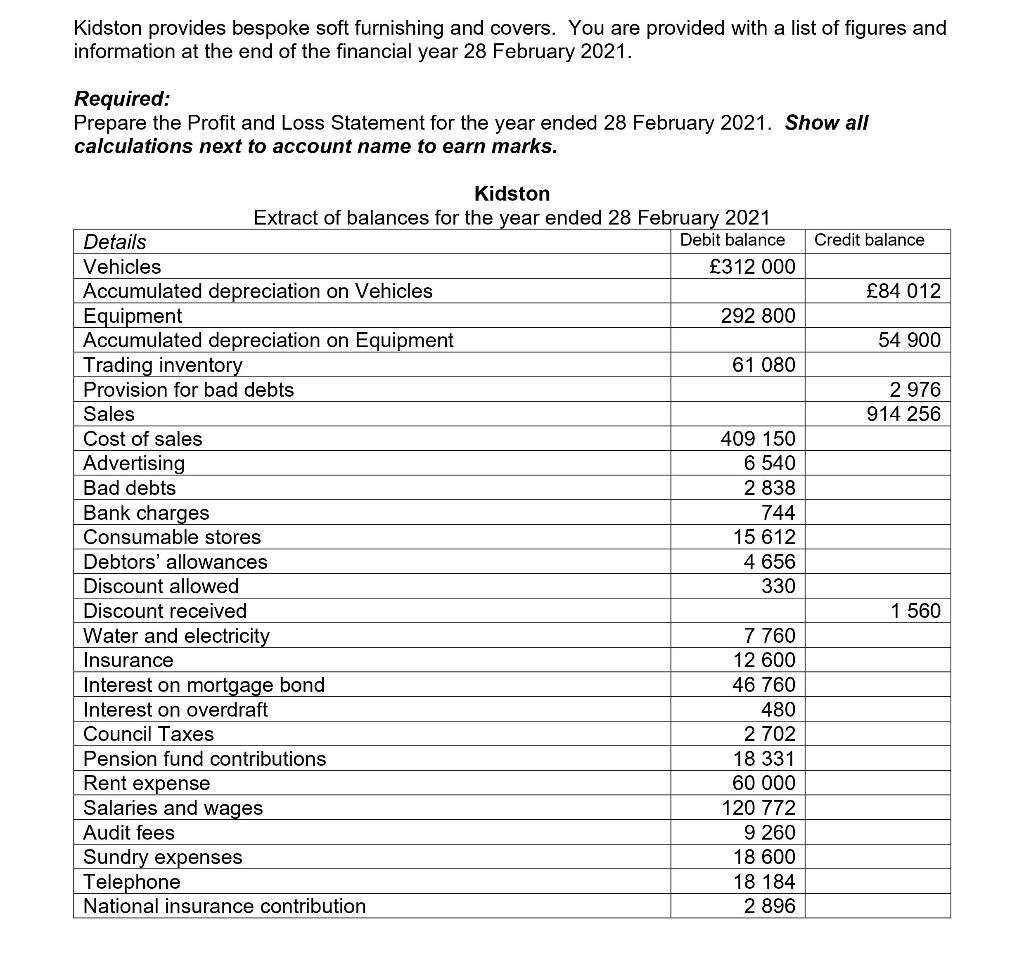

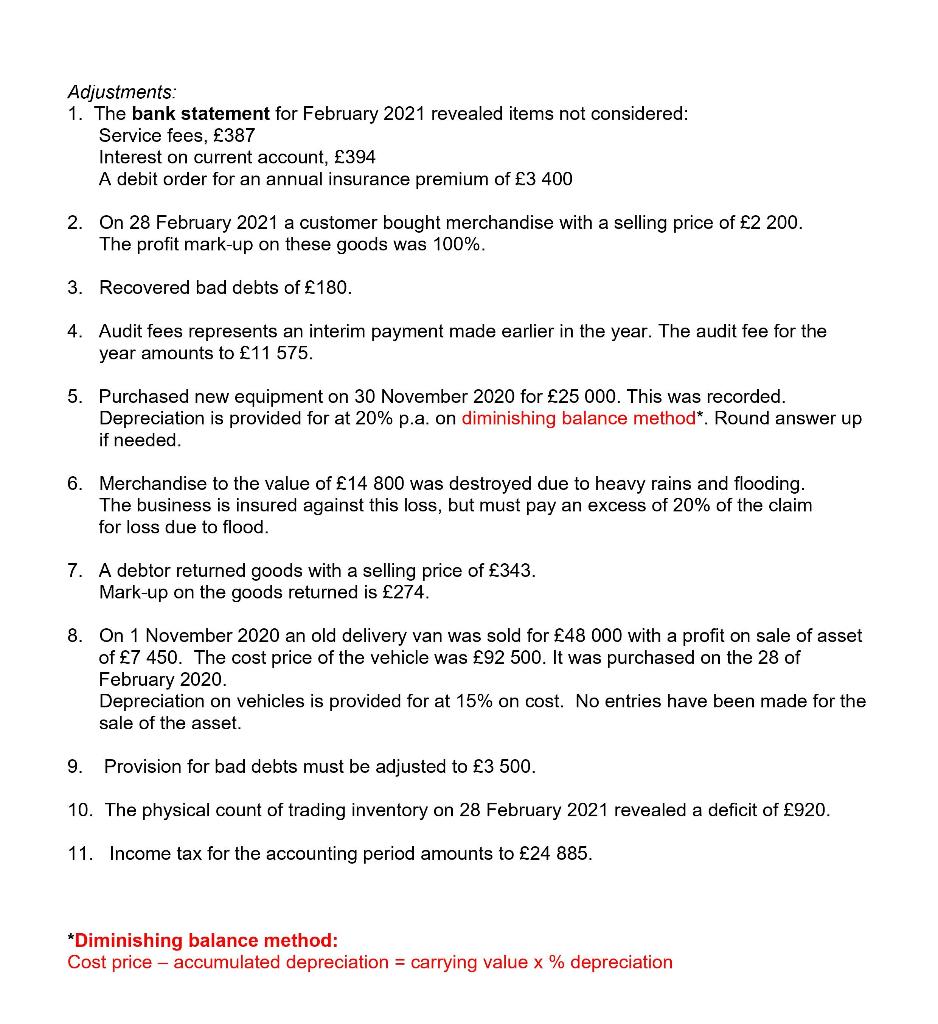

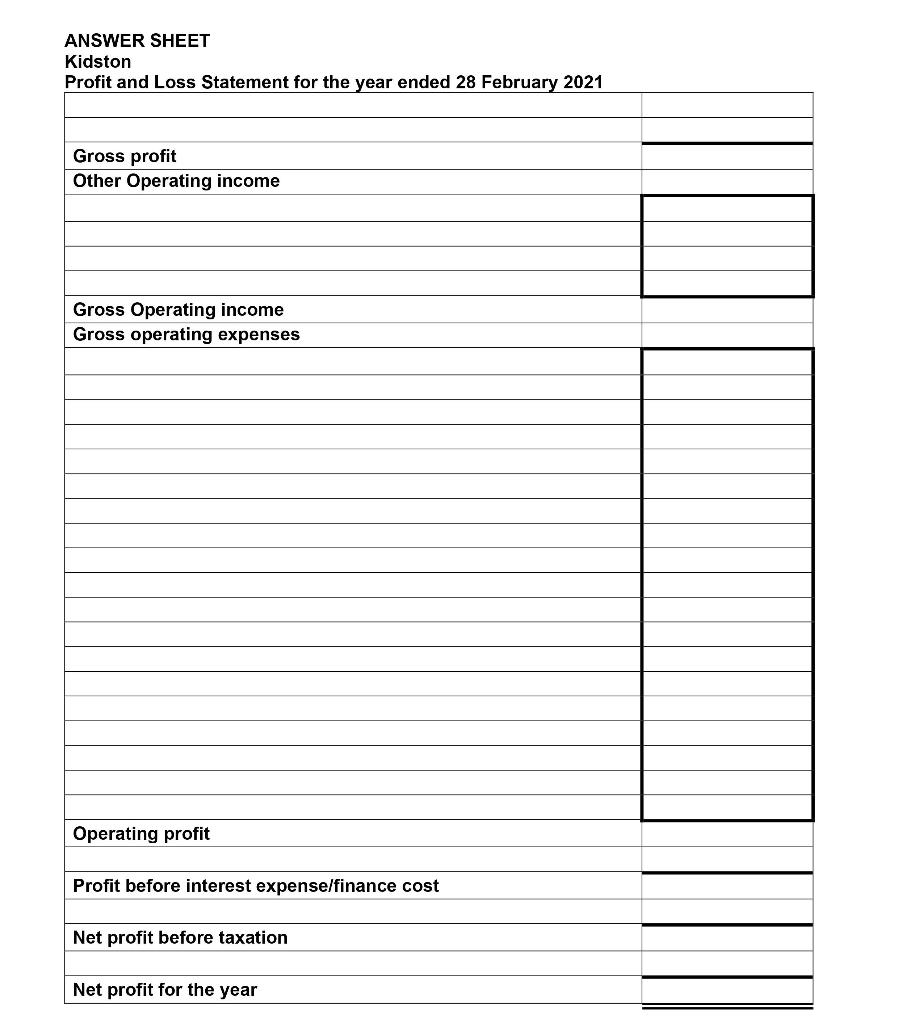

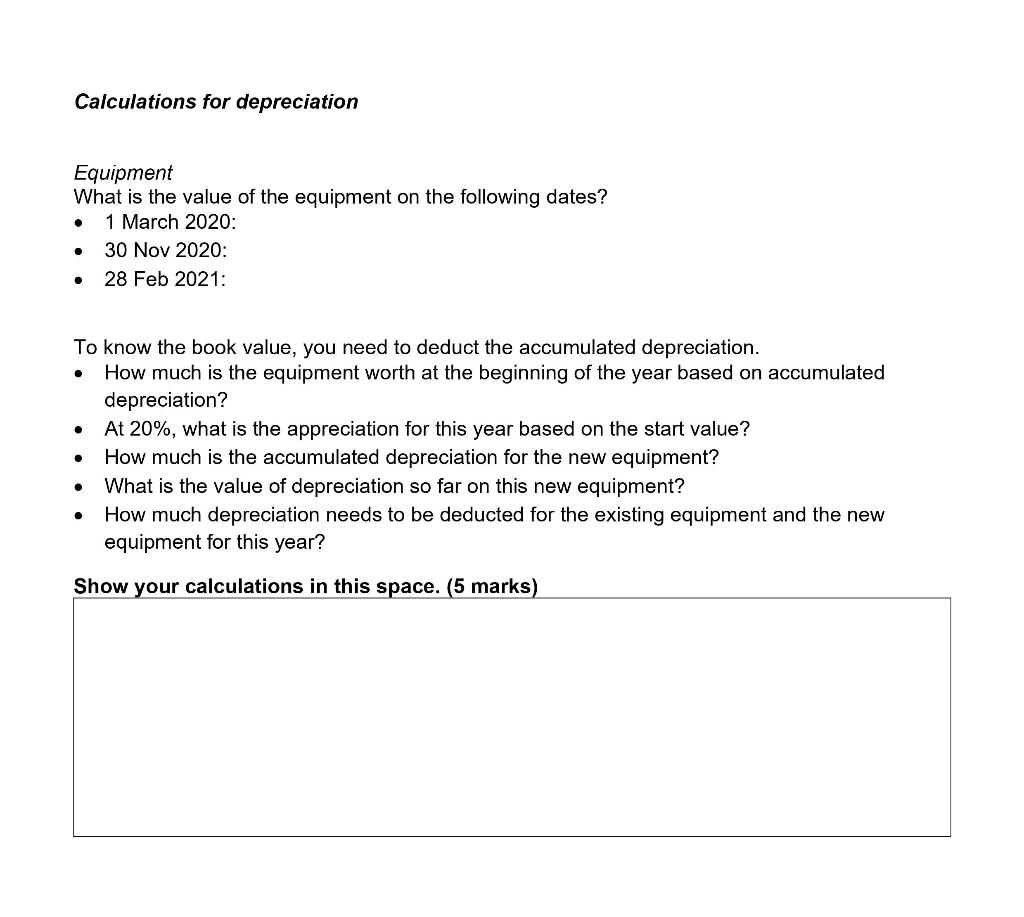

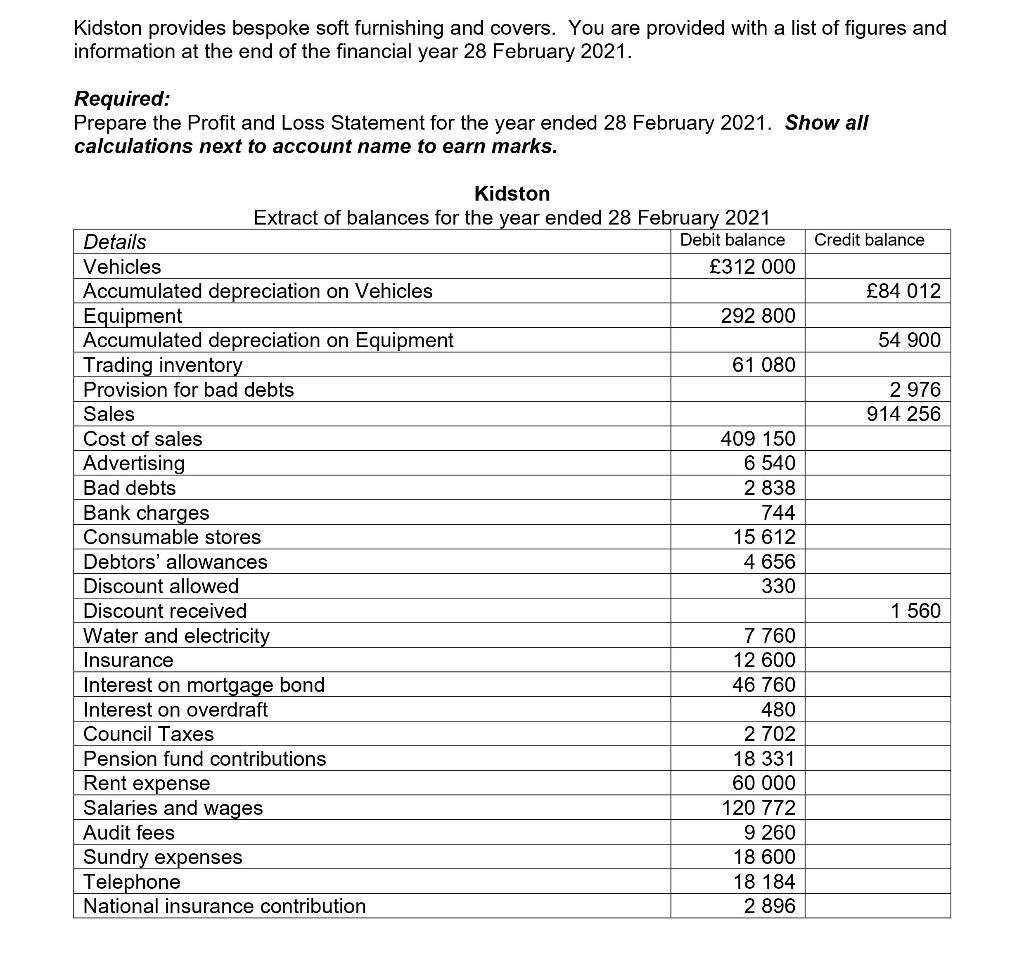

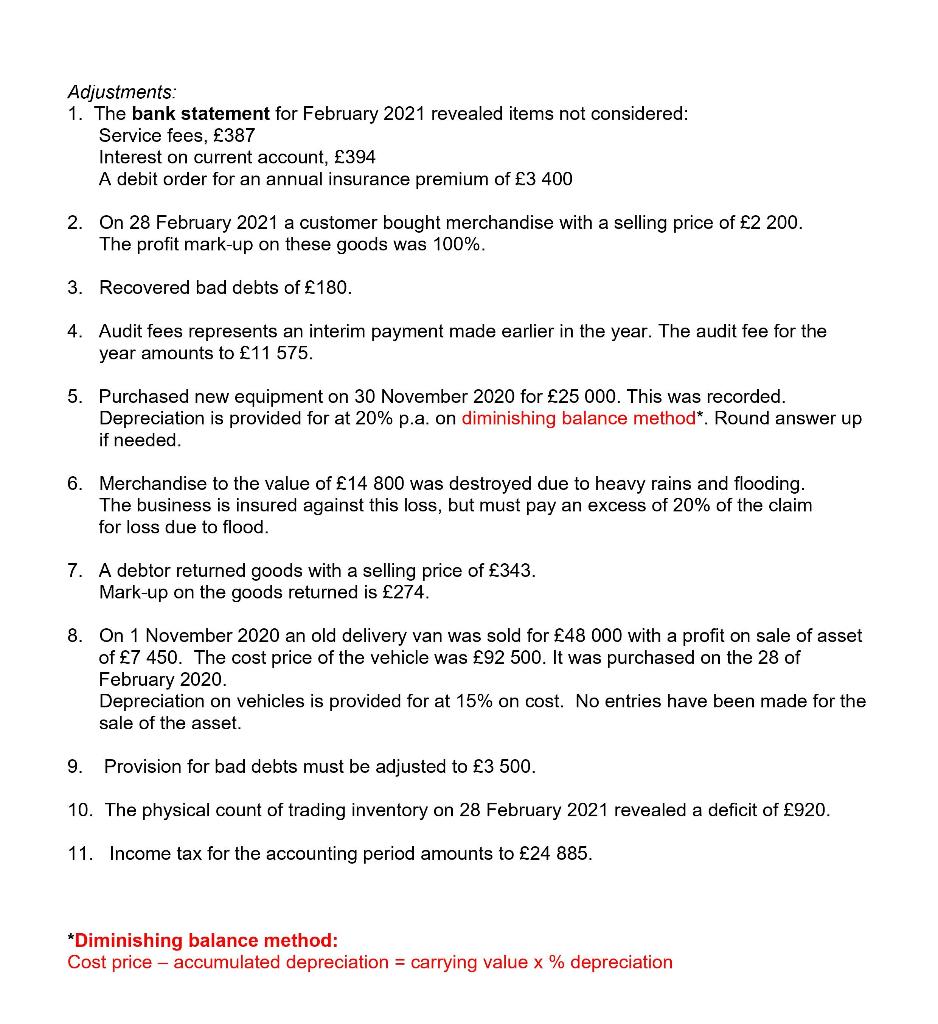

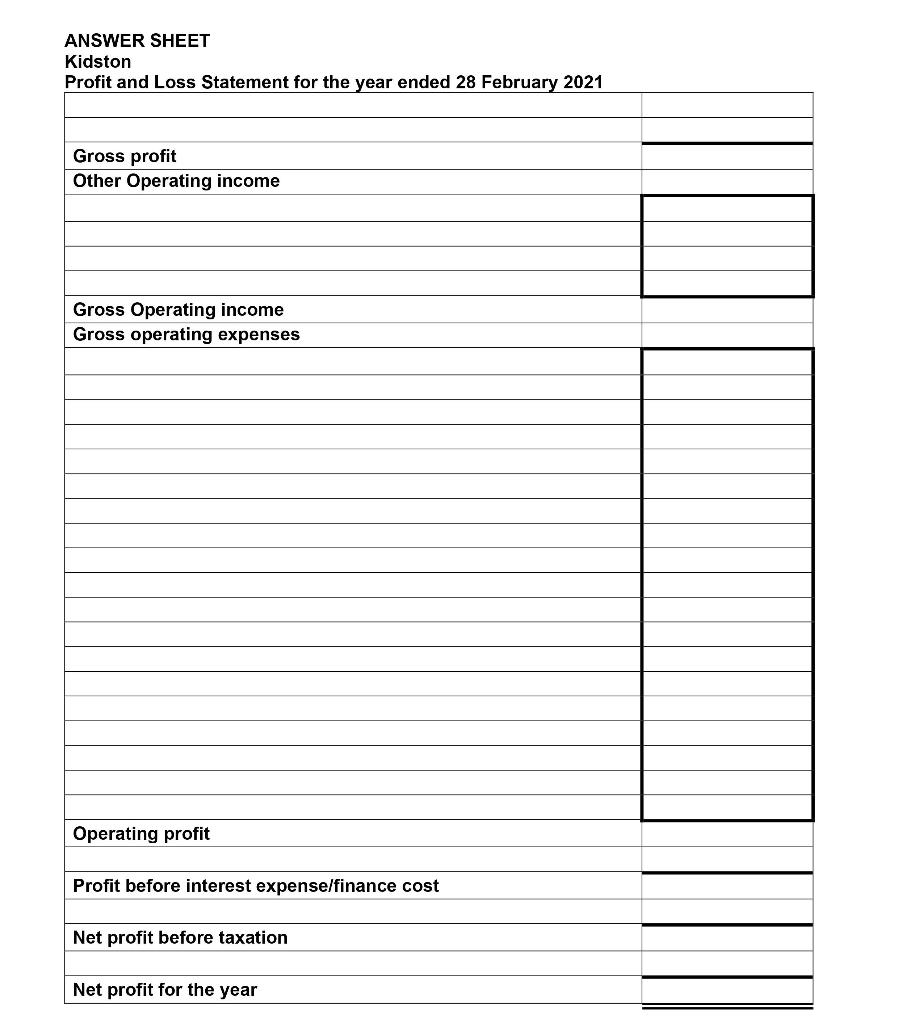

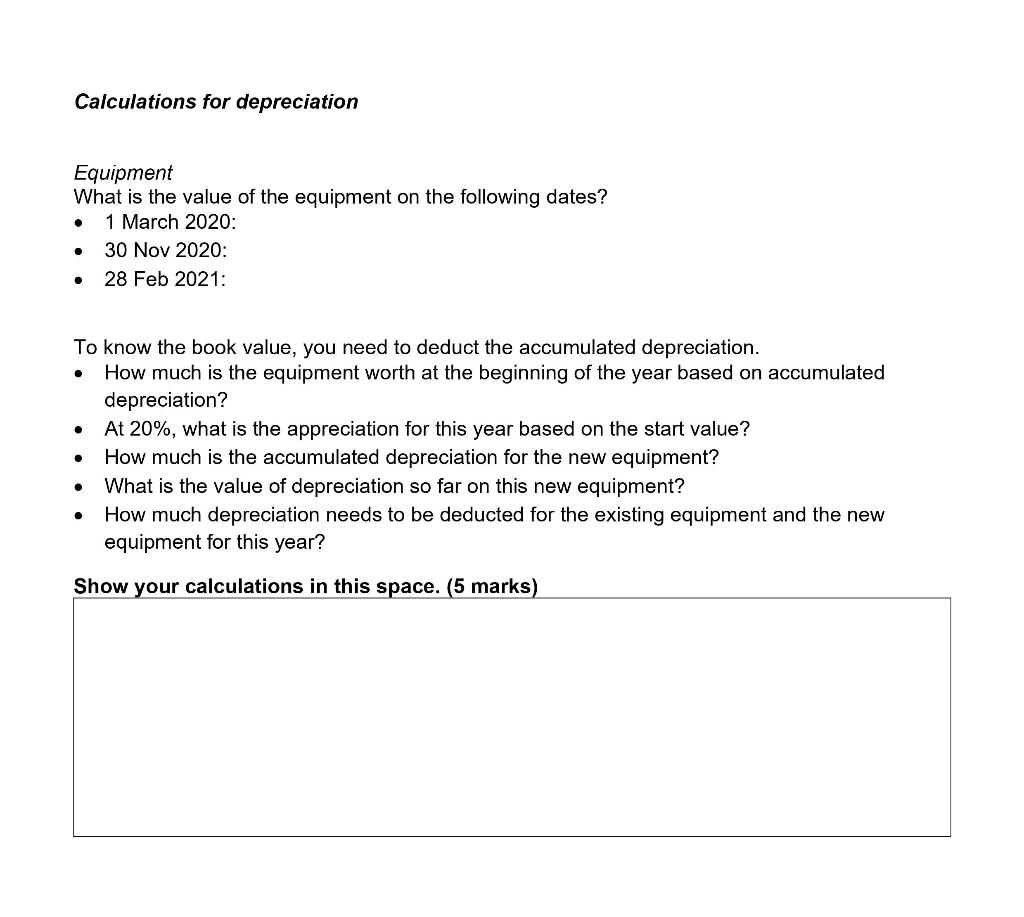

Kidston provides bespoke soft furnishing and covers. You are provided with a list of figures and information at the end of the financial year 28 February 2021. Required: Prepare the Profit and Loss Statement for the year ended 28 February 2021. Show all calculations next to account name to earn marks. Credit balance 84 012 54 900 2 976 914 256 Kidston Extract of balances for the year ended 28 February 2021 Details Debit balance Vehicles 312 000 Accumulated depreciation on Vehicles Equipment 292 800 Accumulated depreciation on Equipment Trading inventory 61 080 Provision for bad debts