Question

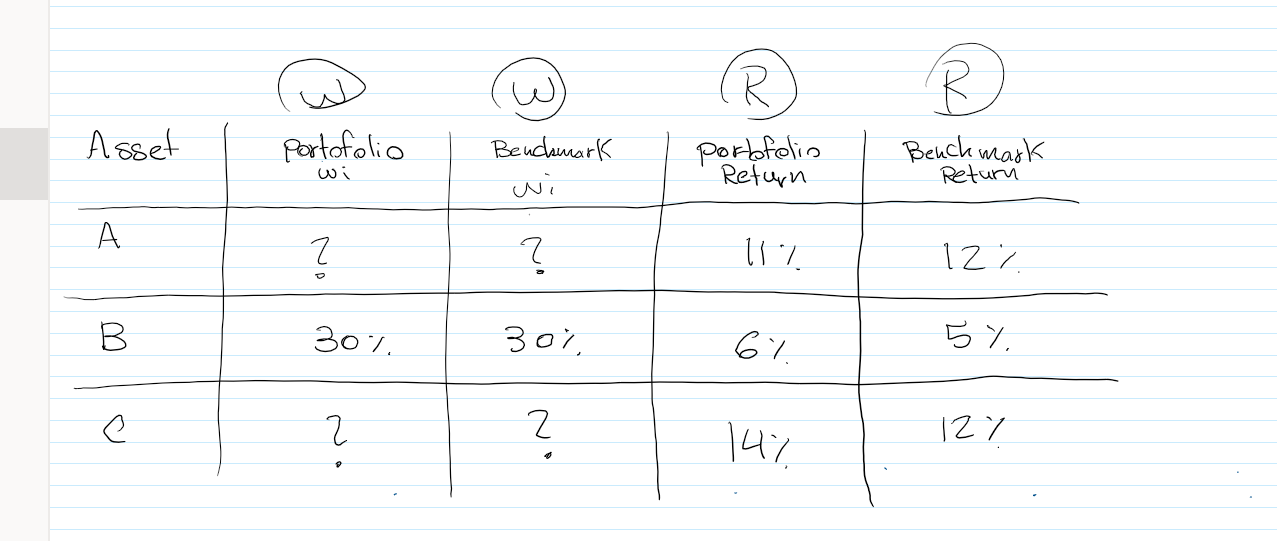

knowing that active return from security selection is equal to .35 calculate the missing information ( the weights ) show the steps ** I have

knowing that active return from security selection is equal to .35

calculate the missing information ( the weights ) show the steps

** I have no clue what do you mean by rate of return metrics as the rates are already in the column of portfolio return and benchmark return

Asset A B e Portofolio wi 2 . 2 Benchmark wi ? 30% 2 Portfolio Return 117 6% 14% Benchmark Return 12% 5% 127

Step by Step Solution

3.54 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

DETAILED ANSWER Based on the information provided we can use the formula for active return to solve for the missing weights Active Return Portfolio Re...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Managing Information Technology

Authors: Carol Brown, Daniel W. DeHayes, Jeffrey A. Hoffer, Wainright E. Martin, William C. Perkins

6th edition

131789546, 978-0131789548

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App