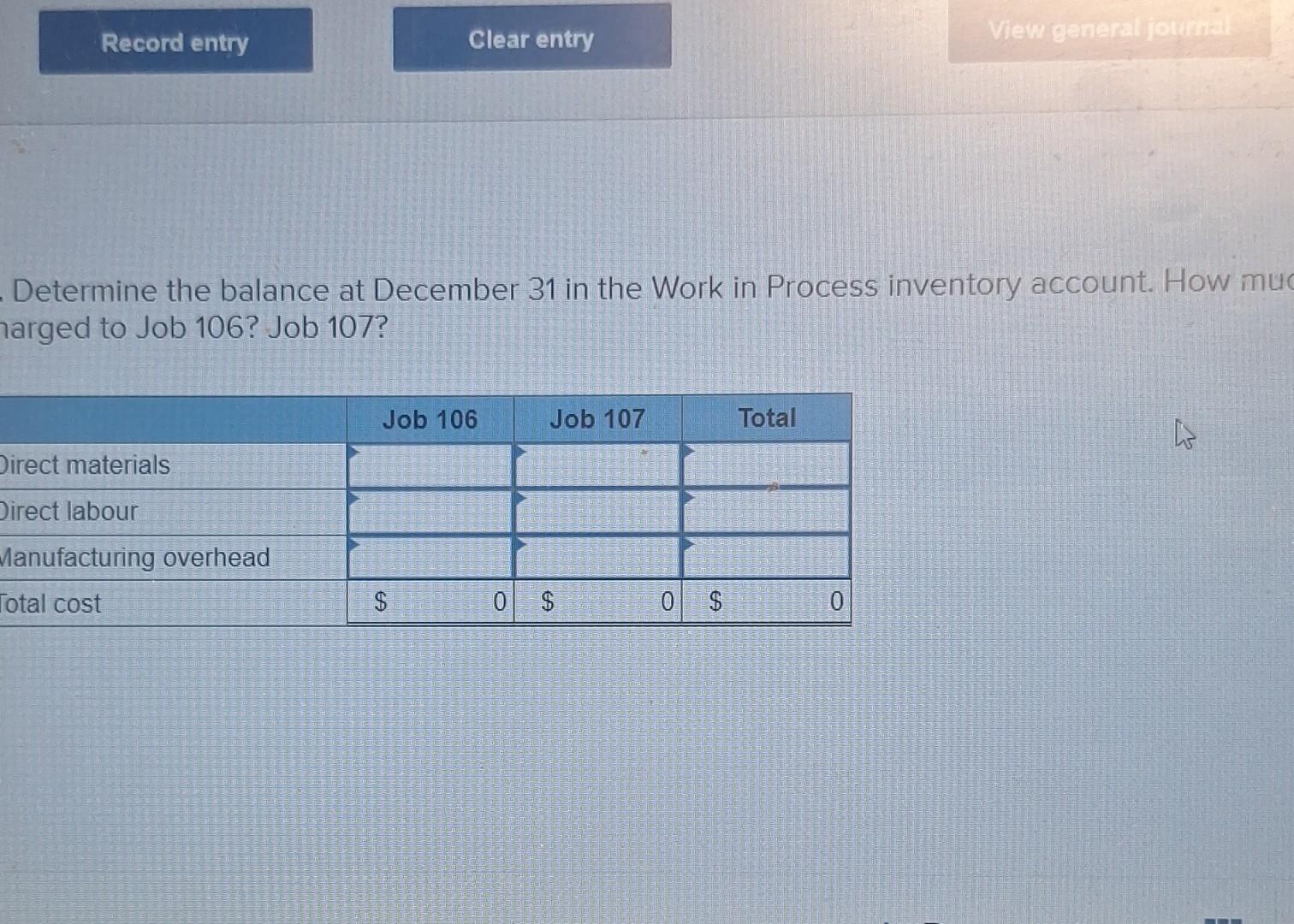

Kenworth Company uses a job-order costing system. Only three jobs-Job 105, Job 106. November and December. Job 105 was completed on December 10; the other two jobs we end of the company's operating year. Data from the job cost sheets of the three jobs follow. November costs incurred: Direct materials Direct labour Manufacturing overhead December costs incurred: Direct materials Direct labour Manufacturing overhead Raw Materials Work in Process Finished Goods $19,900 $12,700 $ $16,400 $10,400 $ $24,600 $15,600 $ Job Cost Sheet Job 105 Job 106 Job 107 $ 0 $ 9,900 $6,550 $ 7,700 ? ? $50,200 $102,000 The following additional information is available: a. Manufacturing overhead is applied to jobs on the basis of direct labour cost. b. Balances in the inventory accounts at November 30 were as follows: ? 0 0 0 $ 28,100 $ 13,400 Required: 1. Prepare T-accounts for Raw Materials, Work in Process, Finished Goods, and Manufacturing Overhead. Enter th inventory balances given above; in the case of Work in Process, compute the November 30 balance and enter it Process T-account. Prev JEFFER 3 of 5 I

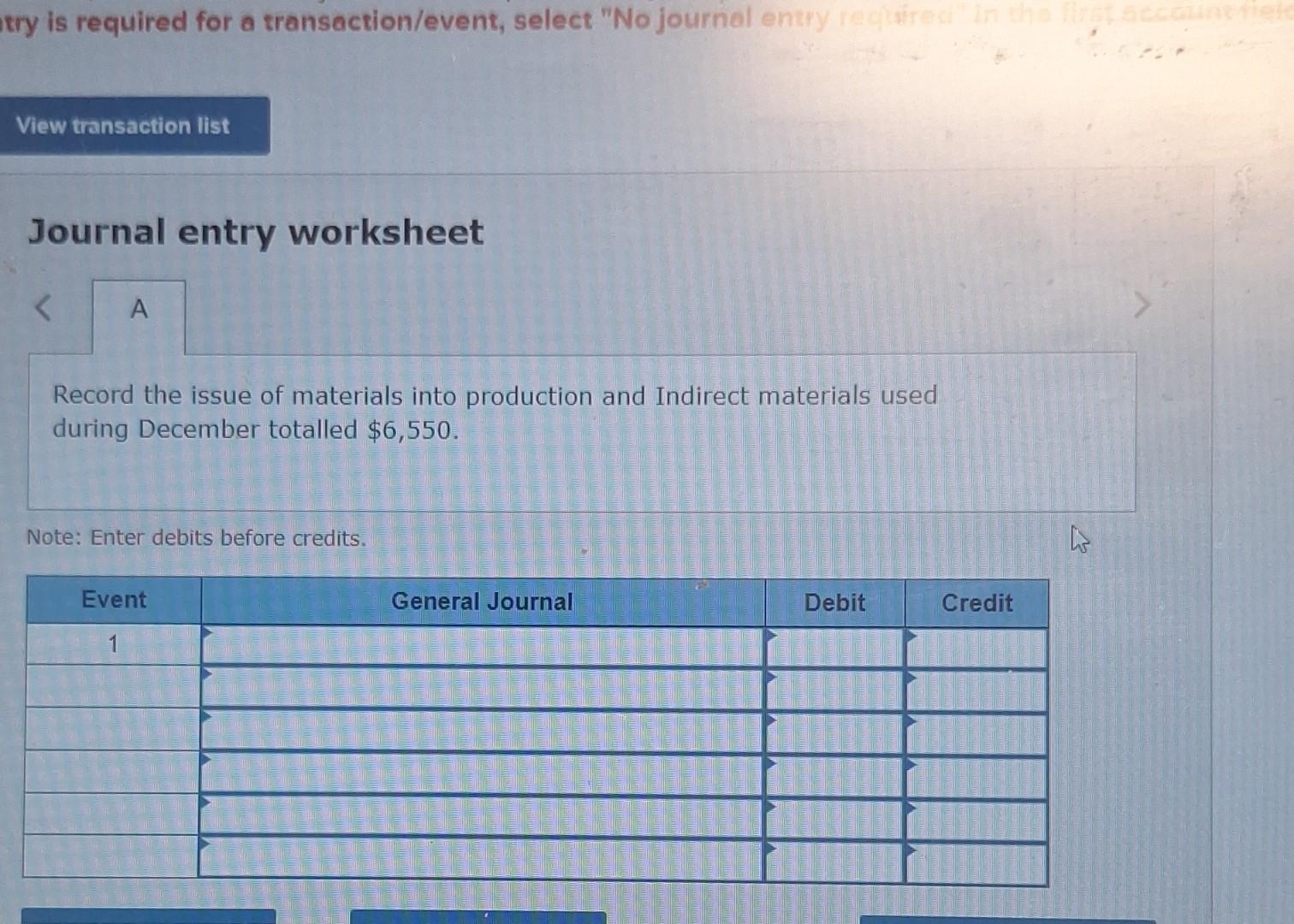

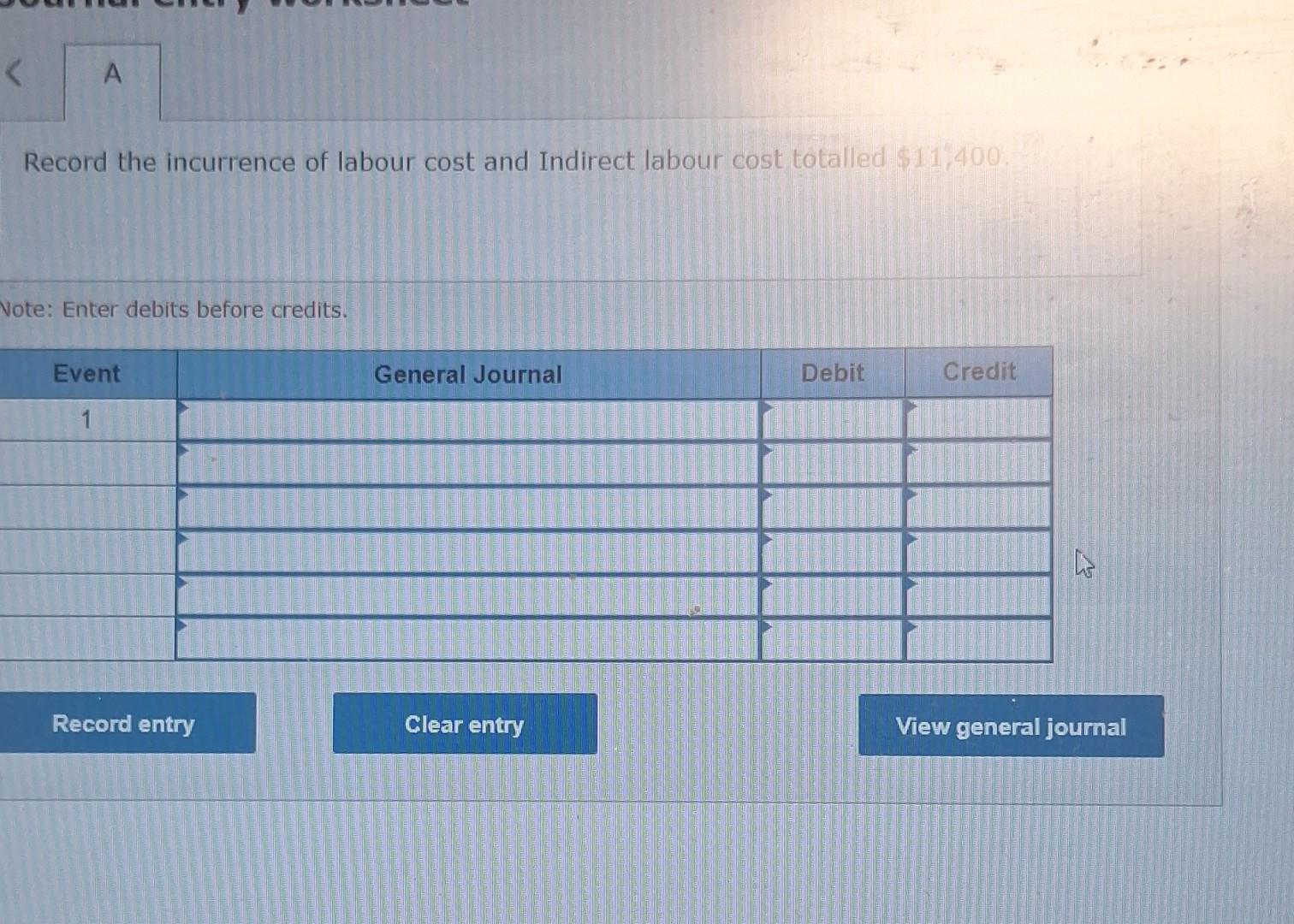

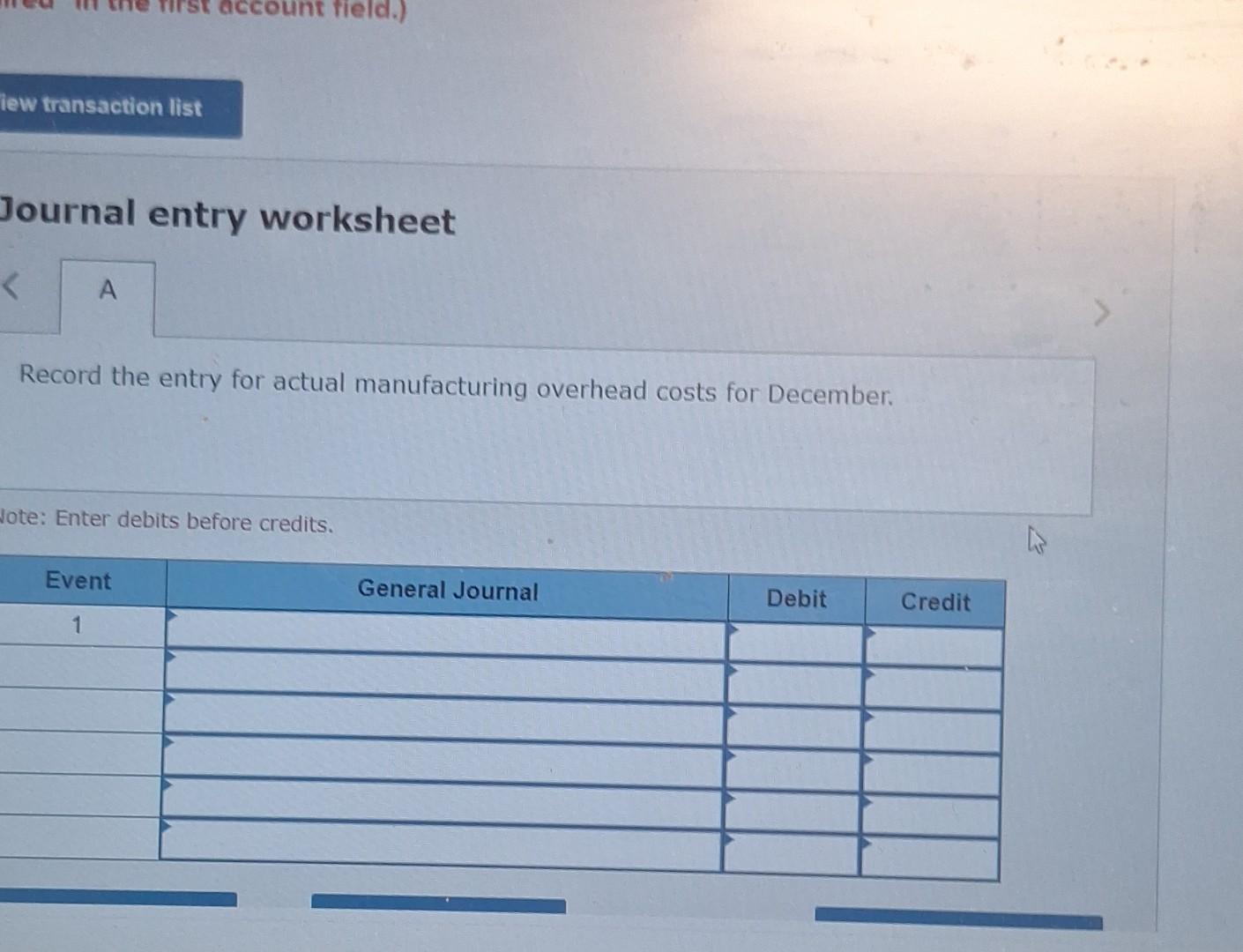

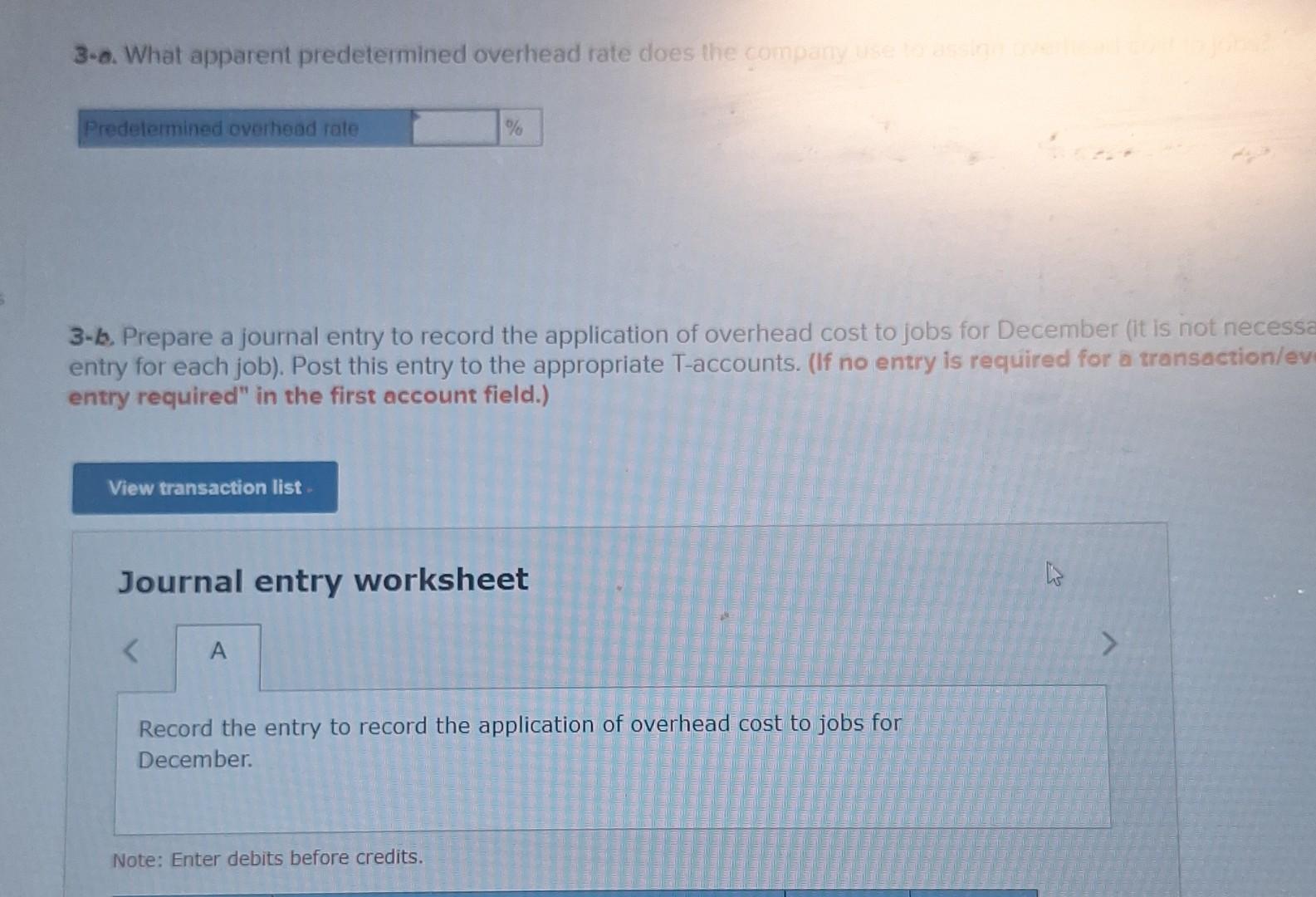

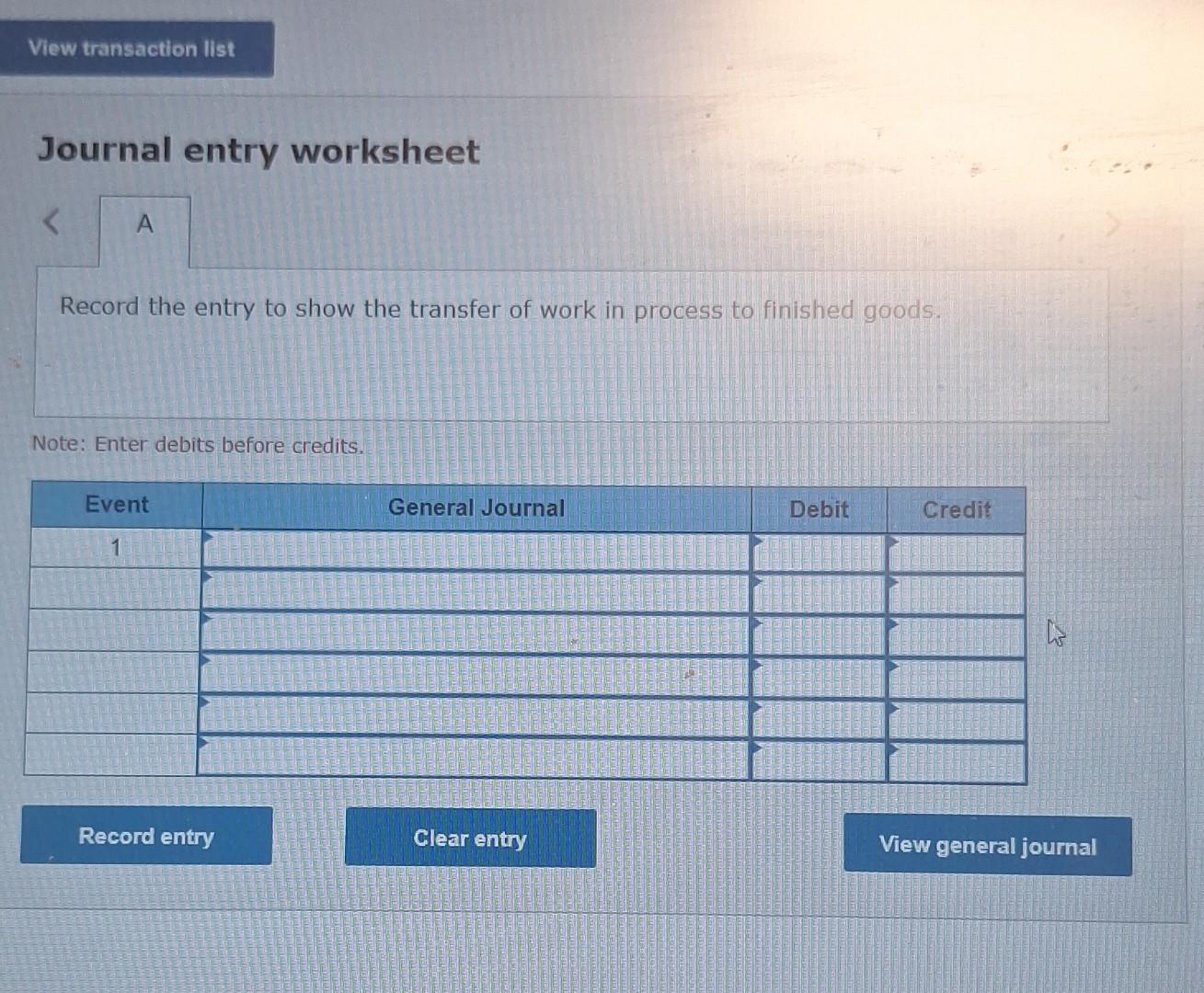

Journal entry worksheet Record the issue of materials into production and Indirect materials used during December totalled $6,550. Note: Enter debits before credits. Determine the balance at December 31 in the Work in Process inventory account. How mus larged to Job 106? Job 107? Journal