Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly answer all questions as soon as possible. it's very urgent. Will upvote for the first Problem 2 (40 points) Consider an economy with a

Kindly answer all questions as soon as possible. it's very urgent. Will upvote for the first

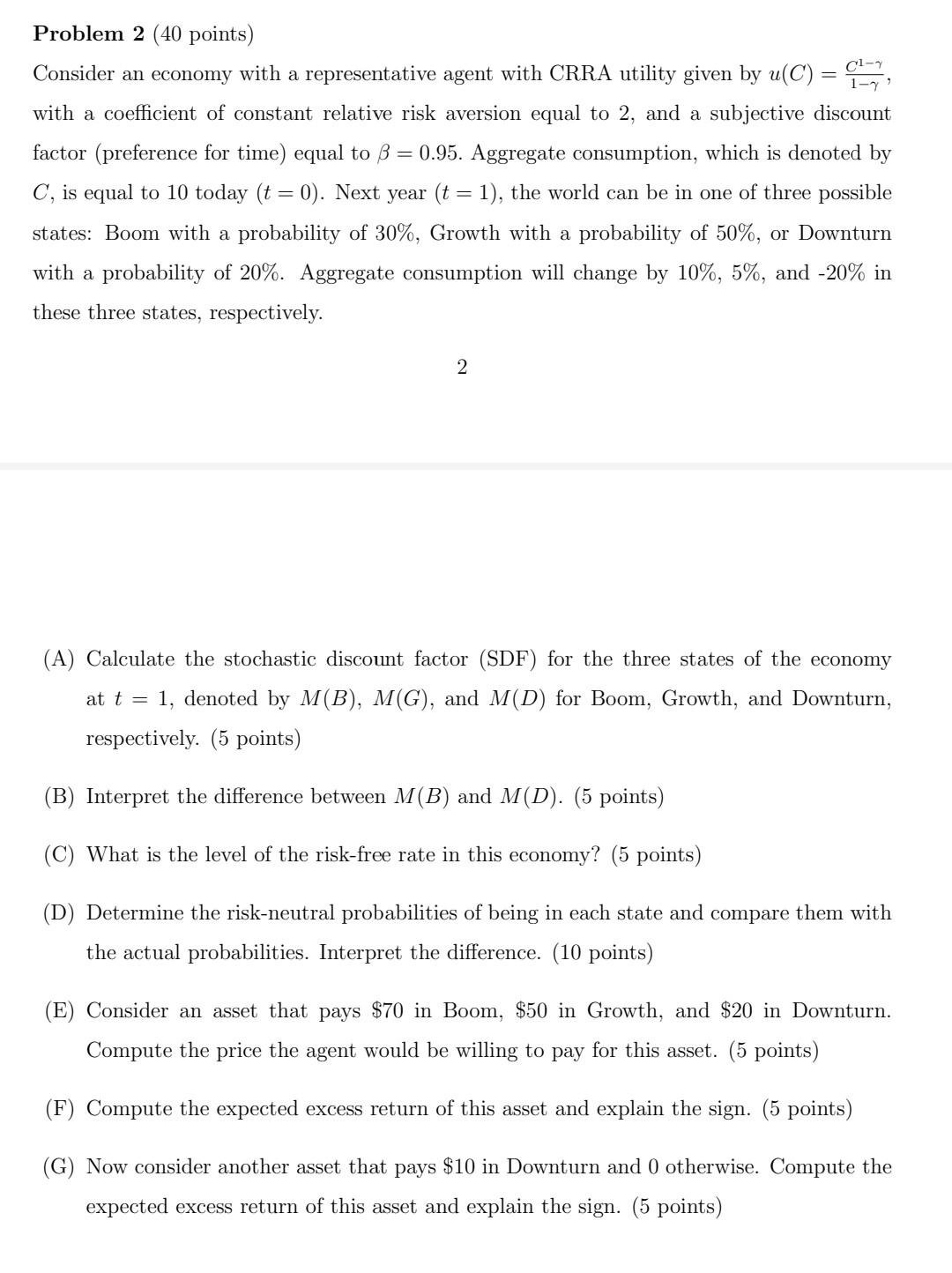

Problem 2 (40 points) Consider an economy with a representative agent with CRRA utility given by u(C) = with a coefficient of constant relative risk aversion equal to 2, and a subjective discount factor (preference for time) equal to 3= 0.95. Aggregate consumption, which is denoted by C, is equal to 10 today (t = 0). Next year (t = 1), the world can be in one of three possible states: Boom with a probability of 30%, Growth with a probability of 50%, or Downturn with a probability of 20%. Aggregate consumption will change by 10%, 5%, and -20% in these three states, respectively. 2 (A) Calculate the stochastic discount factor (SDF) for the three states of the economy at t = 1, denoted by M(B), M(G), and M(D) for Boom, Growth, and Downturn, respectively. (5 points) (B) Interpret the difference between M(B) and M(D). (5 points) (C) What is the level of the risk-free rate in this economy? (5 points) (D) Determine the risk-neutral probabilities of being in each state and compare them with the actual probabilities. Interpret the difference. (10 points) (E) Consider an asset that pays $70 in Boom, $50 in Growth, and $20 in Downturn. Compute the price the agent would be willing to pay for this asset. (5 points) (F) Compute the expected excess return of this asset and explain the sign. (5 points) (G) Now consider another asset that pays $10 in Downturn and 0 otherwise. Compute the expected excess return of this asset and explain the sign. (5 points) Problem 2 (40 points) Consider an economy with a representative agent with CRRA utility given by u(C) = with a coefficient of constant relative risk aversion equal to 2, and a subjective discount factor (preference for time) equal to 3= 0.95. Aggregate consumption, which is denoted by C, is equal to 10 today (t = 0). Next year (t = 1), the world can be in one of three possible states: Boom with a probability of 30%, Growth with a probability of 50%, or Downturn with a probability of 20%. Aggregate consumption will change by 10%, 5%, and -20% in these three states, respectively. 2 (A) Calculate the stochastic discount factor (SDF) for the three states of the economy at t = 1, denoted by M(B), M(G), and M(D) for Boom, Growth, and Downturn, respectively. (5 points) (B) Interpret the difference between M(B) and M(D). (5 points) (C) What is the level of the risk-free rate in this economy? (5 points) (D) Determine the risk-neutral probabilities of being in each state and compare them with the actual probabilities. Interpret the difference. (10 points) (E) Consider an asset that pays $70 in Boom, $50 in Growth, and $20 in Downturn. Compute the price the agent would be willing to pay for this asset. (5 points) (F) Compute the expected excess return of this asset and explain the sign. (5 points) (G) Now consider another asset that pays $10 in Downturn and 0 otherwise. Compute the expected excess return of this asset and explain the sign. (5 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started