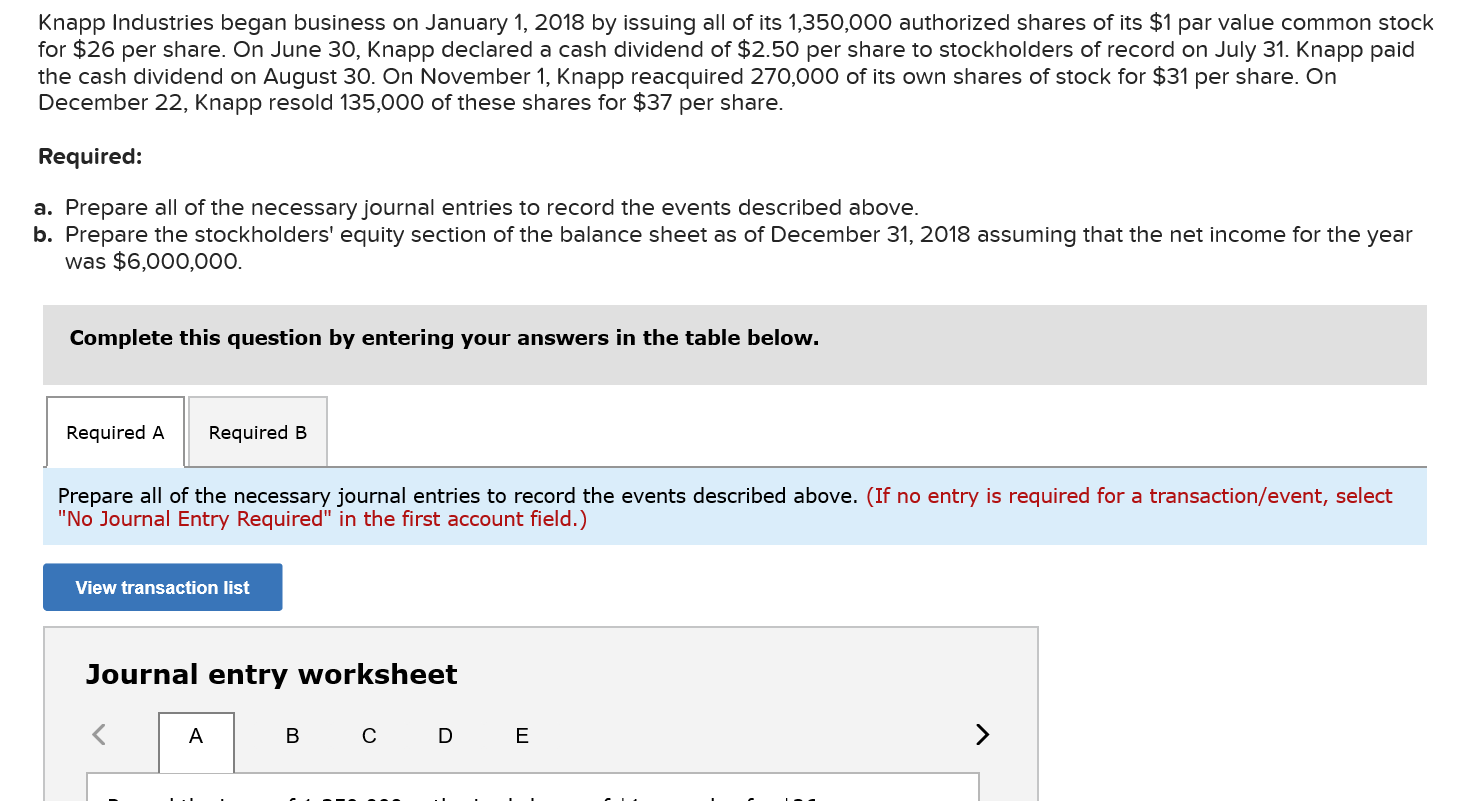

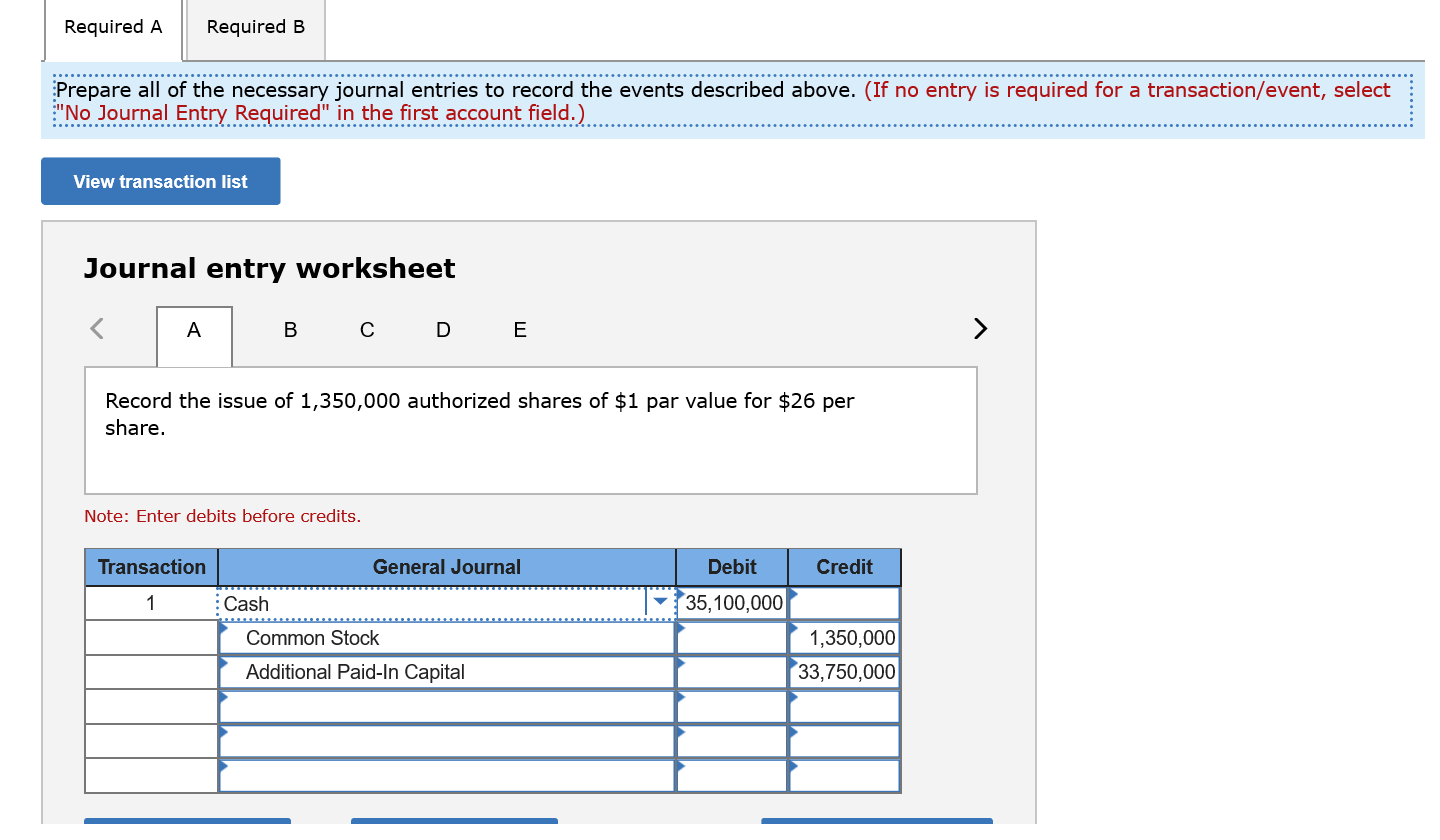

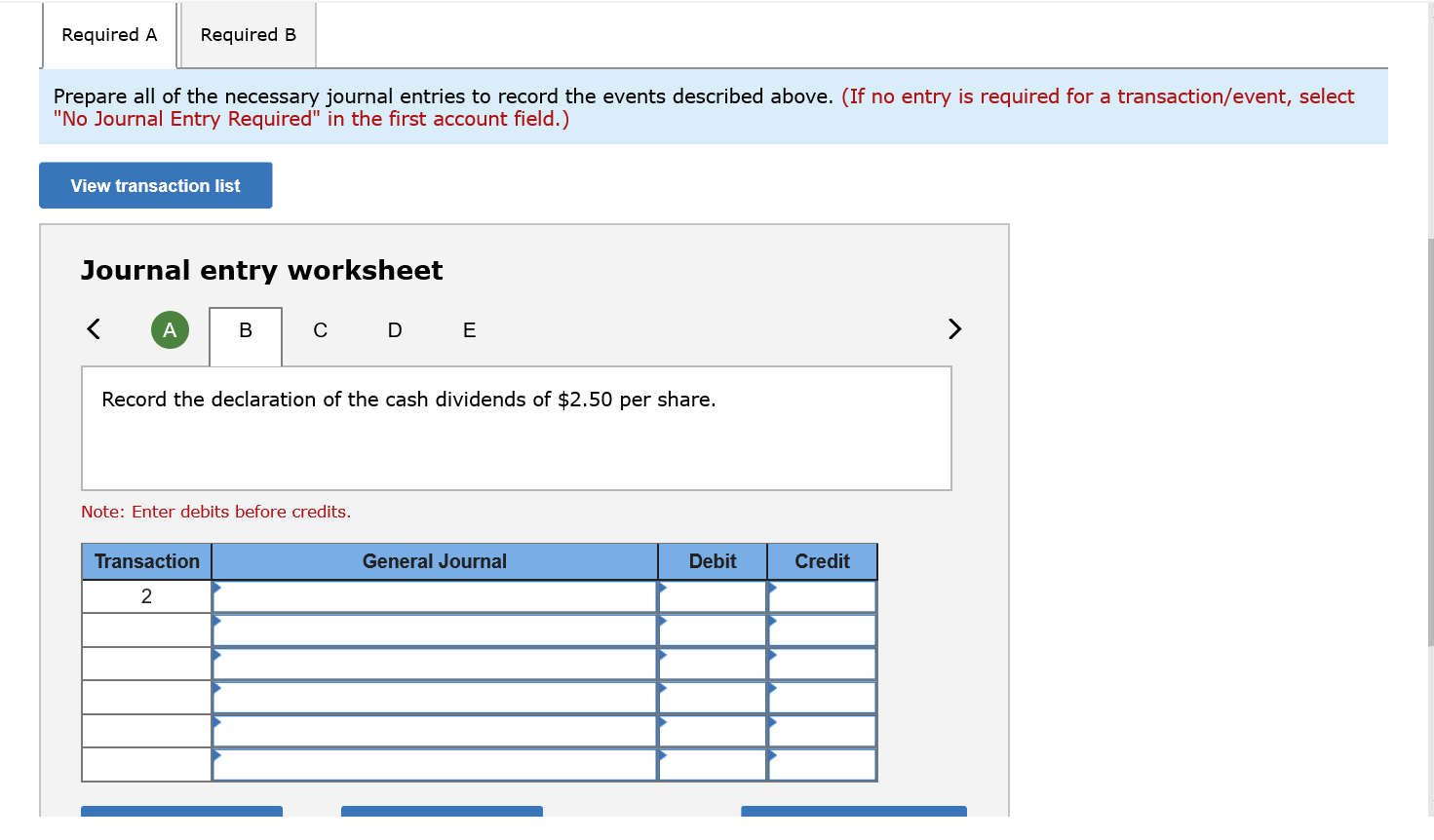

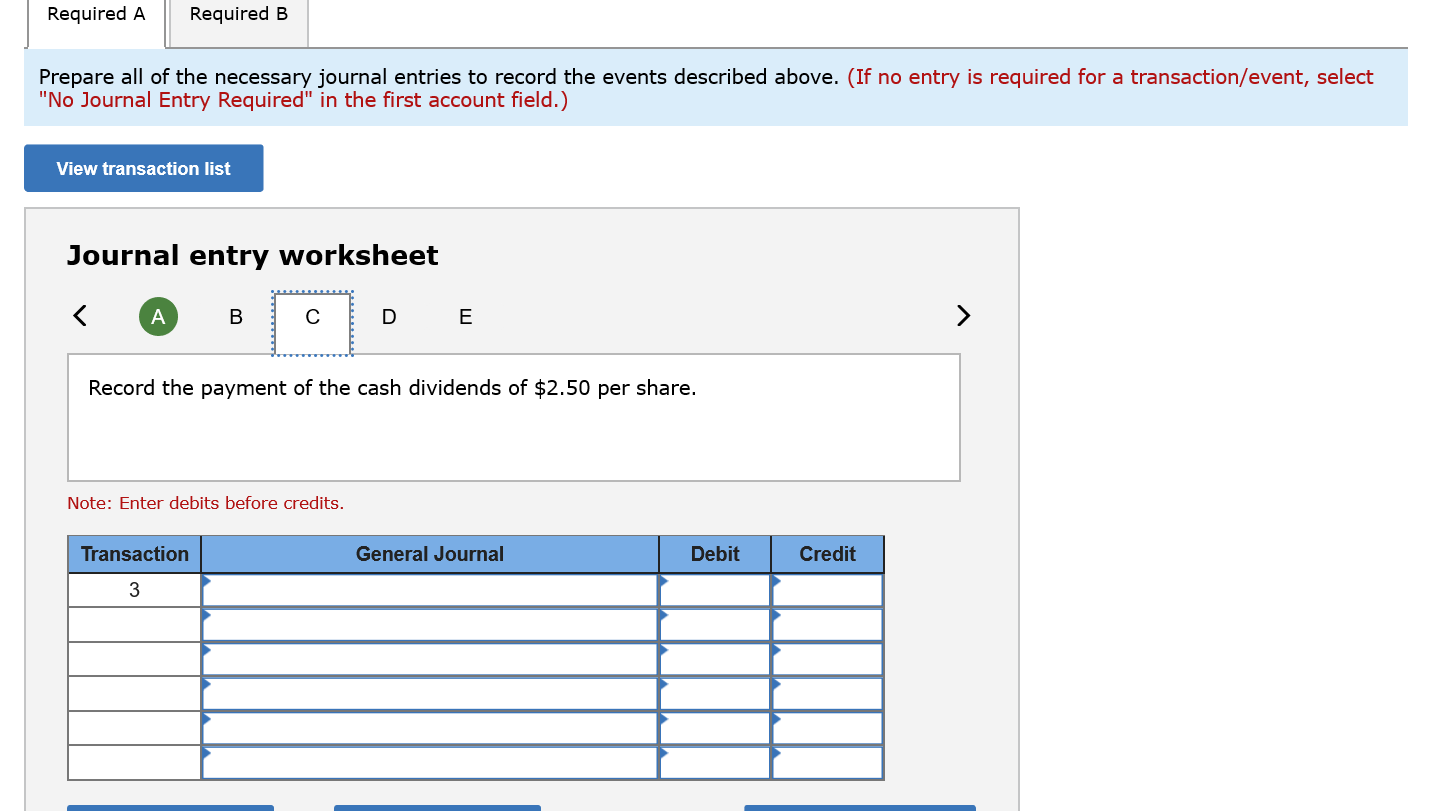

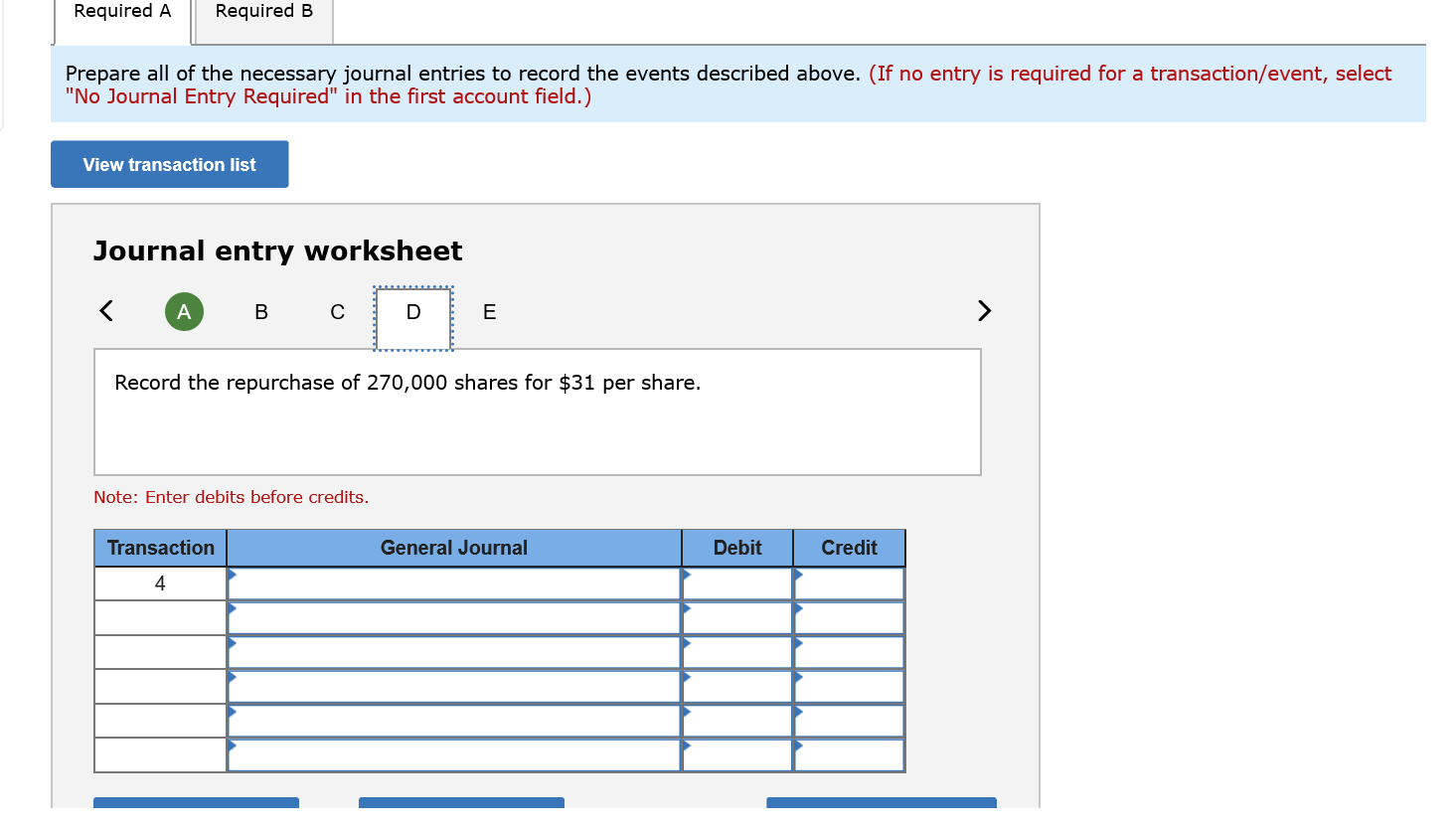

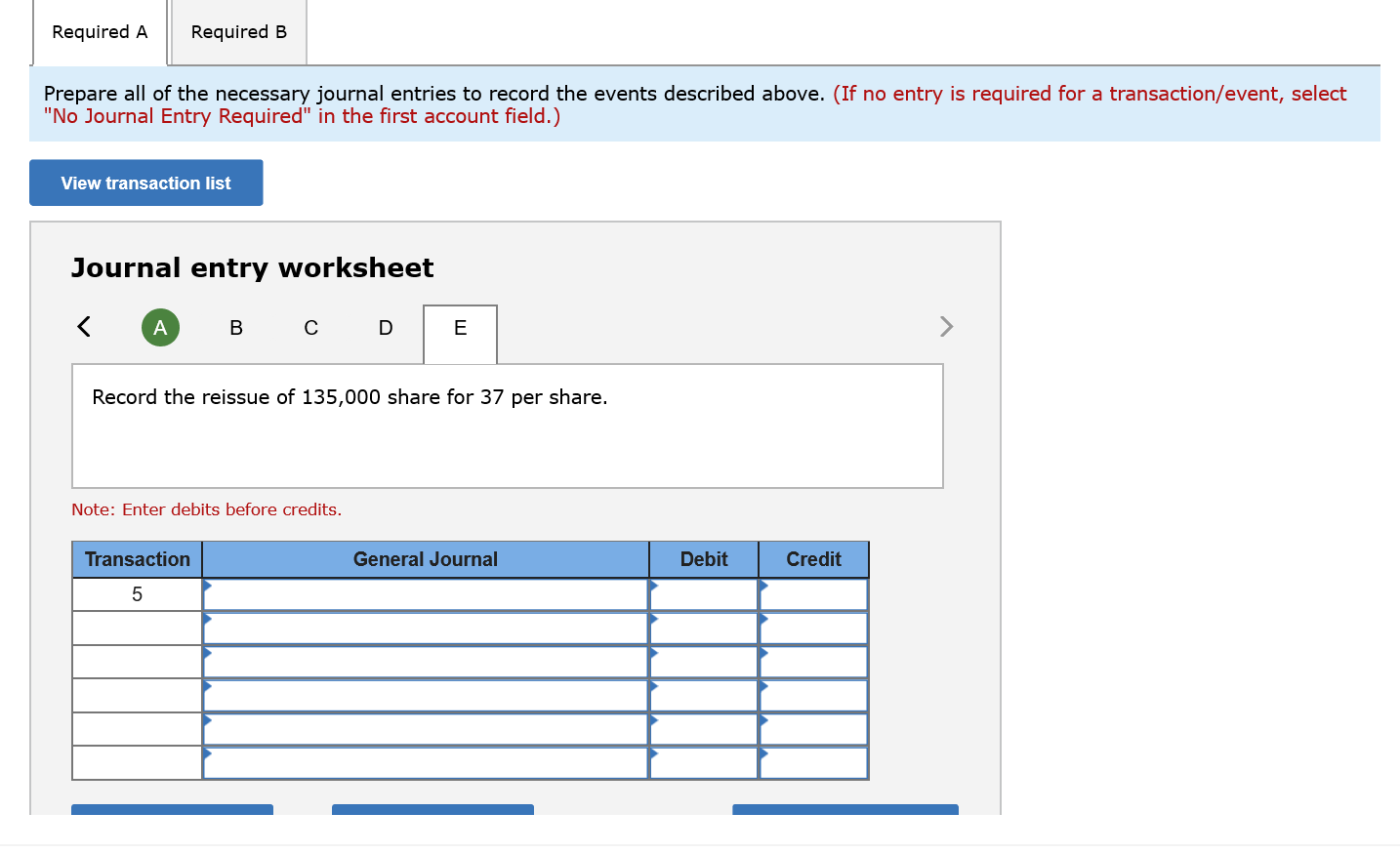

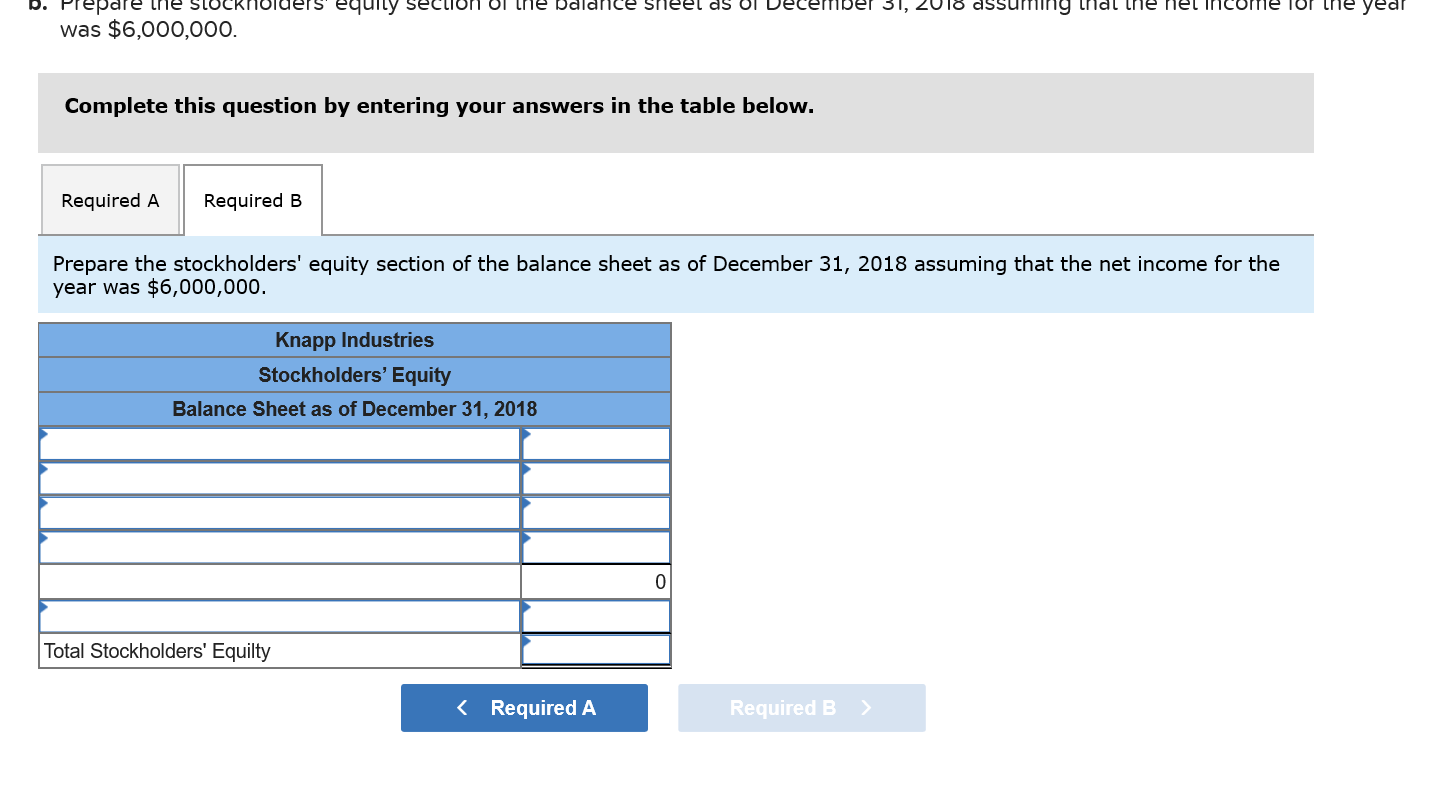

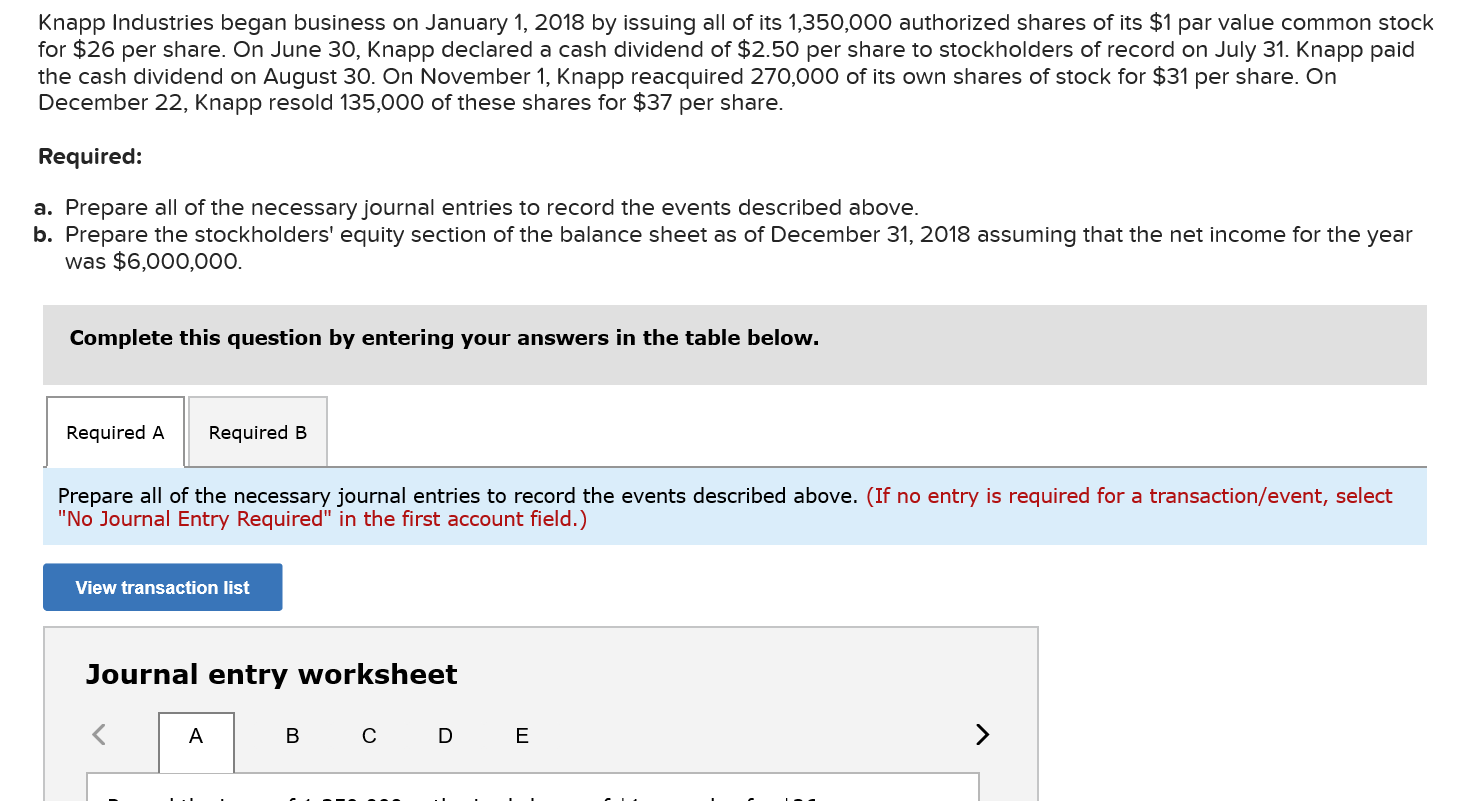

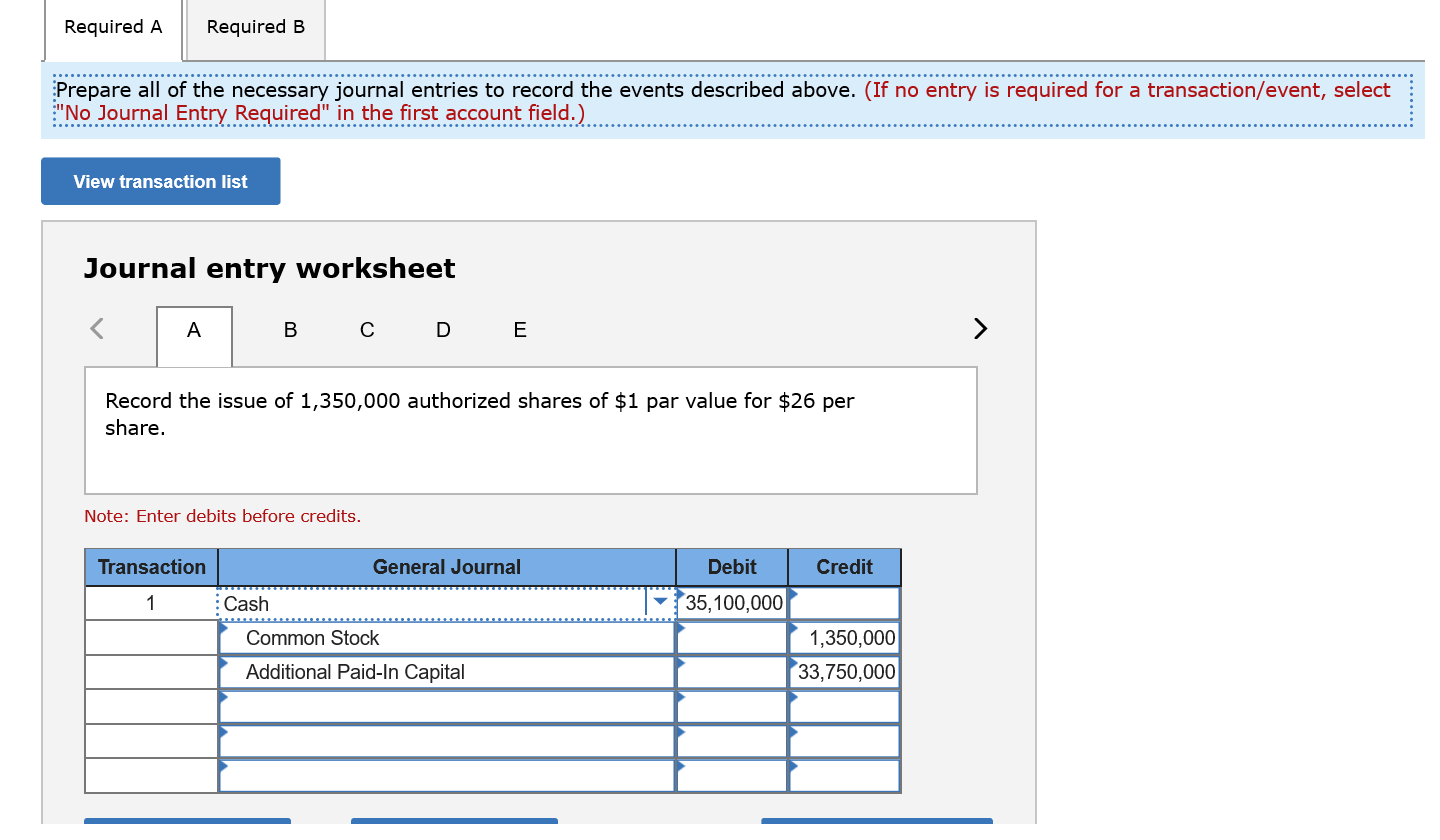

