Answered step by step

Verified Expert Solution

Question

1 Approved Answer

r 6. Prepare a post-closing trial balance as at December 31, 2021. (5 marks) 7. Prepare the comparative financial statements including Income Statement and Balance

r

r

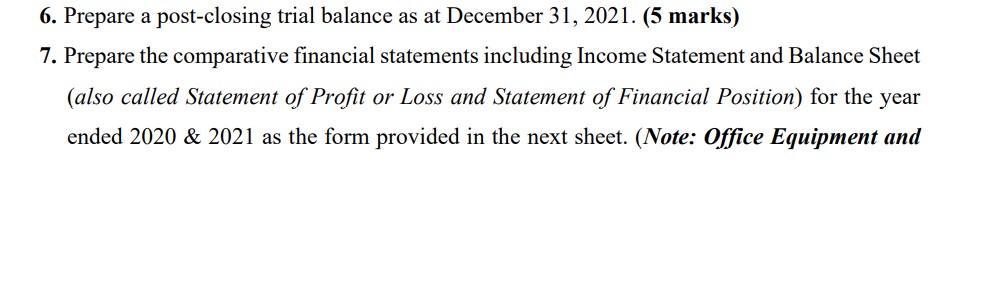

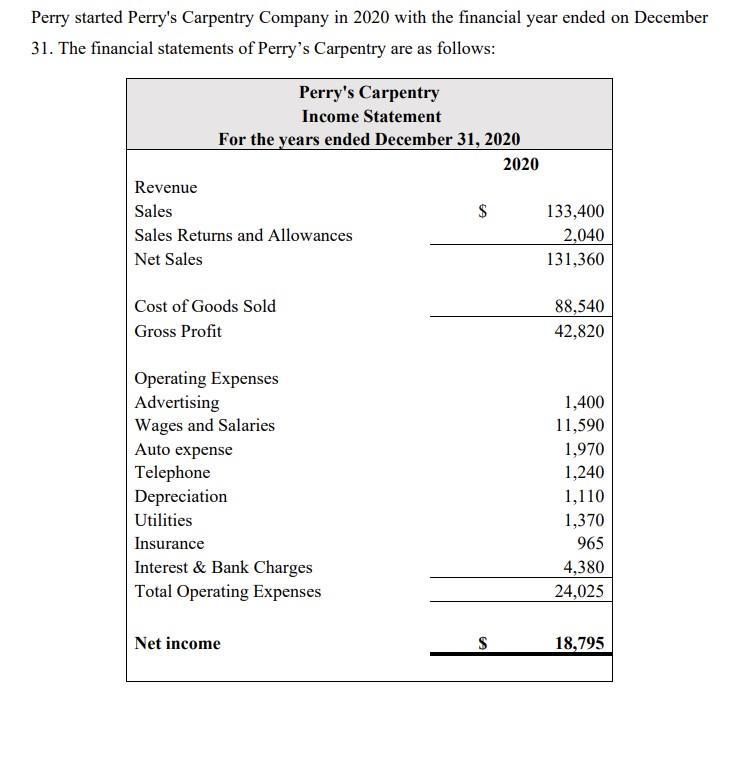

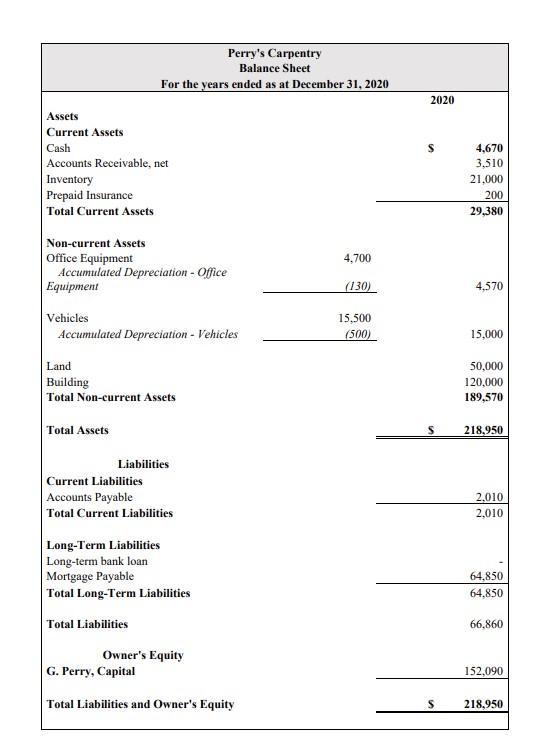

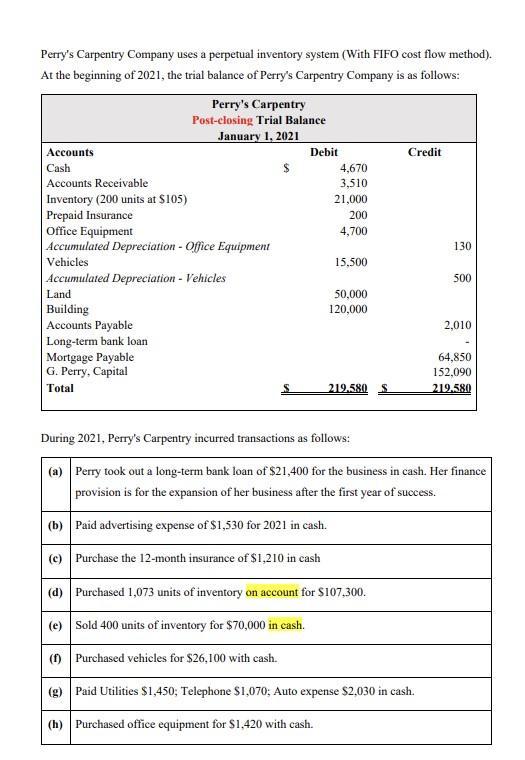

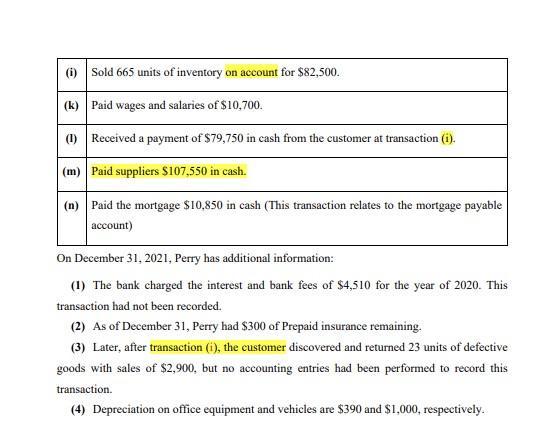

6. Prepare a post-closing trial balance as at December 31, 2021. (5 marks) 7. Prepare the comparative financial statements including Income Statement and Balance Sheet (also called Statement of Profit or Loss and Statement of Financial Position) for the year ended 2020 & 2021 as the form provided in the next sheet. (Note: Office Equipment and 8. Prepare the horizontal analysis for these comparative financial statements. (4 marks) 9. Prepare the vertical analysis for these financial statements. (4 marks) 10. Using the information from Requirement (#8) & (#9), complete these tasks as follows: - Comment on the management's ability to manage the accounts receivable over the past two years. (3 marks) - What is a possible explanation for the decrease in the Wages and Salaries expense? (3 marks) Perry started Perry's Carpentry Company in 2020 with the financial year ended on December 31. The financial statements of Perry's Carpentry are as follows: Perry's Carpentry Income Statement For the years ended December 31, 2020 2020 Revenue Sales Sales Returns and Allowances Net Sales Cost of Goods Sold Gross Profit Operating Expenses Advertising Wages and Salaries Auto expense Telephone Depreciation Utilities Insurance Interest & Bank Charges Total Operating Expenses Net income $ S 133,400 2,040 131,360 88,540 42,820 1,400 11,590 1,970 1,240 1,110 1,370 965 4,380 24,025 18,795 Assets Current Assets Cash Accounts Receivable, net Inventory Prepaid Insurance Total Current Assets Perry's Carpentry Balance Sheet For the years ended as at December 31, 2020 Non-current Assets Office Equipment Accumulated Depreciation - Office Equipment Vehicles Accumulated Depreciation - Vehicles Land Building Total Non-current Assets Total Assets Liabilities Current Liabilities Accounts Payable Total Current Liabilities Long-Term Liabilities Long-term bank loan Mortgage Payable Total Long-Term Liabilities Total Liabilities Owner's Equity