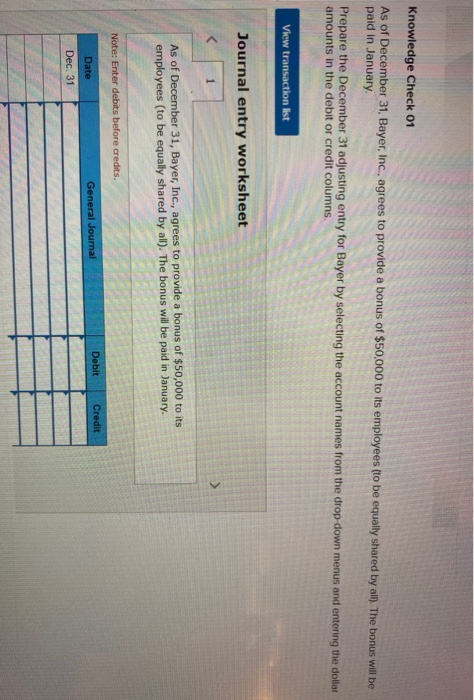

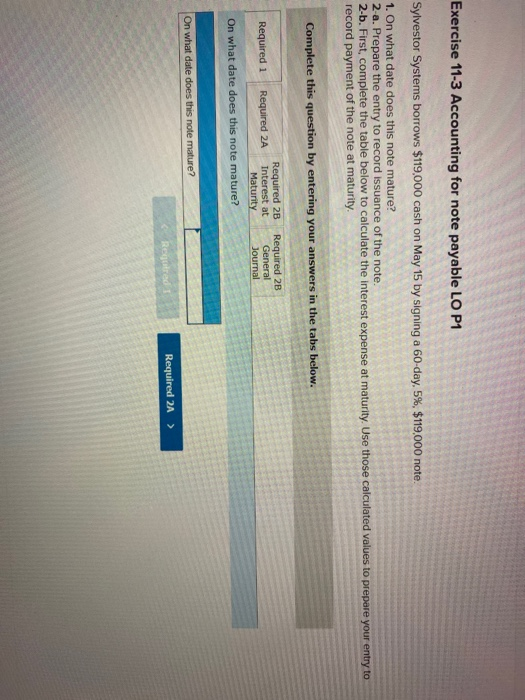

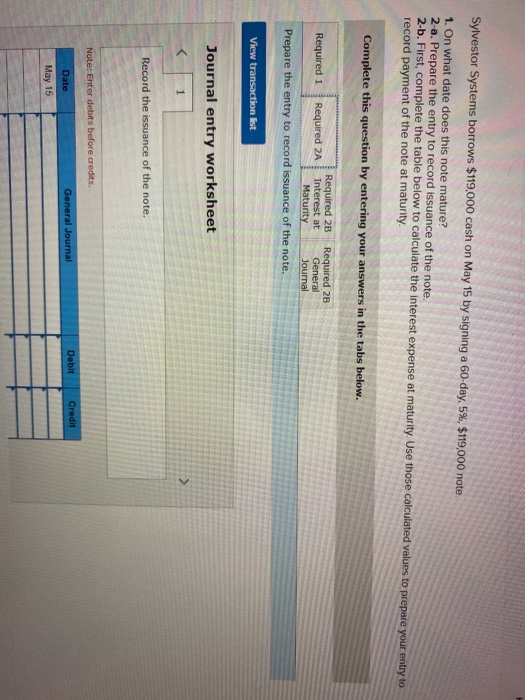

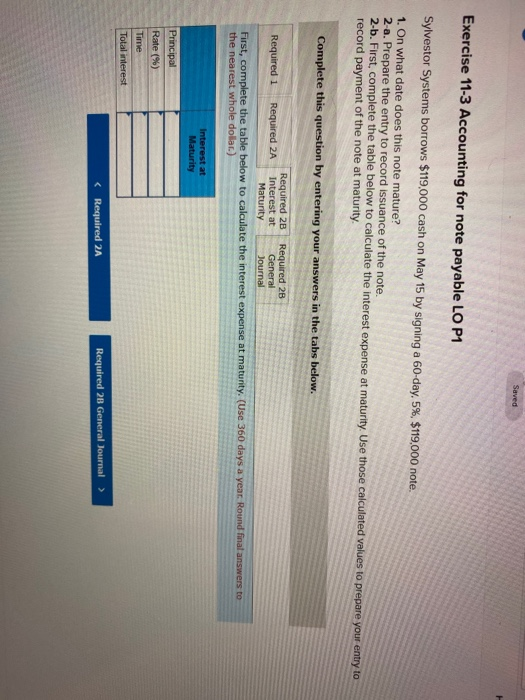

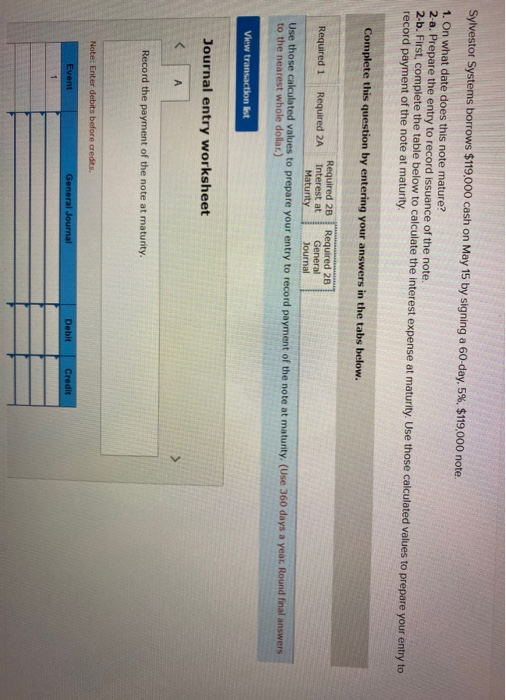

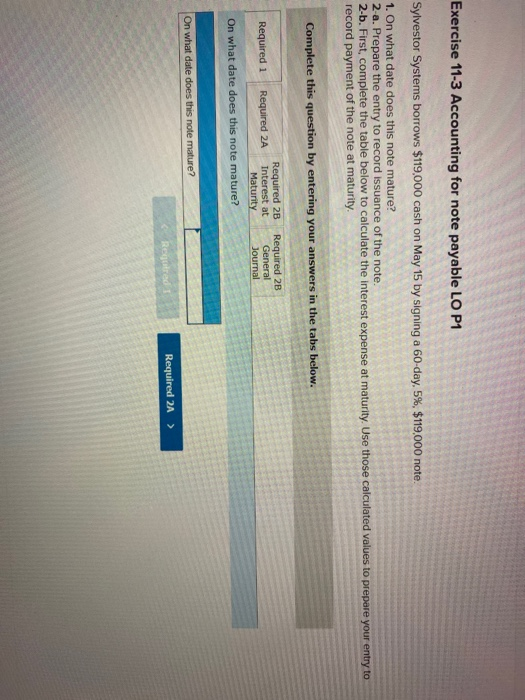

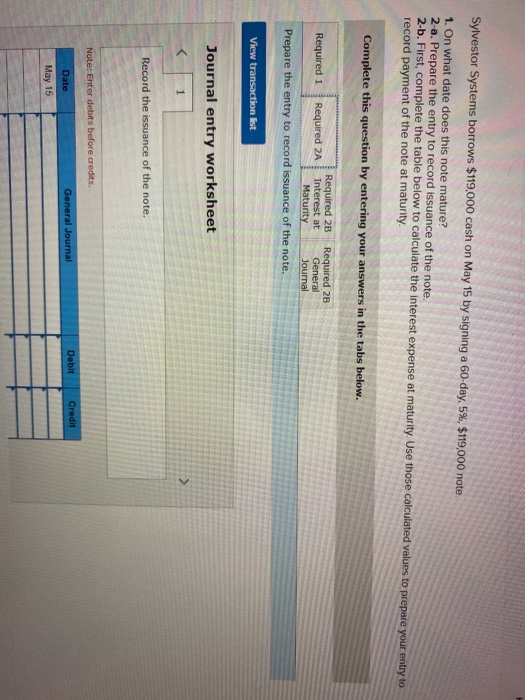

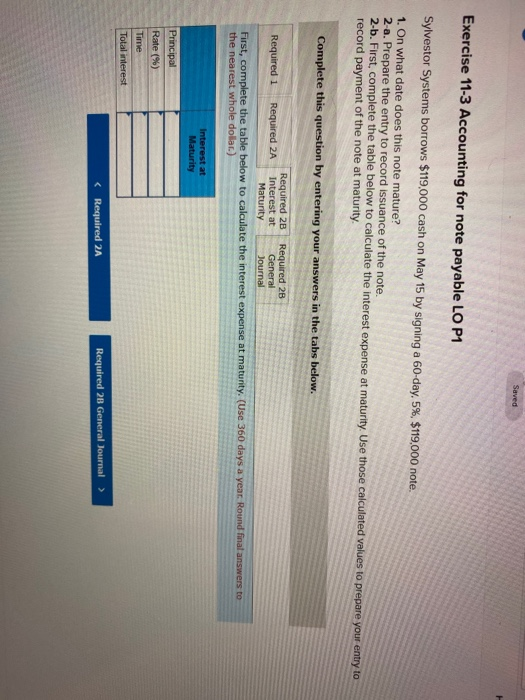

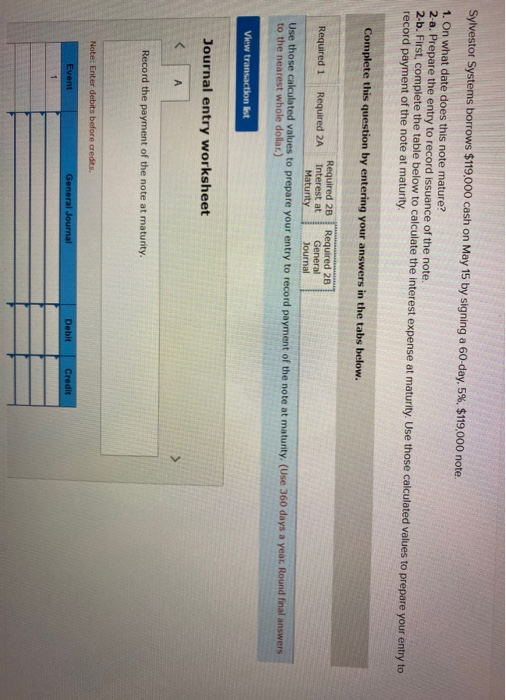

Knowledge Check 01 As of December 31, Bayer, Inc., agrees to provide a bonus of $50,000 to its employees to be equally shared by all). The bonus will be paid in January Prepare the December 31 adjusting entry for Bayer by selecting the account names from the drop-down menus and entering the dollar amounts in the debitor credit columns View transaction ist Journal entry worksheet As of December 31, Bayer, Inc., agrees to provide a bonus of $50,000 to its employees (to be equally shared by all). The bonus will be paid in January. Note: Enter debits before credits. Credit Debit Date General Journal Dec. 31 Exercise 11-3 Accounting for note payable LO P1 Sylvestor Systems borrows $119,000 cash on May 15 by signing a 60-day, 5%, $119,000 note. 1. On what date does this note mature? 