Answered step by step

Verified Expert Solution

Question

1 Approved Answer

kindly show working thanks ID o LTE + 35% 9:29 Done 3 50 Question 3 Sharon Company is a subsidiary of DABO, a popular soap

kindly show working thanks

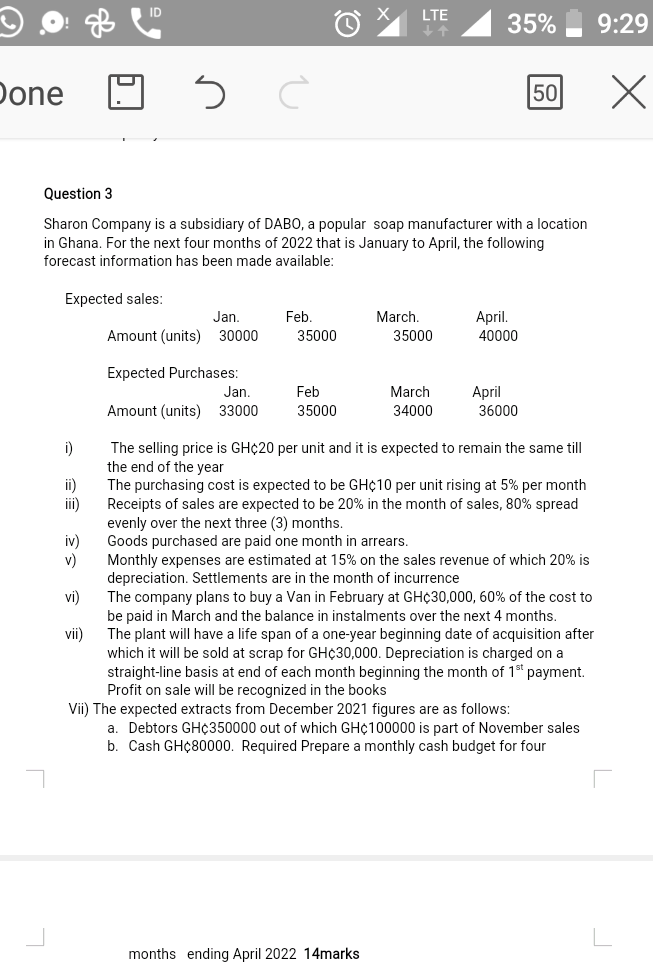

ID o LTE + 35% 9:29 Done 3 50 Question 3 Sharon Company is a subsidiary of DABO, a popular soap manufacturer with a location in Ghana. For the next four months of 2022 that is January to April, the following forecast information has been made available: Expected sales: Amount (units) Jan. 30000 Feb. 35000 March 35000 April. 40000 Expected Purchases: Jan. Amount (units) 33000 Feb 35000 March 34000 April 36000 i) The selling price is GH20 per unit and it is expected to remain the same till the end of the year ii) The purchasing cost is expected to be GH10 per unit rising at 5% per month Receipts of sales are expected to be 20% in the month of sales, 80% spread evenly over the next three (3) months. iv) Goods purchased are paid one month in arrears. Monthly expenses are estimated at 15% on the sales revenue of which 20% is depreciation. Settlements are in the month of incurrence vi) The company plans to buy a Van in February at GH30,000,60% of the cost to be paid in March and the balance in instalments over the next 4 months. vii) The plant will have a life span of a one-year beginning date of acquisition after which it will be sold at scrap for GH30,000. Depreciation is charged on a straight-line basis at end of each month beginning the month of 1st payment. Profit on sale will be recognized in the books Vii) The expected extracts from December 2021 figures are as follows: a. Debtors GH350000 out of which GH100000 is part of November sales b. Cash GH80000. Required Prepare a monthly cash budget for four months ending April 2022 14marksStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started