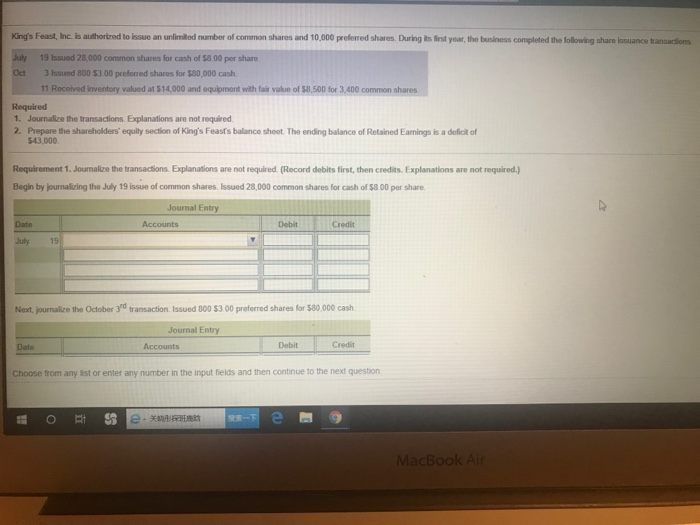

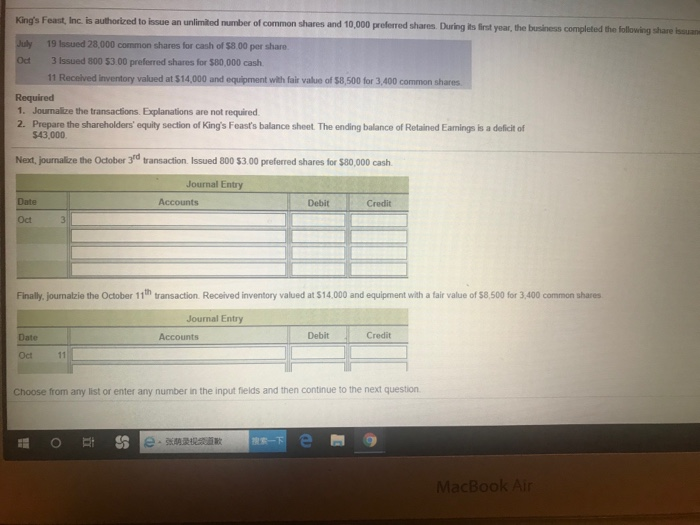

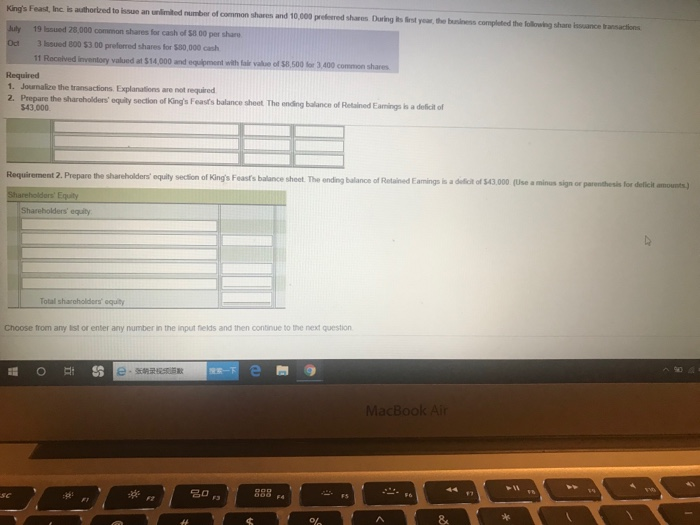

King's Feast, Inc. is authorized to issue an unlimited number common shares and 10,000 preferred shares. During its first year, the business completed the following share issuance transactions July 19 Issued 28,000 common shares for cash of $8.00 per share Od 3 Issued 800 53 00 preferred shares for $80,000 cash 11 Received inventory valued at $14,000 and equipment with fair value of $8,500 for 3,400 common shares Required 1. Journalize the transactions. Explanations are not required. 2. Prepare the shareholders' equity section of King's Feast's balance sheet. The ending balance of Retained Earnings is a deficit of $43.000 Requirement 1. Journalize the transactions. Explanations are not required. (Record debits first, then credits. Explanations are not required.) Begin by journalizing the July 19 issue of common shares. Issued 28,000 common shares for cash of 58 00 per share Journal Entry Accounts Date Debit Credit 19 Next, journalize the October 30 transaction. Issued 800 53.00 preferred shares for $80.000 cash Journal Entry Accounts Date Debit Credit Choose from any list or enter any number in the input fields and then continue to the next question MacBook Air King's Feast, Inc. is authorized to issue an unlimited number of common shares and 10,000 preferred share. During its first year, the business completed the following share issuan July Od 19 Issued 28,000 common shares for cash of $8.00 per share 3 Issued 800 53.00 preferred shares for $80,000 cash 11 Received Inventory valued at $14,000 and equipment with fair value of 58,500 for 3,400 common shares Required 1. Journalize the transactions. Explanations are not required. 2. Prepare the shareholders' equity section of King's Feast's balance sheet. The ending balance of Retained Earnings is a deficit of $43,000 Next, journalize the October 3rd transaction. Issued 800 53.00 preferred shares for $80,000 cash Journal Entry Date Accounts Debit Credit Oct 3 Finally, journalzie the October 11th transaction. Received inventory valued at $14,000 and equipment with a fair value of $8,500 for 3,400 common shares Journal Entry Accounts Date Debit Credit Oct 11 Choose from any list or enter any number in the input fields and then continue to the next question BE SS MacBook Air foto King's Feast, Inc. is authorized to issue an unlimited number of common shares and 10.000 preferred shares Dorings you the business completed the following share ancesactions 19 Issued 28,000 common shares for cash of 5800 per share Od 3 Issued 800 53 00 preferred shares for $80,000 cash 11 Received inventory valued at $14,000 and equipment with fale vase of $8.500 for 3.400 common shares Required 1. Journalize the transactions. Explanations are not required 2. Prepare the shareholders' equily section of King's Feast's balance sheet The ending balance of Retained Earnings is a delicit of $43.000 Requirement 2. Prepare the shareholders' equity section of King's Feasts balance sheet. The ending balance of Retained Eamings is a delict of 543.000 (Use a minus sign or parenthesis for deficit amounts) Shareholders' Equity Shareholders' equily Total shareholders' equity Choose from any list or enter any number in the input fields and then continue to the next question BI e E MacBook Air BO 4