Sales Cost of sales 409 150 Advertising 6 540 Bad debts 2 838 Bank charges 744 Consumable stores 15 612 Debtors' allowances 4 656 Discount allowed 330 Discount received Water and electricity 7 760 Insurance 12 600 Interest on mortgage bond 46 760 Interest on overdraft 480 Council Taxes 2 702 Pension fund contributions 18 331 Rent expense 60 000 Salaries and wages 120 772 Audit fees 9 260 Sundry expenses 18 600 Telephone 18 184 National insurance contribution 2 896 1 560 Adjustments: 1. The bank statement for February 2021 revealed items not considered: Service fees, 387 Interest on current account, 394 A debit order for an annual insurance premium of 3 400 2. On 28 February 2021 a customer bought merchandise with a selling price of 2 200. The profit mark-up on these goods was 100%. 3. Recovered bad debts of 180. 4. Audit fees represents an interim payment made earlier in the year. The audit fee for the year amounts to 11 575. 5. Purchased new equipment on 30 November 2020 for 25 000. This was recorded. Depreciation is provided for at 20% p.a. on diminishing balance method*. Round answer up if needed. 6. Merchandise to the value of 14 800 was destroyed due to heavy rains and flooding. The business is insured against this loss, but must pay an excess of 20% of the claim for loss due to flood. 7. A debtor returned goods with a selling price of 343. Mark-up on the goods returned is 274. 8. On 1 November 2020 an old delivery van was sold for 48 000 with a profit on sale of asset of 7 450. The cost price of the vehicle was 92 500. It was purchased on the 28 of February 2020. Depreciation on vehicles is provided for at 15% on cost. No entries have been made for the sale of the asset. 9. Provision for bad debts must be adjusted to 3 500. 10. The physical count of trading inventory on 28 February 2021 revealed a deficit of 920. 