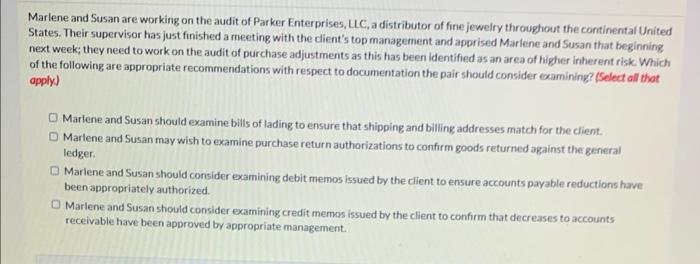

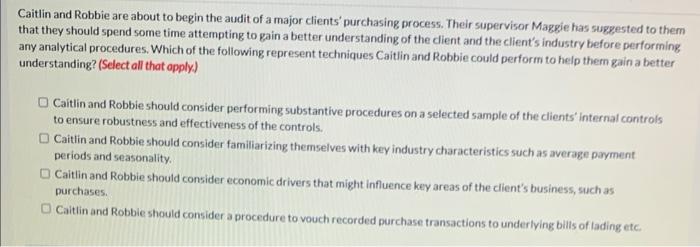

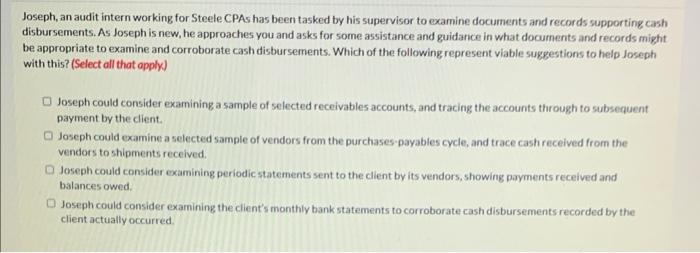

Marlene and Susan are working on the audit of Parker Enterprises, LC, a distributor of fine jewelry throughout the continental United States. Their supervisor has just finished a meeting with the client's top management and apprised Marlene and Susan that beginning next week; they need to work on the audit of purchase adjustments as this has been identified as an area of higher inherent risk. Which of the following are appropriate recommendations with respect to documentation the pair should consider examining? (Select all thot apply) Marlene and Susan should examine bills of lading to ensure that shipping and billing addresses match for the client. Marlene and Susan may wish to examine purchase return authorizations to confirm goods returned against the general ledger. Mariene and Susan should consider examining debit memos issued by the client to ensure accounts payable reductions have been appropriately authorized. Marlene and Susan should consider examining credit memos issued by the client to confirm that decreases to accounts receivable have been approved by appropriate management. Caitlin and Robbie are about to begin the audit of a major clients' purchasing process. Their supervisor Maggie has suggested to them that they should spend some time attempting to gain a better understanding of the dient and the client's industry before performing any analytical procedures. Which of the following represent techniques Caitlin and Robbie could perform to help thern gain a better understanding? (Select all that opply) Caitlin and Robbie should consider performing substantive procedures on a selected sample of the clients' internal controls to ensure robustness and effectiveness of the controls. Caitlin and Robbie should consider familiarizing themselves with key industry characteristics such as average payment periods and seasonality. Caitlin and Robbie should consider economic drivers that might influence key areas of the client's business, such as purchases. Caitlin and Robbie should consider a procedure to vouch recorded purchase transactions to underlying bilis of lading etc. Joseph, an audit intern working for Steele CPAs has been tasked by his supervisor to examine documents and records supporting cash disbursements. As Joseph is new, he approaches you and asks for some assistance and guidarce in what documents and records might be appropriate to examine and corroborate cash disbursements. Which of the following represent viable suggestions to help Joseph with this? (Select all that opply) Joseph could consider examining a sample of selected receivables accounts, and tracing the accounts through to subsequent payment by the client. Joseph could examine a selected sample of vendors from the purchases-payables cycle, and trace cash received from the vendors to shipments received Joseph could consider examining periodic statements sent to the client by its vendors, showing payments received and balances owed. Joseph could consider exarnining the client's monthly bank statements to corroborate cash disbursements recorded by the client actually occurred