Question

Krane Products Inc. is a manufacturer of ski equipment. The company has been in operation since 1997. Ms. Andrews is a credit analyst for an

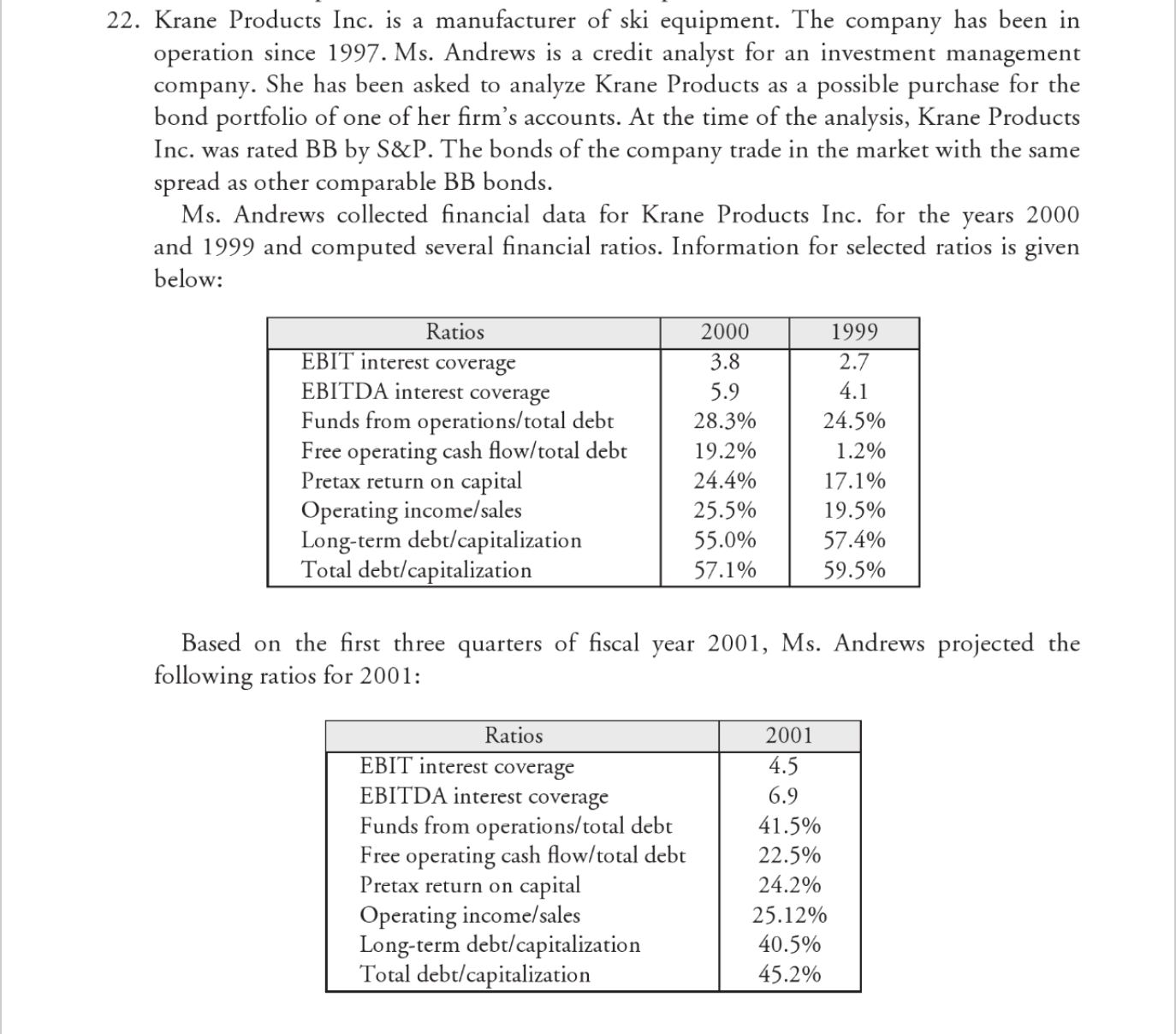

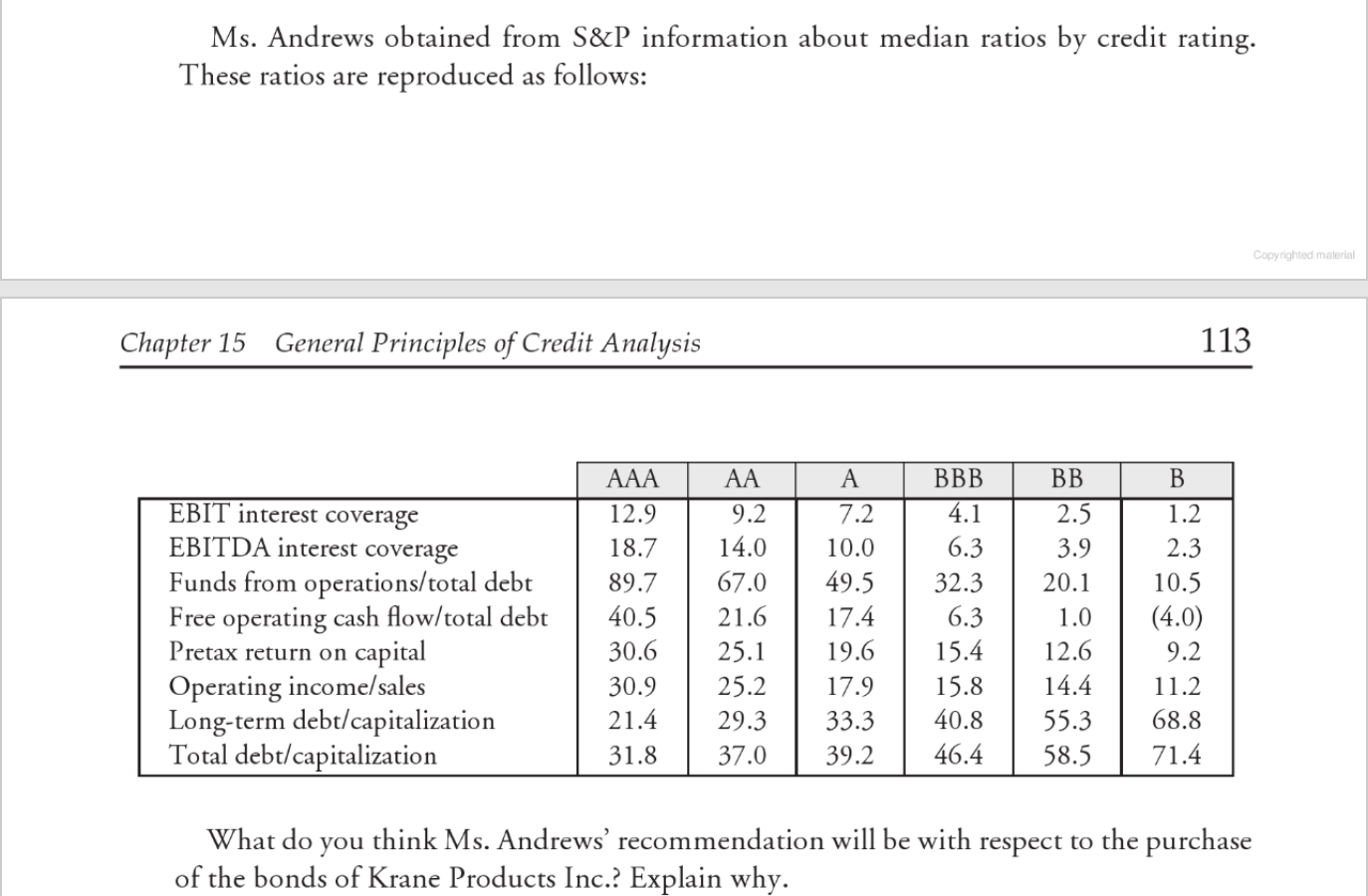

Krane Products Inc. is a manufacturer of ski equipment. The company has been in operation since 1997. Ms. Andrews is a credit analyst for an investment management company. She has been asked to analyze Krane Products Inc. as a possible purchase for the bod portfolio of one of the firms's accounts. At the time of the analysis, Krane Product Inc. was rated BB by S&P. The bonds of the company trade in the market with the same spread as other comparable BB bonds. Ms. Andrews collected financial date for Krane Products Inc. for the years 2000 and 1999 and competed several financial ratios.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started