Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly help very very Urgent... transcribe image cant be sent.. important please help ASAP VERY IMPORTANT IMMEDIATE RESPONSE NEEDED PLEASE 1. Compute the Value-at-Risk (VaR)

kindly help very very Urgent... transcribe image cant be sent.. important please help ASAP VERY IMPORTANT IMMEDIATE RESPONSE NEEDED PLEASE

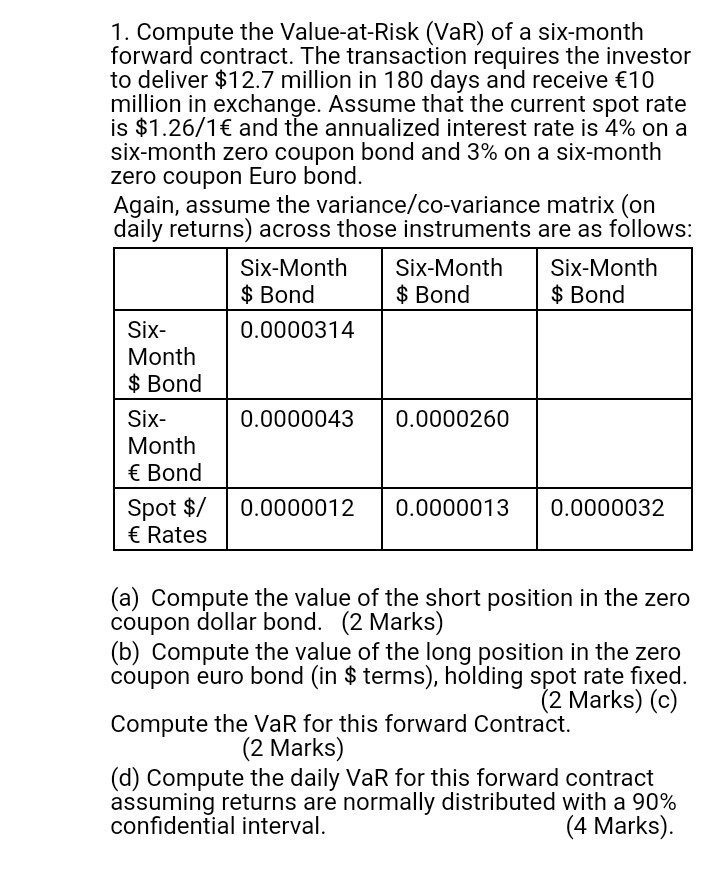

1. Compute the Value-at-Risk (VaR) of a six-month forward contract. The transaction requires the investor to deliver $12.7 million in 180 days and receive 10 million in exchange. Assume that the current spot rate is $1.26/1 and the annualized interest rate is 4% on a six-month zero coupon bond and 3% on a six-month zero coupon Euro bond. Again, assume the variance/co-variance matrix (on daily returns) across those instruments are as follows: Six-Month Six-Month Six-Month $ Bond $ Bond $ Bond Six- 0.0000314 Month $ Bond Six 0.0000043 0.0000260 Month Bond Spot $/ 0.0000012 0.0000013 0.0000032 Rates (a) Compute the value of the short position in the zero coupon dollar bond. (2 Marks) (b) Compute the value of the long position in the zero coupon euro bond (in $ terms), holding spot rate fixed. (2 Marks) (c) Compute the VaR for this forward Contract. (2 Marks) (d) Compute the daily VaR for this forward contract assuming returns are normally distributed with a 90% confidential interval. (4 Marks). 1. Compute the Value-at-Risk (VaR) of a six-month forward contract. The transaction requires the investor to deliver $12.7 million in 180 days and receive 10 million in exchange. Assume that the current spot rate is $1.26/1 and the annualized interest rate is 4% on a six-month zero coupon bond and 3% on a six-month zero coupon Euro bond. Again, assume the variance/co-variance matrix (on daily returns) across those instruments are as follows: Six-Month Six-Month Six-Month $ Bond $ Bond $ Bond Six- 0.0000314 Month $ Bond Six 0.0000043 0.0000260 Month Bond Spot $/ 0.0000012 0.0000013 0.0000032 Rates (a) Compute the value of the short position in the zero coupon dollar bond. (2 Marks) (b) Compute the value of the long position in the zero coupon euro bond (in $ terms), holding spot rate fixed. (2 Marks) (c) Compute the VaR for this forward Contract. (2 Marks) (d) Compute the daily VaR for this forward contract assuming returns are normally distributed with a 90% confidential interval. (4 Marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started