G. Perry, Capital Total Liabilities and Owner's Equity 4,700 (130) 15.500 (500) 2020 4,670 3.510 21,000 200 29,380 4,570 15,000 50,000 120,000 189,570 218,950 2,010 2,010 64,850 64,850 66,860 152,090 218,950 Perry's Carpentry Company uses a perpetual inventory system (With FIFO cost flow method). At the beginning of 2021, the trial balance of Perry's Carpentry Company is as follows: Accounts Cash Accounts Receivable Inventory (200 units at $105) Prepaid Insurance Office Equipment Accumulated Depreciation - Office Equipment Vehicles Accumulated Depreciation - Vehicles Land Building Accounts Payable Long-term bank loan Mortgage Payable G. Perry, Capital Total Perry's Carpentry Post-closing Trial Balance January 1, 2021 (h) $ Debit 4,670 3,510 21,000 200 4,700 Purchased office equipment for $1,420 with cash. 15,500 50,000 120,000 219.580 S Credit 130 500 2,010 During 2021, Perry's Carpentry incurred transactions as follows: (a) Perry took out a long-term bank loan of $21,400 for the business in cash. Her finance provision is for the expansion of her business after the first year of success. (b) Paid advertising expense of $1,530 for 2021 in cash. (c) Purchase the 12-month insurance of $1,210 in cash (d) Purchased 1,073 units of inventory on account for $107.300. (e) Sold 400 units of inventory for $70,000 in cash. (f) Purchased vehicles for $26,100 with cash. (g) Paid Utilities $1,450; Telephone $1,070; Auto expense $2,030 in cash. 64,850 152,090 219.580 (i) Sold 665 units of inventory on account for $82,500. (k) Paid wages and salaries of $10,700. (1) Received a payment of $79,750 in cash from the customer at transaction (i). (m) Paid suppliers $107,550 in cash. (n) Paid the mortgage $10,850 in cash (This transaction relates to the mortgage payable account) On December 31, 2021, Perry has additional information: (1) The bank charged the interest and bank fees of $4,510 for the year of 2020. This transaction had not been recorded. (2) As of December 31, Perry had $300 of Prepaid insurance remaining. (3) Later, after transaction (i), the customer discovered and returned 23 units of defective goods with sales of $2,900, but no accounting entries had been performed to record this transaction. (4) Depreciation on office equipment and vehicles are $390 and $1,000, respectively.

Step by Step Solution

★★★★★

3.43 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started