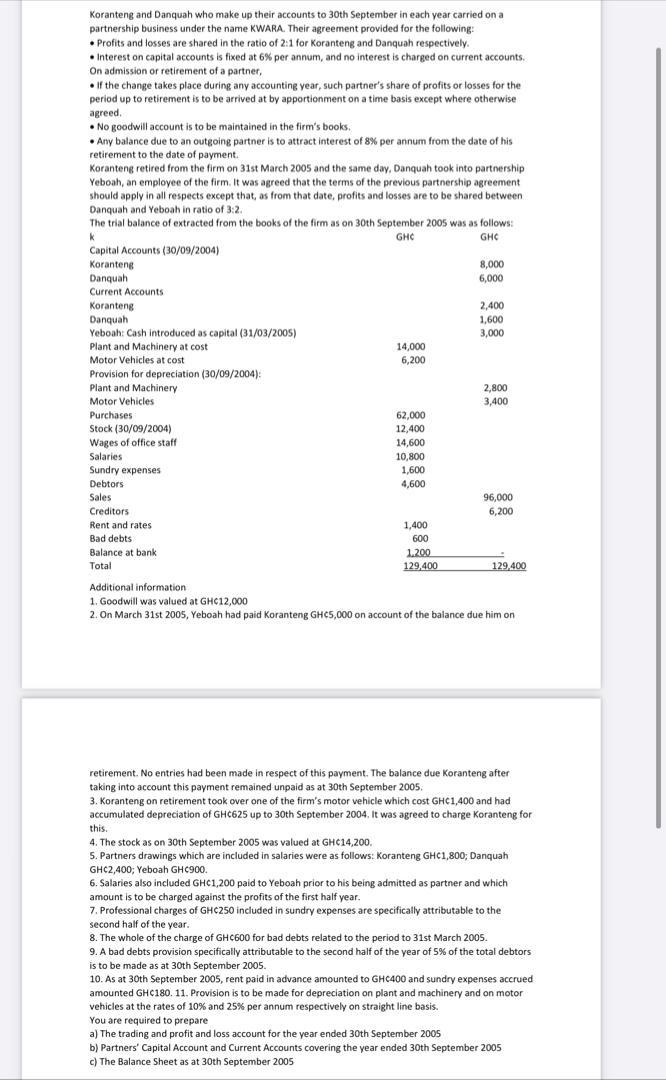

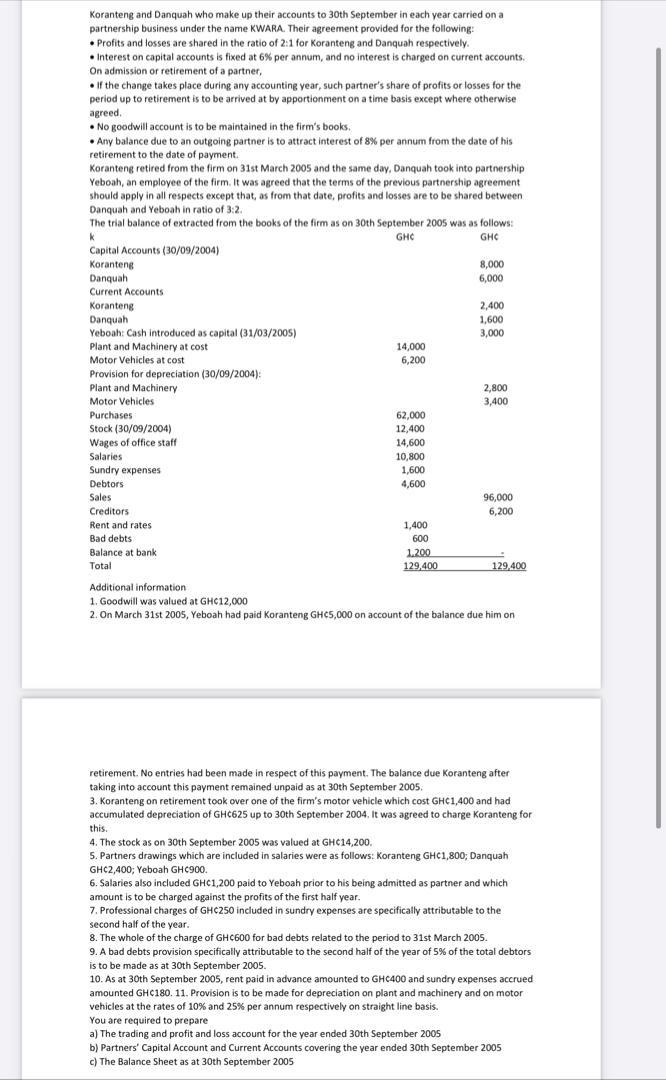

Koranteng and Danquah who make up their accounts to 30th September in each year carried on a partnership business under the name KWARA. Their agreement provided for the following: Profits and losses are shared in the ratio of 2:1 for Koranteng and Danquah respectively. Interest on capital accounts is fixed at 6% per annum, and no interest is charged on current accounts. On admission or retirement of a partner, if the change takes place during any accounting year, such partner's share of profits or losses for the period up to retirement is to be arrived at by apportionment on a time basis except where otherwise agreed. No goodwill account is to be maintained in the firm's books, . Any balance due to an outgoing partner is to attract interest of 8% per annum from the date of his retirement to the date of payment. Koranteng retired from the firm on 31st March 2005 and the same day, Danquah took into partnership Yeboah, an employee of the firm. It was agreed that the terms of the previous partnership agreement should apply in all respects except that, as from that date, profits and losses are to be shared between Danquah and Yeboah in ratio of 3:2 The trial balance of extracted from the books of the firm as on 30th September 2005 was as follows: K GHC GHC Capital Accounts (30/09/2004) Koranteng 8,000 Danquah 6,000 Current Accounts Koranteng 2,400 Danquah 1,600 Yeboaht Cash Introduced as capital (31/03/2005) 3,000 Plant and Machinery at cost 14,000 Motor Vehicles at cost Provision for depreciation (30/09/2004): Plant and Machinery 2,800 Motor Vehicles 3,400 Purchases 62,000 Stock (30/09/2004) 12,400 Wages of office staff 14,600 Salaries 10,800 Sundry expenses 1,600 Debtors 4,600 Sales 96,000 Creditors 6,200 Rent and rates 1,400 Bad debts 600 Balance at bank 1.200 Total 129.400 129.400 6,200 Additional information 1. Goodwill was valued at GHC12,000 2. On March 31st 2005, Yeboah had paid Koranteng GHC5,000 on account of the balance due him on retirement. No entries had been made in respect of this payment. The balance due Koranteng after taking into account this payment remained unpaid as at 30th September 2005 3. Koranteng on retirement took over one of the firm's motor vehicle which cost GHC1,400 and had accumulated depreciation of GHC625 up to 30th September 2004. It was agreed to charge Koranteng for this. 4. The stock as on 30th September 2005 was valued at GHC14,200. 5. Partners drawings which are included in salaries were as follows: Koranteng GHC1,800; Danquah GHC2,400; Yeboah GHC900. 6. Salaries also included GHC1,200 paid to Yeboah prior to his being admitted as partner and which amount is to be charged against the profits of the first half year. 7. Professional charges of GHC250 included in sundry expenses are specifically attributable to the second half of the year. . 8. The whole of the charge of GHC600 for bad debts related to the period to 31st March 2005. 9. A bad debts provision specifically attributable to the second half of the year of 5% of the total debtors is to be made as at 30th September 2005. 10. As at 30th September 2005, rent paid in advance amounted to GHC400 and sundry expenses accrued amounted GHC180. 