Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Klein's Tools is considering offering a cash discount to speed up the collection of accounts receivable. Currently the firm has an average collection period of

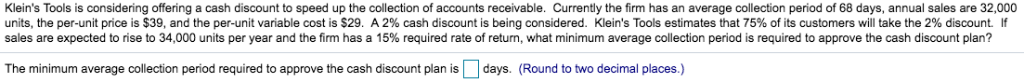

Klein's Tools is considering offering a cash discount to speed up the collection of accounts receivable. Currently the firm has an average collection period of 68 days, annual sales are 32,000 units, the per-unit price is $39, and the per-unit variable cost is $29. A 2% cash discount is being considered. Klein's Tools estimates that 75% of its customers will take the 2% discount. If sales are expected to rise to 34,000 units per year and the firm has a 15% required rate of return, what minimum average collection period is required to approve the cash discount plan? The minimum average collection period required to approve the cash discount plan is days. (Round to two decimal places.) Klein's Tools is considering offering a cash discount to speed up the collection of accounts receivable. Currently the firm has an average collection period of 68 days, annual sales are 32,000 units, the per-unit price is $39, and the per-unit variable cost is $29. A 2% cash discount is being considered. Klein's Tools estimates that 75% of its customers will take the 2% discount. If sales are expected to rise to 34,000 units per year and the firm has a 15% required rate of return, what minimum average collection period is required to approve the cash discount plan? The minimum average collection period required to approve the cash discount plan is days. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started