Answered step by step

Verified Expert Solution

Question

1 Approved Answer

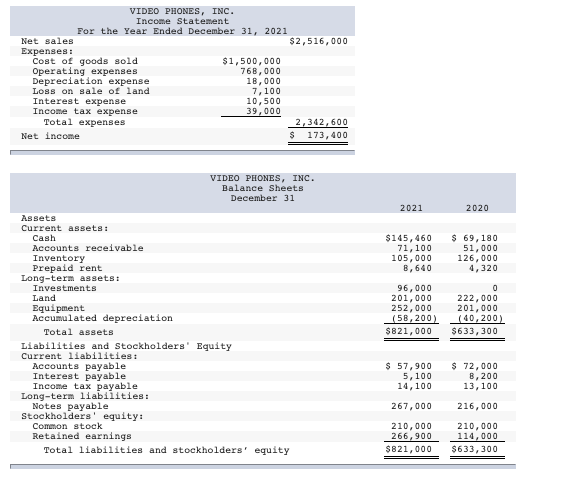

The income statement, balance sheets, and additional information for Video Phones, Inc., are provided. Additional Information for 2021: Purchase investment in bonds for $96,000. Sell

The income statement, balance sheets, and additional information for Video Phones, Inc., are provided.

Additional Information for 2021:

- Purchase investment in bonds for $96,000.

- Sell land costing $21,000 for only $13,900, resulting in a $7,100 loss on sale of land.

- Purchase $51,000 in equipment by issuing a $51,000 long-term note payable to the seller. No cash is exchanged in the transaction.

- Declare and pay a cash dividend of $20,500.

Required:

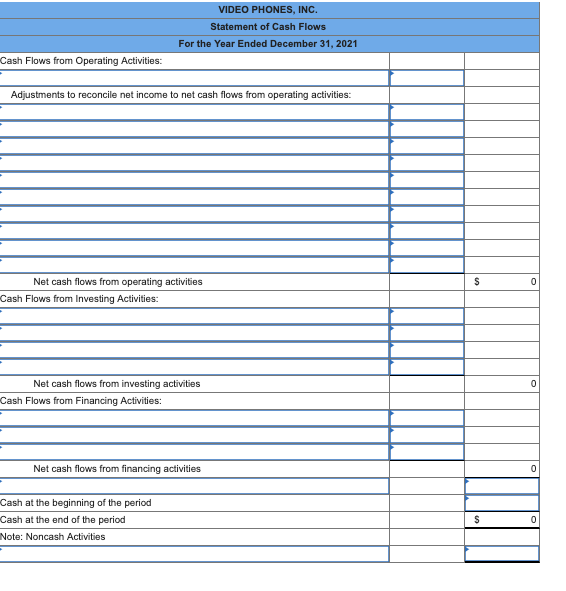

Prepare the statement of cash flows using the indirect method. Disclose any noncash transactions in an accompanying note. (List cash outflows and any decrease in cash as negative amounts.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started