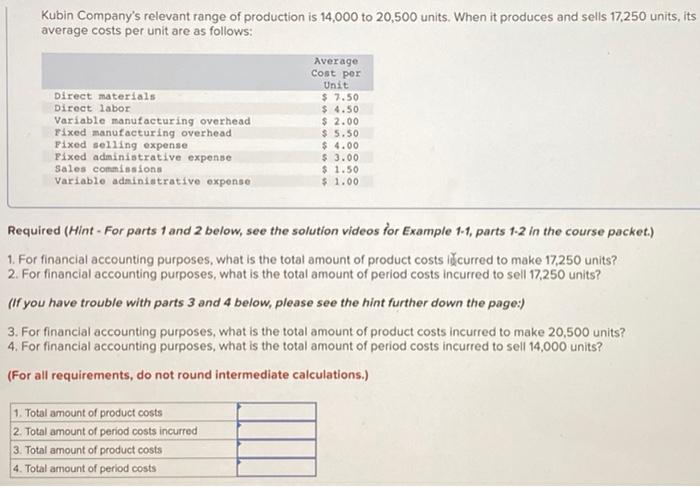

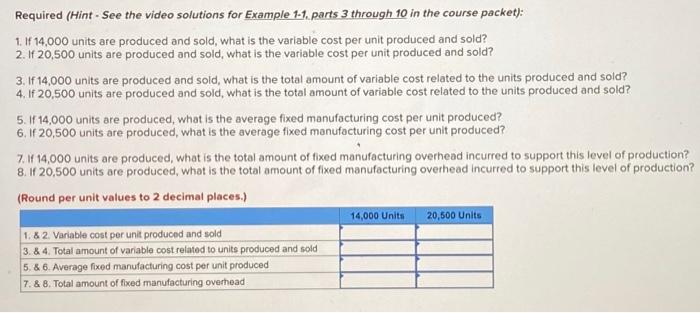

Kubin Company's relevant range of production is 14,000 to 20,500 units. When it produces and sells 17,250 units, its average costs per unit are as follows: Direct materials Direct labor Variable manufacturing overhead Tixed manufacturing overhead Fixed selling expense Pixed administrative expense Sales commissions Variablo administrative expense Average Cost per Unit $ 7.50 $ 4.50 $ 2.00 $ 5.50 $ 4.00 $ 3.00 $ 1.50 $ 1.00 Required (Hint - For parts 1 and 2 below, see the solution videos for Example 1-1, parts 1-2 in the course packet.) 1. For financial accounting purposes, what is the total amount of product costs icurred to make 17,250 units? 2. For financial accounting purposes, what is the total amount of period costs incurred to sell 17,250 units? (if you have trouble with parts 3 and 4 below, please see the hint further down the page:) 3. For financial accounting purposes, what is the total amount of product costs incurred to make 20,500 units? 4. For financial accounting purposes, what is the total amount of period costs incurred to sell 14,000 units? (For all requirements, do not round intermediate calculations.) 1. Total amount of product costs 2. Total amount of period costs incurred 3. Total amount of product costs 4. Total amount of period costs Required (Hint - See the video solutions for Example 1-1. parts 3 through 10 in the course packet): 1. If 14,000 units are produced and sold, what is the variable cost per unit produced and sold? 2. If 20,500 units are produced and sold, what is the variable cost per unit produced and sold? 3. If 14,000 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 4. If 20,500 units are produced and sold, what is the total amount of variable cost related to the units produced and sold? 5. If 14,000 units are produced, what is the average fixed manufacturing cost per unit produced? 6. If 20,500 units are produced, what is the average fixed manufacturing cost per unit produced? 7. M 14,000 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? 8. If 20,500 units are produced, what is the total amount of fixed manufacturing overhead incurred to support this level of production? (Round per unit values to 2 decimal places.) 14,000 Units 20,500 units 1.8 2. Variable cost per unit produced and sold 3.& 4. Total amount of variable cost related to units produced and sold 5. & 6. Average fixed manufacturing cost per unit produced 7. & 8. Total amount of fixed manufacturing overhead