Answered step by step

Verified Expert Solution

Question

1 Approved Answer

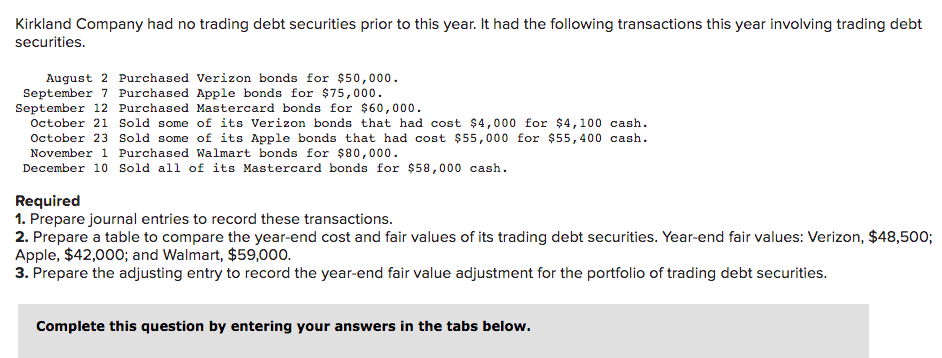

Kirkland Company had no trading debt securities prior to this year. It had the following transactions this year involving trading debt securities. August 2 Purchased

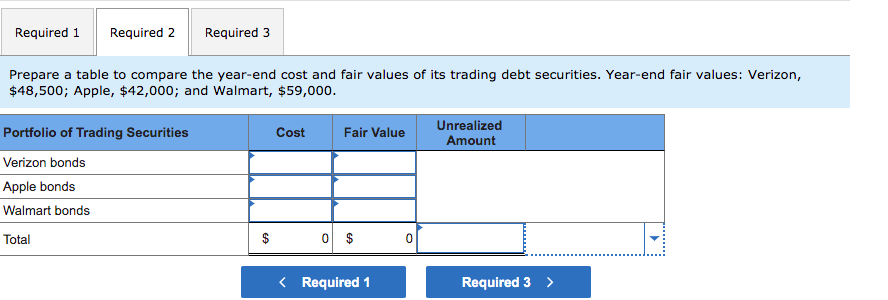

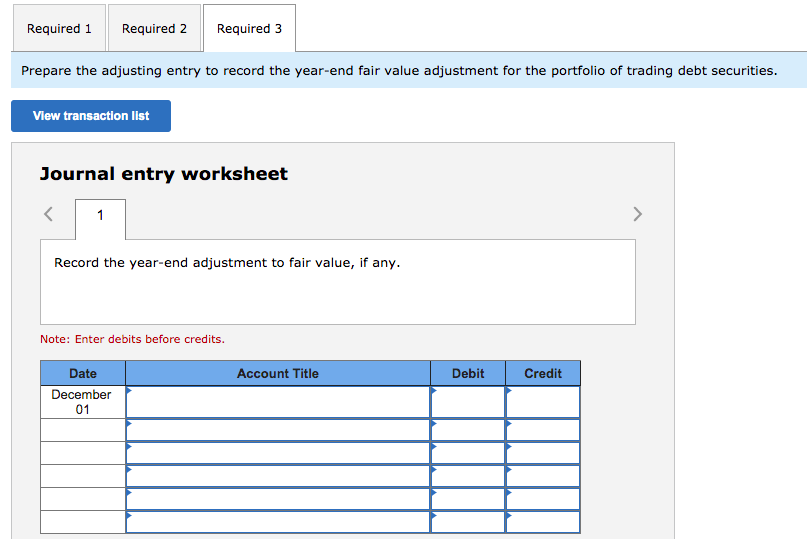

Kirkland Company had no trading debt securities prior to this year. It had the following transactions this year involving trading debt securities. August 2 Purchased Verizon bonds for $50,000. September 7 Purchased Apple bonds for $75,000. September 12 Purchased Mastercard bonds for $60,000. October 21 Sold some of its Verizon bonds that had cost $4,000 for $4,100 cash. October 23 Sold some of its Apple bonds that had cost $55,000 for $55,400 cash. November 1 Purchased Walmart bonds for $80,000. December 10 sold all of its Mastercard bonds for $58,000 cash. Required 1. Prepare journal entries to record these transactions. 2. Prepare a table to compare the year-end cost and fair values of its trading debt securities. Year-end fair values: Verizon, $48,500; Apple, $42,000; and Walmart, $59,000. 3. Prepare the adjusting entry to record the year-end fair value adjustment for the portfolio of trading debt securities. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare a table to compare the year-end cost and fair values of its trading debt securities. Year-end fair values: Verizon, $48,500; Apple, $42,000; and Walmart, $59,000. Cost Fair Value Unrealized Amount Portfolio of Trading Securities Verizon bonds Apple bonds Walmart bonds Total $ $ 0 $ 0 Required 1 Required 2 Required 3 Prepare the adjusting entry to record the year-end fair value adjustment for the portfolio of trading debt securities. View transaction list Journal entry worksheet 1 > Record the year-end adjustment to fair value, if any. Note: Enter debits before credits. Account Title Debit Credit Date December 01

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started