Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly help me with a and b P7-48. Analyzing Debt Terms, Yields, Prices, and Credit Ratings Reproduced below is the debt footnote from the May

kindly help me with a and b

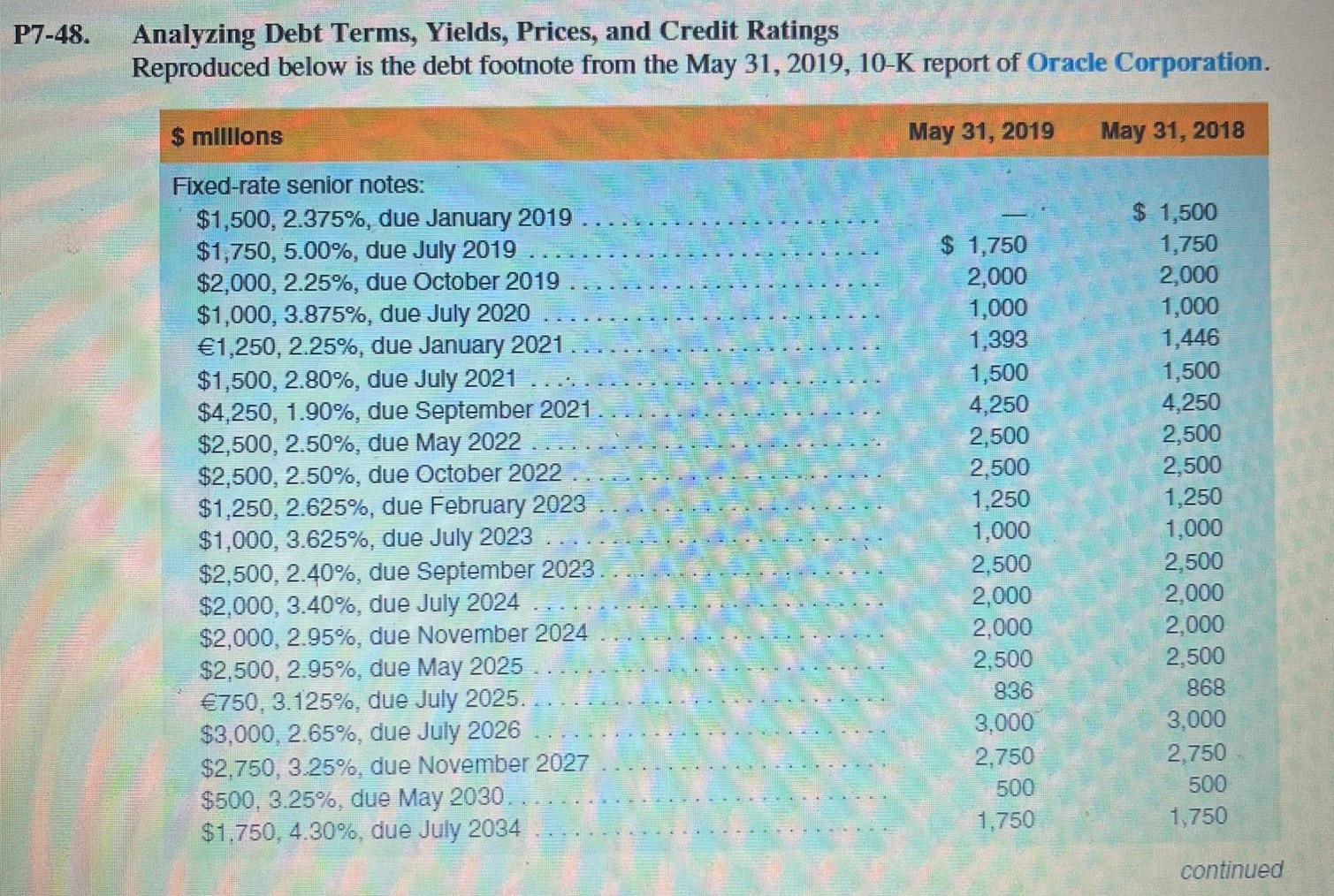

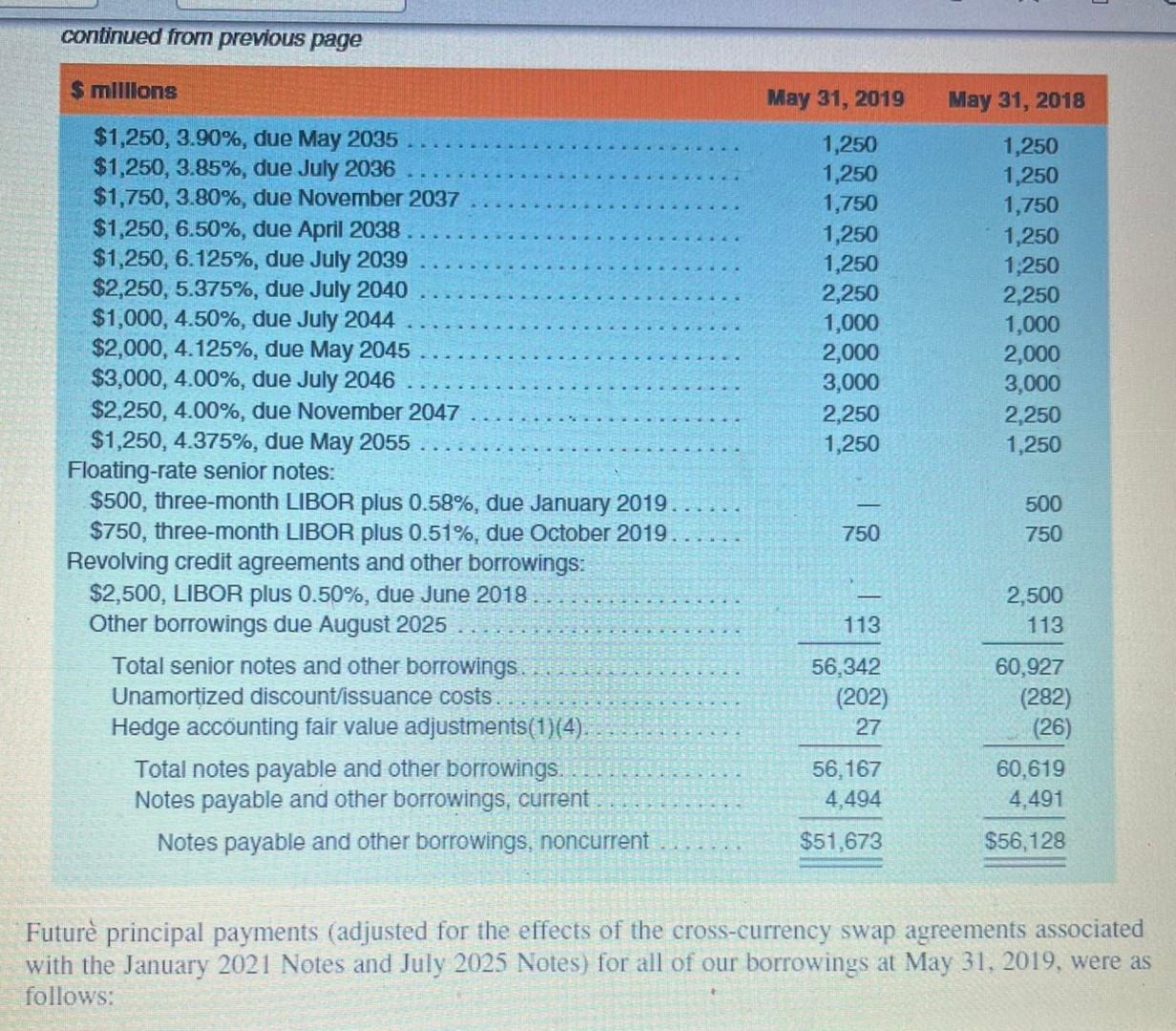

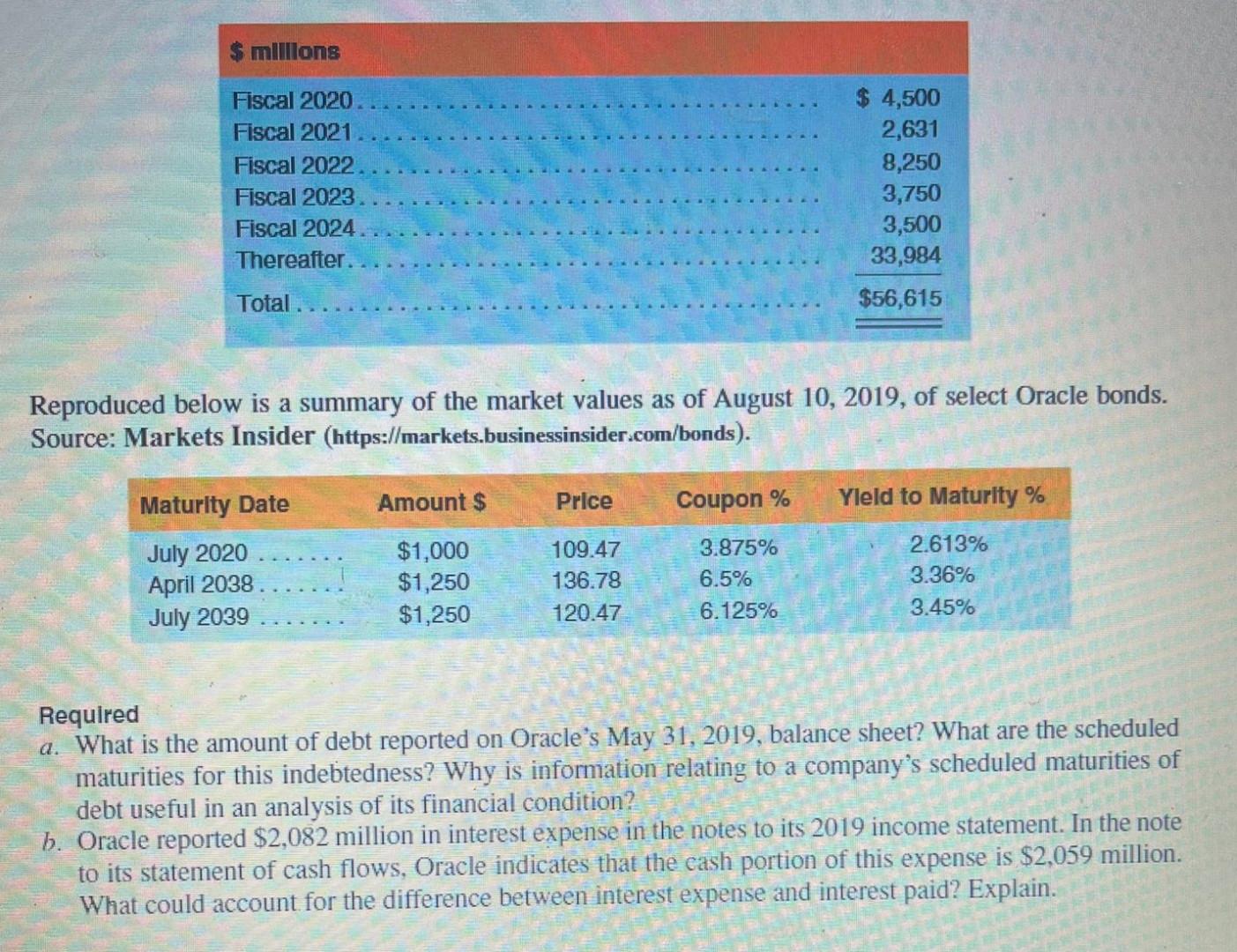

P7-48. Analyzing Debt Terms, Yields, Prices, and Credit Ratings Reproduced below is the debt footnote from the May 31, 2019, 10-K report of Oracle Corporation. $ millions May 31, 2019 May 31, 2018 Fixed-rate senior notes: $ 1,500 $1,750 1,750 2,000 2,000 1,000 1,000 $1,500, 2.375%, due January 2019 $1,750, 5.00%, due July 2019 $2,000, 2.25%, due October 2019 $1,000, 3.875%, due July 2020 1,250, 2.25%, due January 2021 $1,500, 2.80%, due July 2021 $4,250, 1.90%, due September 2021 $2,500, 2.50%, due May 2022 1,393 1,446 1,500 1,500 4,250 4,250 2,500 2,500 2,500 2,500 $2,500, 2.50%, due October 2022 $1,250, 2.625%, due