Question: Key issue/problem statement - what is the key problem/s or issue/s addressed in the case? What is the main decision that manager/s need to make?

Key issue/problem statement - what is the key problem/s or issue/s addressed in the case? What is the main decision that manager/s need to make? Maximum = 2 issues. Options with pros and cons identified - what are the options for resolving the key problems/issues? What are the major pros and cons with each options? Maximum = 3 options. Recommendations - what is your advice for managers regarding problem/issues raised? (i.e., provide definite, succinct, clearly explained practical recommendations). Maximum = 2 recommendations. Key takeaways - what are the lessons for supply chain managers? (i.e., after reading this article/question/case, I learned that ...?) Maximum = 2 lessons.

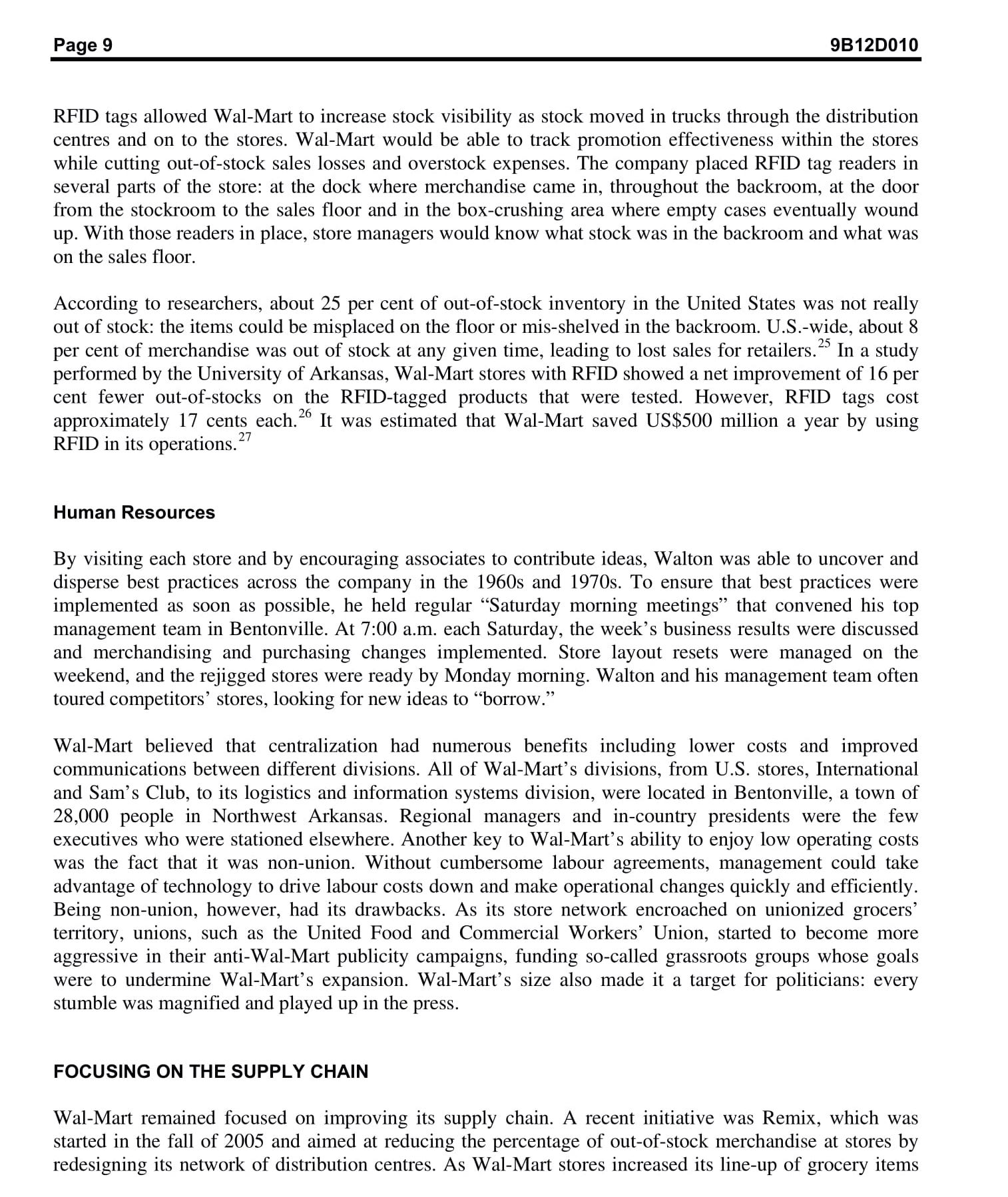

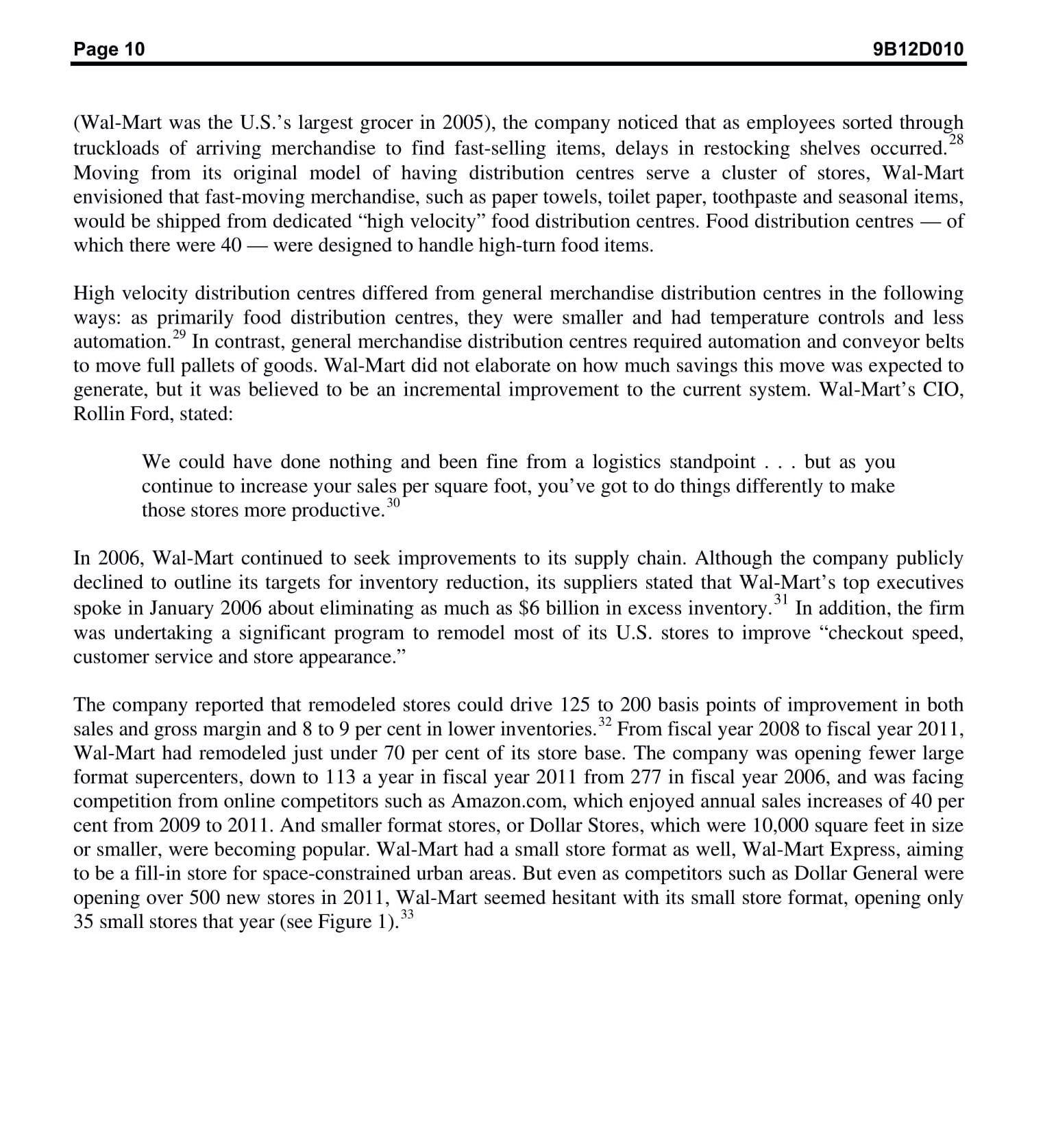

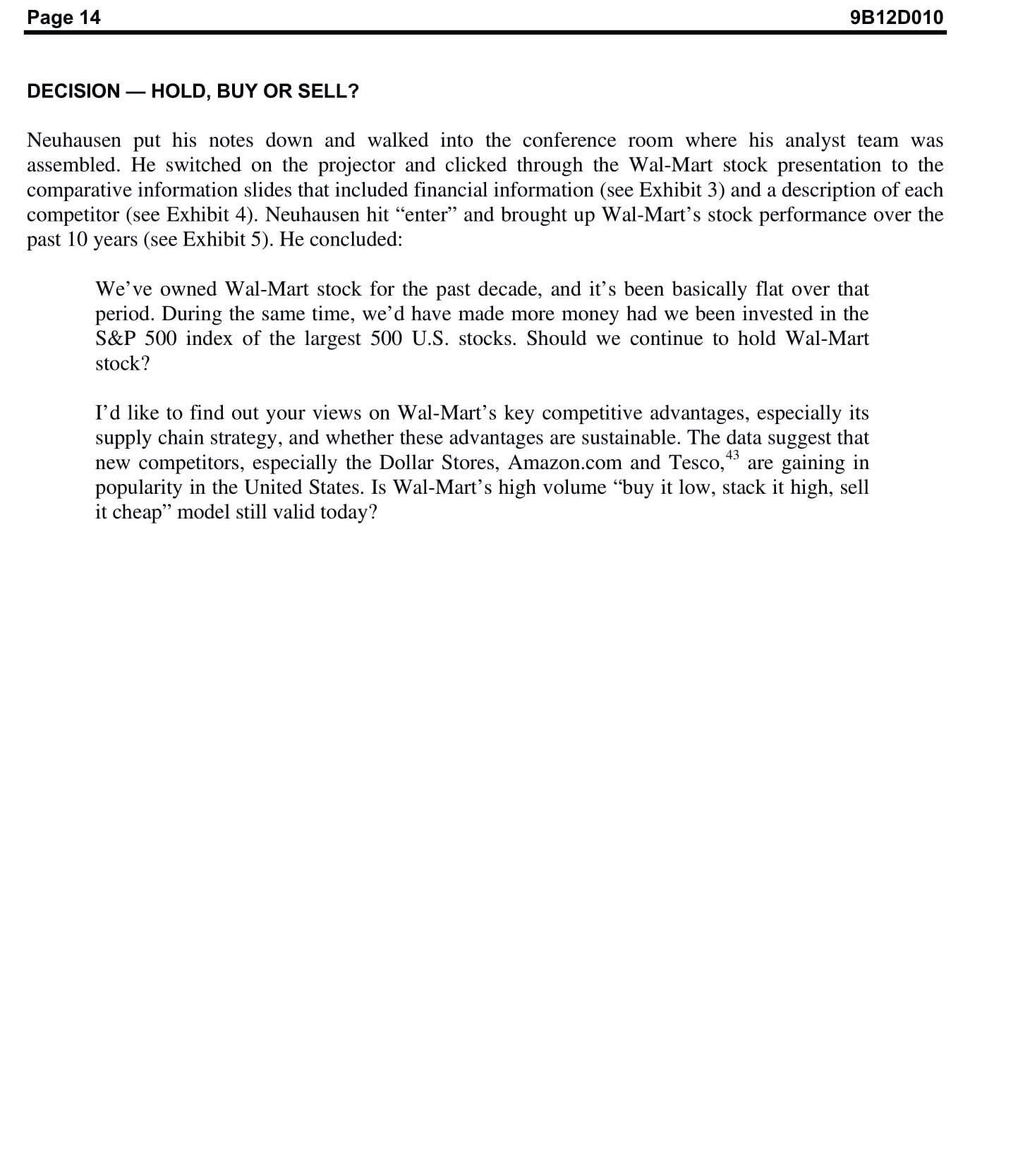

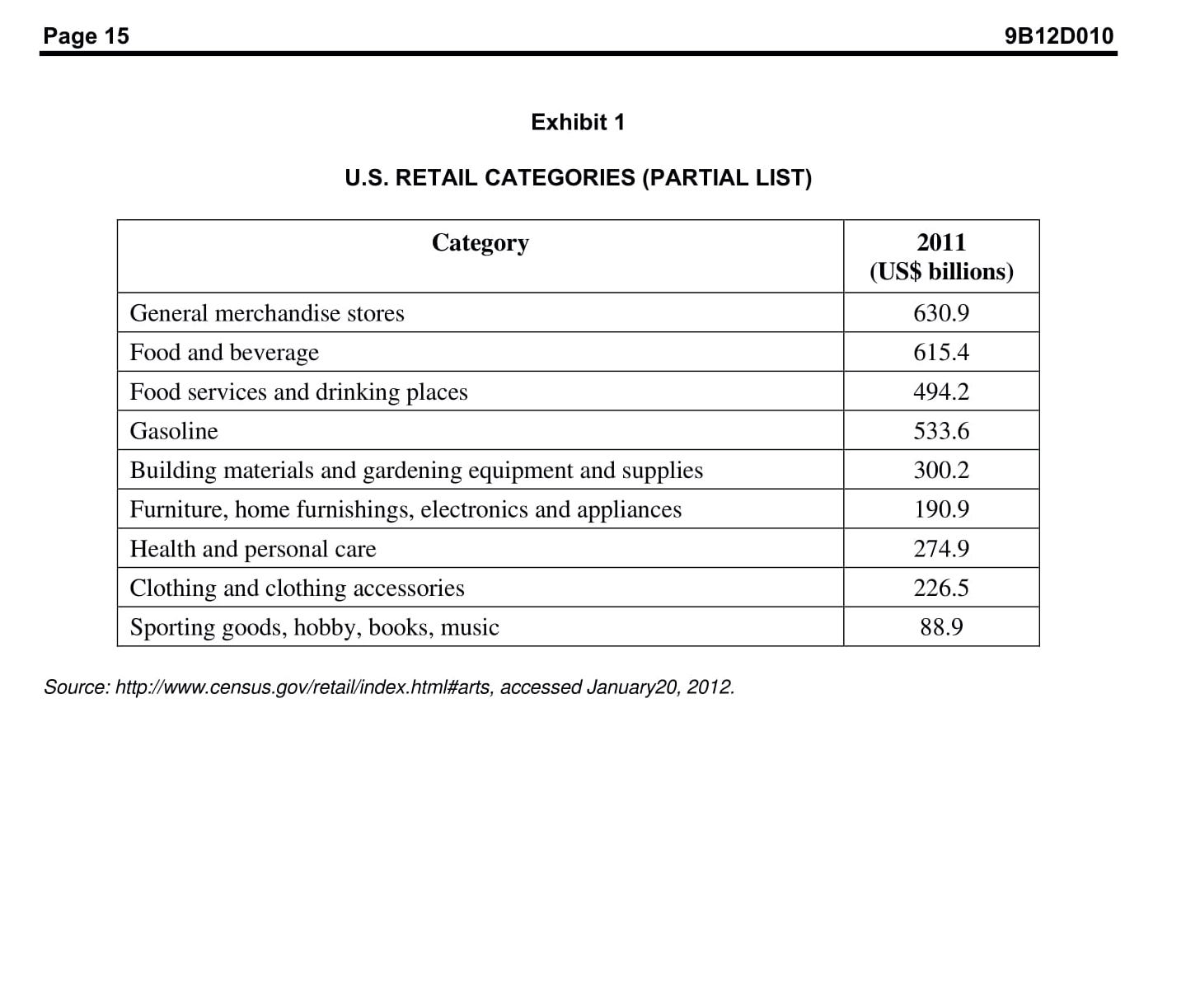

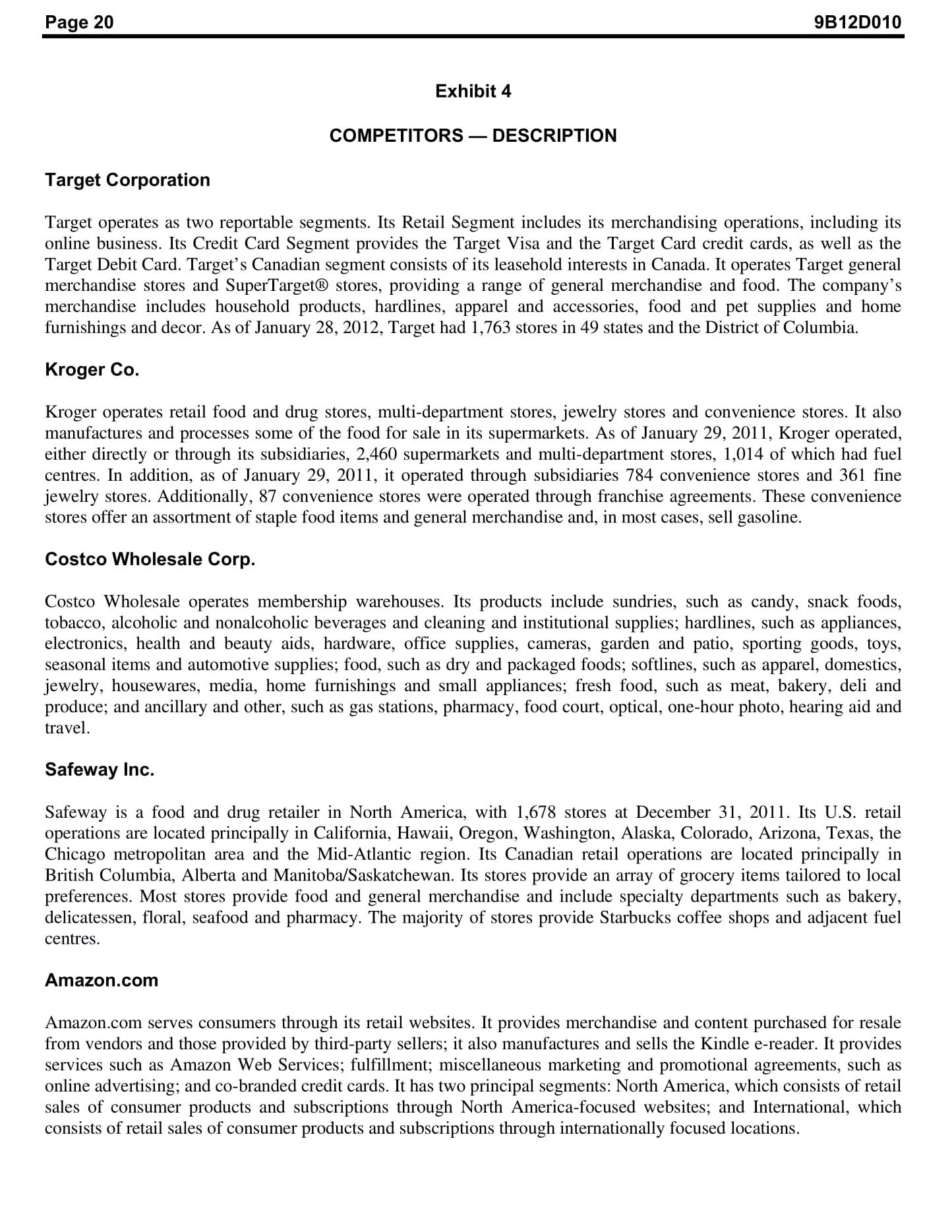

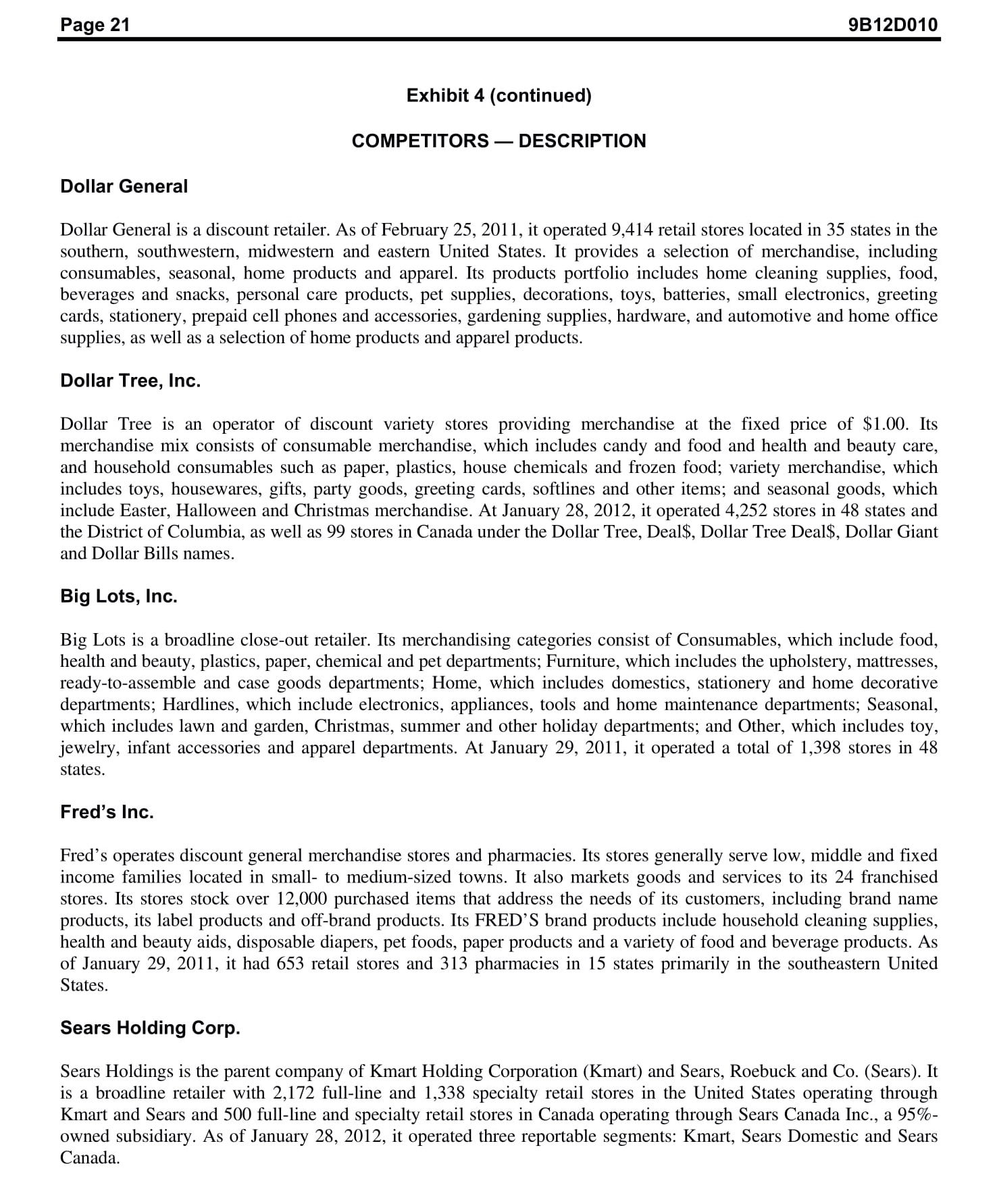

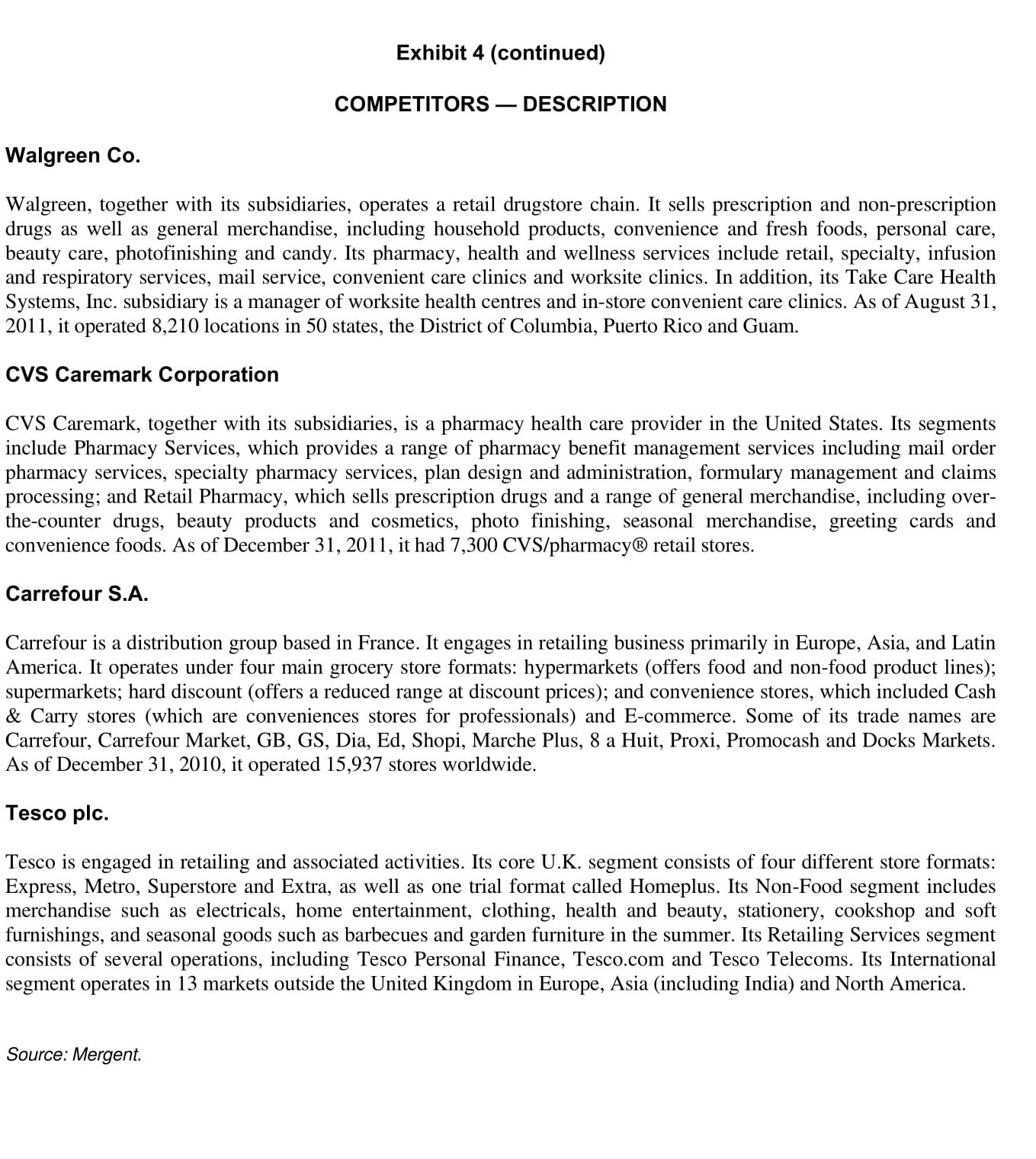

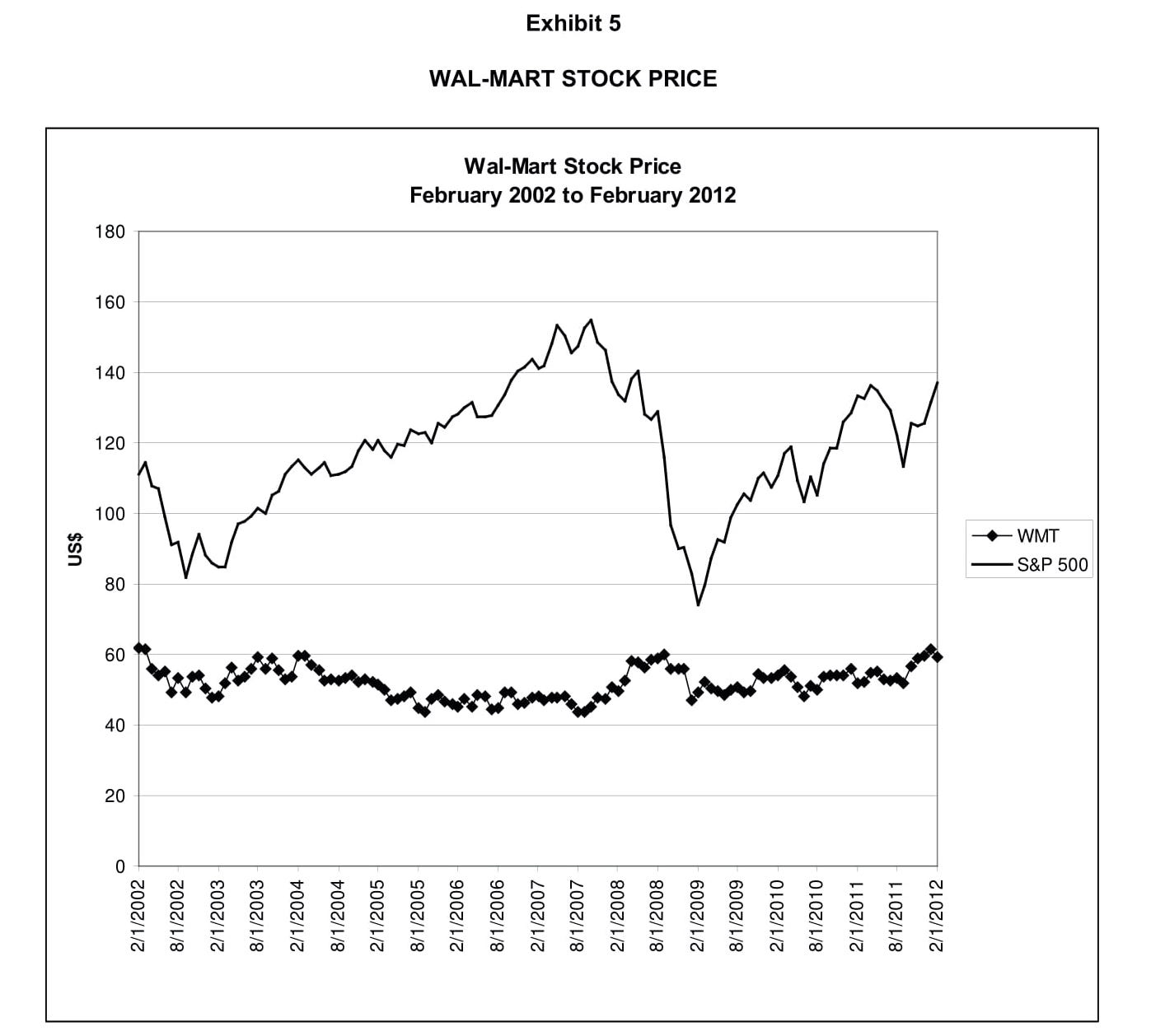

'IVEY i Publishing W1 2894 HALF1A CENTURY 0F SUPPLY CHAIN MANAGEMENT AT WAL- MART Ken Mark wrote this case under the supervision of Professor P. Fraser Johnson solely to provide material for class discussion. The authors do not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect condentiality. This publication may not be transmitted, photocopied, digitized or otherwise reproduced in any form or by any means without the permission of the copyright holder. Reproduction of this material is not covered under authorization by any reproduction rights organization. To order copies or request permission to reproduce materials, contact lvey Publishing, lvey Business School, Western University, London, Ontario, Canada, N6G 0N1; (t) 519.661.3208; (5-) cases@ivey.ca; www.iveycases.com. Copyright @2012, Richard ivey School of Business Foundation Version: 2013-1 1-12 INTRODUCTION James Neuhausen was a U.S. stock analyst tasked with preparing a recommendation on what his firm, a large U.S. investment house, should do with its stake in Wal-Mart Stores, Inc. It was an unseasonably warm day in early February 2012, and Neuhausen was reviewing his notes on the firm. Wal-Mart, the world's largest retailer, was trying to recover from a series of missteps that had seen competitors such as Dollar Stores and Amazoncom close the performance gap. Competitors had copied many aspects of Wal- Mart's distribution system, including cross-docking product to eliminate storage time in warehouses, positioning stores around distribution centres and widespread adoption of electronic data interchange (EDI), to manage ordering and stripping from suppliers. Neuhausen stated: Wal-Mart is believed to have one of the most efficient supply chains in the retail world. What impact will the increasing variety of product, store formats and the growing importance of international stores have on the way it distributes product? What improvements to its supply chain does the company need to make in order to continue to stay ahead of competitors? Last year, Wal-Mart suffered nine consecutive quarters of declining same store sales. Procter & Gamble's Chief Executive, Robert McDonald, pointed out that part of the problem was that there were execution issues at Wal-Mart's U.S. stores.2 More nimble competitors such as Dollar General are rolling out small format stores that are eating into WalMart's share. In the online space, Amazon.com has become a major threat. WalMart has also changed over the years and it now operates a Variety of store formats under 60 different banners around the world. International sales hit US$109 billion in fiscal year 2011, more than a quarter of its business. Can its supply chain keep up and still deliver efficiency gains? Page 2 9B12DD1O TH E RETAIL IN DUSTRY U.S. retail sales, excluding motor vehicles and parts dealers, reached US$39 trillion in 2011. Major categories in the U.S. retail industry included general merchandise, food and beverage, health and personal care and other categories as can be seen in Exhibit 1. In the United States, retailers competed at local, regional and national levels, with some of the major chains such as Wal-Mart and Costco counting operations in foreign countries as well. In addition to the traditional one-store owner-operated retailer, the industry included formats such as discount stores, department stores (selling a large percentage of soft goods, or clothing), variety and convenience stores, specialty stores, supermarkets, supercentres (combination discount and supermarket stores), Internet retailers and catalog retailers. Online retail sales were rising in importance, accounting for US$197 billion in 2011.3 The top 200 retailers accounted for approximately 30 per cent of worldwide retail sales.4 Major retailers competed for employees and store locations as well as customers. There were two broad strategies in global retailing: variable pricing, or \"hi-lo pricing," and everyday low price (EDLP). Hi-lo pricing, practiced by retailers for decades, involved adjusting the retail price of items to optimize gross margins. For example, at traditional grocery stores, while prices of key items such as milk, sugar, eggs and butter were kept consistently low, items such as toothpaste, detergent and tissue had high prices. The goal in a hi-lo environment was to generate increased sales by having the manufacturer fund the trade promotions on some items lowering prices by 25 to 30 per cent every month or quarter. On the other hand, an EDLP strategy meant that prices on items were generally consistent from week to week but were kept as low as possible so as to generate the highest consumer foot trafc. Running an EDLP strategy generally required the retailer to focus on keeping operational costs as low as possible and investing any savings into lowering retail prices. The goal, in an EDLP environment, was to generate higher aggregate gross profit by increasing the volume of items sold. As many of the top global retailers faced intense competition in their home markets, a growing trend for these global retailers was international expansion, especially into developing markets such as Asia, South America and Africa. The objective of international expansion was to nd a way to continue to grow earnings at a faster pace than was possible domestically. Retailers going abroad sought to capitalize on global purchasing economies of scale and to leverage international expertise from