Answered step by step

Verified Expert Solution

Question

1 Approved Answer

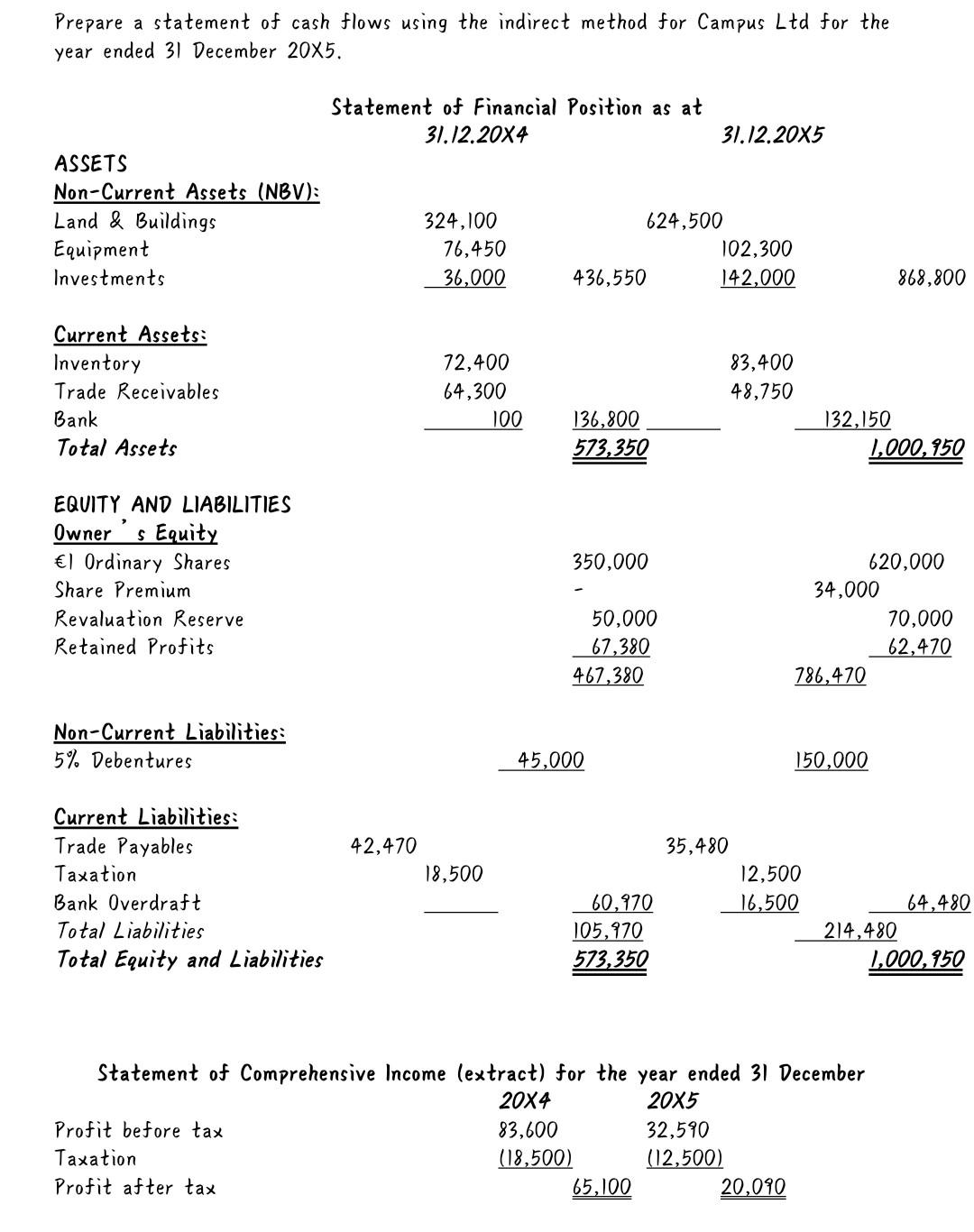

kindly provide me the solutions to this cashflow statement. Prepare a statement of cash flows using the indirect method for Campus Ltd for the year

kindly provide me the solutions to this cashflow statement.