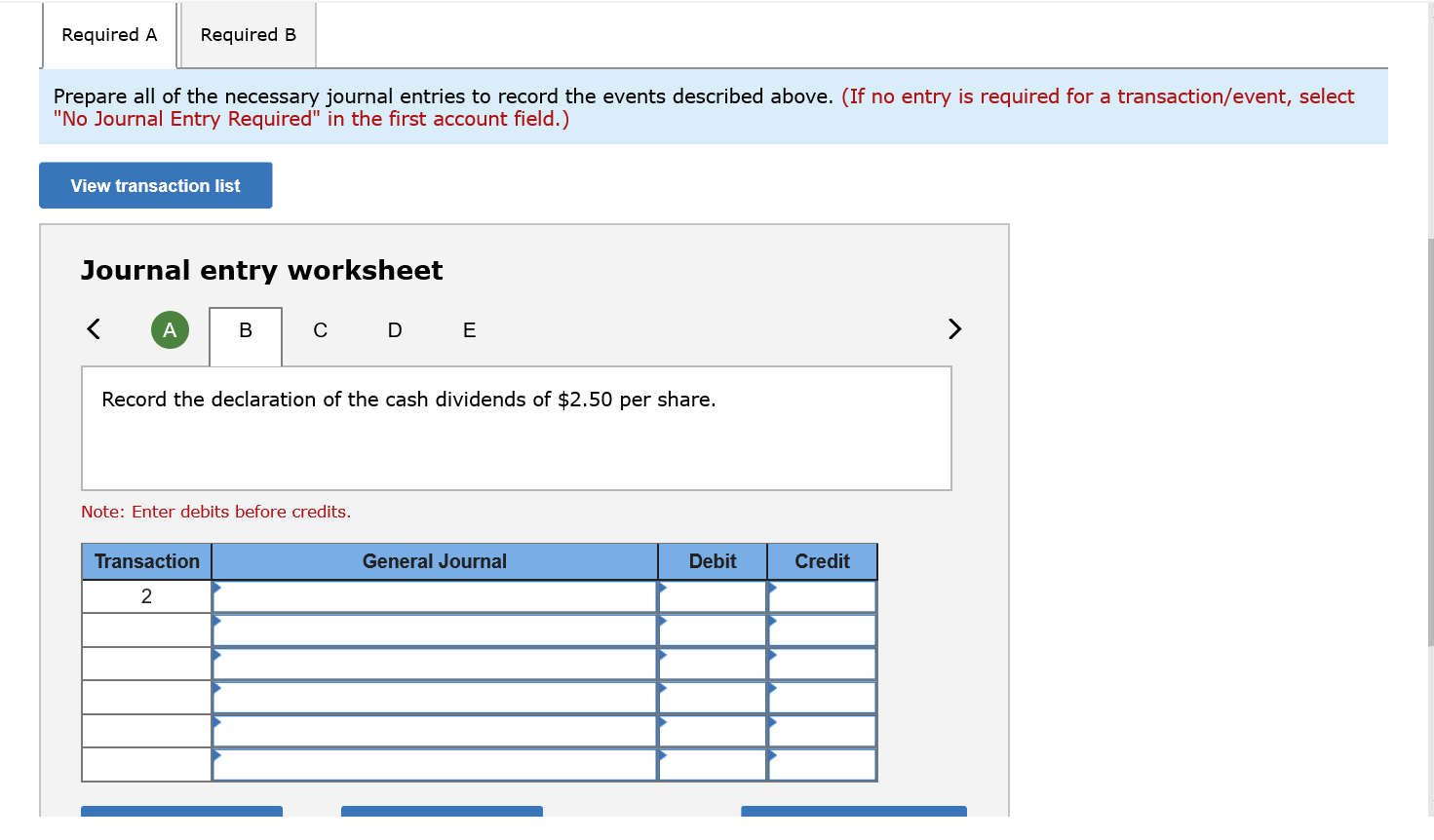

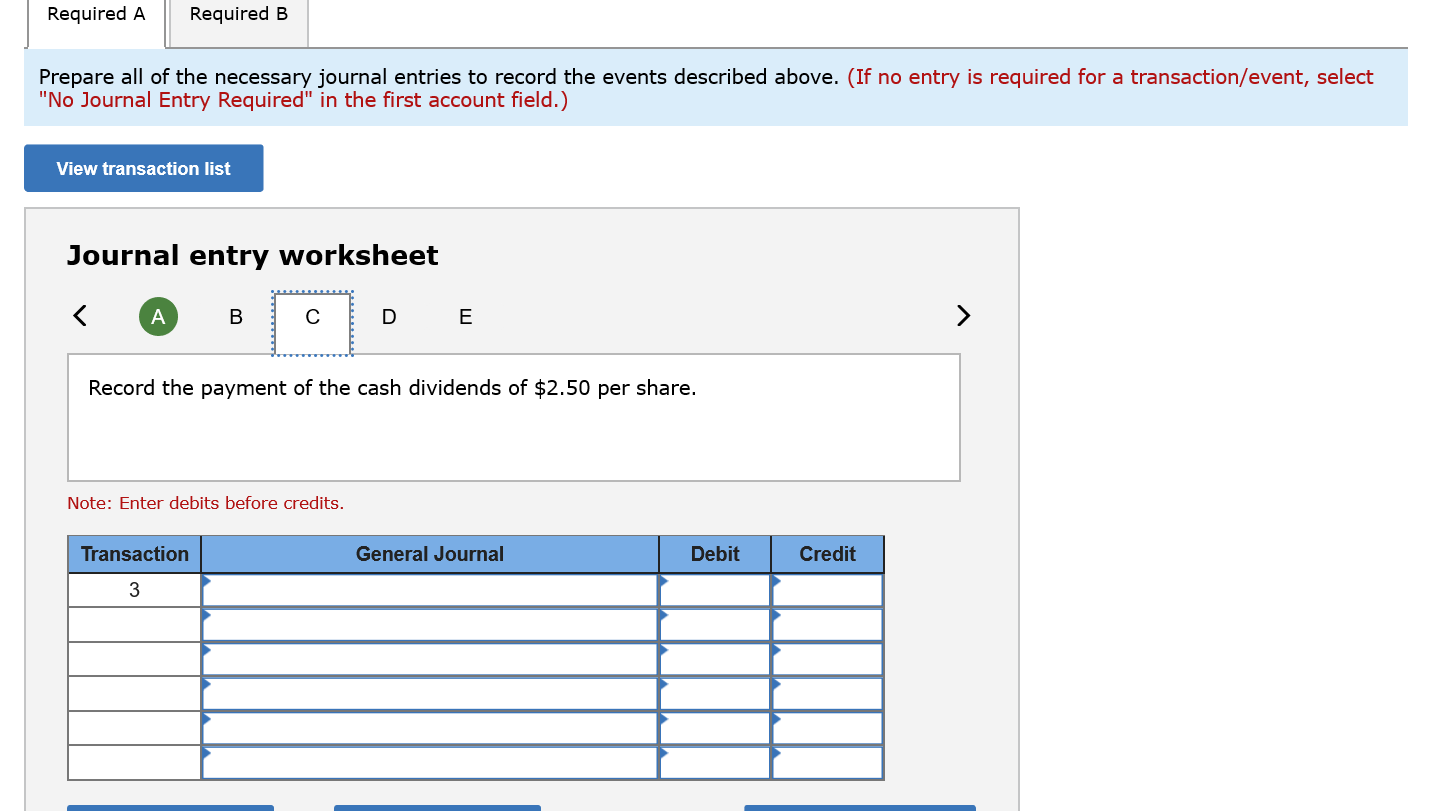

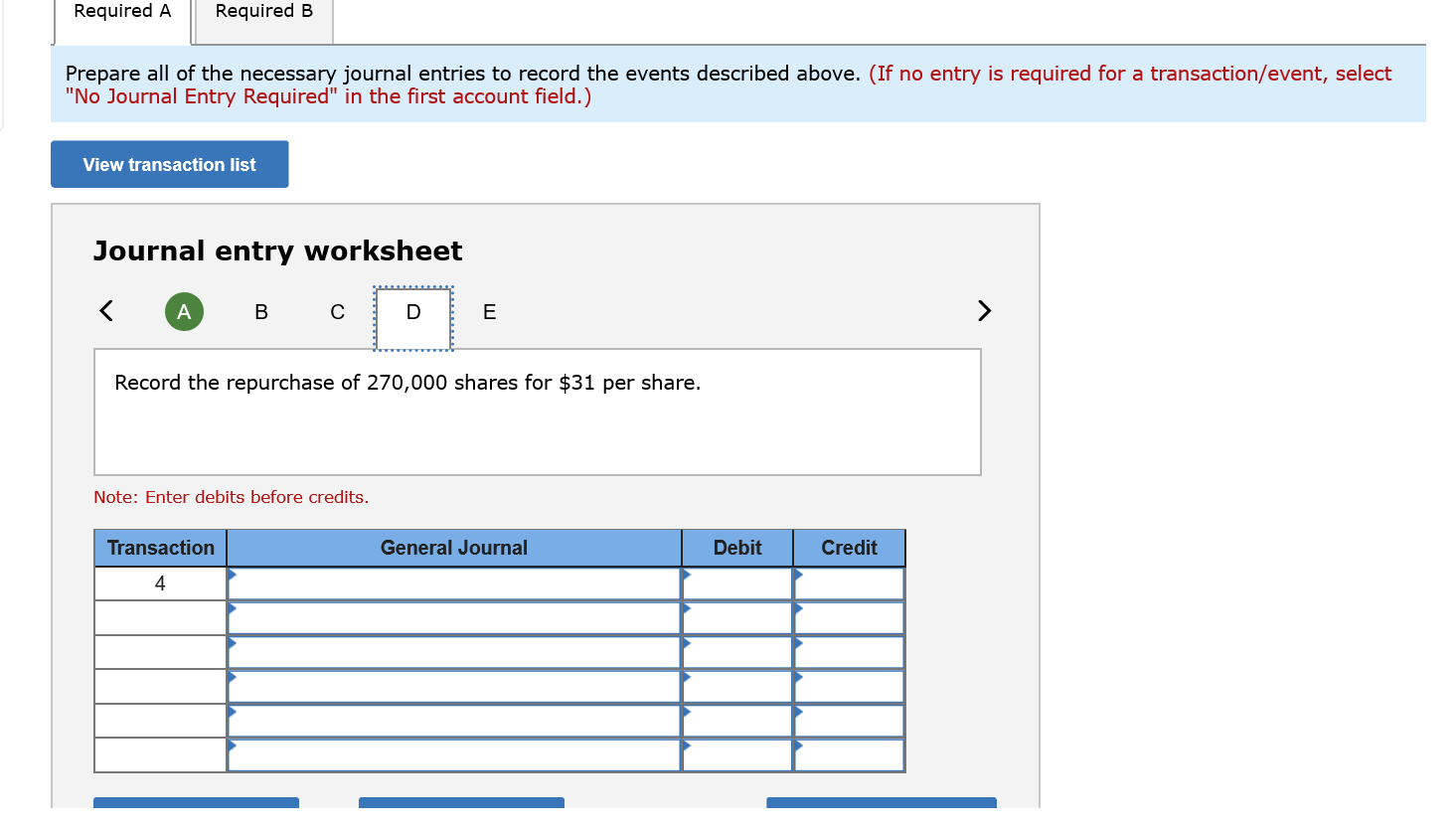

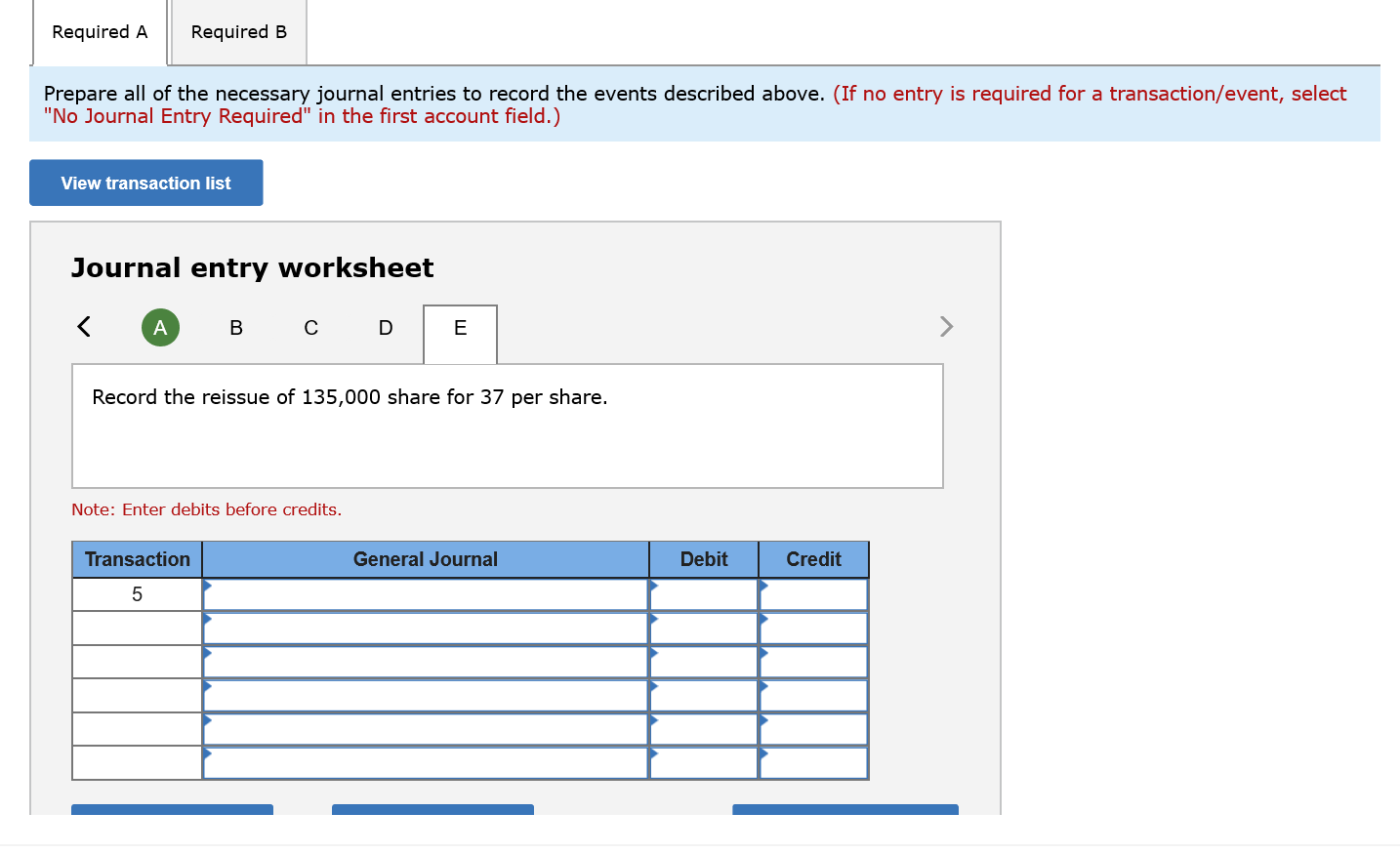

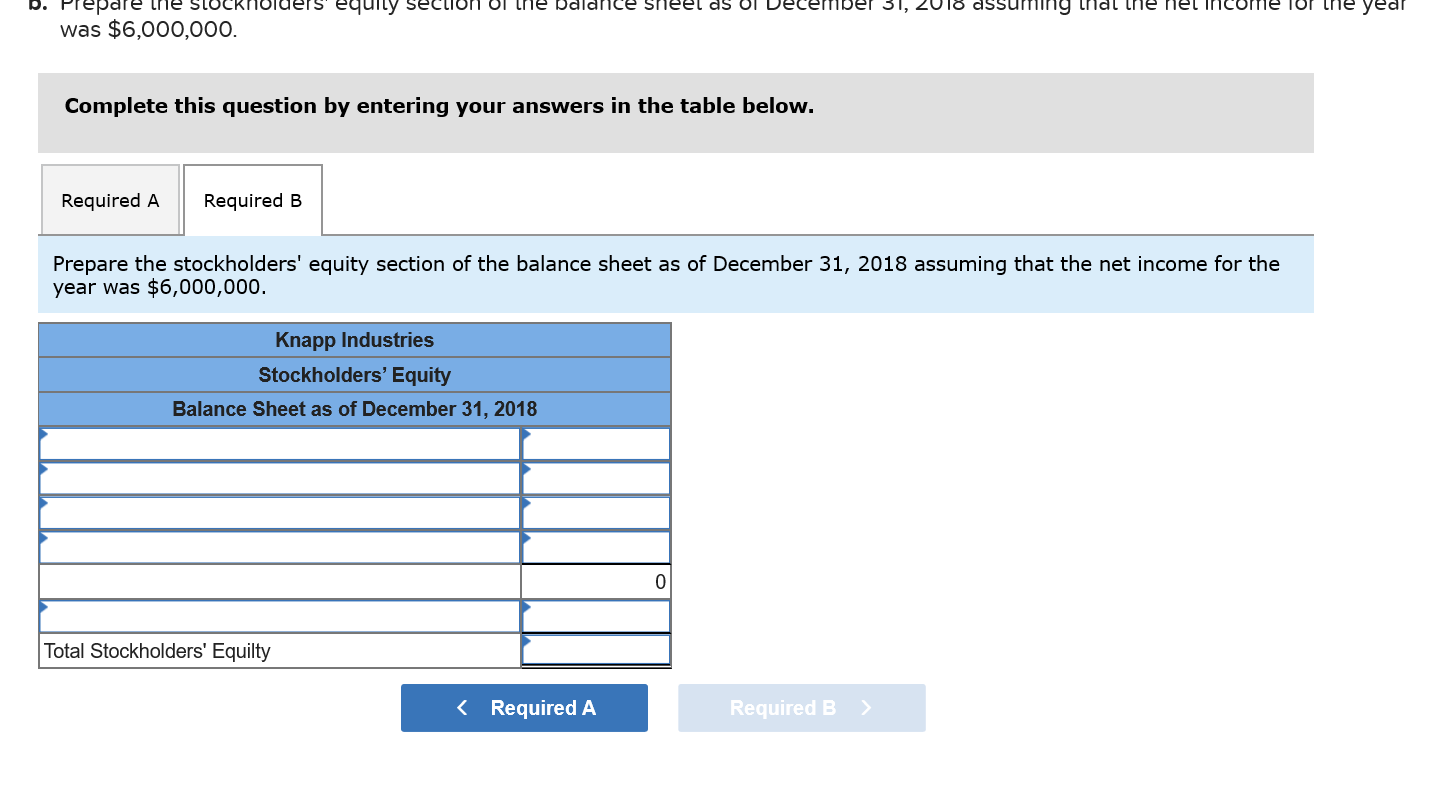

Knapp Industries began business on January 1, 2018 by issuing all of its 1,350,000 authorized shares of its $1 par value common stock for $26 per share. On June 30, Knapp