one market to another. But international expansion was fraught with risk, and it was not uncommon for retailers to pull out of a market if they were unable to build protable operations. WALMART STORES, INC. Based in Bentonville, Arkansas and founded by the legendary Sam Walton, Wal-Mart was the number one retailer in the world with scal year 2011 net income, from continuing operations, of US$16 billion on sales of US$419 billion. It had over 2 million employees and 8,500 stores in 15 countries, the result of a series of acquisitions over the past 20 years. Beginning with its \"big box\" discount store format in the 1960s, Wal-Mart's store formats around the world had grown to include supercentres, which were a larger version of a discount store that included groceries, supermarkets, wholesale outlets, restaurants and apparel stores. Globally, it served about 200 million customers per week.5 Page 3 BB12D010 WalMart's strategy was to provide a broad assortment of quality merchandise and services at \"everyday low prices\" (EDLP) and was best known for its discount stores, which offered merchandise such as apparel, small appliances, housewares, electronics and hardware. In the U.S. general merchandise arena, Wal-Mart's competitors included Sears and Target, with specialty retailers including Gap and Limited. Department store competitors included Dillard, Federated and J.C. Penney. Grocery store competitors included Kroger, Albertsons and Safeway. The major membership-only warehouse competitor was Costco Wholesale. WalMart was facing growing competition for large ticket general merchandise products and from online retailers such as Amazoncom. THE DEVELOPMENT OF WAL-MART'S SUPPLY CHAIN Before he started Wal-Mart Stores in 1962, Sam Walton owned a successful chain of stores under the Ben Franklin Stores banner, a franchisor of variety stores in the United States. Although he was under contract to purchase most of his merchandise requirements from Ben Franklin Stores, Walton was able to selectively purchase merchandise in bulk from new suppliers and transport these goods to his stores directly. When Walton realized that a new trend, discount retailing based on driving high volumes of product through lowcost retail outlets was sweeping the nation, he decided to open up large warehouse style stores in order to compete. To stock these new stores, initially named \"Wal-Mart Discount City,\" Walton needed to step up his merchandise procurement efforts. As none of the suppliers were willing to send their trucks to his stores, which were located in rural Arkansas, self-distribution was necessary. WalMart undertook an initial public offering in 1969 to raise funds to build its first distribution centre in Bentonville, Arkansas. As the company grew in the 1960s to 1980s, it beneted from improved road infrastructure and the inability of its competitors to react to changes in legislation, such as the removal of \"resale price maintenance,\" which had prevented retailers from discounting merchandise. To keep an eye on his growing network, Walton piloted a small single-engine airplane, which he would land at air strips close to his new stores. WalMart's supply chain, a key enabler of its growth from its beginnings in rural Arkansas, was long considered by many to be a major source of competitive advantage for the company. It was one of the first rms to rely on data to make operational decisions, using bar codes, sharing sales data with suppliers, controlling its own trucking eet and installing computerized pointofsale systems that collected item level data in real time. When Wal-Mart was voted \"Retailer of the Decade\" in 1989, its distribution costs were estimated at 1.7 per cent of its cost of sales, comparing favourably with competitors such as Kmart (3.5 per cent of total sales) and Sears (5 per cent of total sales).6 Its successes were widely publicized, and competitors had adopted many of WalMart's management techniques. Yet WalMart continued to lead the industry in efficiency, achieving inventory turns of 11.5 times in scal year 2011. For perspective, for the same period, key U.S. competitors Target Corp, Amazon.com and Sears had inventory turns of 8.7 times, 6.2 times, and 4.7 times, respectively. But Kroger Co., the second largest grocery retailer in the United States, had inventory turns of 14.2 times, primarily due to its focus on high-turning perishable food items.7 Page 4 BB12DO1O Procurement As his purchasing efforts increased in scale, Walton and his senior management team would make trips to buying ofces in New York City, cutting out the middleman (wholesalers and distributors). WalMart's U.S. buyers, located in Bentonville, worked with suppliers to ensure that the correct mix of staples and new items were ordered. Over time, many of Wal-Mart's largest suppliers maintained ofces in Bentonville, staffed by analysts and managers supporting Wal-Mart's business. In addition, WalMart started sourcing products globally, opening the rst of these ofces in China in the mid-1980s. Wal-Mart's international purchasing ofces worked directly with local factories to source Wal- Mart's private label merchandise. Private label products were appealing to customers as they were often priced at a significant discount to brand name merchandise; for Wal-Mart, the private label items generated higher margins than suppliers' branded products. Private label sales at Wal-Mart, rst developed in the 1980s, were believed to account for just 16 per cent of Wal-Mart's sales, compared to 25 per cent at U.S. rivals Safeway and Kroger.8 This was because Wal-Mart's stated strategy was to be a \"house of brands,\" procuring top brands in volume and selling them at low prices.9 Every quarter, buyers met in Bentonville to review new merchandise, exchange buying notes and tips and review a fully merchandised prototype store, which was located in a warehouse. In order to gather field intelligence, buyers toured stores two or three days a week and worked on sales oors helping associates stock and sell merchandise. WalMart wielded enormous power over its suppliers. For example, observers noted that increase bargaining clout was a contributing factor in Procter & Gamble's (P&G) acquisition of chief rival Gillette. 10 Prior to the acquisition, sales to WalMart accounted for 17 per cent of P&G's and 13 per cent of Gillette's revenues.\" On the other hand, these two suppliers combined accounted for about 8 per cent of Wal-Mart's sales. 