11. Provision is to be made for depreciation on plant and machinery and on motor vehicles at the rates of 10% and 25% per annum respectively on straight line basis. You are required to prepare a) The trading and profit and loss account for the year ended 30th September 2005 b) Partners' Capital Account and Current Accounts covering the year ended 30th September 2005 c) The Balance Sheet as at 30th September 2005 Koranteng and Danquah who make up their accounts to 30th September in each year carried on a partnership business under the name KWARA. Their agreement provided for the following: Profits and losses are shared in the ratio of 2:1 for Koranteng and Danquah respectively. Interest on capital accounts is fixed at 6% per annum, and no interest is charged on current accounts. On admission or retirement of a partner, if the change takes place during any accounting year, such partner's share of profits or losses for the period up to retirement is to be arrived at by apportionment on a time basis except where otherwise agreed. No goodwill account is to be maintained in the firm's books, . Any balance due to an outgoing partner is to attract interest of 8% per annum from the date of his retirement to the date of payment. Koranteng retired from the firm on 31st March 2005 and the same day, Danquah took into partnership Yeboah, an employee of the firm. It was agreed that the terms of the previous partnership agreement should apply in all respects except that, as from that date, profits and losses are to be shared between Danquah and Yeboah in ratio of 3:2 The trial balance of extracted from the books of the firm as on 30th September 2005 was as follows: K GHC GHC Capital Accounts (30/09/2004) Koranteng 8,000 Danquah 6,000 Current Accounts Koranteng 2,400 Danquah 1,600 Yeboaht Cash Introduced as capital (31/03/2005) 3,000 Plant and Machinery at cost 14,000 Motor Vehicles at cost Provision for depreciation (30/09/2004): Plant and Machinery 2,800 Motor Vehicles 3,400 Purchases 62,000 Stock (30/09/2004) 12,400 Wages of office staff 14,600 Salaries 10,800 Sundry expenses 1,600 Debtors 4,600 Sales 96,000 Creditors 6,200 Rent and rates 1,400 Bad debts 600 Balance at bank 1.200 Total 129.400 129.400 6,200 Additional information 1. Goodwill was valued at GHC12,000 2. On March 31st 2005, Yeboah had paid Koranteng GHC5,000 on account of the balance due him on retirement. No entries had been made in respect of this payment. The balance due Koranteng after taking into account this payment remained unpaid as at 30th September 2005 3. Koranteng on retirement took over one of the firm's motor vehicle which cost GHC1,400 and had accumulated depreciation of GHC625 up to 30th September 2004. It was agreed to charge Koranteng for this. 4. The stock as on 30th September 2005 was valued at GHC14,200. 5. Partners drawings which are included in salaries were as follows: Koranteng GHC1,800; Danquah GHC2,400; Yeboah GHC900. 6. Salaries also included GHC1,200 paid to Yeboah prior to his being admitted as partner and which amount is to be charged against the profits of the first half year. 7. Professional charges of GHC250 included in sundry expenses are specifically attributable to the second half of the year. . 8. The whole of the charge of GHC600 for bad debts related to the period to 31st March 2005. 9. A bad debts provision specifically attributable to the second half of the year of 5% of the total debtors is to be made as at 30th September 2005. 10. As at 30th September 2005, rent paid in advance amounted to GHC400 and sundry expenses accrued amounted GHC180. 11. Provision is to be made for depreciation on plant and machinery and on motor vehicles at the rates of 10% and 25% per annum respectively on straight line basis. You are required to prepare a) The trading and profit and loss account for the year ended 30th September 2005 b) Partners' Capital Account and Current Accounts covering the year ended 30th September 2005 c) The Balance Sheet as at 30th September 2005