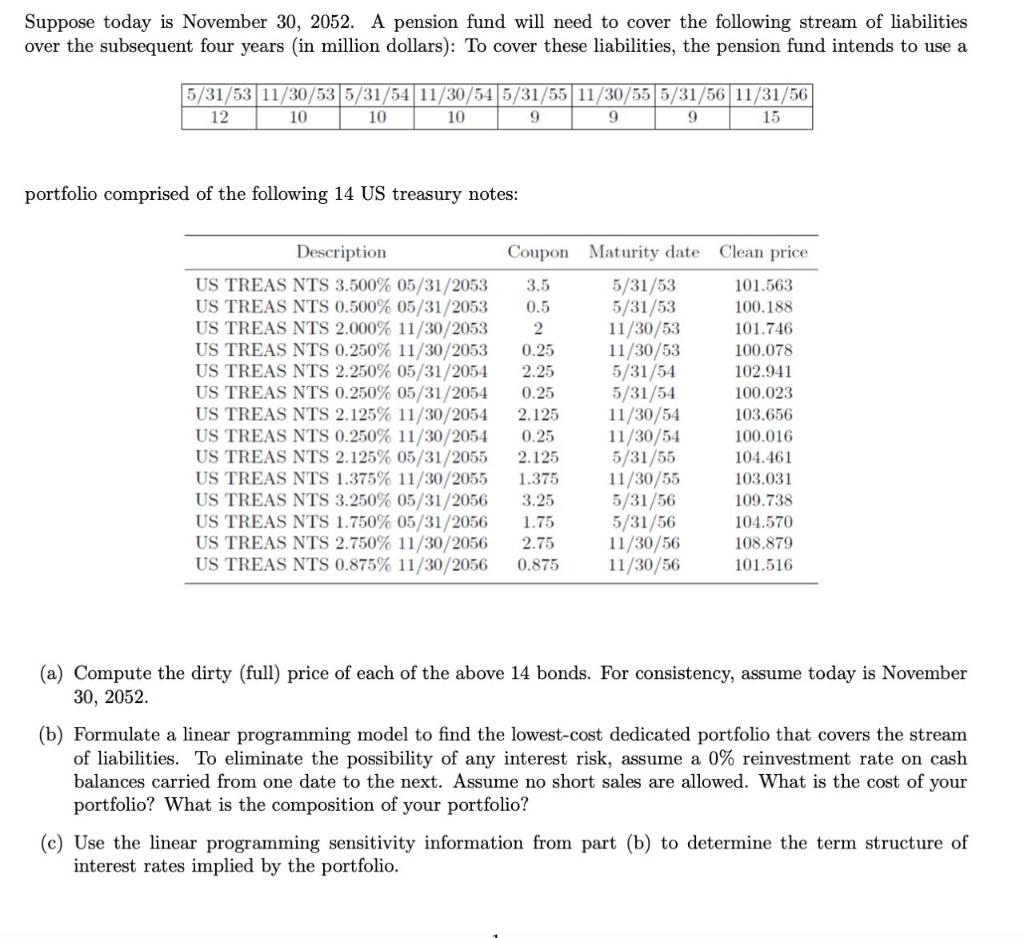

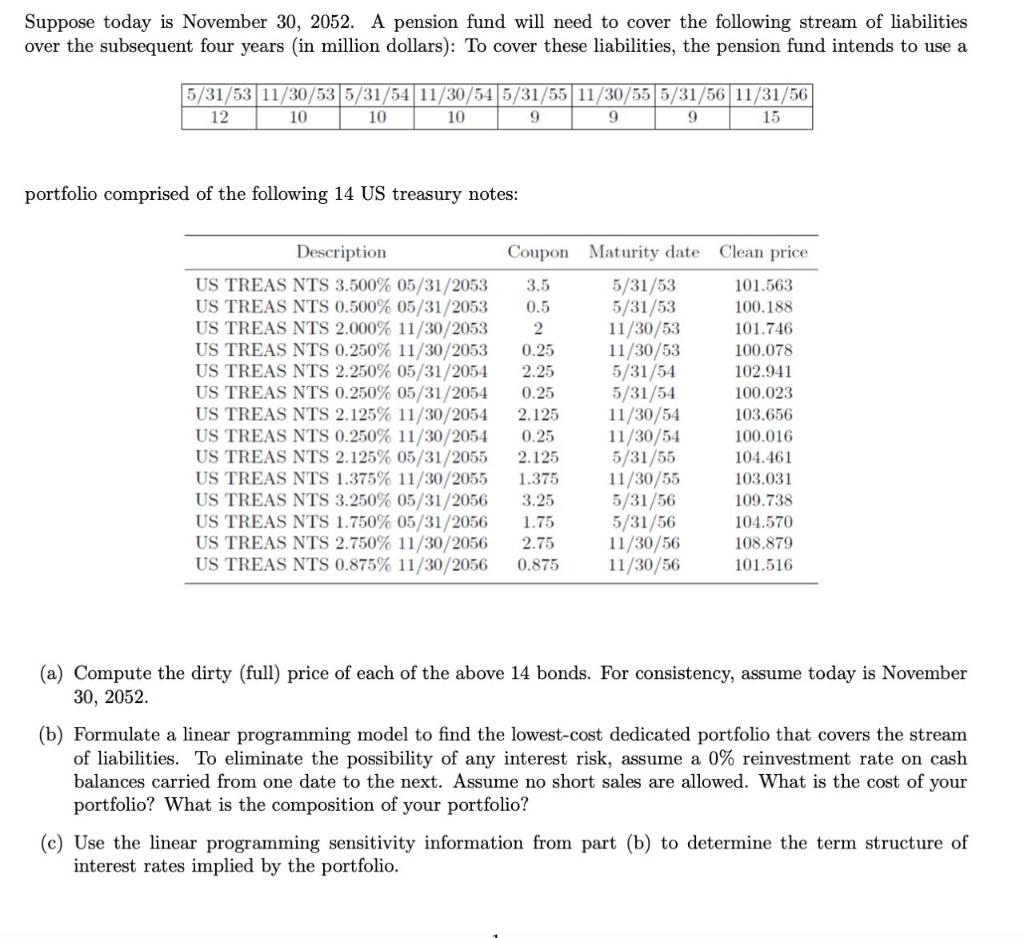

Suppose today is November 30, 2052. A pension fund will need to cover the following stream of liabilities over the subsequent four years in million dollars): To cover these liabilities, the pension fund intends to use a 5/31/53 11/30/53 5/31/54 11/30/54 5/31/55 11/30/55 5/31/56 11/31/56 12 10 10 10 9 9 9 15 portfolio comprised of the following 14 US treasury notes: Description US TREAS NTS 3.500% 05/31/2053 US TREAS NTS 0.500% 05/31/2053 US TREAS NTS 2.000% 11/30/2053 US TREAS NTS 0.250% 11/30/2053 US TREAS NTS 2.250% 05/31/2054 US TREAS NTS 0.250% 05/31/2054 US TREAS NTS 2.125% 11/30/2054 US TREAS NTS 0.250% 11/30/2054 US TREAS NTS 2.125% 05/31/2055 US TREAS NTS 1.375% 11/30/2055 US TREAS NTS 3.250% 05/31/2056 US TREAS NTS 1.750% 05/31/2056 US TREAS NTS 2.750% 11/30/2056 US TREAS NTS 0.875% 11/30/2056 Coupon Maturity date Clean price 3.5 5/31/53 101.563 0.5 5/31/53 100.188 2 11/30/53 101.746 0.25 11/30/53 100.078 2.25 5/31/54 102.941 0.25 5/31/54 100.023 2.125 11/30/54 103.656 0.25 11/30/54 100.016 2.125 5/31/55 104.461 1.375 11/30/55 103.031 3.25 5/31/56 109.738 1.75 5/31/56 104.570 2.75 11/30/56 108.879 0.875 11/30/56 101.516 (a) Compute the dirty (full) price of each of the above 14 bonds. For consistency, assume today is November 30, 2052. (b) Formulate a linear programming model to find the lowest-cost dedicated portfolio that covers the stream of liabilities. To eliminate the possibility of any interest risk, assume a 0% reinvestment rate on cash balances carried from one date to the next. Assume no short sales are allowed. What is the cost of your portfolio? What is the composition of your portfolio? (c) Use the linear programming sensitivity information from part (b) to determine the term structure