12 Some viewed Wal-Mart's close cooperation with suppliers in a negative light: Wal-Mart dictates that its suppliers . . . accept payment entirely on Wal-Mart's terms . . . share information all the way back to the purchasing of raw materials. WalMart controls with whom its suppliers speak, how and where they can sell their goods and even encourages them to support Wal-Mart in its political ghts. WalMart all but dictates to suppliers where to manufacture their products, as well as how to design those products and what materials and ingredients to use in those products. 13 When negotiating with its suppliers, WalMart insisted on a single invoice price and did not pay for co operative advertising, discounting or distribution. Globally, WalMart was thought to have around 40,000 suppliers, of whom 200 such as Nestle, P&G, Unilever, and Kraft were key global suppliers. With WalMart's expectations on sales data analysis, category management responsibilities and external research specic to their Wal-Mart business, it was not uncommon for a supplier to have several employees working full-time to support the Wal-Mart business. Page 5 9312D010 Distribution WalMart's store openings were driven directly by its distribution strategy. Because its first distribution centre was a signicant investment for the rm, Walton insisted on saturating the area within a day's driving distance in order to gain economies of scale. Over the years, competitors had copied this \"hub-and- spoke\" design of high volume distribution centres serving a cluster of stores. This distribution-led store expansion strategy persisted for the next two decades as Wal-Mart added thousands of U.S. stores, expanding across the nation from its headquarters in Arkansas. Stores were located in lowrent, suburban areas close to major highways. In contrast, key competitor Kmart's stores were thinly spread throughout the US. and located in prime urban areas. By the time the rest of the retail industry started to take notice of Wal-Mart in the 19805, it had built up the most efcient logistics network of any retailer. Wal-Mart's 75,000-person logistics and its information systems division included the largest private truck eet employee base of any firm 6,600 trucks and 55,000 trailers, which delivered the majority of merchandise sold at stores.14 Its 150 distribution centres, located throughout the United States, were a mix of general merchandise, food and soft goods (clothing) distribution centres, processing over ve billion cases a year through its entire network. In the United States, Wal-Mart's distribution centres received about 315,000 inbound truckloads, of which 115,000 were shipped \"collect,\" which meant they were picked up directly from suppliers' warehouses by Wal-Mart's trucking eet, The remaining 200,000 loads were shipped by suppliers' trucks or by logistics providers. The goal at Wal-Mart's distribution centres was for high turning items such as fresh food or other perishable merchandise to be crossdocked, or directly transferred from inbound to outbound trailers without extra storage. The average distance from distribution centre to stores was approximately 130 miles. Each of these distribution centres were profiled in a store friendly way, with similar products stacked together. Merchandise purchased directly from factories in offshore locations such as China or India were processed at coastal distribution centres before shipment to US. stores. On the way back from delivering product to stores, WalMart's trucks generated \"backhaul\" revenue by transporting unsold merchandise on trucks that would be otherwise empty. Wal-Mart's backhaul revenues its private eet operated as a for-hire carrier when it was not busy transporting merchandise from distribution centres to stores were more than US$1 billion per year.15 In mid2010, WalMart was looking to expand its backhaul program, to pick up more product directly from suppliers' factories. It was seeking, in some cases, a 6 per cent reduction in the manufacturer's selling price. For perspective, suppliers estimated the actual transportation expense was just 3 per cent of the selling price. 16 Because their trucking employees were nonunionized and inhouse, WalMart was able to implement and improve upon standard delivery procedures, coordinating and deploying the entire eet as necessary. Uniform operating standards ensured that miscommunication between traffic coordinators, truckers and store level employees were minimized. During an analyst meeting in October 2011, Johnnie Dobbs, Wal- Mart Stores' (W al-Mart's) EVP Logistics, had stated: Everyday low cost is the foundation for everyday low prices. So our focus across the organization is delivering products that our customers need in the most efcient method Page 6 9312D010 and process available. So, here's an example of a sustained cost reduction in our transportation area. We have improved visibility and routing tools. We've reengineered processes that have decreased the number of empty miles and out-of-route miles that our drivers drive. Our merchants and our suppliers have improved packaging, and we've adjusted methods that we use to load our trailers, resulting in increased cases in cube in every trailer that we ship. . . . (This year) we'll ship 335 million more cases while we'll drive 300 million fewer miles. 17 Store Network In the early years, Wal-Mart grew rapidly as customers were attracted by its assortment of low-priced product. Over time, the company copied the merchandise assortment strategies of other retailers, mostly through observation as a result of store visits. It bought in bulk, bypassing distributors, and passed savings on to consumers. Each WalMart store aimed to be the \"store of the community,\" tailoring its product mix to appeal to the distinct tastes of that community. Thus, two Wal-Mart Stores a short distance apart could potentially stock different merchandise. In contrast, most other retailers made purchasing decisions at the district or regional level. The display of merchandise was suggested by a store-wide template, with a unique template for each store, indicating the layout of WalMart's various departments. This template was created by WalMart's merchandising department after analyzing historical store sales and community traits. Associates were free to alter the merchandising template to fit their local store requirements. Shelf space in WalMart's different departments from shoes to household appliances to automotive supplies was divided up, each spot allocated to specic SKUs. Unlike its competitors in the 19705 and 19805, Wal-Mart implemented an EDLP policy, which meant that products were displayed at a steady price and not discounted on a regular basis. In a \"hilo\" discounting environment, discounts would be rotated from product to product, necessitating huge inventory stockpiles in anticipation of a discount. In an EDLP environment, demand was smoothed out to reduce the \"bullwhip effect.