declared a cash dividend of $2.50 per share to stockholders of record on July 31. Knapp paid the cash dividend on August 30. On November 1, Knapp reacquired 270,000 of its own shares of stock for $31 per share. On December 22, Knapp resold 135,000 of these shares for $37 per share. Required: a. Prepare all of the necessary journal entries to record the events described above. b. Prepare the stockholders' equity section of the balance sheet as of December 31, 2018 assuming that the net income for the year was $6,000,000. Complete this question by entering your answers in the table below. Required A Required B Prepare all of the necessary journal entries to record the events described above. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet A B D E Required A Required B Prepare all of the necessary journal entries to record the events described above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. View transaction list Journal entry worksheet Record the issue of 1,350,000 authorized shares of $1 par value for $26 per share. Note: Enter debits before credits. Transaction General Journal Debit Credit 1 Cash 35,100,000 Common Stock 1,350,000 33,750,000 Additional Paid-In Capital Required A Required B Prepare all of the necessary journal entries to record the events described above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet A BC C D E > Record the declaration of the cash dividends of $2.50 per share. Note: Enter debits before credits. Transaction General Journal Debit Credit 2 Required A Required B Prepare all of the necessary journal entries to record the events described above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet A B D E > Record the payment of the cash dividends of $2.50 per share. Note: Enter debits before credits. Transaction General Journal Debit Credit 3 Required A Required B Prepare all of the necessary journal entries to record the events described above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet Record the repurchase of 270,000 shares for $31 per share. Note: Enter debits before credits. Transaction General Journal Debit Credit 4 Required A Required B Prepare all of the necessary journal entries to record the events described above. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet