Answered step by step

Verified Expert Solution

Question

1 Approved Answer

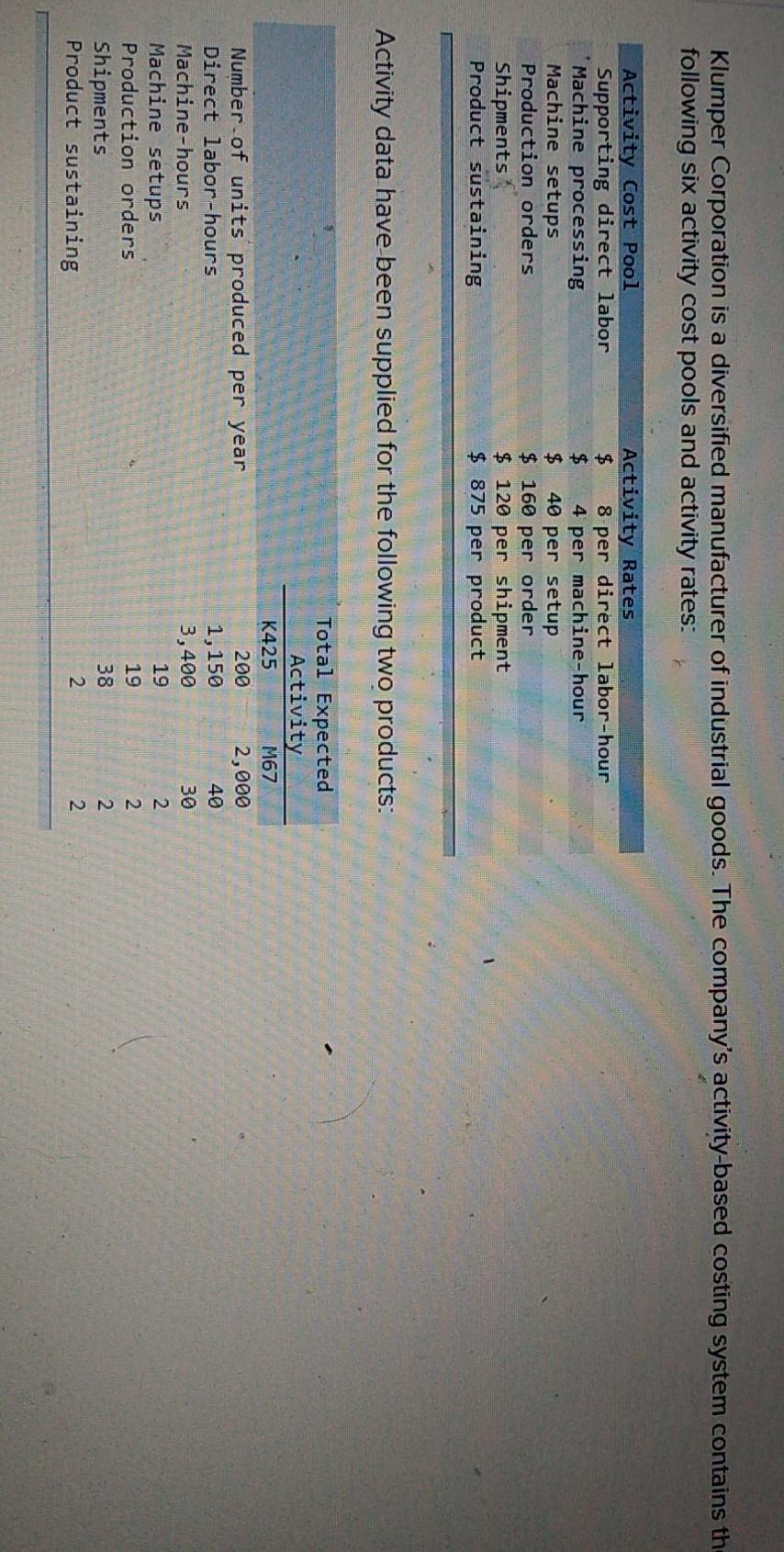

Klumper Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains th following six activity cost pools and activity rates: Activity