\" Because of its EDLP policy, WalMart did not need to advertise as frequently as their competitors and channeled the savings back into price reductions. To generate additional volume, Wal-Mart buyers worked with suppliers on price rollback campaigns. Price rollbacks, each lasting about 90 days and funded by suppliers, had the goal of increasing product sales between 200 and 500 per cent. A researcher remarked: \"Consumers certainly love Wal-Mart's low prices, which are an average of 8 per cent to 27 per cent lower than the competition?\"3 The company also ensured that its store level operations were at least as efficient as its logistics operations. The stores were simply furnished and constructed using standard materials. Efforts were made to continually reduce operating costs. For example, light and temperature settings for all US. stores were controlled centrally from Bentonville. Page 7 9312:1010 As Wal-Mart distribution centres had close to real-time information on stores' instock levels, the merchandise could be pushed to stores automatically. In addition, store level information systems allowed manufacturers to be notied as soon as an item was purchased. In anticipation of changes in demand for some items, associates had the authority to manually input orders or override impending deliveries. In contrast, most of Wal-Mart's retail competitors did not confer merchandising responsibility to entry level employees as merchandising templates were sent to stores via head office and were expected to be followed precisely. To ensure that employees were kept up-to-date, management shared detailed information about day/weekfmonth store sales with all employees during daily 10minute long \"standing\" meetings. Information Systems Walton had always been interested in gathering and analyzing information about his company operations. As early as 1966, when Walton had 20 stores, he attended an IBM school in upstate New York with the intent on hiring the smartest person in the class to come to Bentonville to computerize his operations.\" Even with a growing network of stores in the 19605 and 1970s, Walton was able to personally visit and keep track of operations in each one, due to his use of a personal airplane, which he used to observe new construction development (to determine where to place stores) and to monitor customer traffic (by observing how full the parking lot was). In the mid-19803, Wal-Mart invested in a central database, store level point-of-sale systems and a satellite network. Combined with one of the retail industry's rst chainwide implementation of UPC bar codes, store level information could now be collected instantaneously and analyzed. By combining sales data with external information such as weather forecasts, WalMart was able to provide additional support to buyers, improving the accuracy of its purchasing forecasts. In the early 1990s, Wal-Mart developed Retail Link. At an estimated 570 terabytes which, Wal-Mart claimed, was larger than all the fixed pages on the Internet Retail Link was the largest civilian database in the world. By 2008, Retail Link had 2.5 petabytes (2,500 terabytes) in data storage capacity, second only to eBay's 4petabyte installation.20 For a description of how Retail Link ts in with WalMart's supply chain, see Exhibit 2. Retail Link contained data on every sale ever made at the company during a two decade period. Wal-Mart gave its suppliers access to real-time sales data on the products they supplied, down to individual stock-keeping items at the store level. In order to harness the knowledge of its suppliers, key category suppliers, called \"category captains," rst introduced in the late 1980s, provided input on shelf space allocation. As an observer noted: One obvious result [of using category captains] is that a producer like ColgatePalmolive will end up working intensively with rms it formerly competed with, such as Crest manufacturer P&G, to nd the mix of products that will allow WalMart to earn the most it can from its shelf space. If Wal-Mart discovers that a supplier promotes its own products at the expense of Wal-Mart's revenue, the retailer may name a new captain in its stead.21 In 1990, Wal-Mart became one of the early adopters of collaborative planning, forecasting and replenishment (CPRF), an integrated approach to planning and forecasting through sharing critical supply Page 8 BB12DD1O chain information, such as data on promotions, inventory levels and daily sales.22 WalMart's vendor managed inventory (VMI) program (also known as continuous replenishment) required suppliers to manage inventory levels at the company's distribution centres, based on agreed service levels. The VMI program started with P&G diapers in the late 1980s and by 2006 had expanded to include all major suppliers.23 In some situations, particularly grocery products, suppliers owned the inventory in Wal-Mart stores up to the point that the sale was scanned at checkout. Retail Link had an estimated 100,000 registered users, working for suppliers, who accessed the system. They ran approximately 350,000 weekly queries of the data warehouse that contained two years of weekly pointofsale information.24 WalMart buyers held regular meetings with category captains, who would come to the meeting prepared with category analyses and recommendations for how shelf space for the various competitors should be allocated. In exchange for providing suppliers access to these data, Wal- Mart expected them to proactively monitor and replenish product on a continual basis. To support this inventory management effort, supplier analysts worked closely with WalMart's supply chain personnel to coordinate the ow of products from suppliers' factories and resolved any supply chain issues, from routine issues such as ensuring that products were ready for pick up by WalMart's trucks and arranging for the return of defective products, to last minute issues such as managing sudden spikes in demand for popular items. When Wal-Mart buyers met, on a frequent basis, with a supplier's sales teams, two important topics of review were supplier's out-of-stock rate and inventory levels at Wal-Mart, indications of how well replenishment was being handled. Suppliers were provided targets for out-of-stock rates and inventory levels. In addition to managing shortterm inventory and discussing product trends, WalMart worked with suppliers