11. Income tax for the accounting period amounts to 24 885. *Diminishing balance method: Cost price - accumulated depreciation = carrying value x % depreciation ANSWER SHEET Kidston Profit and Loss Statement for the year ended 28 February 2021 Gross profit Other Operating income Gross Operating income Gross operating expenses Operating profit Profit before interest expense/finance cost Net profit before taxation Net profit for the year Calculations for depreciation Equipment What is the value of the equipment on the following dates? 1 March 2020: 30 Nov 2020: 28 Feb 2021: . . . . To know the book value, you need to deduct the accumulated depreciation. How much is the equipment worth at the beginning of the year based on accumulated depreciation? At 20%, what is the appreciation for this year based on the start value? How much is the accumulated depreciation for the new equipment? What is the value of depreciation so far on this new equipment? How much depreciation needs to be deducted for the existing equipment and the new equipment for this year? . . Show your calculations in this space. (5 marks) Kidston provides bespoke soft furnishing and covers. You are provided with a list of figures and information at the end of the financial year 28 February 2021. Required: Prepare the Profit and Loss Statement for the year ended 28 February 2021. Show all calculations next to account name to earn marks. Credit balance 84 012 54 900 2 976 914 256 Kidston Extract of balances for the year ended 28 February 2021 Details Debit balance Vehicles 312 000 Accumulated depreciation on Vehicles Equipment 292 800 Accumulated depreciation on Equipment Trading inventory 61 080 Provision for bad debts Sales Cost of sales 409 150 Advertising 6 540 Bad debts 2 838 Bank charges 744 Consumable stores 15 612 Debtors' allowances 4 656 Discount allowed 330 Discount received