Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 1, 2021, Company ICI made a number of non-strategic investments detailed below: (1) The company acquired 100,000 ordinary shares in Company N

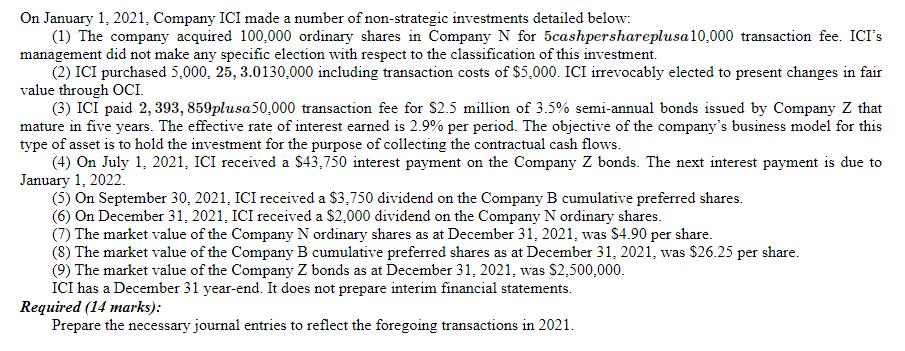

On January 1, 2021, Company ICI made a number of non-strategic investments detailed below: (1) The company acquired 100,000 ordinary shares in Company N for 5cashpershareplusa 10,000 transaction fee. ICI's management did not make any specific election with respect to the classification of this investment. (2) ICI purchased 5,000, 25, 3.0130,000 including transaction costs of $5,000. ICI irrevocably elected to present changes in fair value through OCI. (3) ICI paid 2, 393, 859plusa 50,000 transaction fee for $2.5 million of 3.5% semi-annual bonds issued by Company Z that mature in five years. The effective rate of interest earned is 2.9% per period. The objective of the company's business model for this type of asset is to hold the investment for the purpose of collecting the contractual cash flows. (4) On July 1, 2021, ICI received a $43,750 interest payment on the Company Z bonds. The next interest payment is due to January 1, 2022. (5) On September 30, 2021, ICI received a $3,750 dividend on the Company B cumulative preferred shares. (6) On December 31, 2021, ICI received a $2,000 dividend on the Company N ordinary shares. (7) The market value of the Company N ordinary shares as at December 31, 2021, was $4.90 per share. (8) The market value of the Company B cumulative preferred shares as at December 31, 2021, was $26.25 per share. (9) The market value of the Company Z bonds as at December 31, 2021, was $2,500,000. ICI has a December 31 year-end. It does not prepare interim financial statements. Required (14 marks): Prepare the necessary journal entries to reflect the foregoing transactions in 2021.

Step by Step Solution

★★★★★

3.22 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Sl No Date Account Name Calculation Debit Credit Comment 1 01Jan Invenstment in Shares of N Ltd FVPL 5 per share 100000 Shares 500000 FVPL hence trans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started