on medium to long-term supply chain strategies including factory location, cooperation with downstream raw materials suppliers and production volume forecasting. Wal-Mart's satellite network, in addition to receiving and transmitting point-of-sale data, also provided senior management with the ability to broadcast video messages to the stores. Although the bulk of senior management lived and worked in Bentonville, Arkansas, frequent video broadcasts to each store in their network kept store employees informed of the latest developments in the rm. In an effort to emulate WalMart's ability to share information with suppliers, WalMart's competitors began developing systems similar to Retail Link. Available through Agentrics LLC, a software service provider, the software platform, built with the input of dozens of global retailers, was made available through a subscription and collected and made available store level data by retailer. Agentrics' customer base included many of the world's top retailers including Carrefour, Tesco, Metro, Costco, Kroger and Walgreen's. Many of these retailers were also investors in Agentrics. RFID To ensure that cases moved efciently through the distribution centres, Wal-Mart worked with suppliers to standardize case sizes and labeling. Since 2003, Wal-Mart had required its top 100 suppliers to afx RFID (radio-frequency identification) tags to shipping cases to facilitate the tracking and sorting of inbound product. Page 9 BB12D010 RFID tags allowed WalMart to increase stock visibility as stock moved in trucks through the distribution centres and on to the stores. WalMart would be able to track promotion effectiveness within the stores while cutting out-of-stock sales losses and overstock expenses. The company placed RFID tag readers in several parts of the store: at the dock where merchandise came in, throughout the backroom, at the door from the stockroom to the sales oor and in the box-crushing area where empty cases eventually wound up. With those readers in place, store managers would know what stock was in the backroom and what was on the sales oor. According to researchers, about 25 per cent of outofstock inventory in the United States was not really out of stock: the items could be misplaced on the floor or misshelved in the backroom. U.S.wide, about 8 per cent of merchandise was out of stock at any given time, leading to lost sales for retailers.25 In a study performed by the University of Arkansas, Wal-Mart stores with RFID showed a net improvement of 16 per cent fewer out-of-stocks on the RFID-tagged products that were tested. However, RFID tags cost approximately 17 cents each.26 It was estimated that WalMart saved US$500 million a year by using RFID in its operations.27 Human Resources By visiting each store and by encouraging associates to contribute ideas, Walton was able to uncover and disperse best practices across the company in the 19605 and 1970s. To ensure that best practices were implemented as soon as possible, he held regular \"Saturday morning meetings\" that convened his top management team in Bentonville. At 7:00 am. each Saturday, the week's business results were discussed and merchandising and purchasing changes implemented. Store layout resets were managed on the weekend, and the rejigged stores were ready by Monday morning. Walton and his management team often toured competitors' stores, looking for new ideas to \"borrow.\" Wal-Mart believed that centralization had numerous benefits including lower costs and improved communications between different divisions. All of Wal-Mart's divisions, from U.S. stores, International and Sam's Club, to its logistics and information systems division, were located in Bentonville, a town of 28,000 people in Northwest Arkansas. Regional managers and incountry presidents were the few executives who were stationed elsewhere. Another key to Wal-Mart's ability to enjoy low operating costs was the fact that it was nonunion. Without cumbersome labour agreements, management could take advantage of technology to drive labour costs down and make operational changes quickly and efciently. Being non-union, however, had its drawbacks. As its store network encroached on unionized grocers\" territory, unions, such as the United Food and Commercial Workers' Union, started to become more aggressive in their anti-Wal-Mart publicity campaigns, funding so-called grassroots groups whose goals were to undermine WalMart's expansion. WeiMatt's size also made it a target for politicians: every stumble was magnified and played up in the press. FOCUSING ON THE SUPPLY CHAIN Wal-Mart remained focused on improving its supply chain. A recent initiative was Remix, which was started in the fall of 2005 and aimed at reducing the percentage of out-ofstock merchandise at stores by redesigning its network of distribution centres. As Wal-Mart stores increased its line-up of grocery items Page 10 9312D010 (WalMart was the U.S.'s largest grocer in 2005), the company noticed that as employees sorted through truckloads of arriving merchandise to nd fast-selling items, delays in restocking shelves occurred.28 Moving from its original model of having distribution centres serve a cluster of stores, Wal-Mart envisioned that fast-moving merchandise, such as paper towels, toilet paper, toothpaste and seasonal items, would be shipped from dedicated \"high velocity\" food distribution centres. Food distribution centres of which there were 40 were designed to handle highturn food items. High velocity distribution centres differed from general merchandise distribution centres in the following ways: as primarily food distribution centres, they were smaller and had temperature controls and less automation.29 In contrast, general merchandise distribution centres required automation and conveyor belts to move full pallets of goods. Wal-Mart did not elaborate on how much savings this move was expected to generate, but it was believed to be an incremental improvement to the current system. Wal-Mart's CIO, Rollin Ford, stated: We could have done nothing and been fine from a logistics standpoint . . . but as you continue to increase your sales per square foot, you've got to do things differently to make - 3 those stores more productive. 0 In 2006, Wal-Mart continued to seek improvements to its supply chain. Although the company publicly declined to outline its targets for inventory reduction, its suppliers stated that WalMart's top executives spoke in January 2006 about eliminating as much as $6 billion in excess inventory.31 In addition, the rm was undertaking a signicant program to remodel most of its U.S. stores to improve \"checkout speed, customer service and store appearance.