Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Kinsman, a retailer provides the following data for 2012 and 2013. Budgeted sales for 2013 are $.1,200.000; sales for 2012 were $1,100,000. Cash sales average

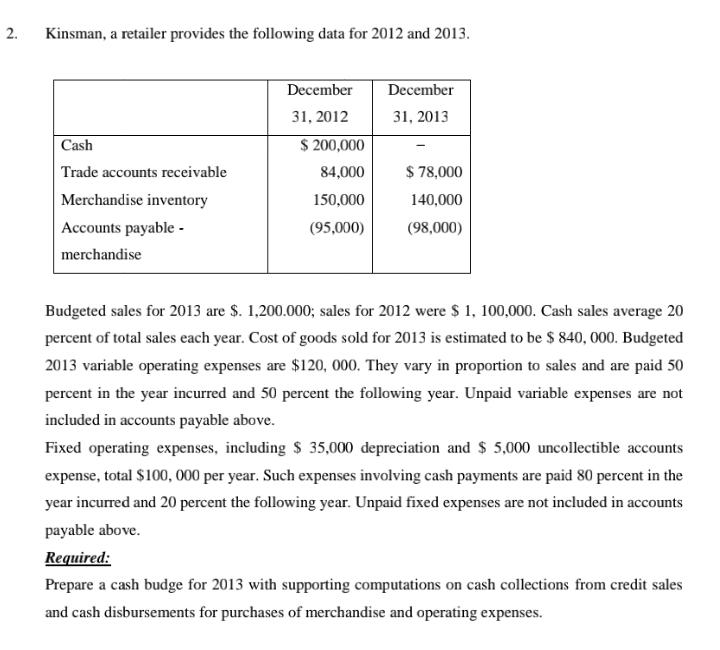

Kinsman, a retailer provides the following data for 2012 and 2013. Budgeted sales for 2013 are $.1,200.000; sales for 2012 were $1,100,000. Cash sales average 20 percent of total sales each year. Cost of goods sold for 2013 is estimated to be $840,000. Budgeted 2013 variable operating expenses are $120,000. They vary in proportion to sales and are paid 50 percent in the year incurred and 50 percent the following year. Unpaid variable expenses are not included in accounts payable above. Fixed operating expenses, including \$ 35,000 depreciation and \$5,000 uncollectible accounts expense, total $100,000 per year. Such expenses involving cash payments are paid 80 percent in the year incurred and 20 percent the following year. Unpaid fixed expenses are not included in accounts payable above. Required: Prepare a cash budge for 2013 with supporting computations on cash collections from credit sales and cash disbursements for purchases of merchandise and operating expenses

Kinsman, a retailer provides the following data for 2012 and 2013. Budgeted sales for 2013 are $.1,200.000; sales for 2012 were $1,100,000. Cash sales average 20 percent of total sales each year. Cost of goods sold for 2013 is estimated to be $840,000. Budgeted 2013 variable operating expenses are $120,000. They vary in proportion to sales and are paid 50 percent in the year incurred and 50 percent the following year. Unpaid variable expenses are not included in accounts payable above. Fixed operating expenses, including \$ 35,000 depreciation and \$5,000 uncollectible accounts expense, total $100,000 per year. Such expenses involving cash payments are paid 80 percent in the year incurred and 20 percent the following year. Unpaid fixed expenses are not included in accounts payable above. Required: Prepare a cash budge for 2013 with supporting computations on cash collections from credit sales and cash disbursements for purchases of merchandise and operating expenses Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started