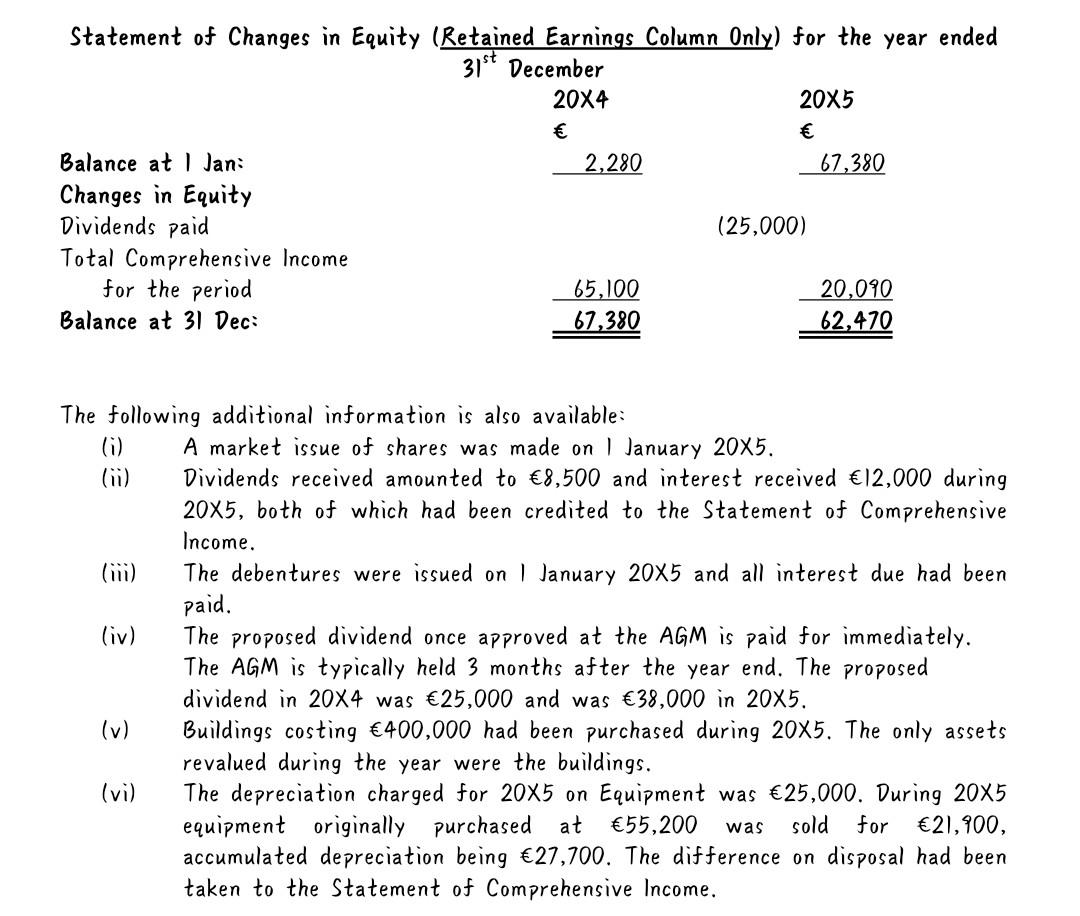

Prepare a statement of cash flows using the indirect method for Campus Ltd for the year ended 31 December 20X5. Statement of Financial Position as at 31.12.20X4 31.12.20X5 ASSETS Non-Current Assets (NBV): Land & Buildings 324,100 624,500 Equipment 76,450 102,300 Investments 36,000 436,550 142,000 868,800 Current Assets: Inventory Trade Receivables Bank Total Assets 72,400 64,300 100 83,400 48,750 136,800 573,350 132,150 1,000,950 350,000 EQUITY AND LIABILITIES Owner s Equity ) Ordinary Shares Share Premium Revaluation Reserve Retained Profits 50,000 67,380 467,380 620,000 34,000 70,000 62,470 786,470 Non-Current Liabilities: 5% Debentures 45,000 150,000 42,470 18,500 Current Liabilities: Trade Payables Taxation Bank Overdraft Total Liabilities Total Equity and Liabilities 35,480 12,500 16,500 60,970 105,970 573,350 64,480 214,480 1,000,950 Statement of Comprehensive Income (extract) for the year ended 31 December 20X4 20X5 Profit before tax 83,600 32,590 Taxation (18,500) (12,500) Profit after tax 65,100 20,090 Statement of Changes in Equity (Retained Earnings Column Only) for the year ended 31st December 20X4 20X5 2,280 67,380 (25,000) Balance at ! Jan: Changes in Equity Dividends paid Total Comprehensive Income for the period Balance at 31 Dec: 65,100 67,380 20,090 62,470 The following additional information is also available: (0) A market issue of shares was made on January 20X5. Dividends received amounted to 8,500 and interest received 12,000 during 20X5, both of which had been credited to the Statement of Comprehensive Income. The debentures were issued on 1 January 20X5 and all interest due had been paid. (iv) The proposed dividend once approved at the AGM is paid for immediately. The AGM is typically held 3 months after the year end. The proposed dividend in 20X4 was 25,000 and was 38,000 in 20X5. (v) Buildings costing 400,000 had been purchased during 20X5. The only assets revalued during the year were the buildings. (vi) The depreciation charged for 20x5 on Equipment was 25,000. During 20X5 equipment originally purchased at 55,200 sold for 21,900, accumulated depreciation being 27,700. The difference on disposal had been taken to the Statement of Comprehensive Income. wasStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started