\" The company reported that remodeled stores could drive 125 to 200 basis points of improvement in both sales and gross margin and 8 to 9 per cent in lower inventories.32 From scal year 2008 to fiscal year 2011, WalMart had remodeled just under 70 per cent of its store base. The company was opening fewer large format supercenters, down to 113 a year in scal year 2011 from 277 in scal year 2006, and was facing competition from online competitors such as Amazoncom, which enjoyed annual sales increases of 40 per cent from 2009 to 2011. And smaller format stores, or Dollar Stores, which were 10,000 square feet in size or smaller, were becoming popular. Wal-Mart had a small store format as well, Wal-Mart Express, aiming to be a fill-in store for space-constrained urban areas. But even as competitors such as Dollar General were opening over 500 new stores in 2011, WalMart seemed hesitant with its small store format, opening only 35 small stores that year (see Figure l).33 Page 11 9B 12D010 Figure 1: Net New Small Store Plans - FY 2011 600 565 500 400 300 240 190 200 150 100 15 35 12 Dollar General Dollar Tree Walgreens CVS Big Lots Wal-Mart Fred's But execution issues at the store level and disruption from the remodeling had a negative impact on Wal- Mart's sales. There was also the financial crisis that started in 2008, along with a cutback on staffing levels. The result was nine consecutive quarters of same store sales decline starting in the second quarter of 2009.34 Figure 2: Wal-Mart Same Store Sales Increases (Decreases) 5.0% 4.4% 4.0% 3.6% 3.0% 2.8% 2.6% 2.4% 2.2% 2.0% 1.9% 1.0% 0.0% 1Q08 2Q08 3Q08 4Q08 1Q09 2009 3Q09 4009 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 4Q11 0.5% 1.0% -0.9% 1.1% -1.4% -1.3% -1.5% -2.0% -1.8% -1.8% -2.0% 3.0%Page 12 9312D010 By October 2011, due to its lacklustre topline and earnings growth prospects, WalMart's stock price had languished in the $45 to $55 dollar range for the entire decade. The stock price seemed to be a topic of conversation at every analyst meeting that Neuhausen had attended for the past few years. This year, however, he wondered whether Wal-Mart's management's efforts to drive additional gains from its already efcient operations could help its lagging stock price. NEW INITIATIVES AND A REORGANIZATION There were three significant initiatives at Wal-Mart whose goals were to improve its supply chain as the rm operated an increasingly varied number of store types and grew its global operations. There were changes to the way it procured product (Global Sourcing), optimizing product delivery to stores to increase on-shelf availability (Project One Touch) and finding ways to leverage its strength in physical store locations to boost its online business (Multi-Channel). To facilitate the improvements, Wal-Mart reorganized, combining its real estate division with store operations and logistics. Wal-Mart was split into three geographic business units (GBUs) in the United States: West, South, and North.35 Global Sourcing In February 2010, the Wal-Mart buying group was reorganized into Global Merchandising Centers: general merchandise; food; consumables, health and wellness and Wal-Mart.com; and softlines.36 For its private label business, instead of purchasing directly from factories, it entered into a partnership with Li & Fung. The latter would assist with product sourcing in a range of categories and markets where WalMart did not \"have the scale or the competencies and skills to leverage.\"7 In 2010, the rst year of the agreement called for approximately $2 billion in goods to be purchased through Li & Fung.38 WalMart was targei9Hg 5 to 15 per cent savings on the $100 billion in product it was purchasing through non-direct channels. Project One Touch \"Across the organization, we're focused on the supply chain all the way down to the customer,\" said Dobbs. \"Improvements in our DCs [distribution centres] and our transportation operations generate savings, but if you improve processes at the store level, you have a signicant multiplier, when you think about the 3,800 plus stores out there (in the United States).\" He continued: So we've been working with our store operations team and our innovations teams to develop what we call Project One Touch. We aligned the merchandise ow, our delivery schedules, and the store labor schedules together. Then, we reorganized our high velocity distribution centers to deliver category group pallets that allow our associates to easily transfer product from our trailers to the sales oor. Then, we added aisle and modular locations to the general merchandise case labels to make it easy for our store associates to get these types of products onto the shelf. And finally, this past year, we installed a Page 13 9312D010 systemsdriven process that dramatically improves the less than case back processing in our back rooms. 40 In the 10 months from January to October 2011, Wal-Mart's on-shelf availability increased by 5.7 per cent to over 90 per cent. On key items, it had 93 per cent availability. In addition, as a result of reorganizing its logistics, Wal-Mart was able to reinvest the US$2 billion in cost reductions into reducing prices at store level.41 The Multi-Channel strategy Wal-Mart aimed to build a \"continuous channel approach" to leverage both its physical store and distribution centre infrastructure and its growing presence online. Wal-Mart.com aimed to carry a broader selection of items not available in stores. In addition, the rm looked to nd ways to use the stores to drive online business. Joel Anderson, EVP and president of Wal-Mart.com, stated: Our store teams next year (in 2012) will get sales credit for both store sales and .com sales. This is like unleashing a sales force of over 1 million people. That is a differentiation that will be hard to replicate. Secondly, I want to focus on access. Several pilots are currently in place to leverage our ship food storage capabilities. We will offer next day delivery at a very economical price. We will use these capabilities to reach customers in urban areas that we have not yet penetrated. And nally, our online marketing efforts will over index in these areas we haven't penetrated so that we can continue to provide access to the WalMart brand. The third area is fulfillment. We already have unlimited assets in place. Nearly 4,000 stores, over 150 DCs, this will give us the exibility to offer our customers best in class delivery options. For example, last week, we transitioned several disparaged shipping