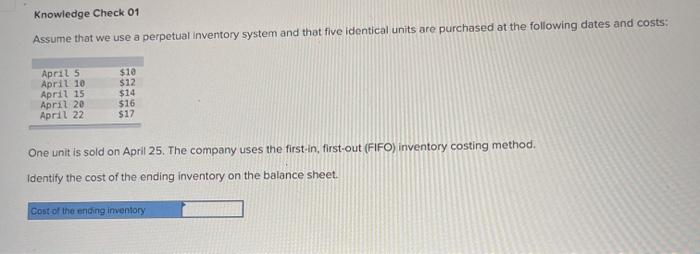

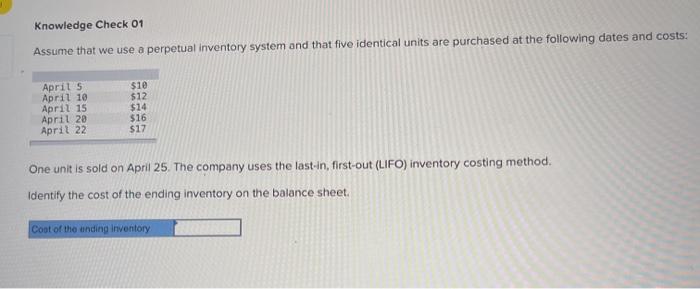

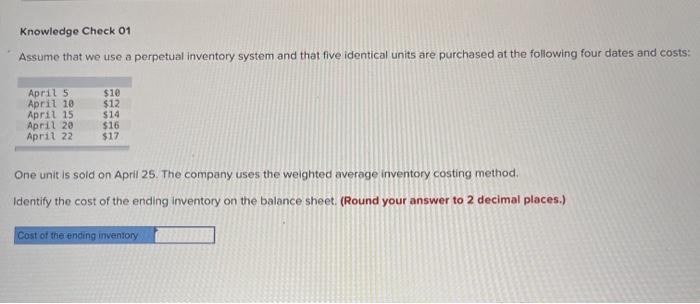

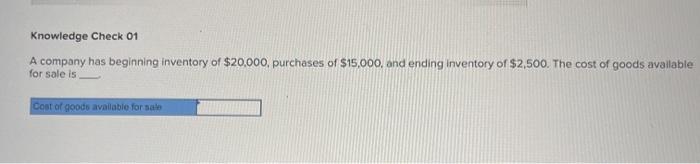

Knowledge Check 01 A company uses a periodic inventory system. On August 1, the company had 6 items of beginning inventory with a cost of $7 per unit. On August 3, the company purchased 16 units at $14 per unit. Then, on August 5, the company sold 12 units. The 12 units sold consisted of 7 units from the August 3rd purchase and 5 units from the August 1st beginning inventory. Using specific identification, the cost of the 12 units sold is Cost of the units sold Knowledge Check 01 A company uses a periodic inventory system. On August 1, the company had 6 items of beginning inventory with a cost of 57 per unit. On August 3, the company purchased 16 units at $14 per unit. Then, on August 5, the company sold 12 units. Using FIFO, the cost of the 12 units sold is Cost of the units sold Knowledge Check 01 A company uses a periodic inventory system. On November 1, the company had 8 items of beginning inventory with a cost of $22 per unit. On November 2, the company purchased 10 units at $21 per unit. On November 6, the company purchased 5 units at $25 per unit. Then, on November 8, the company sold 18 units. Using LIFO, the cost of the 18 units sold is Cost of the urtits sold Knowledge Check 01 A company uses a periodic inventory system. On April 1, the company had 9 items of beginning inventory with a cost of $13 per unit. On April 18, the company purchased 15 units at $14 per unit. Then, on April 29, the company sold 14 units. Using weighted average, the cost of the 14 units sold is closest to Cost of the unitusoid Knowledge Check 01 Assume that we use a perpetual inventory system and that five identical units are purchased at the following dates and costs: $10 April 5 April 10 April 15 April 20 April 22 $12 $14 $16 $17 One unit is sold on April 25. The company uses the first-in, first-out (FIFO) inventory costing method. Identify the cost of the ending inventory on the balance sheet. Cost of the ending inventory Knowledge Check 01 Assume that we use a perpetual inventory system and that five identical units are purchased at the following dates and costs: April s April 10 April 15 April 20 April 22 $10 $12 $14 $16 $17 One unit is sold on April 25. The company uses the last-in, first-out (LIFO) inventory costing method. Identify the cost of the ending inventory on the balance sheet. Coot of the ending inventory Knowledge Check 01 Assume that we use a perpetual inventory system and that five identical units are purchased at the following four dates and costs: April 5 April 10 April 15 April 20 April 22 $10 $12 $14 $16 $17 One unit is sold on April 25. The company uses the weighted average inventory costing method. Identify the cost of the ending inventory on the balance sheet. (Round your answer to 2 decimal places.) Cost of the ending inventory Knowledge Check 01 A company has beginning inventory of $20,000, purchases of $15,000, and ending inventory of $2,500. The cost of goods available for sale is Cost of goods available for sale Knowledge Check 01 A company uses a periodic inventory system. On August 1, the company had 6 items of beginning inventory with a cost of $7 per unit. On August 3, the company purchased 16 units at $14 per unit. Then, on August 5, the company sold 12 units. The 12 units sold consisted of 7 units from the August 3rd purchase and 5 units from the August 1st beginning inventory. Using specific identification, the cost of the 12 units sold is Cost of the units sold Knowledge Check 01 Intercontinental Inc, uses a perpetual inventory system. Consider the following information about its inventory: July 1. purchased 10 units for $910 or $91 per unit, July 3, purchased 15 units for $1,590 or $106 per unit July 14, sold 20 units: July 17. purchased 20 units for $2,300 or $115 per unit: July 28, purchased 10 units for $1190 or $19 per unit: July 31, sold 23 units. Using FIFO, the cost of goods sold for the sale of 23 units on July 31s and the inventory bolonce at July 31 is Cost of goods sold Inventory balance Knowledge Check 01 Intercontinental, Inc., uses a perpetual inventory system. Consider the following information about its inventory: July 1. purchased 10 units for $910 or $91 per unit: July 3, purchased 15 units for $1,590 or $106 per unit: July 14, sold 20 units, July 17. purchased 20 units for $2,300 or $115 per unit, July 28, purchased 10 units for $1,190 or $119 per unit: July 31, sold 23 units. Using LIFO, the cost of goods sold for the sale of 23 units on July 31 is and the inventory balance at July 31 is Cost of goods sold Inventory balance Knowledge Check 01 Intercontinental, Inc., uses a perpetual inventory system. Consider the following information about its inventory: July 1, purchased 10 units for $910 or $91 per unit: July 3, purchased 15 units for $1,590 or $106 per unit July 14, sold 20 units, July 17. purchased 20 units for $2,300 or $115 per unit; July 28, purchased 10 units for $1.190 or $119 per unit: July 31, sold 23 units. Using weighted average, the cost of goods sold for the sale of 23 units on July 31 is and the inventory balance at July 31 is Cost of goods sold Inventory balance