February 2023 $1,000, 3.625%, due July 2023 1,250 1,250 1,000 1,000 2,500 2,500 $2,500, 2.40%, due September 2023 $2,000, 3.40%, due July 2024 2,000 2,000 $2,000, 2.95%, due November 2024 2,000 2,000 $2,500, 2.95%, due May 2025 2,500 2,500 750, 3.125%, due July 2025. 836 868 $3,000, 2.65%, due July 2026 3,000 3,000 $2,750, 3.25%, due November 2027 2,750 2,750 $500, 3.25%, due May 2030. 500 500 $1,750, 4.30%, due July 2034 1,750 1,750 continued continued from previous page $ millions $1,250, 3.90%, due May 2035 $1,250, 3.85%, due July 2036 $1,750, 3.80%, due November 2037 $1,250, 6.50%, due April 2038 $1,250, 6.125%, due July 2039 $2,250, 5.375%, due July 2040 $1,000, 4.50%, due July 2044 $2,000, 4.125%, due May 2045 $3,000, 4.00%, due July 2046 $2,250, 4.00%, due November 2047 $1,250, 4.375%, due May 2055 Floating-rate senior notes: $500, three-month LIBOR plus 0.58%, due January 2019. $750, three-month LIBOR plus 0.51%, due October 2019. Revolving credit