of interest rates implied by the portfolio. Suppose today is November 30, 2052. A pension fund will need to cover the following stream of liabilities over the subsequent four years in million dollars): To cover these liabilities, the pension fund intends to use a 5/31/53 11/30/53 5/31/54 11/30/54 5/31/55 11/30/55 5/31/56 11/31/56 12 10 10 10 9 9 9 15 portfolio comprised of the following 14 US treasury notes: Description US TREAS NTS 3.500% 05/31/2053 US TREAS NTS 0.500% 05/31/2053 US TREAS NTS 2.000% 11/30/2053 US TREAS NTS 0.250% 11/30/2053 US TREAS NTS 2.250% 05/31/2054 US TREAS NTS 0.250% 05/31/2054 US TREAS NTS 2.125% 11/30/2054 US TREAS NTS 0.250% 11/30/2054 US TREAS NTS 2.125% 05/31/2055 US TREAS NTS 1.375% 11/30/2055 US TREAS NTS 3.250% 05/31/2056 US TREAS NTS 1.750% 05/31/2056 US TREAS NTS 2.750% 11/30/2056 US TREAS NTS 0.875% 11/30/2056 Coupon Maturity date Clean price 3.5 5/31/53 101.563 0.5 5/31/53 100.188 2 11/30/53 101.746 0.25 11/30/53 100.078 2.25 5/31/54 102.941 0.25 5/31/54 100.023 2.125 11/30/54 103.656 0.25 11/30/54 100.016 2.125 5/31/55 104.461 1.375 11/30/55 103.031 3.25 5/31/56 109.738 1.75 5/31/56 104.570 2.75 11/30/56 108.879 0.875 11/30/56 101.516 (a) Compute the dirty (full) price of each of the above 14 bonds. For consistency, assume today is November 30, 2052. (b) Formulate a linear programming model to find the lowest-cost dedicated portfolio that covers the stream of liabilities. To eliminate the possibility of any interest risk, assume a 0% reinvestment rate on cash balances carried from one date to the next. Assume no short sales are allowed. What is the cost of your portfolio? What is the composition of your portfolio? (c) Use the linear programming sensitivity information from part (b) to determine the term structure of interest rates implied by the portfolio