kindly show computations

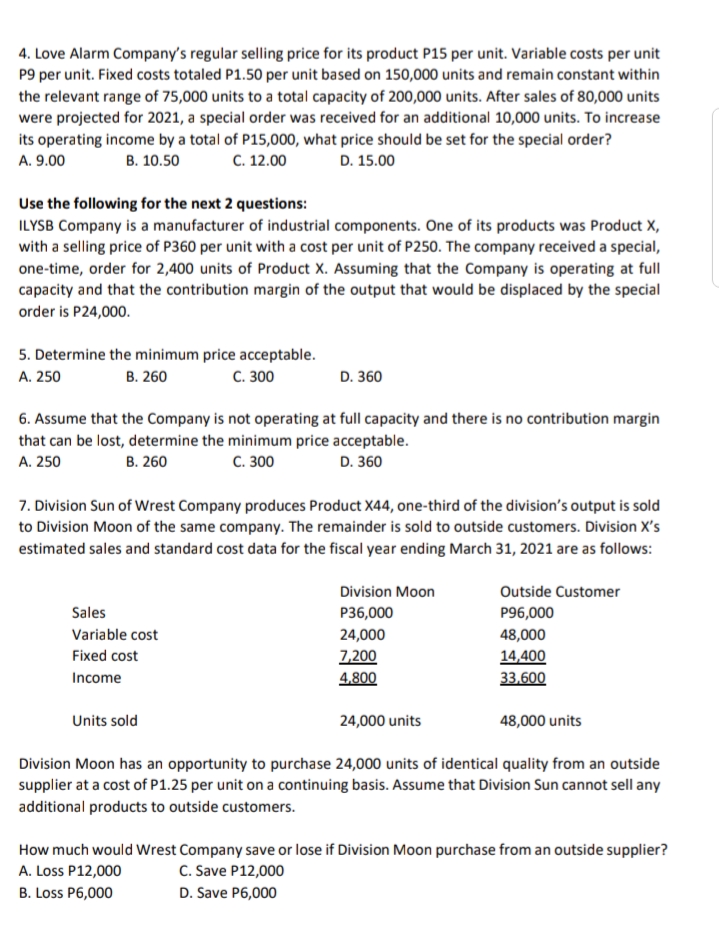

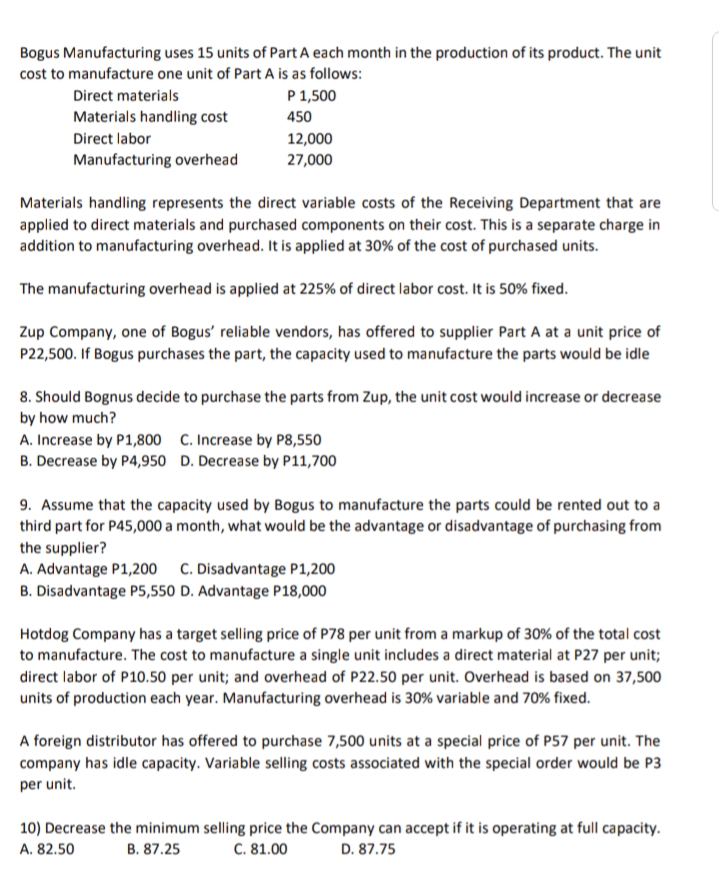

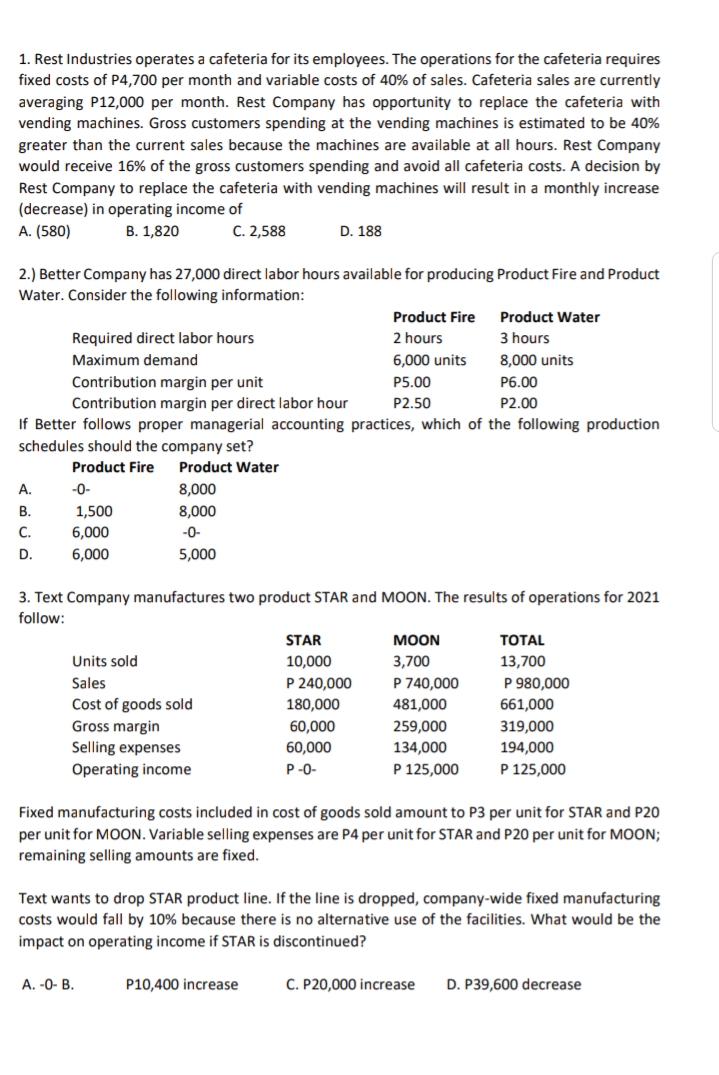

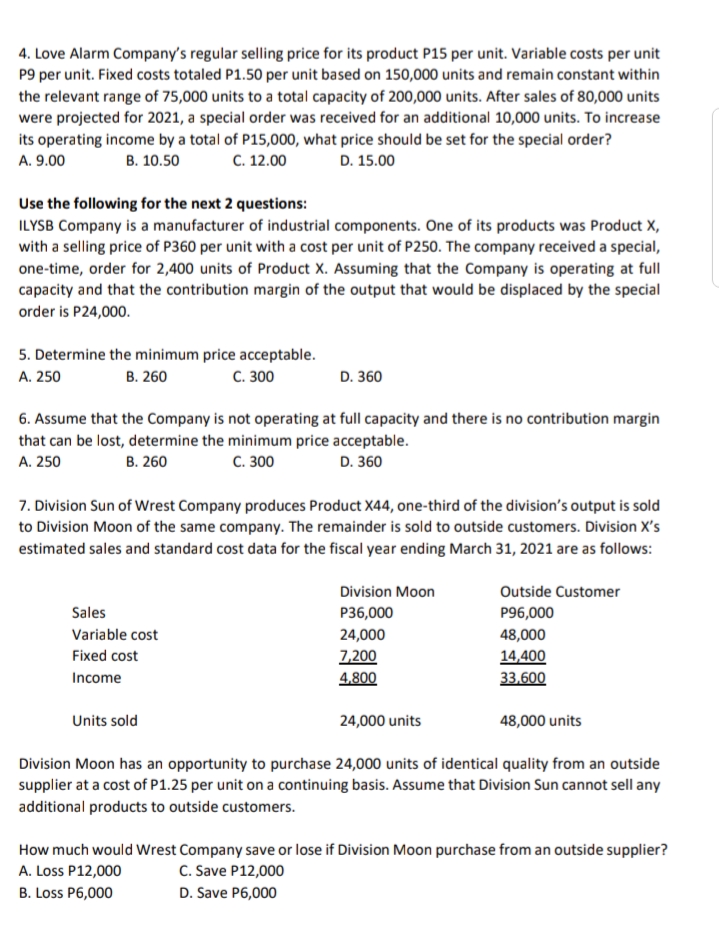

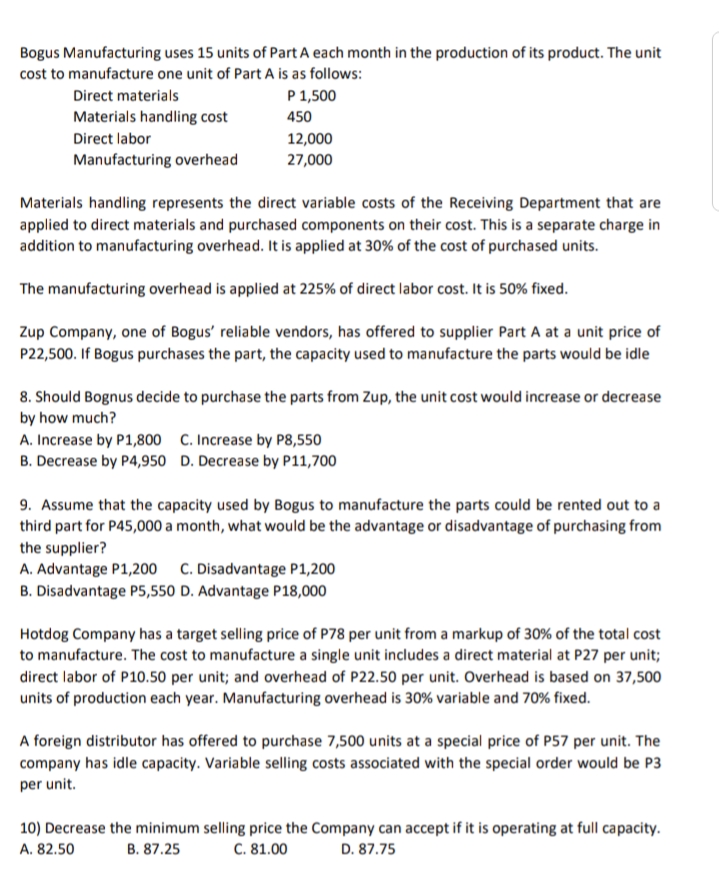

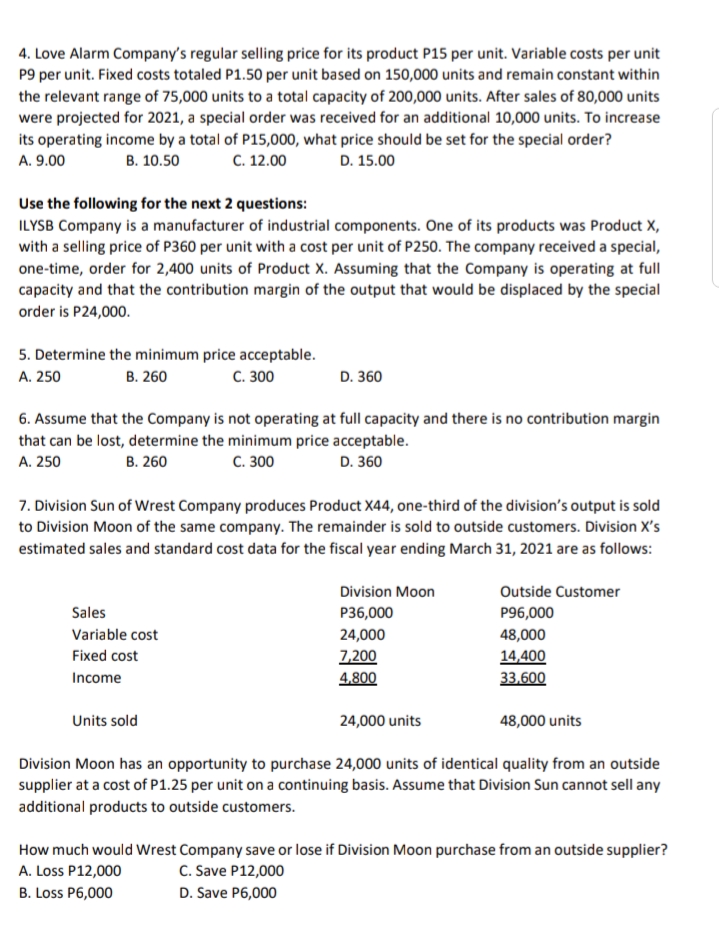

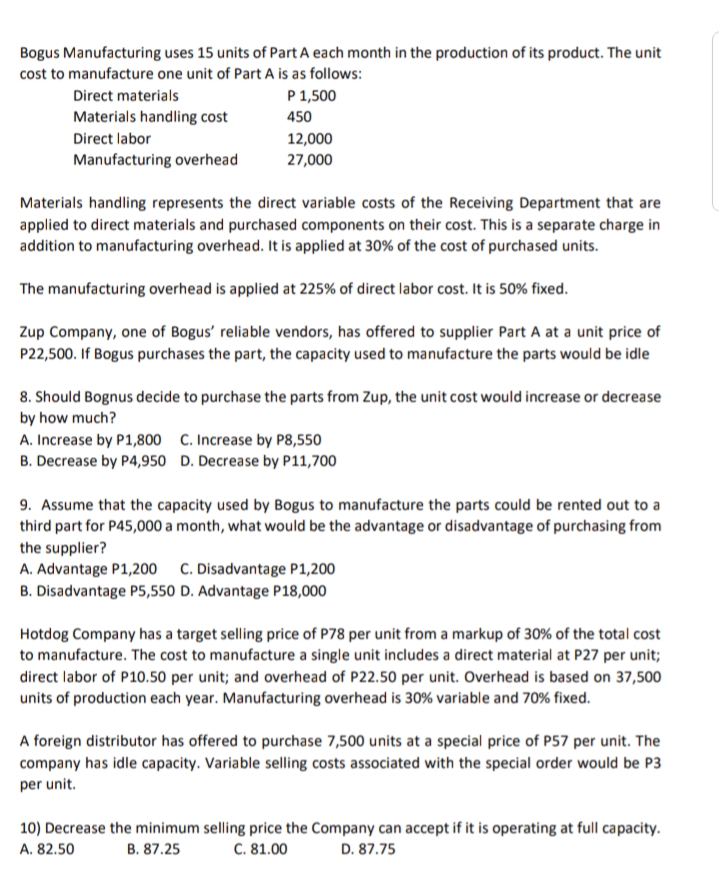

1. Rest Industries operates a cafeteria for its employees. The operations for the cafeteria requires fixed costs of P4,700 per month and variable costs of 40% of sales. Cafeteria sales are currently averaging P12,000 per month. Rest Company has opportunity to replace the cafeteria with vending machines. Gross customers spending at the vending machines is estimated to be 40% greater than the current sales because the machines are available at all hours. Rest Company would receive 16% of the gross customers spending and avoid all cafeteria costs. A decision by Rest Company to replace the cafeteria with vending machines will result in a monthly increase (decrease) in operating income of A. (580) B. 1,820 C. 2,588 D. 188 2.) Better Company has 27,000 direct labor hours available for producing Product Fire and Product Water. Consider the following information: Product Fire Product Water Required direct labor hours 2 hours 3 hours Maximum demand 6,000 units 8,000 units Contribution