Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kindly show workings on Paper. Question 7 [12 marks] PearMQ is a major mobile phone manufacturer which has recently releases its new product, PearPhone PS.

Kindly show workings on Paper.

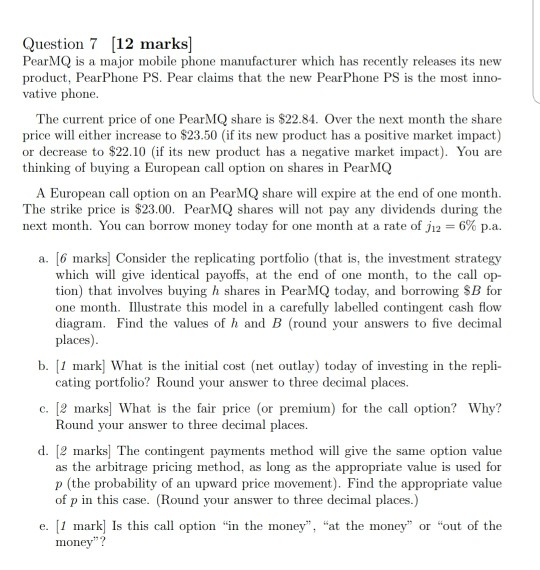

Question 7 [12 marks] PearMQ is a major mobile phone manufacturer which has recently releases its new product, PearPhone PS. Pear claims that the new PearPhone PS is the most inno- vative phone. The current price of one PearMQ share is $22.84. Over the next month the share price will either increase to $23.50 (if its new product has a positive market impact) or decrease to $22.10 (if its new product has a negative market impact). You are thinking of buying a European call option on shares in PearMQ A European call option on an PearMQ share will expire at the end of one month. The strike price is $23.00. PearMQ shares will not pay any dividends during the next month. You can borrow money today for one month at a rate of j12 = 6% p.a. a. [6 marks] Consider the replicating portfolio (that is, the investment strategy which will give identical payoffs, at the end of one month, to the call op- tion) that involves buying h shares in PearMQ today, and borrowing $B for one month. Illustrate this model in a carefully labelled contingent cash flow diagram. Find the values of h and B (round your answers to five decimal places). b. [1 mark] What is the initial cost (net outlay) today of investing in the repli- cating portfolio? Round your answer to three decimal places. c. [2 marks] What is the fair price (or premium) for the call option? Why? Round your answer to three decimal places. d. [2 marks] The contingent payments method will give the same option value as the arbitrage pricing method, as long as the appropriate value is used for p (the probability of an upward price movement). Find the appropriate value of p in this case. (Round your answer to three decimal places.) e. [1 mark] Is this call option "in the money", "at the money" or "out of the money"? Question 7 [12 marks] PearMQ is a major mobile phone manufacturer which has recently releases its new product, PearPhone PS. Pear claims that the new PearPhone PS is the most inno- vative phone. The current price of one PearMQ share is $22.84. Over the next month the share price will either increase to $23.50 (if its new product has a positive market impact) or decrease to $22.10 (if its new product has a negative market impact). You are thinking of buying a European call option on shares in PearMQ A European call option on an PearMQ share will expire at the end of one month. The strike price is $23.00. PearMQ shares will not pay any dividends during the next month. You can borrow money today for one month at a rate of j12 = 6% p.a. a. [6 marks] Consider the replicating portfolio (that is, the investment strategy which will give identical payoffs, at the end of one month, to the call op- tion) that involves buying h shares in PearMQ today, and borrowing $B for one month. Illustrate this model in a carefully labelled contingent cash flow diagram. Find the values of h and B (round your answers to five decimal places). b. [1 mark] What is the initial cost (net outlay) today of investing in the repli- cating portfolio? Round your answer to three decimal places. c. [2 marks] What is the fair price (or premium) for the call option? Why? Round your answer to three decimal places. d. [2 marks] The contingent payments method will give the same option value as the arbitrage pricing method, as long as the appropriate value is used for p (the probability of an upward price movement). Find the appropriate value of p in this case. (Round your answer to three decimal places.) e. [1 mark] Is this call option "in the money", "at the money" or "out of the moneyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started