offers into one comprehensive fulllment program. We are now offering three compelling free shipping programs. This is an excellent example of multi channel strategy beginning to come to life. Let's look at this one a little bit closer. We call it fast, faster, fastest. You have our site to store offer. And this offers our broadest merchandise assortment beyond the stores. Site to store allows a customer to pick it up in our store or hundreds of urban FedEx locations for free. Home free in the middle is our new faster program. This launched just last week. Home free allows our customers to bundle their items into one order and have it delivered to home for free. And there are no membership fees like some other online retailers currently charge. Pickup today . . . is our third program. It is our fastest option, and it provides the convenience of same day pickup in our stores for free. Pickup today is available in every one of our stores on the hottest assortment we have to offer.42 Page 14 BB12D01D DECISION HOLD, BUY OR SELL? Neuhausen put his notes down and walked into the conference room where his analyst team was assembled. He switched on the projector and clicked through the WalMart stock presentation to the comparative information slides that included financial information (see Exhibit 3) and a description of each competitor (see Exhibit 4). Neuhausen hit \"enter\" and brought up Wal-Mart's stock performance over the past 10 years (see Exhibit 5). He concluded: We've owned Wal-Mart stock for the past decade, and it's been basically at over that period. During the same time, we'd have made more money had we been invested in the S&P 500 index of the largest 500 U.S. stocks. Should we continue to hold WalMart stock? I'd like to find out your views on Wal-Mart's key competitive advantages, especially its supply chain suategy, and whether these advantages are sustainable. The data suggest that new competitors, especially the Dollar Stores, Amazoncorn and Tesco,43 are gaining in popularity in the United States. Is WalMart's high volume \"buy it low, stack it high, sell it cheap\" model still valid today? Page 15 BB12DD1O Exhibit 1 U.S. RETAIL CATEGORIES (PARTIAL LIST) Category 2011 (US$ billions) General merchandise stores 630.9 Food and beverage 615.4 Food services and drinking places 494.2 Gasoline 533.6 Building materials and gardening equipment and supplies 300.2 Furniture, home furnishings, electronics and appliances 190.9 Health and personal care 274.9 Clothing and clothing accessories 226.5 Sporting goods, hobby, books, music 88.9 Source: http://www. census. go v/retail/index. himhi'arts, accessed January20, 2012. Page 16 9B12D010 Exhibit 2 WAL-MART'S RETAIL LINK DATABASE Store Distribution Network Centres Shipping to Distribution Centres or Factory Pick-Up (Logistics) Sales Data At Data Retail Link Supplier Merchandise Store Level Transmission Database Network Production via accesses real- by Suppliers (Collected from Global (located in time sales data cash registers Satellite Bentonville, in all stores) Network AR) II External Data Wal-Mart (Weather internal forecasts, analysts work economic to forecast forecasts etc) demand, work with suppliers Source: Case writers.Page 20 9312DD10 Exhibit 4 COMPETITORS DESCRIPTION Target Corporation Target operates as two reportable segments. Its Retail Segment includes its merchandising operations, including its online business. Its Credit Card Segment provides the Target Visa and the Target Card credit cards, as well as the Target Debit Card. Target's Canadian segment consists of its leasehold interests in Canada. It operates Target general merchandise stores and SuperTarget stores, providing a range of general merchandise and food. The company's merchandise includes household products, hardlines, apparel and accessories, food and pet supplies and home furnishings and decor. As of January 28, 2012, Target had 1,763 stores in 49 states and the District of Columbia. Kroger Co. Kroger operates retail food and drug stores, multi-department stores, jewelry stores and convenience stores. It also manufactures and processes some of the food for sale in its supermarkets. As of January 29, 2011, Kroger operated, either directly or through its subsidiaries, 2,460 supermarkets and multidepartment stores, 1,014 of which had fuel centres. In addition, as of January 29, 2011, it operated through subsidiaries 784 convenience stores and 361 ne jewelry stores. Additionally, 87 convenience stores were operated through franchise agreements. These convenience stores offer an assortment of staple food items and general merchandise and, in most cases, sell gasoline. Costco Wholesale Corp. Costco Wholesale operates membership warehouses. Its products include sundries, such as candy, snack foods, tobacco, alcoholic and nonalcoholic beverages and cleaning and institutional supplies; hardlines, such as appliances, electronics, health and beauty aids, hardware, ofce supplies, cameras, garden and patio, sporting goods, toys, seasonal items and automotive supplies; food, such as dry and packaged foods; softlines, such as apparel, domestics, jewelry, housewares, media, home furnishings and small appliances; fresh food, such as meat, bakery, deli and produce; and ancillary and other, such as gas stations, pharmacy, food court, optical, one-hour photo, hearing aid and travel. Safeway Inc. Safeway is a food and drug retailer in North America, with 1,678 stores at December 31, 2011. Its US. retail operations are located principally in California, Hawaii, Oregon, Washington, Alaska, Colorado, Arizona, Texas, the Chicago metropolitan area and the Mid-Atlantic region. Its Canadian retail operations are located principally in British Columbia, Alberta and Manitoba/Saskatchewan. Its stores provide an array of grocery items tailored to local preferences. Most stores provide food and general merchandise and include specialty departments such as bakery, delicatessen, oral, seafood and pharmacy. The majority of stores provide Starbucks coffee shops and adjacent fuel centres. Amazon.com Amazon.com serves consumers through its retail websites. It provides merchandise and content purchased for resale from vendors and those provided by third-party sellers; it also manufactures and sells the Kindle ereader. It provides services such as Amazon Web Services; fulllment; miscellaneous marketing and promotional agreements, such as online advertising; and co-branded credit cards. It has two principal segments: North America, which consists of retail sales of consumer products and subscriptions through North Americafocused websites; and