2 a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. Required 2B Required 1 Required 2A Interest at Maturity On what date does this note mature? Required 2B General Journal On what date does this note mature? Regated Required 2A > Sylvestor Systems borrows $119,000 cash on May 15 by signing a 60-day, 5%, $119,000 note 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. Required 2B Required 2B Required 1 Required 2A Interest at General Maturity Journal Prepare the entry to record issuance of the note. View transaction ist Journal entry worksheet 1 Record the issuance of the note. Note: Enter debits before credits. Debit General Journal Credit Date May 15 Saved Exercise 11-3 Accounting for note payable LO P1 Sylvestor Systems borrows $119,000 cash on May 15 by signing a 60-day. 5%, $119,000 note. 1. On what date does this note mature? 2-a. Prepare the entry to record issuance of the note. 2-b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. Required 2B Required 2B Required 1 Required 2A Interest at General Maturity Journal First, complete the table below to calculate the interest expense at maturity. (Use 360 days a year. Round final answers to the nearest whole dollar) Interest at Maturity Principal Rate(%) Time Total interest Sylvestor Systems borrows $119.000 cash on May 15 by signing a 60-day, 5%. $119.000 note. 1. On what date does this note mature? 2 a. Prepare the entry to record issuance of the note. 2.b. First, complete the table below to calculate the interest expense at maturity. Use those calculated values to prepare your entry to record payment of the note at maturity. Complete this question by entering your answers in the tabs below. Required 2B Required 28 Required 1 Required 2A Interest at General Maturity Journal Use those calculated values to prepare your entry to record payment of the note at maturity. (Use 360 days a year. Round final answers to the nearest whole dollar.) View transaction list Journal entry worksheet Record the payment of the note at maturity. Note: Enter debits before credits. Event General Journal Debit Credit 1