margin per unit P5.00 P6.00 Contribution margin per direct labor hour P2.50 P2.00 If Better follows proper managerial accounting practices, which of the following production schedules should the company set? Product Fire Product Water A. -0- 8,000 B. 1,500 8,000 C. 6,000 -0- D 6,000 5,000 3. Text Company manufactures two product STAR and MOON. The results of operations for 2021 follow: STAR MOON TOTAL Units sold 10,000 3,700 13,700 Sales P 240,000 P 740,000 P 980,000 Cost of goods sold 180,000 481,000 661,000 Gross margin 60,000 259,000 319,000 Selling expenses 60,000 134,000 194,000 Operating income P -0- P 125,000 P 125,000 Fixed manufacturing costs included in cost of goods sold amount to P3 per unit for STAR and P20 per unit for MOON. Variable selling expenses are P4 per unit for STAR and P20 per unit for MOON; remaining selling amounts are fixed. Text wants to drop STAR product line. If the line is dropped, company-wide fixed manufacturing costs would fall by 10% because there is no alternative use of the facilities. What would be the impact on operating income if STAR is discontinued? A. - 0- B. P10,400 increase C. P20,000 increase D. P39,600 decrease4. Love Alarm Company's regular selling price for its product P15 per unit. Variable costs per unit P9 per unit. Fixed costs totaled P1.50 