agreements and other borrowings: $2,500, LIBOR plus 0.50%, due June 2018 Other borrowings due August 2025 (202) (282) 27 (26) Total senior notes and other borrowings. Unamortized discount/issuance costs. Hedge accounting fair value adjustments(1)(4). Total notes payable and other borrowings. Notes payable and other borrowings, current. Notes payable and other borrowings, noncurrent 56,167 60,619 4,494 4,491 $51,673 $56,128 Futur principal payments (adjusted for the effects of the cross-currency swap agreements associated with the January 2021 Notes and July 2025 Notes) for all of our borrowings at May 31, 2019, were as follows: May 31, 2019 1,250 1,250 1,750 1,250 1,250 2,250 1,000 2,000 3,000 2,250 1,250 750 113 56,342 May 31, 2018 1,250 1,250 1,750 1,250 1,250 2,250 1,000 2,000 3,000 2,250 1,250 500 750 2,500 113 60,927 $ millions Fiscal 2020. $ 4,500 Fiscal 2021 2,631 Fiscal 2022 8,250 Fiscal 2023 3,750 Fiscal 2024 3,500 Thereafter. 33,984 Total $56,615 Reproduced below is a summary of the market values as of August 10, 2019, of select Oracle bonds. Source: Markets Insider (https://markets.businessinsider.com/bonds). Maturity Date Amount $ Price Coupon % Yleld to Maturity % July 2020 $1,000 109.47 3.875% 2.613% April 2038 $1,250 136.78 6.5% 3.36% July 2039 $1,250 120.47 6.125% 3.45% Required a. What is the amount of debt reported on Oracle's May 31, 2019, balance sheet? What are the scheduled maturities for this indebtedness? Why is information relating to a company's scheduled maturities of debt useful in an analysis of its financial condition? b. Oracle reported $2,082 million in interest expense in the notes to its 2019 income statement. In the note to its statement of cash flows, Oracle indicates that the cash portion of this expense is $2,059 million. What could account for the difference between interest expense and interest paid? ExplainStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started