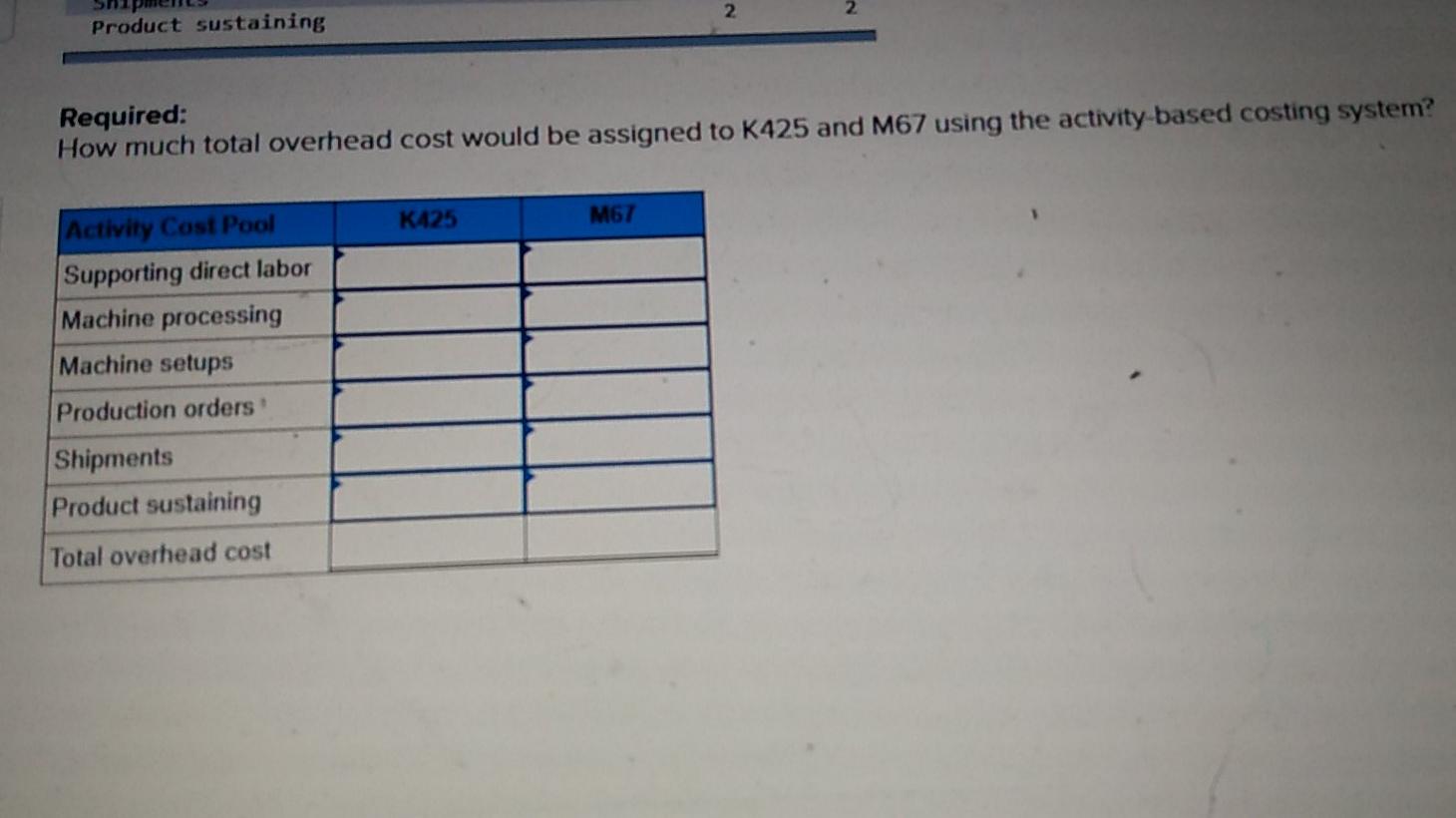

Klumper Corporation is a diversified manufacturer of industrial goods. The company's activity-based costing system contains th following six activity cost pools and activity rates: Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Activity Rates $ 8 per direct labor-hour $ 4 per machine-hour $ 40 per setup $ 160 per order $ 120 per shipment $ 875 per product Activity data have been supplied for the following two products: Number of units produced per year Direct labor-hours Machine-hours Machine setups Production orders Shipments Product sustaining Total Expected Activity K425 M67 200 2,000 1,150 40 3,400 30 19 19 38 2 NNNN Product sustaining Required: How much total overhead cost would be assigned to K425 and M67 using the activity based costing system? K425 M67 Activity Cost Pool Supporting direct labor Machine processing Machine setups Production orders Shipments Product sustaining Total overhead cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started