Water and electricity 7 760 Insurance 12 600 Interest on mortgage bond 46 760 Interest on overdraft 480 Council Taxes 2 702 Pension fund contributions 18 331 Rent expense 60 000 Salaries and wages 120 772 Audit fees 9 260 Sundry expenses 18 600 Telephone 18 184 National insurance contribution 2 896 1 560 Adjustments: 1. The bank statement for February 2021 revealed items not considered: Service fees, 387 Interest on current account, 394 A debit order for an annual insurance premium of 3 400 2. On 28 February 2021 a customer bought merchandise with a selling price of 2 200. The profit mark-up on these goods was 100%. 3. Recovered bad debts of 180. 4. Audit fees represents an interim payment made earlier in the year. The audit fee for the year amounts to 11 575. 5. Purchased new equipment on 30 November 2020 for 25 000. This was recorded. Depreciation is provided for at 20% p.a. on diminishing balance method*. Round answer up if needed. 6. Merchandise to the value of 14 800 was destroyed due to heavy rains and flooding. The business is insured against this loss, but must pay an excess of 20% of the claim for loss due to flood. 7. A debtor returned goods with a selling price of 343. Mark-up on the goods returned is 274. 8. On 1 November 2020 an old delivery van was sold for 48 000 with a profit on sale of asset of 7 450. The cost price of the vehicle was 92 500. It was purchased on the 28 of February 2020. Depreciation on vehicles is provided for at 15% on cost. No entries have been made for the sale of the asset. 9. Provision for bad debts must be adjusted to 3 500. 10. The physical count of trading inventory on 28 February 2021 revealed a deficit of 920. 11. Income tax for the accounting period amounts to 24 885. *Diminishing balance method: Cost price - accumulated depreciation = carrying value x % depreciation ANSWER SHEET Kidston Profit and Loss Statement for the year ended 28 February 2021 Gross profit Other Operating income Gross Operating income Gross operating expenses Operating profit Profit before interest expense/finance cost Net profit before taxation Net profit for the year Calculations for depreciation Equipment What is the value of the equipment on the following dates? 1 March 2020: 30 Nov 2020: 28 Feb 2021: . . . . To know the book value, you need to deduct the accumulated depreciation. How much is the equipment worth at the beginning of the year based on accumulated depreciation? At 20%, what is the appreciation for this year based on the start value? How much is the accumulated depreciation for the new equipment? What is the value of depreciation so far on this new equipment? How much depreciation needs to be deducted for the existing equipment and the new equipment for this year? . . Show your calculations in this space