International, which consists of retail sales of consumer products and subscriptions through internationally focused locations. Page 21 9312DD10 Exhibit 4 (continued) COMPETITORS DESCRIPTION Dollar General Dollar General is a discount retailer. As of February 25, 201 1, it operated 9,414 retail stores located in 35 states in the southern. southwestern, midwestem and eastern United States. It provides a selection of merchandise, including consumables, seasonal, home products and apparel. Its products portfolio includes home cleaning supplies. food, beverages and snacks, personal care products, pet supplies, decorations, toys, batteries, small electronics, greeting cards, stationery, prepaid cell phones and accessories, gardening supplies, hardware, and automotive and home ofce supplies, as well as a selection of home products and apparel products. Dollar Tree, Inc. Dollar Tree is an operator of discount variety Stores providing merchandise at the fixed price of $1.00. Its merchandise mix consists of consumable merchandise, which includes candy and food and health and beauty care, and household consumables such as paper, plastics, house chemicals and frozen food; variety merchandise, which includes toys, housewares, gifts, party goods, greeting cards, softlines and other items; and seasonal goods, which include Easter, Halloween and Christmas merchandise. At January 28, 2012, it operated 4,252 stores in 48 states and the District of Columbia, as well as 99 stores in Canada under the Dollar Tree, Deal$, Dollar Tree Deal$, Dollar Giant and Dollar Bills names. Big Lots, Inc. Big Lots is a broadline closeout retailer. Its merchandising categories consist of Consumables, which include food, health and beauty, plastics, paper, chemical and pet departments; Furniture, which includes the upholstery, mattresses, readytoassemble and case goods departments; Home, which includes domestics, stationery and home decorative departments; Hardlines, which include electronics, appliances, tools and home maintenance departments; Seasonal, which includes lawn and garden, Christmas, summer and other holiday departments; and Other, which includes toy, jewelry, infant accessories and apparel departments. At January 29, 2011, it operated a total of 1,398 stores in 48 states. Fred's Inc. Fred's operates discount general merchandise stores and pharmacies. Its stores generally serve low, middle and xed income families located in small- to medium-sized towns. It also markets goods and services to its 24 franchised stores. Its stores stock over 12,000 purchased items that address the needs of its customers, including brand name products, its label products and offbrand products. Its FRED'S brand products include household cleaning supplies, health and beauty aids, disposable diapers, pet foods, paper products and a variety of food and beverage products. As of January 29, 2011, it had 653 retail stores and 313 pharmacies in 15 states primarily in the southeastern United States. Sears Holding Corp. Sears Holdings is the parent company of Kmart Holding Corporation (Kmart) and Sears, Roebuck and Co. (Sears). It is a broadline retailer with 2,172 full-line and 1,338 specialty retail stores in the United States operating through Kmart and Sears and 500 fullline and specialty retail stores in Canada operating through Sears Canada Inc., a 95%- owned subsidiary. As of January 28, 2012, it operated three reportable segments: Kmart, Sears Domestic and Sears Canada. Exhibit 4 (continued) COMPETITORS - DESCRIPTION Walgreen Co. Walgreen, together with its subsidiaries, operates a retail drugstore chain. It sells prescription and non-prescription drugs as well as general merchandise, including household products, convenience and fresh foods, personal care, beauty care, photofinishing and candy. Its pharmacy, health and wellness services include retail, specialty, infusion and respiratory services, mail service, convenient care clinics and worksite clinics. In addition, its Take Care Health Systems, Inc. subsidiary is a manager of worksite health centres and in-store convenient care clinics. As of August 31, 2011, it operated 8,210 locations in 50 states, the District of Columbia, Puerto Rico and Guam. CVS Caremark Corporation CVS Caremark, together with its subsidiaries, is a pharmacy health care provider in the United States. Its segments include Pharmacy Services, which provides a range of pharmacy benefit management services including mail order pharmacy services, specialty pharmacy services, plan design and administration, formulary management and claims processing; and Retail Pharmacy, which sells prescription drugs and a range of general merchandise, including over- the-counter drugs, beauty products and cosmetics, photo finishing, seasonal merchandise, greeting cards and convenience foods. As of December 31, 2011, it had 7,300 CVS/pharmacy@ retail stores. Carrefour S.A. Carrefour is a distribution group based in France. It engages in retailing business primarily in Europe, Asia, and Latin America. It operates under four main grocery store formats: hypermarkets (offers food and non-food product lines); supermarkets; hard discount (offers a reduced range at discount prices); and convenience stores, which included Cash & Carry stores (which are conveniences stores for professionals) and E-commerce. Some of its trade names are Carrefour, Carrefour Market, GB, GS, Dia, Ed, Shopi, Marche Plus, 8 a Huit, Proxi, Promocash and Docks Markets. As of December 31, 2010, it operated 15,937 stores worldwide. Tesco plc. Tesco is engaged in retailing and associated activities. Its core U.K. segment consists of four different store formats: Express, Metro, Superstore and Extra, as well as one trial format called Homeplus. Its Non-Food segment includes merchandise such as electricals, home entertainment, clothing, health and beauty, stationery, cookshop and soft furnishings, and seasonal goods such as barbecues and garden furniture in the summer. Its Retailing Services segment consists of several operations, including Tesco Personal Finance, Tesco.com and Tesco Telecoms. Its International segment operates in 13 markets outside the United Kingdom in Europe, Asia (including India) and North America. Source: Mergent.US$ 180 100 140 160 120 80 20 40 60 0 2/1/2002 8/1/2002 2/1/2003 8/1/2003 2/1/2004 8/1/2004 2/1/2005 8/1/2005 2/1/2006 8/1/2006 2/1/2007 February 2002 to February 2012 Exhibit 5 8/1/2007 WAL-MART STOCK PRICE Wal-Mart Stock Price 2/1/2008 8/1/2008 2/1/2009 8/1/2009 2/1/2010 8/1/2010 2/1/2011 8/1/2011 2/1/2012 - WMT S&P 500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts