Question

Kim Hotels is interested in developing a new hotel in Seoul. The company estimates that the hotel would require an initial investment of $24 million.

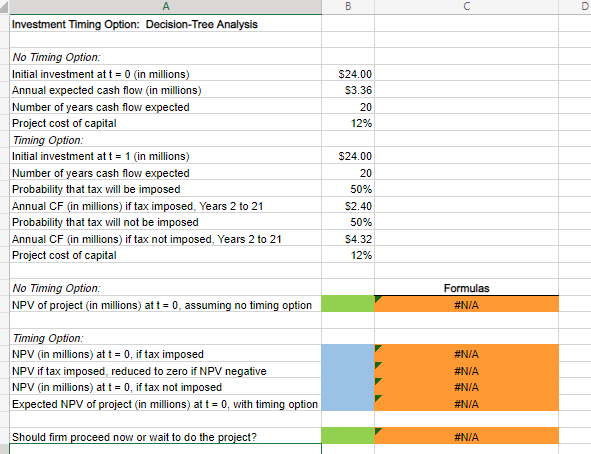

Kim Hotels is interested in developing a new hotel in Seoul. The company estimates that the hotel would require an initial investment of $24 million. Kim expects the hotel will produce positive cash flows of $3.36 million a year at the end of each of the next 20 years. The project's cost of capital is 12%. The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations.

What is the project's net present value? A negative value should be entered with a negative sign. Enter your answer in millions. For example, an answer of $1.2 million should be entered as 1.2, not 1,200,000. Do not round intermediate calculations. Round your answer to two decimal places. $ __ millio

InvestmentTimingOption:Decision-TreeAnalysisA No Timing Option: \begin{tabular}{|l|r|} \hline Initial investment at t=0 (in millions) & $24.00 \\ \hline Annual expected cash flow (in millions) & $3.36 \\ \hline Number of years cash flow expected & 20 \\ \hline Project cost of capital & 12% \\ \hline Timing Option: & $24.00 \\ \hline Initial investment at t=1 (in millions) & 20 \\ \hline Number of years cash flow expected & 50% \\ \hline Probability that tax will be imposed & $2.40 \\ \hline Annual CF (in millions) if tax imposed, Years 2 to 21 & 50% \\ \hline Probability that tax will not be imposed & $4.32 \\ \hline Annual CF (in millions) if tax not imposed, Years 2 to 21 & 12% \\ \hline Project cost of capital & \\ & \end{tabular} No Timing Option: Formulas NPV of project (in millions) at t=0, assuming no timing option Timing Option: NPV (in millions) at t=0, if tax imposed \#N/A NPV if tax imposed, reduced to zero if NPV negative \#N/A NPV (in millions) at t=0, if tax not imposed \#N/A Expected NPV of project (in millions) at t=0, with timing option \#N/A Should firm proceed now or wait to do the project? InvestmentTimingOption:Decision-TreeAnalysisA No Timing Option: \begin{tabular}{|l|r|} \hline Initial investment at t=0 (in millions) & $24.00 \\ \hline Annual expected cash flow (in millions) & $3.36 \\ \hline Number of years cash flow expected & 20 \\ \hline Project cost of capital & 12% \\ \hline Timing Option: & $24.00 \\ \hline Initial investment at t=1 (in millions) & 20 \\ \hline Number of years cash flow expected & 50% \\ \hline Probability that tax will be imposed & $2.40 \\ \hline Annual CF (in millions) if tax imposed, Years 2 to 21 & 50% \\ \hline Probability that tax will not be imposed & $4.32 \\ \hline Annual CF (in millions) if tax not imposed, Years 2 to 21 & 12% \\ \hline Project cost of capital & \\ & \end{tabular} No Timing Option: Formulas NPV of project (in millions) at t=0, assuming no timing option Timing Option: NPV (in millions) at t=0, if tax imposed \#N/A NPV if tax imposed, reduced to zero if NPV negative \#N/A NPV (in millions) at t=0, if tax not imposed \#N/A Expected NPV of project (in millions) at t=0, with timing option \#N/A Should firm proceed now or wait to do the projectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started