Question

Kim Mitchell, the new credit manager of the Vinson Corporation, was alarmed to find that Vinson sells on credit terms of net 90 days while

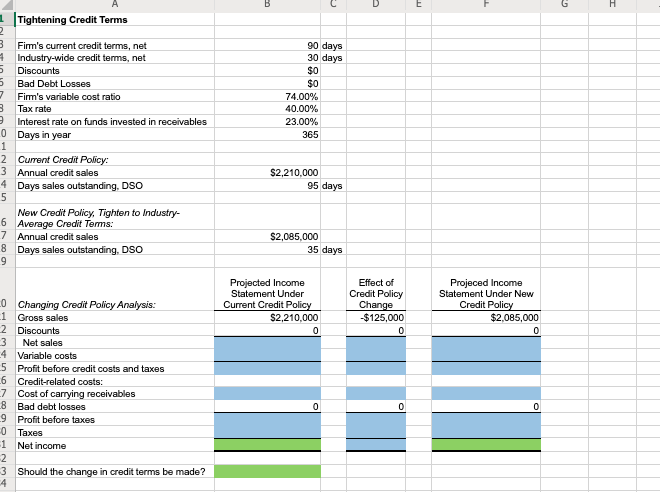

Kim Mitchell, the new credit manager of the Vinson Corporation, was alarmed to find that Vinson sells on credit terms of net 90 days while industry-wide credit terms have recently been lowered to net 30 days. On annual credit sales of $2.21 million, Vinson currently averages 95 days of sales in accounts receivable. Mitchell estimates that tightening the credit terms to 30 days would reduce annual sales to $2,085,000, but accounts receivable would drop to 35 days of sales and the savings on investment in them should more than overcome any loss in profit. Assume that Vinsons variable cost ratio is 74%, taxes are 40%, and the interest rate on funds invested in receivables is 23%.

The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions above.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started