Answered step by step

Verified Expert Solution

Question

1 Approved Answer

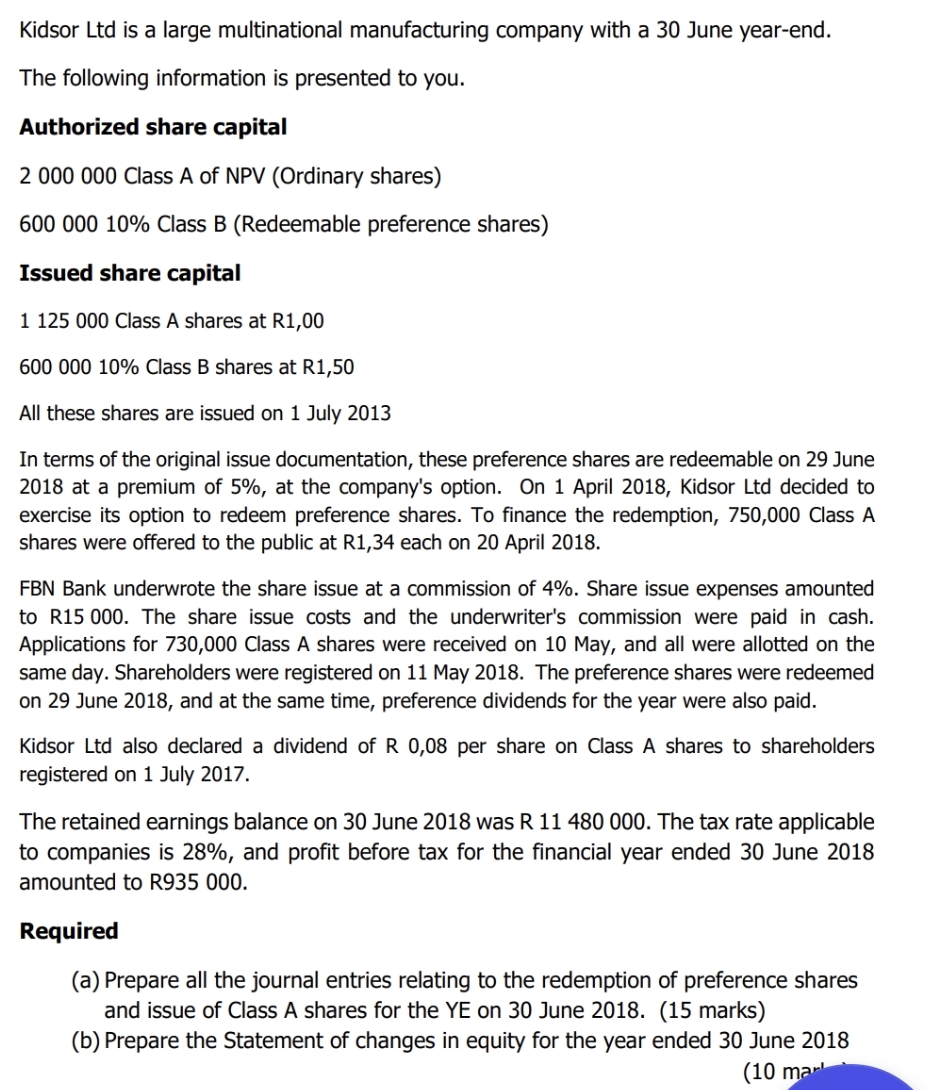

Kidsor Ltd is a large multinational manufacturing company with a 3 0 June year - end. The following information is presented to you. Authorized share

Kidsor Ltd is a large multinational manufacturing company with a June yearend.

The following information is presented to you.

Authorized share capital

Class A of NPV Ordinary shares

Class B Redeemable preference shares

Issued share capital

Class A shares at R

Class B shares at R

All these shares are issued on July

In terms of the original issue documentation, these preference shares are redeemable on June at a premium of at the company's option. On April Kidsor Ltd decided to exercise its option to redeem preference shares. To finance the redemption, Class A shares were offered to the public at R each on April

FBN Bank underwrote the share issue at a commission of Share issue expenses amounted to R The share issue costs and the underwriter's commission were paid in cash. Applications for Class A shares were received on May, and all were allotted on the same day. Shareholders were registered on May The preference shares were redeemed on June and at the same time, preference dividends for the year were also paid.

Kidsor Ltd also declared a dividend of R per share on Class A shares to shareholders registered on July

The retained earnings balance on June was R The tax rate applicable to companies is and profit before tax for the financial year ended June amounted to R

Required

a Prepare all the journal entries relating to the redemption of preference shares and issue of Class A shares for the YE on June marks

b Prepare the Statement of changes in equity for the year ended June mar

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started