Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly answer this as soon as possible: Do interpretation of the data given below in a very professional manner. Income from property. - (1)

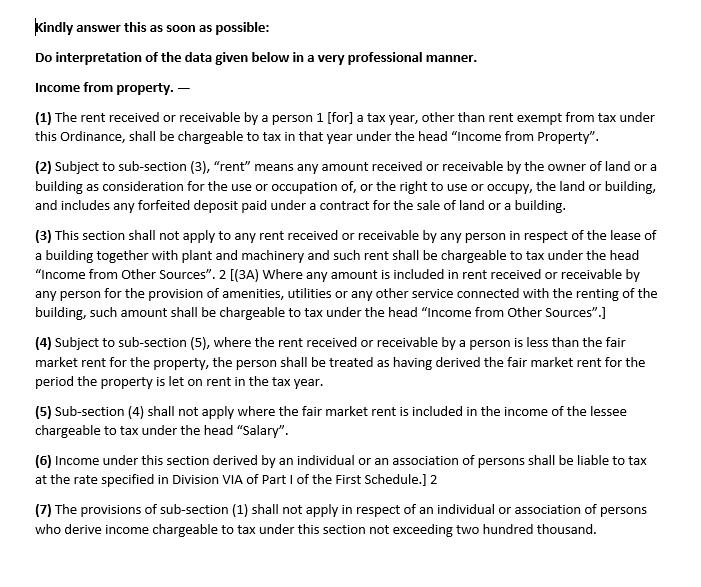

Kindly answer this as soon as possible: Do interpretation of the data given below in a very professional manner. Income from property. - (1) The rent received or receivable by a person 1 [for] a tax year, other than rent exempt from tax under this Ordinance, shall be chargeable to tax in that year under the head "Income from Property". (2) Subject to sub-section (3), "rent" means any amount received or receivable by the owner of land or a building as consideration for the use or occupation of, or the right to use or occupy, the land or building, and includes any forfeited deposit paid under a contract for the sale of land or a building. (3) This section shall not apply to any rent received or receivable by any person in respect of the lease of a building together with plant and machinery and such rent shall be chargeable to tax under the head "Income from Other Sources". 2 [(3A) Where any amount is included in rent received or receivable by any person for the provision of amenities, utilities or any other service connected with the renting of the building, such amount shall be chargeable to tax under the head "Income from Other Sources".] (4) Subject to sub-section (5), where the rent received or receivable by a person is less than the fair market rent for the property, the person shall be treated as having derived the fair market rent for the period the property is let on rent in the tax year. (5) Sub-section (4) shall not apply where the fair market rent is included in the income of the lessee chargeable to tax under the head "Salary". (6) Income under this section derived by an individual or an association of persons shall be liable to tax at the rate specified in Division VIA of Part I of the First Schedule.] 2 (7) The provisions of sub-section (1) shall not apply in respect of an individual or association of persons who derive income chargeable to tax under this section not exceeding two hundred thousand.

Step by Step Solution

★★★★★

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Brief Interpretation is as follows Any Amount recceived or receivable in a tax ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started