entry worksheet Record the entry for actual manufacturing overhead costs for December. lote: Enter debits before credits. Journal entry worksheet Record the entry to show the transfer of work in process to finished goods. Note: Enter debits before credits. 3-o. What apparent predetermined overhead rate does the conpan 3-b. Prepare a journal entry to record the application of overhead cost to jobs for December (it is not necess entry for each job). Post this entry to the appropriate T-accounts. (If no entry is required for a transaction/ev entry required" in the first account field.) Journal entry worksheet Record the entry to record the application of overhead cost to jobs for December. Note: Enter debits before credits. Kenworth Company uses a job-order costing system. Only three November and December. Job 105 was completed on December 10. end of the company's operating year. Data from the job cost sheetse The following additional information is available: a. Manufacturing overhead is applied to jobs on the basis of direct labour cost. b. Balances in the inventory accounts at November 30 were as follows: Required: 1. Prepare T-accounts for Raw Materials, Work in Process, Finished Goods, and Manufacturing Over inventory balances given above; in the case of Work in Process, compute the November 30 balance Process T-account. 1. Prepare T-accounts for Raw Materials, Work in Process, Finished Goods inventory balances given above; in the case of Work in Process, compule Process T-account. Record the incurrence of labour cost and Indirect labour cost totalled $11,400. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started