per unit based on 150,000 units and remain constant within the relevant range of 75,000 units to a total capacity of 200,000 units. After sales of 80,000 units were projected for 2021, a special order was received for an additional 10,000 units. To increase its operating income by a total of P15,000, what price should be set for the special order? A. 9.00 B. 10.50 C. 12.00 D. 15.00 Use the following for the next 2 questions: ILYSB Company is a manufacturer of industrial components. One of its products was Product X, with a selling price of P360 per unit with a cost per unit of P250. The company received a special, one-time, order for 2,400 units of Product X. Assuming that the Company is operating at full capacity and that the contribution margin of the output that would be displaced by the special order is P24,000. 5. Determine the minimum price acceptable. A. 250 B. 260 C. 300 D. 360 6. Assume that the Company is not operating at full capacity and there is no contribution margin that can be lost, determine the minimum price acceptable. A. 250 B. 260 C. 300 D. 360 7. Division Sun of Wrest Company produces Product X44, one-third of the division's output is sold to Division Moon of the same company. The remainder is sold to outside customers. Division X's estimated sales and standard cost data for the fiscal year ending March 31, 2021 are as follows: Division Moon Outside Customer Sales P36,000 P96,000 Variable cost 24,000 48,000 Fixed cost 7,200 14,400 Income 4,800 33,600 Units sold 24,000 units 48,000 units Division Moon has an opportunity to purchase 24,000 units of identical quality from an outside supplier at a cost of P1.25 per unit on a continuing basis. Assume that Division Sun cannot sell any additional products to outside customers. How much would Wrest Company save or lose if Division Moon purchase from an outside supplier? A. Loss P12,000 C. Save P12,000 B. Loss P6,000 D. Save P6,000Bogus Manufacturing uses 15 units of Part A each month in the production of its product. The unit cost to manufacture one unit of Part A is as follows: Direct materials P 1,500 Materials handling cost 450 Direct labor 12,000 Manufacturing overhead 27,000 Materials handling represents the direct variable costs of the Receiving Department that are applied to direct materials and purchased components on their cost. This is a separate charge in addition to manufacturing overhead. It is applied at 30% of the cost of purchased units. The manufacturing overhead is applied at 225% of direct labor cost. It is 50% fixed. Zup Company, one of Bogus' reliable vendors, has offered to supplier Part A at a unit price of P22,500. If Bogus purchases the part, the capacity used to manufacture the parts would be idle 8. Should Bognus decide to purchase the parts from Zup, the unit cost would increase or decrease by how much? A. Increase by P1,800 C. Increase by P8,550 B. Decrease by P4,950 D. Decrease by P11,700 9. Assume that the capacity used by Bogus to manufacture the parts could be rented out to a third part for P45,000 a month, what would be the advantage or disadvantage of purchasing from the supplier? A. Advantage P1,200 C. Disadvantage P1,200 B. Disadvantage P5,550 D. Advantage P18,000 Hotdog Company has a target selling price of P78 per unit from a markup of 30% of the total cost to manufacture. The cost to manufacture a single unit includes a direct material at P27 per unit; direct labor of P10.50 per unit; and overhead of P22.50 per unit. Overhead is based on 37,500 units of production each year. Manufacturing overhead is 30% variable and 70% fixed. A foreign distributor has offered to purchase 7,500 units at a special price of P57 per unit. The company has idle capacity. Variable selling costs associated with the special order would be P3 per unit. 10) Decrease the minimum selling price the Company can accept if it is operating at full capacity. A. 82.50 B. 87.25 C. 81.00 D. 87.75